Medicare Advantage Hospital Networks: How Much Do They Vary?

Methods

This study examined Medicare Advantage plans available in 2015 in 20 counties: Allegheny County, PA; Clark County, NV; Cook County, IL; Cuyahoga County, OH; Davidson County, TN; Douglas County, NE; Erie County, NY; Fulton County, GA; Harris County, TX; Jefferson County, AL; King County, WA; Los Angeles County, CA; Mecklenburg County, NC; Miami-Dade County, FL; Milwaukee County, WI; Multnomah County, OR; New Haven County, CT; Pima County, AZ; Queens County, NY; and Salt Lake County, UT. The county is the smallest area, in general, that a Medicare Advantage plan must cover. Counties vary greatly in size and may not be the best metric to assess the health care market of particular locales, but an analysis at the county level provided the most complete set of data available for this type of analysis as well as a reasonable snapshot of the health care market accessible to beneficiaries in that region.

The counties were chosen so as to encompass a sizeable share of Medicare Advantage enrollees, be geographically dispersed across the country, include large, urban areas with many Medicare beneficiaries, include Medicare Advantage markets that are led by national firms (e.g., UnitedHealthcare) and local firms (e.g., UAB Health System), and range in per capita Medicare spending, number of plans offered to Medicare beneficiaries, and Medicare Advantage penetration rate (Table 2). Together, these counties account for 14 percent of all Medicare Advantage enrollees in 2015.

| Table 2. Characteristics of Counties Included in the Analysis in 2015 | ||||||||

| County | Largest city | Number of Medicare beneficiaries | Medicare Advantage penetration rate, 2015 | Share of enrollees in plans offered by one firm | Medicare Advantage payment quartile | Year oldest plan established | Academic Medical Center in county? | NCI-designated Cancer Center in the county? |

| Allegheny, PA | Pittsburgh | 247,434 | 62% | 41% | 1 | 1985 | Yes | Yes |

| Clark, NV | Las Vegas | 294,530 | 38% | 51% | 1 | 1985 | Yes | No |

| Cook, IL | Chicago | 769,309 | 17% | 32% | 1 | 1985 | Yes | Yes |

| Cuyahoga, OH | Cleveland | 241,669 | 37% | 33% | 2 | 1987 | Yes | Yes |

| Davidson, TN | Nashville | 89,800 | 42% | 48% | 1 | 1996 | Yes | Yes |

| Douglas, NE | Omaha | 75,402 | 23% | 58% | 2 | 1985 | Yes | Yes |

| Erie, NY | Buffalo | 185,347 | 56% | 62% | 4 | 1985 | Yes | Yes |

| Fulton, GA | Atlanta | 118,697 | 35% | 33% | 2 | 1997 | Yes | Yes |

| Harris, TX | Houston | 465,027 | 39% | 21% | 1 | 1988 | Yes | Yes |

| Jefferson, AL | Birmingham | 123,132 | 42% | 39% | 1 | 1994 | Yes | Yes |

| King, WA | Seattle | 283,171 | 34% | 30% | 3 | 1980 | Yes | Yes |

| Los Angeles | Los Angeles | 1,344,850 | 43% | 40% | 1 | 1985 | Yes | Yes |

| Mecklenburg, NC | Charlotte | 119,517 | 31% | 39% | 3 | 1985 | Yes | No |

| Miami-Dade | Miami | 420,702 | 62% | 28% | 1 | 1986 | Yes | No |

| Milwaukee, WI | Milwaukee | 145,125 | 41% | 73% | 2 | 1995 | Yes | No |

| Multnomah, OR | Portland | 110,238 | 58% | 27% | 4 | 1980 | Yes | Yes |

| New Haven, CT | New Haven | 153,214 | 28% | 41% | 1 | 1996 | Yes | Yes |

| Pima, AZ | Tucson | 187,732 | 46% | 53% | 3 | 1986 | Yes | Yes |

| Queens, NY | New York City | 326,376 | 43% | 26% | 1 | 1986 | Yes | No |

| Salt Lake, UT | Salt Lake City | 122,904 | 41% | 43% | 3 | 2003 | Yes | Yes |

| SOURCE: Kaiser Family Foundation analysis of CMS Medicare Advantage enrollment and landscape files for 2015. | ||||||||

Inclusion Criteria for Medicare Advantage Plans

Only HMOs and local PPOs were included in the analysis because the other types of Medicare Advantage plans either do not have networks (e.g., some private fee-for-service plans), or networks that are structured to cover areas larger than a county (e.g., regional PPOs), or are paid in unique ways that influence providers available to beneficiaries (e.g. cost plans). The analysis also excluded Special Needs Plans (SNPs), employer-sponsored group plans, and other plans that are not available to all Medicare beneficiaries. In total, across the 20 counties, we included 307 HMOs and 102 local PPOs. Among the 307 HMOs, 10 were closed panel HMOs, with physicians or groups of physicians directly employed by the HMO, and the remainder were open panel HMOs. Together, these plans enrolled 1.6 million Medicare beneficiaries in 2015, 92 percent of whom were in HMOs and 8 percent of whom were in PPOs. Both HMOs and local PPOs were available in all 20 counties, with the exception of Los Angeles County where only HMOs were available to Medicare beneficiaries.

