Policy Options to Sustain Medicare for the Future

Section 1: Medicare Eligibility, Beneficiary Costs, and Program Financing

.

Age of Eligibility

Options Reviewed

This section reviews two options for raising the age of Medicare eligibility:

» Raise the age of Medicare eligibility from 65 to 67, using a similar phase-in schedule for the Social Security full retirement age

» Raise the Medicare eligibility age from 65 to 67 only for people with relatively high lifetime earnings

Currently, most Americans become eligible for Medicare benefits when they reach age 65. Raising the age at which people can begin to be covered by Medicare has been proposed as a way of decreasing future Medicare program spending by reducing the number of people on Medicare. Most proposals recommend gradually raising the Medicare eligibility age from 65 to 67, aligning Medicare eligibility with the full retirement age for Social Security. If adopted in conjunction with coverage expansions included in the Affordable Care Act (ACA), Federal savings associated with this change would be partially offset by costs associated with providing subsidies to 65- and 66-year-olds covered in the health insurance exchanges or under Medicaid; the effects for individuals would be expected to vary based on age, income, and source of health insurance coverage.

Background

Since Medicare was enacted in 1965, eligibility has generally been based on age (65 and older), employment history (individuals or their spouses contribute Medicare payroll taxes for at least 10 years), and citizenship/residency status.1 The eligibility age for both Medicare and full retirement benefits through Social Security were aligned until 2000, when, as a result of a 1983 law, the normal retirement age for Social Security began to rise in stages from age 65 to age 67.

In the past, a major concern related to raising the Medicare eligibility age has been the potential impact on people ages 65 and 66 who could become uninsured as a result of losing access to Medicare. Studies conducted prior to enactment of the ACA estimated that the number of uninsured 65- and 66-year-old adults would increase if the Medicare eligibility age were raised, in the absence of reforms that would provide older adults with access to affordable insurance, without pre-existing conditions exclusions and other restrictions (Davidoff and Johnson 2008). These studies documented that people who were not entitled to Medicare benefits at age 65 would have limited access to private insurance coverage unless they were working and had access to employer-sponsored group coverage. Such concerns were a major deterrent to increasing the Medicare eligibility age prior to enactment of the ACA.

With the implementation of the ACA, including coverage expansions and Federal subsidies for private coverage through the health insurance exchanges and expanded coverage for low-income individuals under Medicaid, the law will change the insurance coverage landscape for nonelderly individuals beginning in 2014. Combined with an individual mandate, the prohibition against insurers excluding people from coverage due to pre-existing conditions and limits on age-related rating bands, these reforms could create an avenue for affordable health insurance coverage for 65- and 66-year-olds if the Medicare eligibility age were raised above age 65. The individual mandate applies to all individuals, with certain exceptions unrelated to age. If the Medicare eligibility age is increased to 67, 65- and 66-year-olds would be eligible for income-based subsidies as long as they do not have an offer of coverage from an employer. However, a statutory change would be needed to extend eligibility for the Medicaid expansion to 65- and 66-year-olds because the ACA specifically limits the expansion to individuals who meet the new income requirements and are under age 65.

Policy Options

OPTION 1.1

Raise the Medicare eligibility age from 65 to 67

Under this option, the age of Medicare eligibility would gradually increase from 65 to 67, aligning Medicare with the full retirement age for Social Security, whereby the eligibility age is increasing by two months per year, reaching 67 in 2027 for people born in 1960 or later. This option could be modified by: (1) modifying the implementation date; (2) varying the number of years over which the age of eligibility would be raised; (3) indexing the age of eligibility to life expectancy in order to provide greater Federal savings and account for continued gains in life expectancy. The discussion below does not address the effects of these modifications.

Budget effects

The Congressional Budget Office (CBO) estimates that raising the Medicare eligibility age gradually to 67, by two months per year beginning in 2014, would reduce net Federal spending by $113 billion over 10 years (2012–2021) (CBO 2012). This takes into account new Federal costs associated with health insurance exchange subsidies and the Medicaid expansion, and the loss of Medicare Part B premium revenues.

Discussion

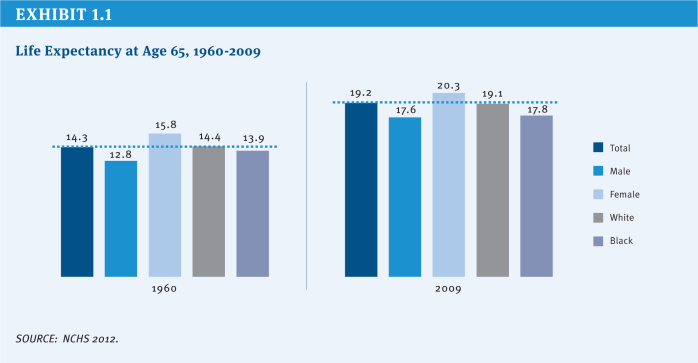

Proponents cite both demographic and economic justifications for increasing the Medicare eligibility age to achieve Medicare savings. Aligning the Medicare age of eligibility with the age when people can claim full retirement benefits for Social Security is bolstered by demographic trends, in particular, gains in average life expectancy at age 65. In 1960, just prior to the enactment of Medicare, the average 65-year-old could expect to live another 14.3 years; five decades later, the average life expectancy for a 65-year-old has increased to 19.2 years (NCHS 2012) (Exhibit 1.1). Gains in life expectancy result in an increase in the average number of years people rely on Medicare for their health insurance coverage, which places greater financial pressure on the Medicare program.

A deferral in Medicare eligibility would be expected to reinforce incentives in the Social Security system for workers to delay retirement and remain in the labor force, while at the same time enabling older Americans to save more for their expenses during retirement, pay payroll taxes to help support Medicare and Social Security, and pay taxes that help to strengthen the economy. Because many people choose to apply for Social Security and Medicare at the same time, CBO reports that raising the Medicare eligibility age would also reduce Social Security retirement benefit outlays in the short term.

The coverage expansions included in the ACA can help to alleviate the concern previously held about raising the age of Medicare eligibility, that 65- and 66-year-olds would be at high risk of becoming uninsured in the absence of Medicare. As mentioned earlier, with full implementation of the ACA, 65- and 66-year-olds would have access to health insurance coverage through the health insurance exchanges and Medicaid (assuming conforming technical changes are made to the law to facilitate coverage under the Medicaid expansion), with subsidies available to those with incomes up to 400 percent of the Federal Poverty Level (FPL).

Opponents cite a number of concerns with this option. Raising the age of eligibility would reduce Medicare spending, but also would shift costs from Medicare to other payers, which would result in a net increase in health care spending system-wide (Kaiser Family Foundation 2011). An increase in the Medicare eligibility age would result in higher premiums for those who remain on Medicare, because younger and relatively low-cost 65- and 66-year-olds would no longer be in the Medicare risk pool; higher premiums for younger adults getting private coverage through the health insurance exchanges because having 65- and 66-year-olds in that risk pool would increase the average cost of exchange coverage; higher costs for employers, to the extent that some of those no longer eligible for Medicare would be covered instead under an employer plan; and higher Medicaid expenditures as some lower-income people ages 65 and 66 would be eligible for coverage under that program.

For people ages 65 and 66, the effects of losing Medicare eligibility would be mixed. People with relatively modest incomes (less than 300 percent of the FPL) would be expected to have lower out-of-pocket costs under their new source of coverage, on average, than they would if covered by Medicare, but the majority of 65- and 66-year-olds with relatively higher incomes (greater than 300 percent of the FPL) are expected to face higher out-of-pocket costs because their private sources of coverage would be more expensive than under Medicare and they would receive less generous or no subsidies for private exchange coverage (Kaiser Family Foundation 2011). And while the ACA provides new coverage options, some low-income 65- and 66-year-olds might not be able to get coverage under the Medicaid expansion if they live in a state that chooses not to expand its Medicaid program. Another concern cited by opponents is the uneven effects on people ages 65 and 66 of raising the Medicare eligibility age due to differences in life expectancy by race, income, and gender. For example, life expectancy at age 65 is nearly two years shorter for black men than white men and one year shorter for black women than white women, on average (NCHS 2012).

OPTION 1.2

Raise the Medicare eligibility age to 67 for people with higher lifetime earnings

Under this option, all qualifying workers would get Medicare benefits but the timing of their eligibility for benefits would differ by income, with beneficiaries’ lifetime earnings determining when they would become eligible for Medicare (Emanuel 2012).22 Beneficiaries in the top quarter of the lifetime earnings distribution would not be eligible for Medicare until age 70; those in the next highest quarter of lifetime earnings distribution would be eligible at 67; and those in the lower half of the lifetime earnings distribution would continue to be eligible at age 65. Both of the higher-earnings groups would be permitted to buy into Medicare at age 65 until they reach the eligibility age for their lifetime earnings quartile.

