Medicare Part D: A First Look at Medicare Drug Plans in 2023

During the Medicare open enrollment period from October 15 to December 7 each year, beneficiaries can enroll in a plan that provides Part D prescription drug coverage, either a stand-alone prescription drug plan (PDP) for people in traditional Medicare, or a Medicare Advantage plan that covers all Medicare benefits, including prescription drugs (MA-PD). In 2022, 49 million of the 65 million people covered by Medicare are enrolled in Part D plans, with more than half (53%) enrolled in MA-PDs and 47% in PDPs. This issue brief provides an overview of the Medicare Part D marketplace in 2023 and key trends over time, focusing primarily on PDPs. (A separate overview of the 2023 Medicare Advantage market is also available.) The brief also describes the provisions in the Inflation Reduction Act of 2022 that affect the Medicare Part D marketplace beginning in 2023. Unless otherwise noted, weighted estimates are based on June 2022 enrollment (see Methods box for additional details).

Highlights for 2023

- The average Medicare beneficiary has a choice of nearly 60 Medicare plans with Part D drug coverage in 2023, including 24 Medicare stand-alone drug plans and 35 Medicare Advantage drug plans.

- A total of 801 PDPs will be offered in 2023 nationwide, a modest increase from 2022. Of this total, 191 PDPs will be premium-free for enrollees receiving the Low-Income Subsidy (LIS) (benchmark plans).

- The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43 in 2023, based on current enrollment, a 10% increase from $39 in 2022 – a rate of increase that outpaces both the current annual inflation rate and the Social Security cost-of-living adjustment for 2023.

- Average monthly premiums for the 16 national PDPs are projected to range from $6 to $111 in 2023. Among the national PDPs, average monthly premiums are increasing for 12 PDPs, including 4 PDPs with increases exceeding $10.

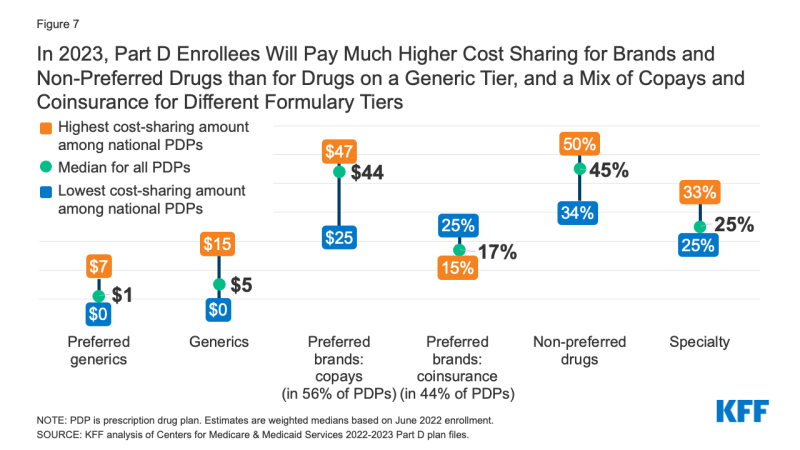

- Most PDP enrollees will face much higher cost sharing for brands than for generic drugs, including coinsurance for non-preferred drugs between 40% and 50% (the maximum coinsurance rate allowed for the non-preferred drug tier) in 12 of the 16 national PDPs, similar to recent years. Close to half of all PDP enrollees will also face coinsurance, rather than copays, for preferred brands, ranging from 15% to 25%; coinsurance can mean less predictable out-of-pocket costs than copayments. Most Part D PDP enrollees who remain in their current plan for 2023 will be in a plan with the standard (maximum) $505 deductible.

- Beginning in 2023, under a provision in the Inflation Reduction Act, Part D enrollees will pay no more than $35 per month for covered insulin products in all Part D plans, and will pay no cost sharing for adult vaccines covered under Part D. Also beginning in 2023, drug manufacturers will be required to pay rebates for drug prices that rise faster than the rate of inflation, which could impact costs for Part D enrollees. The law also adds a hard cap on out-of-pocket drug spending under Part D by eliminating the 5% coinsurance requirement for catastrophic coverage in 2024 and capping out-of-pocket drug spending at $2,000 in 2025, and authorizes the federal government to negotiate drug prices under Medicare, with negotiated prices for 10 Part D drugs first available in 2026.