Main Sources of Data

Provider directories were the primary source of data used for the study. The directories were gathered between November and December 2014, to coincide with the Medicare Annual Election Period for 2015, and were either downloaded from the company’s website in a PDF format, when possible, or downloaded using the searchable directory embedded in the company website. The information extracted from these data was complemented with other information available on these plans and counties in CMS’s Medicare Advantage Enrollment file for March 2015, CMS’s Medicare Advantage Landscape file for 2015, and the American Hospital Association’s (AHA) 2014 survey of hospitals.

Excluded Plans

Seven plans offered by three companies were excluded from the analysis because either a provider directory was not available for 2015 and the company declined to provide a directory when contacted, or the searchable directory embedded in the company website did not allow for information to be saved.

Tiered Networks

Two counties from our sample include HMOs with tiered networks of hospitals. The difference in tier designates a difference in co-pay for a hospital admission. Consequently, even though all of the hospitals listed in the directory are considered “in-network,” the cost for a hospital stay will differ depending on the hospital’s tier. While the provider directories designate each hospital’s tier, the information about the difference in cost-sharing only can be found in the plan’s Summary of Benefits document.

The two plans with tiered networks were different with respect to the breakdown of the hospitals into more expensive and less expensive tiers and the disparities in cost-sharing for hospital stays between the two tiers. For the tiered network in Cook County, the difference in co-pay between tier 1 and tier 2 is $50 per day for days 1 through 4 ($200 total potential difference). The less expensive tier (tier 1) only includes five hospitals, all owned by Advocate Health Care. The majority of the hospitals in the network (22 facilities) are in tier 2, with the more expensive co-pay. In contrast, most of the hospitals in Erie County’s tiered network plan are in the less expensive tier. For this plan’s tier A hospitals, there is a co-pay of $400 per admission, while tier B hospitals require a co-pay of $900 per admission. However, only one of the network’s eight hospitals in Erie County is in tier B. For both of these plans with tiered networks, the analysis included all hospitals in either tier as in-network hospitals because in Cook County the difference in cost-sharing for hospitals in the two tiers was relatively nominal and for the plan in Erie County, the set of hospitals in the second tier was deemed to be sufficiently small. Overall, the inclusion of hospitals in both tiers likely had a negligible effect on the results of the analysis.

Data Entry

The data from the provider directories was inputted twice, by two independent people, and all discrepancies in the data entry were resolved by manually checking the relevant provider directory. Whenever directories contained typos or slight variations in the name of a hospital, the addresses were used to verify a hospital’s inclusion in the network. The Centers for Medicare and Medicaid Services’ Provider of Services (POS) file was used to match each hospital location with its unique provider identification number.

Measures of Hospital Network Size and Composition

All short-term general hospitals in the 20 counties included in the study and their characteristics were identified using the data from the AHA 2014 survey of hospitals. (To support sensitivity analyses, hospitals in the adjacent counties were also identified.) Veterans Health Administration hospitals and children’s hospitals were excluded because of their unique financing or population focus. Two basic measures of network size were constructed for each health plan by county: (1) the share of hospitals in the county that were listed in the directory; and (2) the share of hospital beds in the county that were associated with the hospitals listed in the directory.

Categorizing Networks by Size

This study categorized networks into one of four sizes based on the share of hospitals in the county that were included in the directory: broad (70% or more of the hospitals), medium (30-69% of hospitals), narrow (10-29% of hospitals), and ultra-narrow (less than 10% of hospitals). These definitions differ from those used by the only other known study, conducted by McKinsey & Company, that categorized networks by the share of hospitals in the county included in the network. The McKinsey & Company study examined the size of networks of plans in the Affordable Care Act (ACA) exchanges, and categorized networks into one of three network sizes; the difference between the categories used in this study and the McKinsey study is that this study includes a category for medium-sized networks. That is, this study uses the term “medium” to describe the size of networks that McKinsey described as “narrow”.

For the 10 plans that were closed-panel HMOs, the study used the same four categories to characterize the size of the network. HMOs with closed panel designs are those in which the parent organization has exclusive contracts with physicians (employed either directly or in groups) and sometimes also owns hospitals or contracts with hospitals in other ways that result in more centralized hospital capacity. HMOs with open panel designs, which include the majority of HMOs today, are those in which the parent organization has non-exclusive contracts with a range of providers located in the area, and the providers typically accept multiple insurers. One of the primary reasons people enroll in closed panel HMOs is because they want to have access to the plan’s network of hospitals and doctors, whereas people in other plans generally do not have access to these physicians and facilities.

Definitions for Specialty Hospitals

Access to specialized medical care is important to many Medicare beneficiaries since about one-quarter (26%) of Medicare beneficiaries are in fair or poor health and 45 percent have four or more chronic conditions.1 This study examined the presence of two types of specialty hospitals in plan networks: teaching hospitals and cancer centers. Teaching hospitals can provide access to more specialized care and may provide better care for complex medical conditions, such as organ transplants, certain cancer surgeries, and autoimmune disorders. Both Academic Medical Centers (also known as major teaching hospitals) and minor teaching hospitals have residency and/or internship training programs (or medical school affiliation reported by the American Medical Association) but, unlike Academic Medical Centers, minor teaching hospitals are not members of the Council of Teaching Hospitals. Academic Medical Centers and minor teaching hospitals were identified based upon data from the AHA 2014 survey of hospitals. Each of the 20 counties had at least one Academic Medical Center within its borders, 11 of which included more than one, including Cook County with 12 Academic Medical Centers and Los Angeles County with 8 Academic Medical Centers. All but one of the counties (Mecklenburg) included at least one minor teaching hospital.