Budget effects

No cost estimate is available for this option.

Discussion

Many of the advantages and disadvantages of Option 1.1 also pertain to this option. Adjusting the age of Medicare eligibility by income would take into account the fact that the wealthy, on average, live longer than those in lower-income brackets, which could address concerns that raising the age of Medicare eligibility for all 65- and 66-year-olds would adversely affect those with shorter average lifespans. Raising the eligibility age for Medicare according to lifetime earnings could also encourage more personal savings, as people may prepare differently for health expenses in retirement if they know they will not (or may not) be eligible for Medicare until after age 65.

There are issues to be considered when using a measure based on lifetime earnings. On the one hand, lifetime earnings are considered to be a more stable measure of wealth than income in a particular year or over a limited number of years, but on the other hand, lifetime earnings may not be a good indicator of a person’s financial situation at the time they age on to Medicare, especially if they have experienced a recent change in employment status.

An additional concern relates to the administrative feasibility of this proposal. While information related to earnings is collected by the Social Security Administration and disseminated to all workers who pay employment taxes, a number of questions arise with respect to how lifetime earnings would be calculated and how the policy would be implemented, including: (1) How would lifetime earnings be measured and over what time period? (2) How far in advance of age 65 would a prospective beneficiary be informed of their age of Medicare eligibility? (3) Which agency or agencies of the Federal government would be responsible for making income determinations, resolving discrepancies, and communicating income determinations to beneficiaries? (4) What are the implications of using a measure based exclusively on earnings for individuals with relatively low earnings but substantial unearned income?

References

Click to expand/collapse

Centers for Disease Control and Prevention, National Center for Health Statistics (NCHS). 2012. Health, United States, 2011, May 2012.

Congressional Budget Office (CBO). 2012. Raising the Ages of Eligibility for Medicare and Social Security, January 2012.

Amy J. Davidoff and Richard Johnson. 2003. “Raising the Medicare Eligibility Age: Effects on the Young Elderly,” Health Affairs, July/August 2003.

Ezekiel Emanuel. 2012. “Entitlement Reform for the Entitled,” The New York Times, May 20, 2012.

Kaiser Family Foundation. 2011. Raising the Age of Medicare Eligibility: A Fresh Look Following Implementation of Health Reform, July 2011.

.

Beneficiary Cost Sharing

Options Reviewed

This section reviews several options for reducing Medicare spending by increasing or modifying beneficiary cost sharing:

» Increase the Part B deductible

» Introduce cost sharing for home health services

» Introduce cost sharing for the first 20 days of a skilled nursing facility (SNF) stay

» Introduce cost sharing for clinical laboratory services

» Modify current cost-sharing requirements to reflect “value-based insurance design”

» Restrict first-dollar supplemental coverage or establish a supplemental coverage surcharge

Increasing deductibles and cost sharing for Medicare-covered services would reduce Medicare spending by shifting cost obligations from the Federal government to people on Medicare. In addition, Medicare may achieve savings that result from reduced utilization of Medicare-covered services to the extent that beneficiaries choose to forego medical care—potentially both necessary and unnecessary services—to avoid higher costs. The effects for beneficiaries would be expected to vary based on income, health status, and their supplemental insurance coverage. Increasing Medicare’s cost-sharing requirements also could affect costs incurred by other payers, including the Medicaid program and employers who provide supplemental coverage for retirees on Medicare.3 A related option would modify cost-sharing requirements to encourage the use of higher-value care and discourage the use of lower-value care.

Background

Medicare has a complex benefit design, with a deductible for inpatient services covered under Part A, another deductible for physician and other outpatient services under Part B, and a separate deductible for prescription drugs under the standard benefit design covered by Part D plans. Medicare also imposes cost-sharing requirements that vary by type of service. Unlike typical large employer plans, traditional Medicare does not have an annual limit on out-of-pocket spending for services covered under Parts A and B (although Medicare Advantage plans are required to include a limit on out-of-pocket costs for Medicare-covered services).

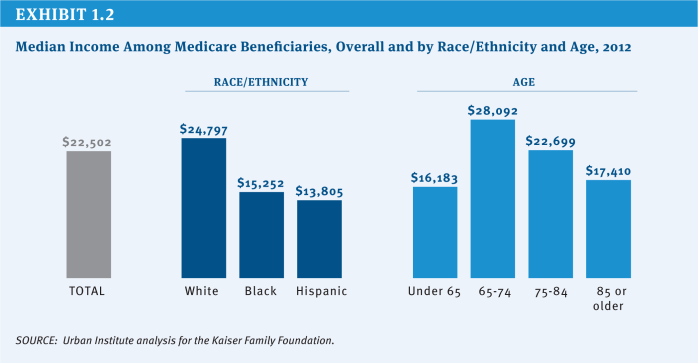

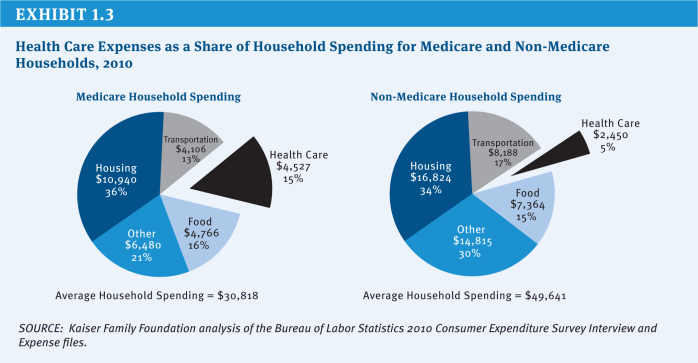

Due to the relatively high cost-sharing requirements and the absence of a limit on out-of-pocket spending, the vast majority of people with traditional Medicare have some type of supplemental insurance to help cover these costs, such as an employer-sponsored retiree health plan, a private Medicare supplemental insurance (Medigap) policy or, for those with low income, Medicaid. However, even though supplemental coverage helps to defray these expenses, out-of-pocket medical costs (including premiums) are a concern for many people with Medicare and have been rising as a share of income (Kaiser Family Foundation 2011a). With a median income for individual Medicare beneficiaries of $22,500 in 2012, health expenses consume a relatively large share of beneficiaries’ incomes and household budgets (Kaiser Family Foundation 2011a; Kaiser Family Foundation 2011c; Kaiser Family Foundation 2012) (Exhibit 1.2) (Exhibit 1.3).

A number of recent proposals have recommended various options to increase or modify deductibles and cost-sharing requirements for some or all Medicare beneficiaries. Some analysts assert that people with Medicare should bear part of the burden of Medicare savings, citing research indicating that the average beneficiary receives more in Medicare benefits than they have paid into the program during their working years (Steurle and Quakenbush 2012). Some also hope that changes in cost sharing would encourage beneficiaries to consume more high-value (i.e., higher-quality and lower-cost) services and fewer low-value services, just as tiered cost sharing has encouraged Part D enrollees to use lower-cost generic or preferred-brand drugs when available, producing savings for Medicare and for beneficiaries. However, others argue that beneficiaries should be protected from increases in cost sharing, especially those with low incomes.

Changes to Medicare’s cost-sharing requirements could produce a number of different outcomes. Higher cost-sharing requirements for specific services would reduce Medicare spending, while increasing costs for users of these services and for other payers. Making beneficiaries responsible for a greater share of their health costs would likely reduce the demand for care. Research demonstrates that people may forgo both unnecessary and necessary care in response to higher out-of-pocket costs (Swartz 2010). To the extent that beneficiaries forego necessary services and subsequently are hospitalized or visit an emergency department to treat preventable illnesses, the savings from higher cost sharing and reduced utilization could be offset in part or in whole by new Medicare spending. Under many of these approaches, the existence of supplemental coverage such as Medigap and employer-sponsored retiree health policies complicates the financial effects of cost-sharing changes.

This section describes several options to raise or modify deductibles and cost sharing, but does not present policy changes that could be considered in conjunction with these options that would strengthen financial protections for low-income beneficiaries, many of whom would be disproportionately affected by new cost sharing. Nor does it present options that would improve benefits, such as by adding a new limit on out-of-pocket spending for Part A and Part B services. The report includes a separate discussion of more comprehensive options that would restructure Medicare’s benefit design (see Section Four, Benefit Redesign).

Policy Options

OPTION 1.3

Increase the Part B deductible

The Part B deductible ($147 in 2013) is relatively low when compared with private coverage, while the Part A deductible ($1,184 in 2013) is relatively high. Under current law, the Part B deductible is indexed to rise with the growth in Part B per capita expenses and, as such, is projected to increase to $226 by 2021 (Boards of Trustees 2012).