Part D Plan Availability

The Average Medicare Beneficiary Has a Choice of Nearly 60 Medicare Plans with Part D Drug Coverage in 2023

The average Medicare beneficiary will have a choice of 24 PDPs in 2023, 1 more PDP option than in 2022 (Figure 1). Although the number of PDP options for 2023 is far lower than the peak in 2007 (when there were 56 PDP options, on average), Medicare beneficiaries continue to have numerous drug plan options.

In 2023, beneficiaries will also have access to 35 MA-PDs, on average, a 13% increase in MA-PD options since 2022. This average excludes Medicare Advantage plans that do not offer the drug benefit and plans not available to all beneficiaries, such as Special Needs Plans and group plans. Including Medicare Advantage plans that do not provide the Part D benefit, an average of 43 will be available to beneficiaries in 2023.

A Total of 801 Medicare Part D Stand-Alone Prescription Drug Plans Will Be Offered in 2023

In 2023, a total of 801 PDPs will be offered by 15 firms in the 34 PDP regions (plus another 10 PDPs in the territories), an increase of 35 PDPs (5%) from 2022 (Figure 2). The number of firms sponsoring stand-alone drug plans has declined steadily over time, from more than 30 firms in 2011 and earlier years, dropping below 25 firms beginning in 2015, and at 15 firms in 2023, is the lowest number in any year since Part D started.

PDP enrollment is expected to be concentrated in a small number of firms in 2023, as it has been every year. Based on June 2022 enrollment, more than 8 out of 10 PDP enrollees (82%) in 2023 are projected to be in PDPs operated by just four firms: CVS Health, Centene, UnitedHealth, and Humana. All four firms offer PDPs in all 34 PDP regions in 2023.

Beneficiaries in each state will have a choice of multiple PDPs, ranging from 19 PDPs in New York to 28 PDPs in Arizona, plus multiple MA-PDs offered at the local level (Figure 3, Table 1).

Availability of Insulin For $35 Per Month

In 2023, under a provision in the Inflation Reduction Act, Part D enrollees will pay no more than $35 per month for covered insulin products in all Part D plans. This new requirement builds on a current Innovation Center model, the Part D Senior Savings Model, in which only participating enhanced Part D drug plans cover insulin products at a monthly copayment of $35 in the deductible, initial coverage, and coverage gap phases of the Part D benefit. In 2023, a total of 2,881 Part D plans will participate in this model (a 33% increase over 2022), including 324 PDPs and 2,557 MA-PDs (including segmented plans). While this model will continue in 2023, beneficiaries do not need to enroll in one of the model-participating plans to benefit from the $35 monthly copay cap for insulin. Under the new Inflation Reduction Act requirement, Part D plans are not required to cover all available insulin products at the $35 monthly copayment amount, only those insulin products that are covered on a plan’s formulary.

Part D Premiums

Average Monthly Premiums for the 16 National PDPs Are Projected to Range from $6 to $111 in 2023

The estimated national average monthly PDP premium for 2023 is projected to be $43, a 10% increase from $39 in 2022, weighted by June 2022 enrollment (Table 2) – a rate of increase that outpaces both the current annual inflation rate and the Social Security cost-of-living adjustment for 2023. It is likely that the actual average weighted premium for 2023, after accounting for enrollment choices by new enrollees and plan changes by current enrollees, will be lower than this estimated average. CMS reported that the average premium for basic Part D coverage offered by both PDPs and MA-PDs will be an estimated $31.50 in 2023. Our premium estimate is higher because it is based on PDPs only (excluding MA-PDs, which have substantially lower premiums than PDPs) and includes PDPs offering both basic and enhanced coverage (enhanced plans, which account for 60% of all PDPs in 2022, have higher premiums than basic plans, on average).