To gain insight into the type of cancer treatment available to Medicare Advantage enrollees, the study examined access to cancer centers designated by the National Cancer Institute (NCI) and hospitals accredited by the American College of Surgeons (ACS). The NCI has designated 69 cancer centers in 35 states as NCI-Designated Cancer Centers in recognition of their leadership and resources in the development of more effective approaches to prevention, diagnosis, and treatment of cancer, and many but not all of these centers are affiliated with Academic Medical Centers. The ACS Commission on Cancer accredits cancer programs within hospitals that meet ACS quality and service standards, and this accreditation is designed to be an indicator of higher quality cancer care. NCI-Designated Cancer Centers were identified through the list of centers on the NCI website, and ACS-accredited cancer centers were identified based upon data from the AHA 2014 survey of hospitals. Fifteen of the 20 counties in the study had at least one NCI Cancer Center within the borders of the county, including Cook, Harris, and Los Angeles counties that had more than one NCI Cancer Center, and all but one of the counties (Pima) had at least one hospital with an ACS-accredited cancer program.

Limitations

The report does not assess several important questions about provider networks. The report does not assess whether networks are adequate to meet the needs of plan enrollees nor does it assess whether the networks meet the minimum requirements for Medicare Advantage provider networks as specified by CMS.2 The report also does not assess whether the quality of providers or the quality of care received varies by the size of a plan’s network of providers. Additionally, the report only assesses the network of hospitals included in a plan’s provider network, and does not examine the physicians and other types of providers in the plans’ networks. Also, this report looked only at urban areas where Medicare Advantage plans should have access to a sufficient supply of providers with which to contract; in rural areas, provider networks may be quite different.

Overlap Between Counties, Hospital Referral Regions, and Metropolitan Statistical Areas

The largest limitation of this analysis stems from the fact that Medicare Advantage plan networks vary widely in the size of the geographic region that they cover. While the networks of some plans are limited to a single county, other plans available in that county offer beneficiaries access to hospitals in neighboring counties and even in bordering states. In order to compare the breadth of coverage for plans within a particular area, we chose to analyze each plan’s network within the county because this is the largest geographic measure that all plans are required to cover. The county analysis therefore provides the most complete set of data available for this type of analysis. For most of the selected counties, this geographic restriction also provides a reasonable snapshot of the health care market accessible to seniors in that region.

However, in some major metropolitan areas where residents frequently cross county lines, this method of analysis is flawed. For example, the proximity and accessibility of Queens County to New York, Kings, and Bronx counties, and the distribution of major medical centers in these neighboring areas, means that many Queens residents go to hospitals outside of their county. In this case, counting the number of hospitals that a plan network covers within Queens County is not necessarily a good measure of a network’s coverage.

Although counties were chosen as the geographical lens for this study, there are other established regional divisions that could be used to evaluate the size of provider networks. The extent to which these regions overlap with counties gives a sense of how significantly the results may differ depending upon the way the country is divided into coverage areas. The Dartmouth Atlas of Health Care created Hospital Referral Regions (HRR) as representations of regional health care markets that include a major referral center.3 The overlap of these HRRs with counties is highly variable, although it depends somewhat on whether a county is primarily rural or urban. In the more rural counties, the entire county accounts for only one small portion of an HRR (all of Fulton County in Georgia accounts for only 15% of HRR 144). For big counties with a larger urban population, one county may contain several HRRs (Cook County in Illinois spans eight different HRRs, including all of HRR 156). In only one case is there almost exact overlap between the county and a single HRR (Clark County in Nevada with HRR 279).

Another potential way to analyze network coverage is Metropolitan Statistical Areas (MSAs), established by the Office of Management and Budget based on core urban areas and their surrounding economically integrated regions.4 Every MSA includes at least one entire county. For 4 of the counties (Clark, Pima, Salt Lake, and New Haven), the county accounts for 95-100% of its MSA. Two counties represent less than 20 percent of the MSA (17% for Fulton and 11% for Queens) and the remaining counties represent between 33 percent (Multnomah) and 81 percent (Erie) of the MSA in which they are located. This could indicate that by restricting our analysis to the county in these areas, we may have excluded some portion of a county resident’s health care market.