This section describes two options to achieve savings by raising the Part B deductible:

» Option 1.3a: Increase the deductible incrementally by $75 for new beneficiaries only. This option was included in President Obama’s Fiscal Year (FY) 2013 Budget and would increase the Part B deductible for new enrollees by $25 in each of 2017, 2019, and 2021 (OMB 2012).

» Option 1.3b: Increase the deductible by $75 for all beneficiaries.

Budget effects

CBO estimated that Option 1.3a, as proposed in President Obama’s FY 2013 Budget, would save the Federal government $2.3 billion over 10 years (2013–2022) (CBO 2012). The savings would increase over time as new people become eligible for Medicare.

Although official government estimates are unavailable for Option 1.3b, analysis conducted by the Actuarial Research Corporation (ARC) for the Kaiser Family Foundation projects Federal savings of $32 billion over 10 years (2014–2023) if the policy were implemented in 2014. This estimate is considerably higher than that for President Obama’s proposal because the increase would apply to all beneficiaries, would be implemented in an earlier year, and would begin immediately, rather than incrementally.

Discussion

Increasing the Part B deductible would produce Federal savings and could make beneficiaries more cost-conscious about their use of physician and outpatient services. However, it also would increase costs for beneficiaries and other payers. According to ARC’s analysis, a $75 increase in the deductible for new enrollees in 2014 (similar to Option 1.3a, but implemented earlier) would raise costs for 5 percent of beneficiaries initially, although that share would grow over time as more people join Medicare. Raising the deductible by $75 for all enrollees in 2014, as in Option 1.3b, would increase cost-sharing obligations for the vast majority of Medicare beneficiaries.4 Supplemental plans that cover the deductible would moderate the effect of the cost-sharing increase for enrollees. This would, in turn, increase supplemental plan premiums and increase spending by employers and Medicaid. Those without supplemental coverage who use Part B services would incur the increase in the deductible directly. Part B premiums, set to cover 25 percent of Medicare Part B spending, would be expected to fall because the higher deductible would result in lower Part B expenditures.

OPTION 1.4

Introduce cost sharing for home health services

Medicare home health services are not subject to a deductible or cost-sharing requirements. Medicare covers home health services through both Part A and Part B, the former for up to 100 visits following an inpatient or skilled nursing facility (SNF) stay and for beneficiaries who are not covered under Part B, and the latter for all other visits (CRS 2010). Medicare home health utilization has risen relatively rapidly in recent years. Between 2002 and 2010, the number of home health users increased by 36 percent (from 2.5 million people to 3.4 million people), the annual number of episodes per user increased from 1.6 to 2.0, and the number of episodes of care increased by 66 percent, from 4.1 million to 6.8 million (MedPAC 2012b). The growth in home health care has been especially large among episodes that are not preceded by a hospitalization or post-acute care, which now comprise nearly two-thirds of home health episodes (MedPAC 2012b).

In 2010, Medicare spent $19.4 billion on home health services, up from $8.5 billion in 2000 (MedPAC 2012b). As part of a settlement agreement resulting from a Federal class action lawsuit, CMS could soon expand coverage of home health services by clarifying that beneficiaries who do not demonstrate a potential for improvement may still be eligible for coverage; it is not clear whether this change will lead to an increase in spending over time (Jimmo v. Sebelius 2012).

This section reviews three options for imposing cost sharing on home health services:

» Option 1.4a: Impose a 10 percent coinsurance on all home health episodes. In 2008, a 10 percent coinsurance on the average home health episode would equal about $300 (MedPAC 2011).

» Option 1.4b: Impose a $150 copayment per full episode, that is, episodes encompassing five or more visits. This $150 copayment represents approximately 5 percent of the average cost of a home health episode (as of 2008) (MedPAC 2011).

» Option 1.4c: Impose a $150 copayment per full episode, restricted to episodes that do not follow a hospitalization or post-acute care. In 2011, MedPAC recommended a copayment for episodes that do not follow a hospitalization or post-acute care, noting the rapid growth in volume of these types of episodes. President Obama’s FY 2013 Budget included a $100 copayment per full episode that does not follow a hospitalization or post-acute care, although this would only apply to new beneficiaries beginning in 2017 (OMB 2012).

Budget effects

The effects of home health cost sharing on program spending and beneficiaries would depend on several factors, including whether the cost sharing is imposed per visit or per episode, whether it applies to all episodes or a subset (e.g., those that do not follow inpatient or post-acute care), whether it applies to all beneficiaries or just new enrollees, and the implementation date.

» Option 1.4a: In 2011, CBO estimated that this option would produce Federal savings of $40 billion over 10 years (2012–2021) if implemented in 2013.

» Option 1.4b: No official government cost estimate is available for this option. According to ARC, a $150 copayment per full episode would produce Federal savings of $19 billion over 10 years (2014–2023).

» Option 1.4c: In 2011, MedPAC estimated that this option would produce between $1 billion and $5 billion in Medicare savings over five years. In 2012, CBO estimated that the Obama Administration proposal (a $100 copayment for this subset of episodes applied to new beneficiaries beginning in 2017) would produce Federal savings of about $0.3 billion from 2013 to 2022. Savings would increase over time as more people became eligible for Medicare.

Discussion

A new cost-sharing requirement for home health care would reduce Medicare spending and could address some concerns about overutilization. Home health cost sharing may also be helpful in that it could give beneficiaries information that could be used to identify and report possible instances of fraudulent billing. At the same time, this option would increase costs for beneficiaries who use these services, employers, and others.

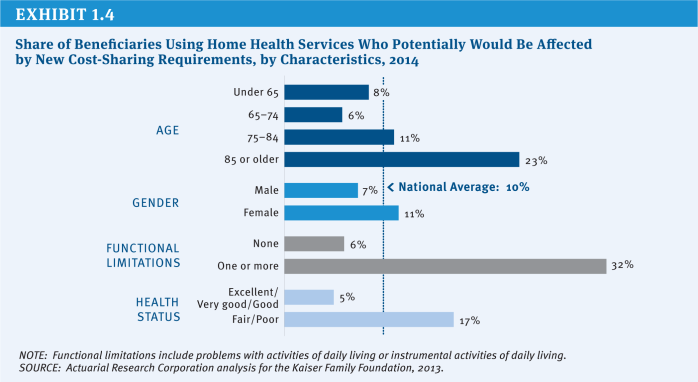

ARC has projected that one in ten beneficiaries (10 percent) will use home health services in 2014, and all would be affected by a 10 percent coinsurance. However, some groups of beneficiaries are more likely to use home health services and would be disproportionately affected by new cost sharing, including beneficiaries with lower incomes and not covered by Medicaid, those ages 85 and older, women, those in relatively poor health, and those with functional impairments (Exhibit 1.4).

The effects of the three different options would differ in terms of how many beneficiaries would be affected, which beneficiaries would be affected, and how much cost sharing they would face. The 10 percent coinsurance would affect all home health users (or, according to ARC, roughly 3.8 million beneficiaries if implemented in 2014), while the $150 copayment would affect the majority of home health users (about 3.2 million beneficiaries if implemented in 2014). A more limited copayment, applied to those without an inpatient stay or post-acute care, would affect fewer beneficiaries (1.4 million).

In contrast to the coinsurance option (Option 1.4a), the two copayment options (Options 1.4b and 1.4c) would cap the cost-sharing obligation per home health episode, although users would pay more than $150 if they had multiple episodes. According to ARC, the average home health user would face $550 in new cost-sharing obligations with a 10 percent coinsurance—more than users would under the flat $150 copayment per full episode. Beneficiaries who use home health services more extensively would face larger increases in cost-sharing obligations with the coinsurance than the flat copayment. For example, among beneficiaries with functional impairments who use home health services, cost-sharing obligations would increase by an estimated $750, on average, with a 10 percent coinsurance.

To the extent that home health users pay the new cost sharing out of their own pockets, use of home health services would be expected to decline (which is factored into the ARC analysis). In some instances, this could occur without major implications for beneficiaries’ health, while in others, beneficiaries may forgo needed care, which could result in higher costs associated with preventable inpatient admissions.5

A new home health copayment could create incentives for beneficiaries to substitute care in one setting for another. For example, a home health copayment applied to services received following an inpatient stay could drive beneficiaries to seek care in a skilled nursing facility for which there is no copayment for the first 20 days. This would be less of a concern with a $150 copayment that is restricted to episodes that do not follow a hospitalization or post-acute care.

Home health users without supplemental coverage would be fully exposed to new cost-sharing requirements. Others would be protected from some or all of these new cost-sharing requirements to the extent that their supplemental insurance covers these expenses. Home health users with Medicaid (36% according to ARC analysis) would be shielded from new cost-sharing obligations if Medicaid assumed these expenses on their behalf, which would in turn increase Medicaid spending. Similarly, beneficiaries with Medigap or employer-sponsored supplemental coverage could be shielded from direct cost-sharing requirements, but premiums would be expected to rise as a result (along with costs for employers). Part B premiums would be expected to fall somewhat because they are tied to Part B per capita program expenses, which are projected to decline under this option.

