Medicare Advantage Hospital Networks: How Much Do They Vary?

A growing number of Medicare beneficiaries receive their care through HMOs and PPOs, known as Medicare Advantage plans; yet, little is known about the size and scope of the provider networks available to beneficiaries enrolled in these plans. Beneficiaries enrolled in Medicare Advantage plans can face significant expense if treated by an out-of-network provider, except in emergencies.

This report, the first broad-based study of Medicare Advantage networks, takes an in-depth look at plans’ hospital networks, examining their size and composition. The analysis draws upon data from 409 plans, including 307 HMOs and 102 local PPOs, serving beneficiaries in 20 diverse counties that together accounted for about one in seven (14%) Medicare Advantage enrollees nationwide in 2015. Key findings include:

- On average, Medicare Advantage plan networks included about half (51%) of all hospitals in their county.

- Most plans (80%) included an Academic Medical Center in their network, but one in five did not.

- Two in five plans in areas with an NCI-designated cancer center did not include the center in their networks.

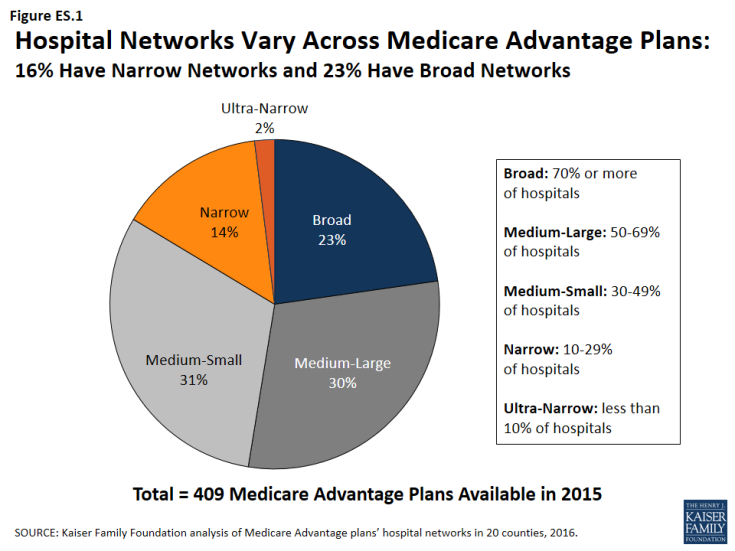

- Almost one-quarter (23%) of Medicare Advantage plans in our study had broad hospital networks in 2015. About one in six plans (16%) had narrow or ultra-narrow networks (Figure ES.1).

- In 9 of the 20 counties studied, none of the plans offered in 2015 had a broad network of hospitals within that county (Clark, NV; Cook, IL; Davison, TN; Harris, TX; Jefferson, AL; King, WA; Los Angeles, CA; Pima, AZ; and Salt Lake, UT).

- Among HMOs, which comprised the majority of the plans in the study (75%), broad and narrow network plans had similar average premiums ($37 vs. $36 per month) and similar quality ratings (3.8 vs. 4.1 stars).

Figure ES 1: Hospital Networks Vary Across Medicare Advantage Plans: 16% Have Narrow Networks and 23% Have Broad Networks

People on Medicare often say that having access to specific doctors and hospitals is a high priority when choosing their Medicare Advantage plans. Yet, plan directories are often riddled with errors, omissions and outdated information that makes it difficult and sometimes impossible to tell which hospitals are included in-network – a finding that emerged over the course of this study.

Creating networks of providers is one of many strategies available to insurers to help control costs and manage the delivery of care. But narrower networks may also limit consumers’ access to certain providers or increase costs for care obtained out-of-network. For Medicare Advantage enrollees who place a high value on having access to a particular set of providers, or a broad range of providers, the findings underscore the importance of comparing provider networks during the Annual Election Period – a task that is easier said than done.