Appendix Tables

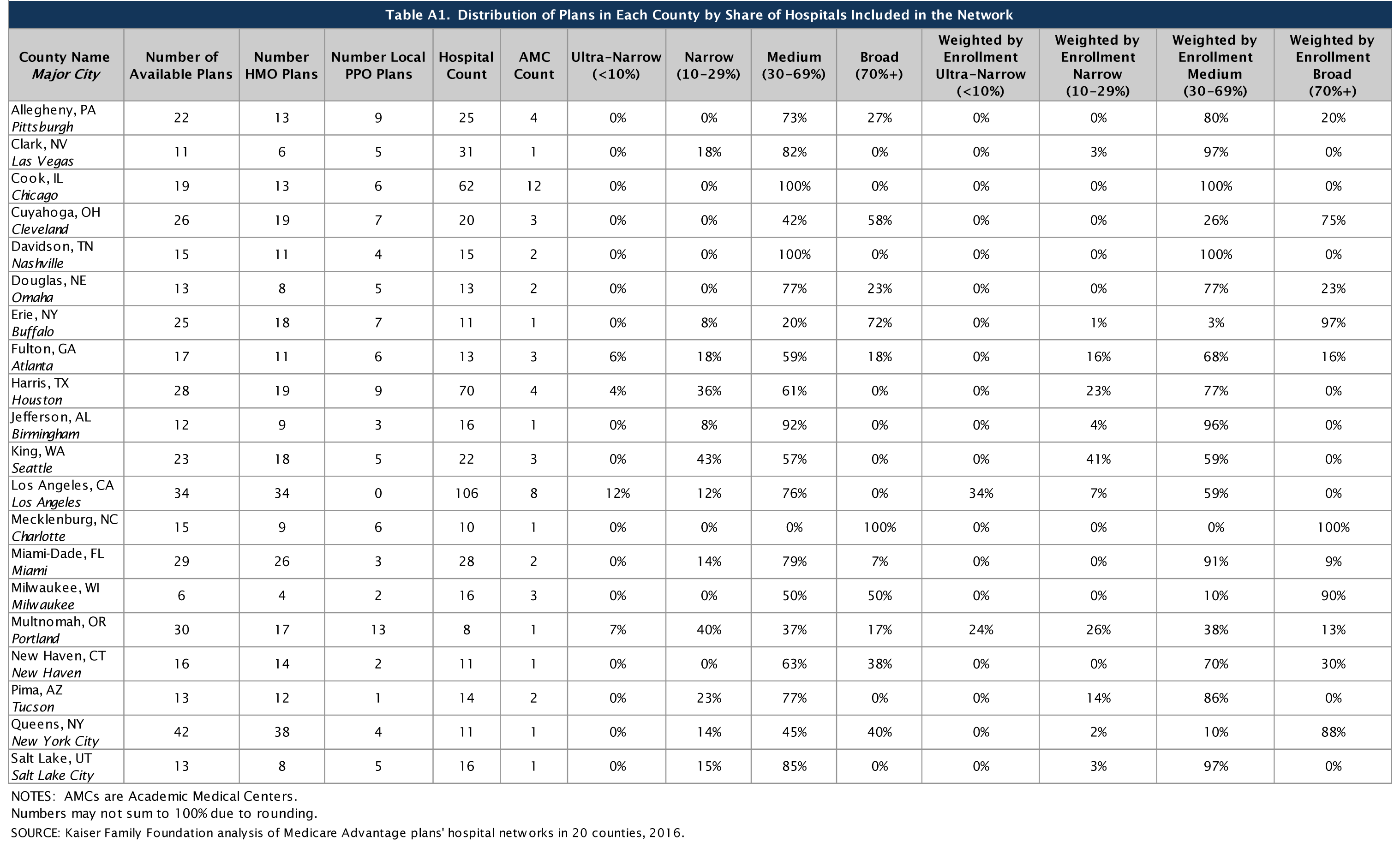

Click on Table A1 to enlarge.

| Table A2. Distribution of Hospital Beds by Plan Network Size | ||||||||

| County Name Major City |

Avg. Hospitals Per Plan |

Avg. Share of Hospitals Per Plan |

Avg. Beds Per Plan | Avg. Share of Beds Per Plan |

Avg. Share of beds Ultra-Narrow plans (<10%) |

Avg. Share of Beds Narrow Plans (10-29%) |

Avg. Share of Beds Medium Plans (30-69%) | Avg. Share of Beds Broad Plans (70%+) |