Finally, a new home health copayment per episode would impose new administrative costs on Medicare and private entities, given that home health providers do not have to keep track of cost-sharing requirements for Medicare beneficiaries under current law.

OPTION 1.5

Introduce cost sharing for the first 20 days of a skilled nursing facility stay

Another option for achieving Medicare savings would be to add upfront cost sharing for short SNF stays. Under current law, Medicare covers SNF stays of up to 100 days per benefit period for beneficiaries who have been hospitalized for at least three consecutive days. Beneficiaries are not required to pay cost sharing for the first 20 days each benefit period, but face a daily copayment for days 21–100, set to equal 12.5 percent of the Part A deductible (or a projected $153 per day in 2014). On average, SNF users paid cost sharing for 23 days in 2010 (and those with cost sharing paid for an average of 36 days) (CMS 2011).

Budget effects

In 2011, CBO estimated that a daily copayment for the first 20 days of a SNF stay set at 5 percent of the Part A deductible would reduce Federal spending by $21.3 billion over 10 years (2012–2021), if implemented in 2013.

Discussion

Introducing an upfront copayment for SNF care could produce substantial Medicare savings. However, it would increase cost sharing for SNF users, a relatively small, but vulnerable, group of beneficiaries. According to analysis by the Actuarial Research Corporation (ARC) for the Kaiser Family Foundation, 4 percent of beneficiaries are projected to have a SNF stay in 2014, and would thus face new cost-sharing obligations under this policy. This would include a larger share of beneficiaries ages 85 or older, those with low incomes, those who report fair or poor health, and people with functional impairments.

With a copayment on the first 20 days set at 5 percent of the Part A deductible (projected to be $60 in 2014), cost-sharing obligations for SNF users would increase in 2014 by $920 on average. The average is somewhat less than $1,200 ($60 for the first 20 days) because some SNF stays are shorter than 20 days. To the extent that the additional SNF cost-sharing requirements are covered by Medigap and employer plans, premiums would be expected to rise for beneficiaries covered by these policies (as would employer spending). Because Medicaid pays cost sharing on behalf of Medicare beneficiaries who are dually eligible for Medicare and Medicaid, Medicaid spending would also rise.

A new copayment would be expected to have some impact on utilization of SNF services (which is factored into the analysis above). With higher front-end costs, the average length of stay would be expected to decline.

OPTION 1.6

Introduce cost sharing for clinical lab services

Currently, Medicare beneficiaries have no cost sharing for clinical lab services. One option to achieve savings would impose the same cost-sharing requirements on lab services as for other Part B services, applying the Part B deductible ($147 in 2013) and 20 percent coinsurance.

Budget effects

In 2008, CBO estimated that this policy would have reduced Federal spending by $24 billion over 10 years (2010–2019), had it been implemented in 2011.

Discussion

According to ARC analysis for the Kaiser Family Foundation, the majority of beneficiaries (85 percent) are expected to use clinical lab services in 2014. Implementing this policy would be expected to increase cost-sharing obligations for this group by an average of $60 in 2014, and 12 percent of beneficiaries would be expected to see increases in cost-sharing obligations of $100 or more.

Medigap insurance, employers, and Medicaid would help enrollees cover these new costs, but this would in turn mitigate the utilization impact and lead to relatively modest increases in plan premiums and employer and Federal and State Medicaid spending. Conversely, Part B premiums, which are tied to per capita program expenses, would fall slightly.

One concern raised with clinical lab cost sharing is that the administrative expenses for lab suppliers, beneficiaries, and insurers could be large relative to the new revenues collected, given the high volume but sometimes low payment for some tests. Relying on a copayment rather than a coinsurance may be easier to implement administratively. Some also argue that cost sharing would not have a substantial impact on utilization, given that lab work is often ordered as part of a physician visit and not as a discretionary stand-alone service. If so, most of the savings from clinical lab cost sharing could represent a cost shift from Medicare to beneficiaries and their supplemental plans, rather than savings from lower utilization.

OPTION 1.7

Modify current cost-sharing requirements to reflect “value-based insurance design”

Evidence about the value of services and providers can be used to provide care more efficiently and could produce savings as a result. One mechanism for doing this within Medicare would be to move towards a value-based insurance design (VBID). Value-based benefit changes would modify Medicare’s cost-sharing requirements in order to encourage beneficiaries to use higher-value services and providers, discourage lower-value services and providers, or promote healthier behavior (Fendrick 2009). For example, the Affordable Care Act (ACA) eliminated cost sharing in traditional Medicare for recommended preventive services. Cost sharing tied to the value of services could be applied broadly to all beneficiaries, or could be targeted towards those who may be more likely to benefit, such as people with particular conditions, especially severe forms of those conditions, or who are participating in disease management programs (Fendrick 2009).

One approach to moving towards VBID in the Medicare program would be to allow the Secretary of the Department of Health and Human Services (HHS) to make value-based changes to the Part A and Part B cost-sharing structures, as long as those changes did not affect the overall actuarial value of Medicare for beneficiaries. MedPAC recommended a similar policy as part of a broader package of changes to Medicare’s benefit design (MedPAC 2012a).6 This approach is designed to be flexible so that the cost-sharing structure can be updated over time as the evidence-base develops (MedPAC 2012c). Another approach would impose lower cost-sharing obligations for using “preferred” providers who offer discounts to Medicare or meet certain quality or efficiency thresholds (see Section Two, Provider Payments for a discussion of this option).

Budget effects

No cost estimate is available for this option.

Discussion

Moving towards VBID could produce savings while minimizing the harm to beneficiaries or even making beneficiaries better off in terms of reducing costs and/or improving the quality of care. Some large employers have already begun to implement components of value-based insurance design in their health plans and many others have expressed interest in doing so (Choudry et al. 2010).

There are some practical complications, however. For one, identifying “high-value” and “low-value” services may be difficult given that the evidence base is still developing. The value inherent in many services may also depend on the particular clinical needs of beneficiaries. This may limit the usefulness of VBID or could suggest the need to tailor the benefit design to individual circumstances. Implementing VBID may be a challenge for traditional Medicare, given that beneficiaries are currently entitled to payment for services that are medically necessary, with cost sharing that is uniform across all beneficiaries. Finally, supplemental coverage could mute the impact of VBID on beneficiaries’ utilization decisions.

OPTION 1.8

Restrict “first-dollar” supplemental coverage or establish a supplemental coverage surcharge

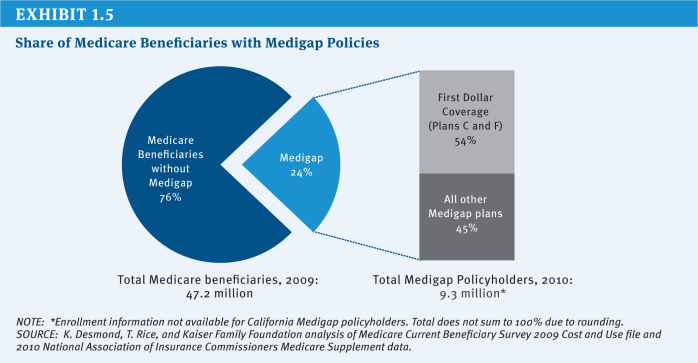

Another option would restrict supplemental coverage or require beneficiaries with this coverage to pay a surcharge. Most beneficiaries have some type of supplemental insurance to help pay Medicare’s cost-sharing requirements and fill gaps in Medicare’s benefit package. For example, in 2009, nearly a quarter of beneficiaries (24%) had a Medigap policy that supplements traditional Medicare and more than one-third (35%) had an employer-sponsored supplemental plan (these estimates include the 5 percent of beneficiaries who had both types of coverage).7

From the perspective of beneficiaries, supplemental plans provide protection from sudden and unpredictable medical expenses, alleviate the burden of ongoing everyday medical spending, and reduce the time spent on paperwork. Yet research has shown that comprehensive first-dollar coverage may lead people to obtain unnecessary services by protecting them from Medicare’s upfront cost-sharing requirements, although the estimates of the extra spending incurred by Medicare vary substantially. This in turn imposes costs not just on the supplemental policy, but on the Medicare program itself—costs borne by all beneficiaries and taxpayers.

Some have proposed to restrict this coverage in order to reduce Medicare spending or to recoup some of the additional costs of beneficiaries with first-dollar supplemental coverage by establishing a surcharge on supplemental plans. Proposals vary in terms of whether they would apply to all types of supplemental plans or just Medigap policies, whether or not they would be restricted to new enrollees, when they would be implemented, and whether they would target first-dollar coverage only or apply to all coverage. This section reviews three options:

» Option 1.8a: Restrict first-dollar Medigap coverage. This option would prohibit Medigap policies from covering the first $550 of beneficiary cost-sharing obligations and limit coverage to 50 percent of the next $4,950 in cost sharing. This option was evaluated by CBO in 2011 and is similar to a recommendation made by the President’s National Commission on Fiscal Responsibility and Reform (the Simpson-Bowles commission).