PDP premiums will vary widely across plans in 2023, as in previous years. Among the 16 national PDPs, there is a difference of more than $1,200 in annual premiums between the highest-premium PDP and the lowest-premium PDP. At the high end, the monthly premium for AARP MedicareRx Preferred will be $111, totaling more than $1,300 annually. At the low end, the monthly premium for SilverScript SmartSaver will be $6, or $67 annually (Figure 4, Table 2).

Changes to premiums from 2022 to 2023, averaged across regions and weighted by 2022 enrollment, also vary widely across PDPs, as do the absolute amounts of monthly premiums for 2023. Among the 16 national PDPs, average monthly premiums are increasing for 12 PDPs, including 4 PDPs with increases exceeding $10: Cigna Extra Rx (+$13, a 26% increase), Elixir RxSecure (+$12, a 35% increase), AARP MedicareRx Preferred (+$12, a 12% increase), and Humana Walmart Value Rx Plan (+$11, a 46% increase).

Monthly premiums are increasing in 2 of the top 3 PDPs ranked by total PDP enrollment:

- For the largest PDP, CVS Health’s SilverScript Choice, which has a total of 3.0 million enrollees in 2022, including 1.4 million non-LIS enrollees, the average monthly premium will increase by $2 (+8%), from $31 in 2022 to $33 in 2023.

- For the second largest PDP, Wellcare Value Script, with a total of 2.3 million enrollees in 2022, including 2.2 million non-LIS enrollees, the average monthly premium will decrease by $2 (-19%), from $12 in 2022 to $10 in 2023.

- For the third largest PDP, AARP MedicareRx Preferred, with a total of 1.6 million enrollees, including 1.5 million non-LIS enrollees, the average monthly premium will increase by $12 (+12%) between 2022 and 2023, from $99 to $111. This is the highest average monthly premium among the national PDPs in 2023. Part D enrollees who have been enrolled in AARP MedicareRx Preferred since 2016 and stay enrolled in 2023 will be paying nearly $50 more per month in premiums – or roughly $600 more annually – than in 2016, when the average monthly premium for this PDP was $61.

Average Monthly Premiums Are Higher for PDPs Offering Enhanced Benefits and Lower or No Deductibles

Most Part D stand-alone drug plans in 2023 (62% of PDPs) will offer enhanced benefits for a higher average monthly premium, and most non-LIS PDP enrollees (75%) are enrolled in enhanced plans, based on June 2022 enrollment. Enhanced benefits can include a lower (or no) deductible, reduced cost sharing, or a higher initial coverage limit than under the basic benefit design. The average premium in 2023 for enhanced benefit PDPs is $48, which is $10 (28%) more than the monthly premium for PDPs offering the basic benefit ($37) (Figure 5).

In 2023, most PDPs (84%) will charge a deductible, including 7 in 10 PDPs (70%) charging the standard (maximum) amount of $505 in 2023. This is on top of the $1,600 Part A deductible and $226 Part B deductible for 2023. Across all PDPs, the average deductible in 2023 will be $408. The average monthly premium in 2023 for PDPs that charge no deductible is $99, more than three times the monthly premium for PDPs that charge the standard deductible ($30) and 66% higher than the monthly premium for PDPs charging a partial deductible ($60).

More than 6 in 10 Part D Stand-alone Drug Plan Enrollees Without Low-income Subsidies Will Pay Higher Premiums in 2023 If They Stay in Their Current Plan

More than 6 in 10 Part D stand-alone plan enrollees (62%) – 8.2 million of the 13.2 million Part D PDP enrollees who are responsible for paying the entire premium (which excludes Low-Income Subsidy (LIS) recipients) – will see their monthly premium increase in 2023 if they stay in their current plan, while 5.0 million (38%) will see a premium reduction if they stay in their current plan (Figure 6).