| Allegheny, PA Pittsburgh |

15 | 61% | 5,286 | 81% | N/A | N/A | 76% | 92% |

| Clark, NV Las Vegas |

12 | 39% | 2,758 | 55% | N/A | 29% | 61% | N/A |

| Cook, IL Chicago |

33 | 53% | 8,767 | 54% | N/A | N/A | 54% | N/A |

| Cuyahoga, OH Cleveland |

13 | 66% | 4,188 | 69% | N/A | N/A | 35% | 93% |

| Davidson, TN Nashville |

9 | 60% | 3,061 | 70% | N/A | N/A | 70% | N/A |

| Douglas, NE Omaha |

7 | 57% | 1,409 | 66% | N/A | N/A | 56% | 99% |

| Erie, NY Buffalo |

8 | 69% | 3,086 | 78% | N/A | 57% | 54% | 87% |

| Fulton, GA Atlanta |

6 | 48% | 2,045 | 56% | 0% | 30% | 62% | 80% |

| Harris, TX Houston |

23 | 33% | 6,461 | 55% | 5% | 37% | 68% | N/A |

| Jefferson, AL Birmingham |

7 | 46% | 2,588 | 70% | N/A | 28% | 73% | N/A |

| King, WA Seattle |

9 | 40% | 1,997 | 48% | N/A | 32% | 61% | N/A |

| Los Angeles, CA Los Angeles |

36 | 34% | 8,534 | 38% | 4% | 16% | 47% | N/A |

| Mecklenburg, NC Charlotte |

8 | 79% | 2,294 | 94% | N/A | N/A | N/A | 94% |

| Miami-Dade, FL Miami |

13 | 48% | 4,488 | 62% | N/A | 36% | 65% | 77% |

| Milwaukee, WI Milwaukee |

11 | 68% | 2,221 | 80% | N/A | N/A | 67% | 93% |

| Multnomah, OR Portland |

4 | 44% | 1024 | 40% | 0% | 16% | 49% | 91% |

| New Haven, CT New Haven |

7 | 63% | 1,939 | 77% | N/A | N/A | 66% | 96% |

| Pima, AZ Tucson |

5 | 34% | 1,692 | 63% | N/A | 35% | 71% | N/A |

| Queens, NY New York City |

6 | 56% | 2,491 | 59% | N/A | 27% | 51% | 79% |

| Salt Lake, UT Salt Lake City |

8 | 49% | 1,609 | 63% | N/A | 41% | 67% | N/A |

| NOTES: N/A indicates not applicable. SOURCE: Kaiser Family Foundation analysis of Medicare Advantage plans’ hospital networks in 20 counties, 2016. |

||||||||

| Table A3. Distribution of Local HMOs in Each County by the Share of Hospitals Included in the Network | ||||||||||

| County Name Major City |

Number of HMOs | Hospital Count | Ultra- Narrow (<10%) |

Narrow (10-29%) |

Medium (30-69%) | Broad (70%+) |

Weighted by Enrollment Ultra-Narrow (<10%) |

Weighted by Enrollment Narrow (10-29%) |

Weighted by Enrollment Medium (30-69%) | Weighted by Enrollment Broad (70%+) |

| Allegheny, PA Pittsburgh |

13 | 25 | 0% | 0% | 77% | 23% | 0% | 0% | 83% | 17% |

| Clark, NV Las Vegas |

6 | 31 | 0% | 33% | 67% | 0% | 0% | 4% | 96% | 0% |

| Cook, IL Chicago |

13 | 62 | 0% | 0% | 100% | 0% | 0% | 0% | 100% | 0% |

| Cuyahoga, OH Cleveland |

19 | 20 | 0% | 0% | 58% | 42% | 0% | 0% | 30% | 70% |

| Davidson, TN Nashville |

11 | 15 | 0% | 0% | 100% | 0% | 0% | 0% | 100% | 0% |

| Douglas, NE Omaha |

8 | 13 | 0% | 0% | 75% | 25% | 0% | 0% | 83% | 17% |

| Erie, NY Buffalo |

18 | 11 | 0% | 0% | 28% | 72% | 0% | 0% | 3% | 97% |

| Fulton, GA Atlanta |

11 | 13 | 9% | 18% | 64% | 9% | 0% | 21% | 75% | 3% |

| Harris, TX Houston |

19 | 70 | 5% | 42% | 53% | 0% | 0% | 24% | 76% | 0% |

| Jefferson, AL Birmingham |

9 | 16 | 0% | 11% | 89% | 0% | 0% | 6% | 94% | 0% |

| King, WA Seattle |

18 | 22 | 0% | 56% | 44% | 0% | 0% | 51% | 49% | 0% |

| Los Angeles, CA Los Angeles |

34 | 106 | 12% | 12% | 76% | 0% | 34% | 7% | 59% | 0% |

| Mecklenburg, NC Charlotte |

9 | 10 | 0% | 0% | 0% | 100% | 0% | 0% | 0% | 100% |

| Miami-Dade, FL Miami |

26 | 28 | 0% | 15% | 77% | 8% | 0% | 0% | 91% | 9% |

| Milwaukee, WI Milwaukee |

4 | 16 | 0% | 0% | 50% | 50% | 0% | 0% | 10% | 90% |

| Multnomah, OR Portland |

17 | 8 | 12% | 53% | 24% | 12% | 34% | 36% | 13% | 18% |

| New Haven, CT New Haven |

14 | 11 | 0% | 0% | 71% | 29% | 0% | 0% | 72% | 28% |

| Pima, AZ Tucson |

12 | 14 | 0% | 25% | 75% | 0% | 0% | 14% | 86% | 0% |

| Queens, NY New York City |

38 | 11 | 0% | 16% | 45% | 39% | 0% | 2% | 9% | 89% |

| Salt Lake, UT Salt Lake City |

8 | 16 | 0% | 0% | 100% | 0% | 0% | 0% | 100% | 0% |

| SOURCE: Kaiser Family Foundation analysis of Medicare Advantage plans’ hospital networks in 20 counties, 2016. | ||||||||||

| Table A4. Distribution of Local PPOs in Each County by the Share of Hospitals Included in the Network | ||||||||||