» Option 1.8b: Impose a 20 percent premium surcharge on all supplemental policies (both Medigap and employer plans). This option would retain beneficiaries’ current options regarding choice of supplemental plans, but would require them to pay a 20 percent surcharge in addition to their plan premium. The surcharge is intended to recover some or all of the additional costs that supplemental coverage may impose on Medicare. MedPAC recommended a premium surcharge on all supplemental plans (including both Medigap and retiree plans) as part of a broader proposal to restructure Medicare’s benefit design (MedPAC 2012a).

» Option 1.8c: Impose a 30 percent Part B premium surcharge for new enrollees who have “near first-dollar” Medigap coverage beginning in 2017. This option was included President Obama’s FY 2013 budget proposal. Although the budget proposal does not define “near first-dollar” coverage, it would minimally include Medigap Plans C and F, which provide first-dollar coverage and covered the majority of Medigap enrollees in 2010 (54 percent, and 13 percent of the overall Medicare population) (Exhibit 1.5).

Budget effects

CBO has estimated that restricting first-dollar Medigap coverage as described under Option 1.8a would produce Federal savings of $53 billion over 10 years (2012–2021) if implemented in 2013 (CBO 2011). CBO has not provided an estimate of Option 1.8b, although it estimated that a related (but narrower) version of this policy that would levy an excise tax on Medigap policies alone set at five percent of the plan premium would save $12 billion over 10 years (2009–2018) (CBO 2008). CBO also estimated that a 30 percent Part B premium surcharge for new enrollees with “near first-dollar” Medigap coverage beginning in 2017, as described under Option 1.8c, would save $2.6 billion over 10 years (2013–2022) (CBO 2012). Savings would increase as new people join Medicare.

The savings to Medicare from restrictions on Medigap are derived from expected reductions in utilization of medical services covered by the Medicare program as a result of greater price sensitivity among beneficiaries who would no longer have their cost sharing fully covered. In practice, the financial impact of surcharges is expected to come from: (1) the surcharges paid by beneficiaries who keep their supplemental coverage, which would be used to finance the extra costs currently imposed on Medicare, and (2) expected reductions in utilization and spending from beneficiaries who choose to drop their coverage or switch to a less generous plan. Actual savings would vary based on the extent to which beneficiaries drop or switch plans.

Discussion

Options to restrict or add a surcharge to supplemental coverage could produce savings for Medicare by reducing the indirect costs that supplemental coverage imposes on Medicare or recuperating the costs through a surcharge. In addition, because Part B spending would decline, Part B premiums would also decline for all beneficiaries.

The downside of these options is that they would limit beneficiaries’ ability to fully insure against the risk of unexpected medical expenses, exposing them to Medicare’s relatively high cost-sharing requirements, or they would require beneficiaries to pay more to insure against that risk. This could be especially burdensome for beneficiaries with modest incomes who do not qualify for Medicaid. In 2009, about two-fifths (41%) of beneficiaries with Medigap and/or employer coverage had incomes between $10,001 and $30,000.8

The effects on Medicare spending and beneficiary well-being would vary based on several key differences between specific proposals:

» Apply restrictions/surcharge to Medigap policies only or, more broadly, to all supplemental plans, including employer-sponsored retiree health coverage? Applying changes to employer plans could be viewed as more equitable in the sense that changes would apply to all supplemental policies rather than being targeted solely to Medigap policies. However, some might argue that retiree plans should be excluded, given that employees may have sacrificed additional earnings during their working years in exchange for retiree benefits. In addition, employer-sponsored retiree health plans generally do not provide first-dollar supplemental coverage. Including retiree health plan enrollees would affect a much larger share of beneficiaries; while about one-quarter (24%) of beneficiaries had Medigap coverage in 2009, more than twice as many (53%) had either Medigap or an employer-sponsored retiree health plan.9

» Apply restrictions/surcharge to first-dollar Medigap policies only or, more broadly, to all Medigap policies? Some proposals (including Option 1.8b above) would apply coverage restrictions or a surcharge on all Medigap policies, while other options more narrowly focus on policies that offer first-dollar coverage. Research suggests that cost sharing may have a greater impact on a patient’s decision of whether to seek care, but less of an impact once the patient has already sought medical care (Swartz 2010). Nonetheless, focusing on first-dollar policies may produce less savings than options that apply to all supplemental policies.

» Impose restrictions on supplemental coverage or impose a premium surcharge? A restriction on first-dollar supplemental coverage would more directly address concerns that first-dollar coverage leads to higher utilization of Medicare-covered services and spending, while a premium surcharge would give beneficiaries more flexibility to purchase their ideal level of insurance relative to a proposal that prohibits first-dollar coverage outright. However, a premium surcharge may discourage beneficiaries—especially those with limited incomes—from retaining or purchasing relatively comprehensive supplemental coverage.

» Apply restrictions/surcharge to all Medigap policyholders or, more narrowly, to new Medicare beneficiaries purchasing first-dollar Medigap policies? Under some proposals, changes to supplemental coverage would exclude beneficiaries who already have supplemental policies, as is the case under Option 1.8c. On the one hand, excluding current policyholders could be justified, given that existing Medigap policyholders may have purchased coverage with an expectation that they would retain access to guaranteed, renewable coverage in the future (and have paid premiums based on the value of this coverage under current law rules). On the other hand, excluding existing policyholders and applying changes only to those newly purchasing Medigap coverage would substantially reduce short-term savings, as indicated by CBO’s estimate of the President’s FY 2013 budget proposal.

» Apply surcharge to the Part B premium or Medigap premiums? This issue has distributional implications: applying a surcharge to the Part B premium would be nationally uniform and easier to administer, while applying a surcharge to Medigap premiums would result in differences due to the variation in Medigap premiums, which can vary by insurer, type of policy, and geographic area.

References

Click to expand/collapse

A.E. Benjamin. 1993. “An Historical Perspective on Home Care Policy,” The Milbank Quarterly, 1993.

Boards of Trustees, Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds. 2012. 2012 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, April 23, 2012.

Centers for Medicare & Medicaid Services (CMS). 2011. Medicare & Medicaid Statistical Supplement: 2011 Edition. November 2011.

Niteesh K. Choudry, et al. 2010. “Assessing The Evidence For Value-Based Insurance Design,” Health Affairs, 2010.

Congressional Budget Office (CBO). 2008. Budget Options, Volume 1: Health Care, December 2008.

Congressional Budget Office (CBO). 2011. Reducing the Deficit: Spending and Revenue Options, March 2011.

Congressional Budget Office (CBO). 2012. Analysis of the President’s FY 2013 Budget, March 2012.

Congressional Research Service (CRS). 2010. Medicare Primer, July 2010.

A. Mark Fendrick. 2009. “Value-Based Insurance Design Landscape Digest,” National Pharmaceutical Council July 2009.

Jimmo v. Sebelius. 2006. Proposed Settlement Agreement, October 16, 2012. Available at: http://www.medicareadvocacy.org/wp-content/uploads/2012/11/Proposed-Settlement-Agreement.101612.pdf.

Kaiser Family Foundation. 2011a. How Much “Skin in the Game” is Enough? The Financial Burden of Health Spending for People on Medicare,” June 2011.

Kaiser Family Foundation. 2011b. Medigap Reform: Setting the Context, June 2011.

Kaiser Family Foundation. 2011c. Projecting Income and Assets: What Might the Future Hold for the Next Generation of Medicare Beneficiaries? June 2011.

Kaiser Family Foundation. 2012. Health Care on a Budget: The Financial Burden of Health Spending by Medicare Households, March 2012.

Medicare Payment Advisory Commission (MedPAC). 2011. Report to the Congress: Medicare Payment Policy, March 2011.

Medicare Payment Advisory Commission (MedPAC). 2012a. Report to the Congress: Medicare and the Health Care Delivery System, June 2012.

Medicare Payment Advisory Commission (MedPAC). 2012b. Report to the Congress: Medicare Payment Policy, March 2012.

Medicare Payment Advisory Commission (MedPAC). 2012c. Transcript of Public Meeting, April 5, 2012.

Office of Management and Budget (OMB). 2011. Living Within Our Means and Investing in the Future, September 2011.

Office of Management and Budget (OMB). 2012. Fiscal Year 2013 Budget of the U.S. Government, February 2012.

Eugene Steurle and Caleb Quakenbush. 2012. Social Security and Medicare Taxes and Benefits Over a Lifetime: 2012 Update, The Urban Institute, October 5, 2012.