While the average weighted monthly PDP premium is increasing by $4 between 2022 and 2023 (from $39 to $43), 2.1 million non-LIS enrollees (16%) will see a premium increase of $10 or more per month – or at least $120 more annually if they remain in their current plan. Substantially fewer non-LIS enrollees (0.1 million, or 1%) will see a premium reduction of the same magnitude. Nearly one-third (32%) of non-LIS enrollees (4.2 million) are projected to pay monthly premiums of at least $60 if they stay in their current plans, or more than $700 annually, including 1.6 million (12% of non-LIS enrollees) projected to pay monthly premiums of at least $100, or at least $1,200 annually. This group includes enrollees in the AARP MedicareRx Preferred PDP, along with enrollees in several Blue Cross/Blue Shield PDPs and other PDPs that are offered in selected regions but not nationwide.

Part D Cost Sharing

Part D Enrollees Pay Much Higher Cost Sharing for Brands and Non-preferred Drugs Than for Generic-Tier Drugs, and a Mix of Copays and Coinsurance for Different Formulary Tiers

In 2023, as in prior years, Part D enrollees will face much higher cost-sharing amounts for brands and non-preferred drugs (which can include both brands and generics) than for drugs on a generic tier, and a mix of copayments and coinsurance for different formulary tiers. The typical five-tier formulary design in Part D includes tiers for preferred generics, generics, preferred brands, non-preferred drugs, and specialty drugs.

Among all PDPs, median standard cost sharing in 2023 is $1 for preferred generics and $5 for generics, $44 for preferred brands (an increase from $42 in 2022), 45% coinsurance for non-preferred drugs (an increase from 40% in 2022; the maximum allowed is 50%), and 25% coinsurance for specialty drugs (the same as in 2022; the maximum allowed is 33%) (Figure 7, Table 3).

Figure 7: In 2023, Part D Enrollees Will Pay Much Higher Cost Sharing for Brands and Non-Preferred Drugs than for Drugs on a Generic Tier, and a Mix of Copays and Coinsurance for Different Formulary Tiers

Plans are implementing a mix of cost-sharing changes for 2023, with both increases and decreases in cost-sharing amounts on various formulary tiers. Among the notable changes:

- For preferred generics, 2 fewer national PDPs will be charging $0 monthly copays in 2023 (5 PDPs) than in 2022 (7 PDPs).

- For non-preferred drugs, cost sharing amounts are increasing in 7 of the 16 national PDPs (while decreasing in only 1 of the 16). In 12 of the 16 national PDPs, coinsurance amounts for non-preferred drugs will range from 40% to 50% (the maximum allowed for this tier) in 2023.

- Close to half of all PDP enrollees in 2023 (44%, up from 34% in 2022) will face coinsurance ranging from 15% to 25% for preferred brands, rather than flat copays. Paying coinsurance rather than flat copayments makes it more difficult to know in advance what actual out-of-pocket costs will be, since that depends on the underlying list price of the drug.

Low-Income Subsidy Plan Availability

In 2023, a Smaller Number of Part D Stand-Alone Drug Plans Will Be Premium-Free to Enrollees Receiving the Low-Income Subsidy (Benchmark Plans) Than in Any Year Since Part D Started

Through the Part D LIS program, enrollees with low incomes and modest assets are eligible for assistance with Part D plan premiums and cost sharing. Nearly 13 million Part D enrollees are receiving LIS, including 7.3 million (57%) in MA-PDs and 5.5 million (43%) in PDPs.

In 2023, a smaller number of PDPs will be premium-free benchmark plans – that is, PDPs available for no monthly premium to Medicare Part D enrollees receiving the Low-Income Subsidy (LIS) – than in any year since Part D started in 2006, with 191 premium-free benchmark plans, or roughly a quarter of all PDPs in 2023 (Figure 8). The number of benchmark plans available in 2023 will vary by region, from three to eight (Table 1). In 2023, 89% of the 5.5 million LIS PDP enrollees are projected to be in PDPs operated by five firms: CVS Health, Centene, Humana, Cigna, and UnitedHealth (based on June 2022 enrollment).