| County Name Major City |

Number of Local PPOs | Hospital Count | Ultra-Narrow (<10%) | Narrow (10-29%) |

Medium (30-69%) |

Broad (70%+) |

Weighted by Enrollment Ultra-Narrow (<10%) |

Weighted by Enrollment Narrow (10-29%) |

Weighted by Enrollment Medium (30-69%) |

Weighted by Enrollment Broad (70%+) |

| Allegheny, PA Pittsburgh |

9 | 25 | 0% | 0% | 67% | 33% | 0% | 0% | 70% | 30% |

| Clark, NV Las Vegas |

5 | 31 | 0% | 0% | 100% | 0% | 0% | 0% | 100% | 0% |

| Cook, IL Chicago |

6 | 62 | 0% | 0% | 100% | 0% | 0% | 0% | 100% | 0% |

| Cuyahoga, OH Cleveland |

7 | 20 | 0% | 0% | 0% | 100% | 0% | 0% | 0% | 100% |

| Davidson, TN Nashville |

4 | 15 | 0% | 0% | 100% | 0% | 0% | 0% | 100% | 0% |

| Douglas, NE Omaha |

5 | 13 | 0% | 0% | 80% | 20% | 0% | 0% | 36% | 64% |

| Erie, NY Buffalo |

7 | 11 | 0% | 29% | 0% | 71% | 0% | 8% | 0% | 92% |

| Fulton, GA Atlanta |

6 | 13 | 0% | 17% | 50% | 33% | 0% | 5% | 49% | 46% |

| Harris, TX Houston |

9 | 70 | 0% | 22% | 78% | 0% | 0% | 7% | 93% | 0% |

| Jefferson, AL Birmingham |

3 | 16 | 0% | 0% | 100% | 0% | 0% | 0% | 100% | 0% |

| King, WA Seattle |

5 | 22 | 0% | 0% | 100% | 0% | 0% | 0% | 100% | 0% |

| Los Angeles, CA Los Angeles |

0 | 106 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Mecklenburg, NC Charlotte |

6 | 10 | 0% | 0% | 0% | 100% | 0% | 0% | 0% | 100% |

| Miami-Dade, FL Miami |

3 | 28 | 0% | 0% | 100% | 0% | 0% | 0% | 100% | 0% |

| Milwaukee, WI Milwaukee |

2 | 16 | 0% | 0% | 50% | 50% | 0% | 0% | 11% | 89% |

| Multnomah, OR Portland |

13 | 8 | 0% | 23% | 54% | 23% | 0% | 0% | 97% | 3% |

| New Haven, CT New Haven |

2 | 11 | 0% | 0% | 0% | 100% | 0% | 0% | 0% | 100% |

| Pima, AZ Tucson |

1 | 14 | 0% | 0% | 100% | 0% | 0% | 0% | 100% | 0% |

| Queens, NY New York City |

4 | 11 | 0% | 0% | 50% | 50% | 0% | 0% | 36% | 64% |

| Salt Lake, UT Salt Lake City |

5 | 16 | 0% | 40% | 60% | 0% | 0% | 16% | 84% | 0% |

| SOURCE: Kaiser Family Foundation analysis of Medicare Advantage plans’ hospital networks in 20 counties, 2016. | ||||||||||

| Table A5. Share of Hospitals Included in the Provider Networks of Closed Panel HMOs | |||||||||

| County | Name of Closed Panel HMO | Does the HMO own hospitals in the county? | Number of Plans Offered | Number of Unique Networks | Number of Hospitals (located in county) Included in the Network | Number of Hospitals Owned by the HMO in the County | Number of Hospitals not Owned by the HMO | Percentage of Hospitals in the County Included in the Network | Among All Plans in the County, Average Percentage of Hospitals Included in Networks |

| Fulton | Kaiser Permanente | No | 2 | 1 | 2 | 0 | 13 | 15% | 48% |

| King | Group Health Cooperative | Yes | 4 | 1 | 6 | 1 | 21 | 27% | 40% |

| Los Angeles | Kaiser Permanente | Yes | 1 | 1 | 8 | 7 | 99 | 8% | 34% |

| Multnomah | Kaiser Permanente | No | 2 | 1 | 0* | 0 | 8 | 0% | 44% |

| Miami-Dade | Leon Medical Centers (CIGNA) | No | 1 | 1 | 13 | 0 | 28 | 46% | 48% |

| NOTE: *Kaiser Permanente’s HMO in Multnomah included one hospital in 2014, but this hospital was dropped from the network in 2015; the 2015 Kaiser Permanente plan in Multnomah includes hospitals in neighboring counties. SOURCE: Kaiser Family Foundation analysis of Medicare Advantage plans’ hospital networks in 20 counties, 2016. |

|||||||||

| Table A6. Inclusion of Academic Medical Centers (AMCs) Distributed by Plan Network Size | ||||||||

| County Name Major City |

AMC Count | Share of Plans that Include 1 or More AMC | Share of HMOs Including 1 or More AMC | Share of Local PPOs Including 1 or More AMC | Share Including AMC Ultra-Narrow (<10%) |