Katherine Swartz. 2010. Cost-Sharing: Effects on Spending and Outcomes, Robert Wood Johnson Foundation Synthesis Project Report No. 20, December 2010.

.

Beneficiary Premiums

Options Reviewed

This section reviews two options for increasing beneficiary premiums:

» Increase the Part B or Part D premium

» Increase the income-related Part B and Part D premiums or expand to more beneficiaries

Raising Medicare premiums, either for all beneficiaries or just for higher-income beneficiaries, would reduce Medicare costs by shifting obligations from the Federal government to beneficiaries and other payers. Under current law, people enrolled in Part B and Part D generally are required to pay a monthly premium, which is set to cover 25 percent of per capita program spending ($104.90 in 2013) under Part B and 25.5 percent of the national average cost of standard Part D coverage ($31.17 in 2013, although actual premiums vary across plans and regions) (CMS 2012a; CMS 2012b). As of 2011, 92 percent of Medicare beneficiaries were enrolled in Part B and 73 percent were enrolled in Part D (Boards of Trustees 2012).

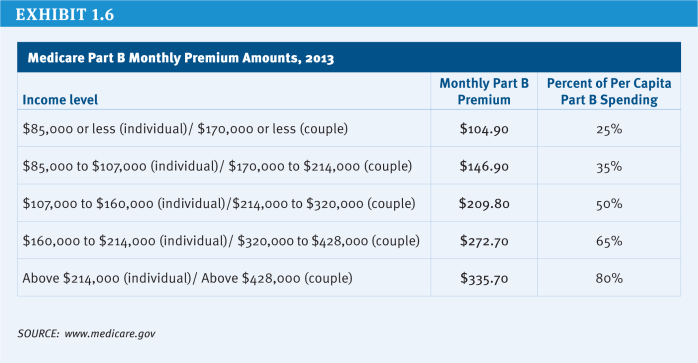

Beneficiaries with annual incomes above $85,000 for an individual or $170,000 for a couple are required to pay a higher premium than other beneficiaries in both Parts B and D. For example, in 2013, the income-related Part B monthly premium ranges from $146.90 to $335.70 (Exhibit 1.6). The income thresholds were fixed beginning in 2011 and will be frozen under current law through 2019, thereby increasing the number and share of beneficiaries required to pay the higher premium during that period. In 2020 and subsequent years, the income thresholds will again be indexed to inflation as if they had not been frozen from 2011 to 2019. The Part B premium for upper-income beneficiaries ranges from 35 percent to 80 percent of Part B per capita expenditures. The Part D premium range is the same.

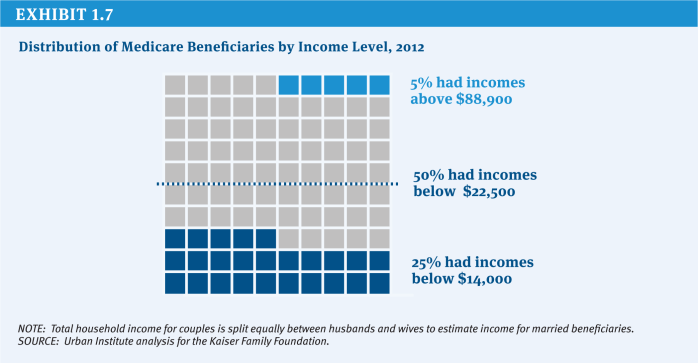

The distribution of income among Medicare beneficiaries is skewed, with half estimated to have income of about $22,500 or less in 2012 and the top 5 percent having income of $88,900 or more (Exhibit 1.7). In 2013, 5 percent of Part B enrollees are estimated to pay the income-related Part B premium; that share is projected to rise to 10 percent by 2019, but then drop to about 7 percent in 2021.10 Similarly, about 4 percent of Part D enrollees will be subject to the income-related Part D premium in 2013, with that share expected to rise to 8 percent in 2019 and then fall to 6 percent in 2021 (OACT 2010).

Many beneficiaries with low incomes are not required to pay Medicare premiums if they are eligible for programs that pay premiums on their behalf, including Medicaid, the Medicare Savings Programs (for Part B premiums), and the Low-Income Subsidy (LIS) program for Part D premiums. In addition, in a year where the Social Security cost of living adjustment (COLA) is insufficient to cover an increase in the Medicare Part B premium for an individual, the so-called “hold harmless” provision prohibits an increase in the Part B premium that would otherwise result in a reduction in that individual’s monthly Social Security payments.

Policy Options

OPTION 1.9

Increase the Part B or Part D premium

One option for achieving Medicare savings would gradually increase the share of Part B costs paid by enrollees from 25 percent to 35 percent and increase Part D premiums from 25.5 percent to 35 percent of the national average cost of standard Part D coverage.

Budget effects

CBO has estimated that gradually increasing the standard Part B premium for people with Medicare by 2 percentage points each year to eventually cover 35 percent of Part B expenditures would reduce Federal spending by $241 billion over 10 years (2012–2021) (CBO 2011). Because the average Part D premium is less than the Part B premium and fewer people are enrolled in Part D, it stands to reason that increasing the Part D premium in a similar way would generate fewer savings to the Federal government, but no cost estimate is available for this option.

To the extent that Medicaid, Medicare Savings Programs, and the Low-Income Subsidy (LIS) program pay premiums on behalf of some low-income beneficiaries, increasing the share of Part B and/or Part D program costs paid by beneficiaries would increase spending by the Federal and State governments that fund these programs.11 This would offset some of the Federal savings from reduced Medicare spending.

Discussion

This policy change would involve tradeoffs in spending by the Federal government, State governments, beneficiaries, and some employers (those that pay Part D premiums on behalf of retirees). Raising Medicare premiums could substantially reduce net program spending, but would shift most of these expenses onto beneficiaries or those entities paying Medicare premiums on their behalf. To cover 35 percent of program costs in 2013, the standard Part B premium would increase from $104.90 to about $147 per month—raising Part B premiums for individuals by about $42 per month ($504 per year) and for couples by $84 per month ($1,007 per year).

Some, but not all, low-income beneficiaries would be protected from the premium increases. For example, Medicaid pays Part B premiums on behalf of the roughly nine million low-income Medicare beneficiaries who also are enrolled in Medicaid or Medicare Savings Programs (MSPs). The Low-Income Subsidy (LIS) program, which provides financial assistance under Part D for about 11 million low-income beneficiaries (Boards of Trustees 2012), would cover the full Part D premium for low-income Part D beneficiaries enrolled in “benchmark” plans and partially protect those who enroll in more expensive plans. Nonetheless, many low-income beneficiaries would be subject to the higher premium because they are not enrolled in Medicaid, Medicare Savings Programs, or the LIS program.

Some of the Medicare savings derived from this option could be used to shield low-income beneficiaries from premium in-creases. This could be accomplished in one of several ways: (1) raise the income and asset thresholds for the MSPs and/or the LIS program to allow more low-income beneficiaries to qualify for these programs; (2) increase the amount of LIS premium assistance for beneficiaries who only receive a partial subsidy; (3) modify the “hold harmless” provision, which currently prevents a reduction in Social Security payments that would otherwise occur for an individual if the monthly Part B premium increase is larger than the monthly Social Security cost-of-living increase, to take into account Part D premiums; or (4) modify the “hold-harmless” provision to prohibit Medicare premium increases from exceeding a certain percentage (e.g., 25 percent) of the COLA.

OPTION 1.10

Increase the income-related Part B and Part D premiums or expand to more beneficiaries

Beneficiaries with higher incomes could be asked to contribute more in premium payments to achieve additional savings. This could be done by:

» Increasing the income-related premium. Beneficiaries with higher incomes could be required to pay a larger share of the cost of their Part B or Part D coverage than they are required to pay under current law or they could be required to pay the full cost of their coverage.

» Increasing the share of beneficiaries paying the income-related premium. The income-related premium could be imposed on a larger share of beneficiaries by continuing the freeze on income thresholds for an extended period of time and/or by lowering the income thresholds.

President Obama’s FY 2013 budget included a proposal that, beginning in 2017, would raise the Part B income-related premiums by 15 percent to cover between 40.25 to 92 percent of Part B program costs depending on the beneficiary’s income, increase the Part D income-related premium based on the same surcharge percentages, and freeze current income thresholds until such time when 25 percent of beneficiaries pay an income-related premium (OMB 2012). Republicans in the U.S. House of Representatives proposed a similar option in 2011 (U.S. House of Representatives 2011).

Budget effects

CBO estimated that President Obama’s proposal would produce Federal savings of $30 billion over 10 years (2013–2022) (CBO 2012). Savings would increase over time as more beneficiaries paid the income-related premium.