On average (weighted by Medicare enrollment), LIS beneficiaries have five benchmark plans available to them for 2023, which is about one-fifth the average number of PDP choices available overall and the lowest average number of benchmark plan options in any year since Part D started. All LIS enrollees can select any plan offered in their area, but if they enroll in a non-benchmark plan, they must pay some portion of their chosen plan’s monthly premium. In 2023, nearly one-fourth (24%) of all LIS PDP enrollees who are eligible for premium-free Part D coverage (1.0 million LIS enrollees) will pay Part D premiums averaging $25 per month unless they switch or are reassigned by CMS to premium-free plans.

Discussion

Our analysis of the Medicare Part D stand-alone drug plan landscape for 2023 shows that millions of Part D enrollees without low-income subsidies will face premium and other cost increases in 2023 if they stay in their current stand-alone drug plan. There are dozens of drug plan choices available to beneficiaries in each area during this year’s open enrollment period, including both PDPs (24 plans, on average) and Medicare Advantage drug plans (35 MA-PD plans, on average). There are also somewhat fewer benchmark plan options for Part D enrollees receiving Low-Income Subsidies. A narrower set of benchmark plan options could make it more difficult for some LIS enrollees to find a premium-free plan that covers all their prescription medications.

Some Part D stand-alone drug plan enrollees who choose to stay in their current plans may see lower premiums and other costs for their drug coverage, but nearly three-fourths of non-LIS PDP enrollees will face higher premiums if they remain in their current plan, and many will also face higher deductibles and cost sharing for covered drugs. Most Part D PDP enrollees who remain in their current plan for 2023 will be in a plan with the standard (maximum) $505 deductible and will face much higher cost sharing for brands than for generic drugs, including as much as 50% coinsurance for non-preferred drugs. Some beneficiaries could see overall cost savings, including the monthly premium, deductible, and cost sharing, if they switched to a lower-premium plan, while for other beneficiaries, a higher-premium plan might better meet their needs at a lower overall total cost.

Despite these year-to-year changes in plan coverage and costs, as well as changes in beneficiaries’ health needs, other KFF analysis finds that most Medicare beneficiaries did not compare plans during a recent open enrollment period, and most Part D enrollees did not compare the coverage offered by their drug plan to other drug plans. Comparing and choosing among the wide array of Part D plans can be difficult, given that plans differ from each other in multiple ways beyond premiums, including cost sharing, deductibles, covered drugs, and pharmacy networks. Comparing Medicare Advantage drug plans may be made more difficult by the fact that not only drug coverage varies but also other features, including cost sharing for medical benefits, provider networks, and coverage and costs for supplemental benefits. Because Part D plans differ in several ways that can have a significant effect on an enrollee’s access to medications and out-of-pocket drug spending, all Part D enrollees could benefit from the opportunity to compare plans during open enrollment.

| Methods |

| This analysis focuses on the Medicare Part D stand-alone prescription drug plan marketplace in 2023 and trends over time. The analysis focuses on the 18.7 million enrollees in stand-alone PDPs, as of March 2022. The analysis excludes 23.5 million MA-PD enrollees (non-employer), and another 4.3 million enrollees in employer-group only PDPs and 3.1 million in employer-group only MA-PDs for whom plan premium and benefits data are unavailable.

Data on Part D plan availability, enrollment, and premiums were collected from a set of data files released by the Centers for Medicare & Medicaid Services (CMS): – Part D plan landscape files, released each fall prior to the annual enrollment period – Part D plan and premium files, released each fall – Part D plan crosswalk files, released each fall – Part D contract/plan/state/county level enrollment files, released monthly – Part D Low-Income Subsidy enrollment files, released each spring – Medicare plan benefit package files, released periodically each year In this analysis, premium and deductible estimates are weighted by June 2022 enrollment unless otherwise noted. Percentage and dollar differences are calculated based on non-rounded estimates and in some cases differ from percentages and dollar differences calculated based on rounded estimates presented in the text. |