Share Including AMC Narrow (10-29%) |

Share Including AMC Medium (30-69%) |

Share Including AMC Broad (70%+) |

| Allegheny, PA Pittsburgh |

4 | 100% | 100% | 100% | N/A | N/A | 100% | 100% |

| Clark, NV Las Vegas |

1 | 64% | 67% | 60% | N/A | 0% | 78% | N/A |

| Cook, IL Chicago |

12 | 100% | 100% | 100% | N/A | N/A | 100% | N/A |

| Cuyahoga, OH Cleveland |

3 | 100% | 100% | 100% | N/A | N/A | 100% | 100% |

| Davidson, TN Nashville |

2 | 93% | 91% | 100% | N/A | N/A | 93% | N/A |

| Douglas, NE Omaha |

2 | 100% | 100% | 100% | N/A | N/A | 100% | 100% |

| Erie, NY Buffalo |

1 | 72% | 72% | 71% | N/A | 0% | 0% | 100% |

| Fulton, GA Atlanta |

3 | 82% | 73% | 100% | 0% | 33% | 100% | 100% |

| Harris, TX Houston |

4 | 96% | 95% | 100% | 0% | 100% | 100% | N/A |

| Jefferson, AL Birmingham |

1 | 42% | 33% | 67% | N/A | 0% | 45% | N/A |

| King, WA Seattle |

3 | 83% | 78% | 100% | N/A | 100% | 69% | N/A |

| Los Angeles, CA Los Angeles |

8 | 82% | 82% | N/A | 25% | 25% | 100% | N/A |

| Mecklenburg, NC Charlotte |

1 | 100% | 100% | 100% | N/A | N/A | N/A | 100% |

| Miami-Dade, FL Miami |

2 | 100% | 100% | 100% | N/A | 100% | 100% | 100% |

| Milwaukee, WI Milwaukee |

3 | 100% | 100% | 100% | N/A | N/A | 100% | 100% |

| Multnomah, OR Portland |

1 | 27% | 12% | 46% | 0% | 0% | 45% | 60% |

| New Haven, CT New Haven |

1 | 75% | 71% | 100% | N/A | N/A | 60% | 100% |

| Pima, AZ Tucson |

2 | 85% | 83% | 100% | N/A | 33% | 100% | N/A |

| Queens, NY New York City |

1 | 57% | 53% | 100% | N/A | 67% | 42% | 71% |

| Salt Lake, UT Salt Lake City |

1 | 85% | 75% | 100% | N/A | 100% | 82% | N/A |

| NOTES: AMCs are Academic Medical Centers. N/A indicates not applicable. SOURCE: Kaiser Family Foundation analysis of Medicare Advantage plans’ hospital networks in 20 counties, 2016. |

||||||||

| Table A7. Share of NCI-Designated Cancer Centers Included in Plans’ Provider Directories | |||||||

| County with a NCI Cancer Center | Cancer Center | Cancer Center Affiliation with a Major Academic Medical Center | Academic Medical Center | Total Number of Plans Offered in the County | Number of Plans Including the AMC | Number of Plans that Explicitly Mention the NCI Cancer Center in the Provider Directory | Number of Plans that Include the AMC but do not Mention the NCI Cancer Center in the Directory |

| Allegheny | Univeristy of Pittsburgh Cancer Center | Yes | UPMC Shadyside | 22 | 21 | 0 | 9 |

| Cook | Robert H. Lurie Comprehensive Cancer Center | Yes | Northwestern Memorial Hospital | 19 | 0 | 0 | 0 |

| Cook | University of Chicago Comprehensive Cancer Center | Yes | University of Chicago Medical Center | 19 | 4 | 0 | 4 |

| Cuyahoga | Seidman Cancer Center | Yes | University Hospitals Case Medical Center | 26 | 26 | 15 | 11 |

| Davidson | Vanderbilt-Ingram Cancer Center | Yes | Vanderbilt Medical Center | 15 | 14 | 0 | 14 |

| Douglas | Buffett Cancer Center | Yes | Nebraska Medical Center | 13 | 8 | 0 | 8 |

| Erie | Roswell Park Cancer Institute | Yes | Buffalo General Hospital | 25 | 22 | 18 | 4 |

| Fulton | Winship Cancer Institute | Yes | Emory University Hospitals | 17 | 13 | 0 | 13 |

| Harris | University of Texas M.D. Anderson Cancer Institute | Yes | UTHealth – Memorial Hermann Texas Medical Center | 28 | 26 | 0 | 26 |

| Harris | Baylor Dan L. Duncan Cancer Institute | Yes | Baylor St. Luke’s Medical Center | 28 | 13 | 0 | 13 |

| Jefferson | UAB Comprehensive Cancer Institute | Yes | UAB Hospital | 12 | 5 | 0 | 5 |

| King | Fred Hutchinson Cancer Institute | Yes | University of Washington Medical Center | 23 | 10 | 0 | 10 |

| Los Angeles | USC Norris Comprehensive Cancer Center | Yes | USC Keck | 34 | 6 | 4 | 2 |

| Los Angeles | Jonsson Comprehensive Cancer Center UCLA | Yes | UCLA Medical Center | 34 | 8 | 0 | 8 |

| Los Angeles | City of Hope | No | N/A | 34 | N/A | 2 | N/A |

| Multnomah | Knight Cancer Institute | Yes | OHSU Hospital | 30 | 8 | 0 | 8 |

| New Haven | Yale Cancer Center | Yes | Yale New Haven Hospital | 16 | 12 | 0 | 12 |

| Pima | University of Arizona Cancer Center | Yes | University of Arizona Medical Center | 13 | 3 | 0 | 3 |

| Salt Lake | Huntsman Cancer Institute | Yes | University of Utah Hospital | 13 | 11 | 8 | 3 |

| NOTES: AMCs are Academic Medical Centers. N/A indicates not applicable. SOURCE: Kaiser Family Foundation analysis of Medicare Advantage plans’ hospital networks in 20 counties, 2016. |