Discussion

By targeting those with incomes above a certain level, this option would be less regressive than a premium increase for all beneficiaries. However, expanding this provision to a greater share of beneficiaries by freezing the income thresholds could reach beneficiaries who would not be considered “high income” by some standards. For example, if the income thresholds are frozen until 25 percent of all beneficiaries are subject to the income-related premium, as in the President’s FY 2013 budget, then beneficiaries with incomes at or above $47,000 in 2012 inflation-adjusted dollars would eventually be required to pay the income-related premium (Kaiser Family Foundation 2012).

Beneficiaries with higher incomes already pay much more into the program during their working (and payroll-tax paying) years than other beneficiaries and, under current law, are paying higher Part B and D premiums than other beneficiaries. There is some concern that proposals to raise premiums for higher-income beneficiaries could lead some to drop out of Medicare Part B and/or Part D, which could result in higher premiums for others who remain on Medicare, assuming the higher income beneficiaries who disenroll are relatively healthy. However, so far, there is no evidence that higher income beneficiaries are dropping out of Part B and Part D in response to existing income-related premiums.

References

Click to expand/collapse

AARP Public Policy Institute. 2012. Option: Raise Medicare Premiums for Higher-Income Beneficiaries, June 2012.

Boards of Trustees, Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds. 2012. 2012 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, April 23, 2012.

Centers for Medicare & Medicaid Services (CMS). 2012a. Annual Release of Part D National Average Bid Amount and Other Part C & D Bid Related Information, August 6 2012.

Centers for Medicare & Medicaid Services (CMS). 2012b. Medicare & You 2013, November 2012.

Office of the Actuary (OACT). 2010. Part D Income-Related Premium, PB2012, Unpublished estimates, December 2010.

Congressional Budget Office (CBO). 2011. Reducing the Deficit: Spending and Revenue Options, March 2011.

Congressional Budget Office (CBO). 2012. Analysis of the President’s FY 2013 Budget, March 2012.

Congressional Research Service (CRS). 2009. The Effect of No Social Security COLA on Medicare Part B Premiums, October 2009.

Kaiser Family Foundation. 2011. The Ups and Downs of Medicare Part B Premiums: Frequently Asked Questions, November 2011.

Kaiser Family Foundation. 2012. Income-Relating Medicare Part B and Part D Premiums Under Current Law and Recent Proposals: What are the Implications for Beneficiaries? February 2012.

National Committee to Preserve Social Security & Medicare. 2012. Medicare and Means Testing, January 2012.

Office of Management and Budget (OMB). 2012. Fiscal Year 2013 Budget of the U.S. Government, February 2012.

U.S. House of Representatives. 2011. Middle Class Tax Relief and Job Creation Act of 2012 (as introduced December 9, 2011), December 9, 2011.

.

Revenues

Options Reviewed

This section reviews options for increasing revenue dedicated to Medicare financing:12

» Raise the Medicare payroll tax

» Increase other existing taxes

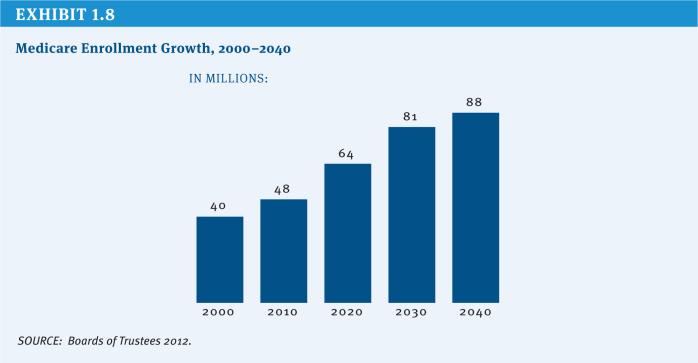

While this report identifies numerous approaches to slowing growth in Medicare spending, it may not be possible to sustain the program through spending reductions alone in light of the demographic changes that underlie Medicare’s financing shortfall. Over the next 20 years, Medicare enrollment will grow by more than 1.5 million beneficiaries each year, as the Baby Boom generation reaches current eligibility age. Between 2011 and 2030, an average of 10,000 Americans will turn 65 every day. By 2030, the program will finance care for twice as many Americans as it did in 2000 (Passel and Cohn 2008) (Exhibit 1.8). This rapid enrollment growth means that even if policy changes were enacted that succeed in limiting Medicare’s per-beneficiary spending trend to the annual growth in the gross domestic product (GDP)—well below the historical average of GDP plus 1.5 percentage points—total program spending still will grow at an average rate of GDP plus 3 percentage points. The demographic challenge may, therefore, lead policymakers to consider revenue options in addition to spending constraints so that Medicare benefits and payments are maintained at a level sufficient to cover the costs of care.

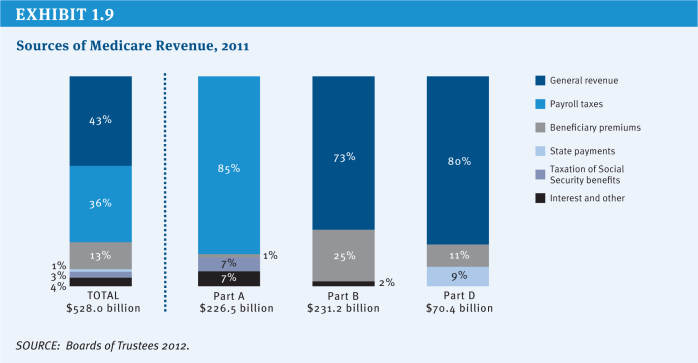

Currently, Medicare is financed by a combination of revenue streams (Exhibit 1.9). Employers and employees each pay a payroll tax of 1.45 percent (for a total of 2.9 percent of wages), which provided 36 percent of total program income in 2011. General tax revenue accounted for 43 percent of Medicare’s income. Beneficiary premium contributions comprised another 13 percent of program income, and 3 percent came from a portion of taxes paid on Social Security benefits. Other revenue sources include interest earned on Medicare’s trust fund reserves and payments from the states related to Medicare prescription drug coverage. Beginning in 2013, an additional Medicare tax will be paid by high-wage earners—those with annual income above $200,000 a year for individuals and $250,000 a year for couples—at a rate of 0.9 percent.

Policy Options

OPTION 1.11

Increase the Medicare payroll tax

The Medicare payroll tax could be increased from its current level of 2.9 percent. For example, one option would replace the additional 0.9 percent tax on high-wage earners with a 1 percentage point increase in the Medicare payroll tax applied to all wage earners, split equally between employer and employee. If that were done, the payroll tax would total 3.9 percent, split between employer and employee (1.95 percent paid by each).

Budget effects

In 2011, CBO estimated that replacing the high-earner additional Medicare tax with a 1 percentage point increase in the basic Medicare payroll tax would generate $651 billion in new revenue over 10 years (2012–2021).

Discussion

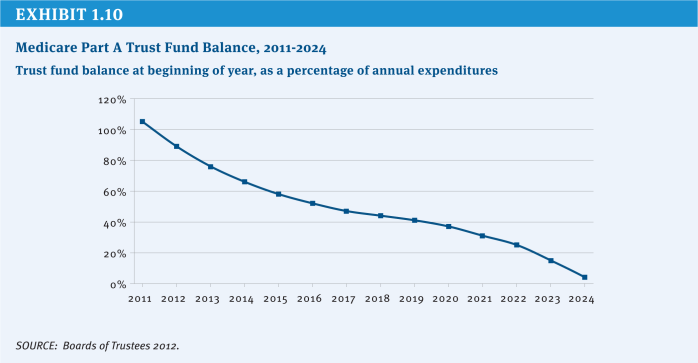

Increasing the payroll tax would shore up an important component of Medicare financing. Under Medicare’s financing structure, inpatient hospital care and other Part A benefits are financed primarily through the payroll tax, which accounts for about 85 percent of annual Hospital Insurance (Part A) trust fund revenue. Unlike Medicare Parts B and D, no automatic general revenue transfers are provided to cover shortfalls in the Part A trust fund. Since 2008, the trust fund annual income has been insufficient to cover benefits, and reserves that were built up in previous years are being drawn down. The Medicare actuaries project that by 2024 these reserves will be exhausted, meaning that there will not be sufficient funds to cover all program obligations for Part A benefits (Exhibit 1.10). CBO estimates that a 1 percentage point increase in the Medicare payroll tax would extend the exhaustion date for several decades.

Raising the rate would increase the total tax burden on workers, which is especially burdensome for those with lower incomes. A possible alternative would be to limit the increase to higher earners, although this would generate less revenue. For example, it could be accomplished by raising the rate for the additional Medicare tax above 0.9 percent or by lowering the income threshold ($200,000 for individuals and $250,000 for couples filing jointly) to which the additional tax is applied.

OPTION 1.12

Increase other existing taxes

Another option would be to impose new taxes and dedicate the revenue to Medicare. These taxes could be dedicated to the Part A trust fund to help ensure its continued solvency. New revenue could also become part of the general revenue that is used to finance the program. Because the Supplementary Medical Insurance (Part B) trust fund draws on general revenues as needed, dedicating a specific revenue stream to cover the costs of this part of Medicare would reduce the need for a draw-down of general funds. Any number of taxes might be considered for Medicare financing, including excise taxes aimed at encouraging healthier behaviors that also could reduce need for health care services, as well as taxes on health insurance benefits. New revenue aimed at encouraging healthier behavior could include increases in existing Federal excise taxes on alcohol and tobacco products to both discourage use and increase revenue. Federal taxes also could be extended to address other behaviors, such as foods associated with obesity and diabetes, with some or all of these new revenues dedicated to financing Medicare.

A variation on this option would be to dedicate an existing revenue stream to the Part A trust fund. This would not increase total Federal revenue, but would improve the financial status of the trust fund. For example, the Affordable Care Act (ACA) added a 3.8 percent tax on unearned income, called the “Unearned Income Medicare Contribution,” that was estimated to raise about $120 billion in revenue over 10 years (2010–2019).13 This new tax, effective January 2013, is applied to net investment income for taxpayers with modified adjusted gross income in excess of $200,000 for singles and $250,000 for married couples. Revenue from this provision, which is currently treated as general revenue, could be dedicated to the Medicare Part A trust fund.

OPTION 1.12a

Increase the Federal tax on alcohol products and dedicate all or a portion of the revenue to Medicare

Federally, different alcoholic beverages currently are taxed at different rates, with a much higher rate imposed on distilled spirits than on beer and wine. The National Coalition on Health Care (NCHC) has recommended equalizing the excise tax rate applied to all alcoholic products at a level that achieves the same monetary level achieved in 1991, the last time there was a tax increase on alcohol, and is further indexed to inflation (NCHC 2012).

Budget effects

CBO estimated that increasing taxes on all alcoholic beverages to a uniform $16 per proof gallon would result in $60 billion in new revenue over 10 years (2012–2021) (CBO 2011).14 The NCHC proposal likely would generate more revenue.

Discussion

Alcohol use has been associated with increased health care spending, which affects Medicare and other payers. Increasing the Federal excise tax would generate revenue to help offset these higher health care costs and would reduce use of alcohol, which could lower alcohol-related health care spending. According to CBO, the current excise tax, when adjusted for inflation, is lower than historical levels. The current tax accounts for 10-to 20 percent of the pretax price of alcohol, compared with 50 percent in 1950. However, the use of alcohol is not always unhealthy and the increased tax would fall on some people who are using alcohol in ways that do not increase health or social costs. In particular, studies have associated moderate use of wine with lower incidence of heart disease and stroke. Equalizing the tax rate on all forms of alcoholic beverages would result in proportionally larger tax increases on wine and beer relative to distilled spirits. In addition, some object to increases in this tax because it already is regressive (the tax represents a higher proportion of income for lower-income households than higher-income households) and an increase would exacerbate this.

OPTION 1.12b

Increase the Federal tax on tobacco products and dedicate all or a portion of the revenue to Medicare

Currently, the Federal excise tax on cigarettes and small cigars is $1.01 per pack. The NCHC has recommended increasing this tax by an additional $1 per pack and increasing the tax on other tobacco products equivalently.

Budget effects

CBO has estimated that a 50-cent per pack increase in the tax on cigarettes and small cigars beginning in 2013 and indexed to inflation would increase revenue by $41 billion over a nine-year period (2013–2021); net savings to Medicare from reduced health spending would total $250 million. The tax would have other budget effects (for example, reduced Medicaid spending and greater Social Security benefit payments). CBO estimates a net nine-year reduction in Federal spending of $730 million. The total budget impact would be $42 billion over nine years (2013–2021) (CBO 2012).

Discussion

Increasing the excise tax on cigarettes and other tobacco products would reduce use, improve health, and result in greater longevity. Research on the impact of price changes in use of tobacco has shown that teenagers would most likely reduce tobacco use if the tax were increased, and more young people would be discouraged from starting to smoke. In the long-term, however, improved longevity would increase Medicare spending and, combined with effects on Social Security and other programs, it would be the revenue-raising aspect of the tax alone that would improve the Federal deficit. The burden of this tax would be greatest on low-income people, who are more likely to smoke than others.

OPTION 1.12c

Impose a new Federal excise tax on sugar-sweetened beverages and dedicate all or a portion of the revenue to Medicare

This option would impose a new Federal excise tax on sodas, fruit drinks, and other beverages sweetened with sugar, high fructose corn syrup, or similar sweeteners.

Budget effects

In 2008, CBO estimated that an excise tax on sugar-sweetened beverages of three cents per 12 ounces would generate about $50 billion in revenue over 10 years (2009–2018).

Discussion

High consumption of sugar-sweetened beverages has been associated with increased incidence of obesity, diabetes, and other health conditions. A recent study found that a one cent per ounce tax would reduce consumption of sugar-sweetened beverages by 15 percent among adults ages 25-64 (Wang et al. 2012).

Reduced consumption might not improve overall health if people continue to consume other unhealthy foods, however. Like other excise taxes, this tax would be regressive and affect lower-income consumers more than others. Finally, no mechanism exists for a Federal tax on sugar-sweetened soft drinks, and a new tax on these items would require investments for administration and collection.

OPTION 1.12d

Increase taxes on employer-funded health insurance

The ACA includes an excise tax on high-cost employer plans beginning in 2018. To further increase revenue, the tax could be phased in more quickly and the thresholds reduced so that it applies to more plans. As enacted, the tax initially is expected to affect a small proportion of plans (7 percent in one estimate) (Congressional Research Service 2011), with this share growing over time. In addition to generating direct revenue, the tax is seen as encouraging employers and employees to shift to lower-cost plans, which in turn will increase Federal revenue by shrinking the portion of employee compensation that is not taxed.15 Part of the revenue raised by such a policy would go directly to the Part A trust fund in the form of payroll tax revenue; policy-makers could choose to dedicate all or a portion of the remaining revenue to Medicare.

Budget effects

In 2011, CBO estimated that beginning the tax on high cost plans in 2014 and lowering the threshold to initially include the top 20 percent of plans, and then indexing it to general inflation, would generate an additional $310 billion in revenue over 10 years (2012–2021). The revenue would be a combination of increased excise, income, and payroll taxes.

Discussion

The exclusion of employer health benefits from individual income and payroll taxes has long been viewed by economists as contributing to higher health care costs. Because of the exclusion from taxation, a dollar in health benefits has greater value to the employee than a dollar in wages, and over time employer health benefits expanded as a result. Extending the ACA tax to more employer coverage would therefore shift the incentives of the current system and encourage employers and employees to choose less costly coverage. However, growing health costs have led many employers to increase employee cost sharing, which already acts to reduce health spending. Lowering the thresholds to expand the number of plans subject to the tax could create inequities, such as taxing plans that are expensive because of the age and health status of the workforce, not the generosity of benefits. To the extent that employers respond to the new tax by shifting to less generous employee coverage, workers (or their dependents) with health problems would be forced to pay more out of pocket for health care, and some may avoid needed services.

Because some employers and employees would choose less costly health plans in order to avoid paying the excise tax, this option would increase Medicare payroll tax revenue. As spending on health benefits declined, the labor market likely would adjust to increase the amount of compensation that is paid in the form of wages subject to payroll and income taxes.

References

Click to expand/collapse

Boards of Trustees, Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds. 2012. 2012 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, April 23, 2012.

Centers for Disease Control and Prevention (CDC). 2010. CDC Guide to Strategies for Reducing the Consumption of Sugar-Sweetened Beverages, March 2010.

Congressional Budget Office (CBO). 2011. Reducing the Deficit: Spending and Revenue Options, March 2011.

Congressional Budget Office (CBO). 2012. Raising the Excise Tax on Cigarettes: Effects on Health and the Federal Budget, June 2012.

Congressional Research Service (CRS). 2011. Health-Related Revenue Provisions in the Patient Protection and Affordable Care Act, February 10, 2011.

Joint Committee on Taxation. 2012. Estimates of Federal Tax Expenditures for Fiscal Years 2011–2015, January 17, 2012.

National Coalition on Health Care (NCHC). 2012. “Curbing Costs, Improving Care: The Path to an Affordable Health Care Future,” November 2012.

Jeffrey S. Passel and D’Vera Cohn. 2008. U.S. Population Projections: 2005–2050, Pew Research Center, 2008.

Y. Clare Wang et al. 2012. “A Penny-Per-Ounce Tax on Sugar-Sweetened Beverages Would Cut Health and Cost Burdens of Diabetes,” Health Affairs, January 2012.