|||||||

| Table A8. Distribution of Plan Network Size by Firm and County | ||||||

| Firm | Firm Enrollment | Share of Medicare Advantage Enrollees in the County | Number of Plans | Share of Plans Including an AMC | Average Share of Hospitals Included in Network | Average Share of Hospital Beds Included in Network |

| Allegheny | ||||||

| Advantra (Aetna) | 19,759 | 20% | 6 | 100% | 76% | 92% |

| BCBS | 45,089 | 45% | 9 | 100% | 60% | 87% |

| Humana | 426 | <1% | 1 | 100% | 36% | 33% |

| UPMC for Life | 35,558 | 35% | 6 | 100% | 52% | 68% |

| Clark | ||||||

| Aetna | 4,626 | 5% | 4 | 100% | 48% | 59% |

| Humana | 36,985 | 37% | 3 | 33% | 43% | 64% |

| UnitedHealth Group | 57,156 | 58% | 4 | 50% | 27% | 45% |

| Cook | ||||||

| Aetna | 2,321 | 3% | 4 | 100% | 66% | 68% |

| BCBS | 10,179 | 13% | 5 | 100% | 48% | 53% |

| Cigna | 11,591 | 15% | 3 | 100% | 48% | 49% |

| Community Care Alliance of Illinois | 354 | <1% | 1 | 100% | 47% | 39% |

| Humana | 32,373 | 41% | 2 | 100% | 60% | 65% |

| Meridian Health Plan | <50 | <1% | 1 | 100% | 44% | 43% |

| UnitedHealth Group | 14,494 | 18% | 1 | 100% | 44% | 49% |

| Anthem | 8,484 | 11% | 2 | 100% | 47% | 44% |

| Cuyahoga | ||||||

| Aetna | 5,364 | 12% | 5 | 100% | 87% | 93% |

| Anthem | 27,373 | 59% | 3 | 100% | 85% | 94% |

| Gateway Health Medicare Assured | 419 | 1% | 3 | 100% | 85% | 97% |

| HealthSpan | 616 | 1% | 4 | 100% | 35% | 24% |

| Humana | 2,838 | 6% | 2 | 100% | 68% | 78% |

| Paramount Elite | <50 | <1% | 3 | 100% | 80% | 92% |

| SummaCare Medicare Advantage Plans | 920 | 2% | 4 | 100% | 40% | 32% |

| UnitedHealth Group | 8,493 | 18% | 2 | 100% | 45% | 44% |

| Davidson | ||||||

| BCBS | 6,804 | 25% | 5 | 100% | 61% | 72% |

| Cigna | 16,215 | 59% | 3 | 100% | 67% | 79% |

| Humana | 2,984 | 11% | 3 | 100% | 67% | 79% |

| UnitedHealth Group | 1,032 | 4% | 1 | 0% | 47% | 47% |

| WellCare | 125 | <1% | 2 | 100% | 40% | 46% |

| Anthem | 464 | 2% | 1 | 100% | 67% | 73% |

| Douglas | ||||||

| Aetna | 4,155 | 27% | 4 | 100% | 81% | 92% |

| Health Alliance Medicare | 118 | 1% | 3 | 100% | 38% | 46% |

| HeartlandPlains Health | 404 | 3% | 1 | 100% | 46% | 52% |

| Humana | 2,231 | 14% | 3 | 100% | 46% | 48% |

| UnitedHealth Group | 8,593 | 55% | 2 | 100% | 58% | 80% |

| Erie | ||||||

| BCBS | 13,769 | 19% | 5 | 100% | 82% | 92% |

| Excellus Health Plan | 8,350 | 11% | 4 | 100% | 82% | 92% |

| Fidelis Care | 375 | 1% | 3 | 0% | 36% | 31% |

| Independent Health | 49,262 | 67% | 5 | 100% | 82% | 94% |

| MVP Health Care | 97 | <1% | 4 | 100% | 73% | 70% |

| Universal American | 383 | 1% | 2 | 0% | 27% | 57% |

| WellCare | 1,807 | 2% | 2 | 0% | 64% | 88% |

| Fulton | ||||||

| Aetna | 4,522 | 20% | 5 | 100% | 68% | 71% |

| Anthem | 886 | 4% | 2 | 100% | 54% | 59% |

| Cigna | 1,011 | 4% | 1 | 100% | 54% | 56% |

| Humana | 7,309 | 32% | 2 | 100% | 50% | 79% |

| Kaiser Permanente | 3,382 | 15% | 2 | 0% | 15% | 29% |

| Piedmont WellStar HealthPlans | 961 | 4% | 1 | 100% | 38% | 36% |

| UnitedHealth Group | 1,955 | 9% | 2 | 100% | 38% | 45% |

| WellCare | 2,774 | 12% | 1 | 100% | 69% | 82% |

| Anthem | <50 | <1% | 1 | 0% | 0% | 0% |

| Harris | ||||||

| Aetna | 7,065 | 6% | 6 | 100% | 47% | 65% |

| BCBS | 2,265 | 2% | 3 | 67% | 23% | 39% |

| Cigna | 25,642 | 21% | 2 | 100% | 39% | 72% |

| Humana | 5,834 | 5% | 2 | 100% | 29% | 56% |

| KelseyCare Advantage | 19,045 | 16% | 5 | 100% | 16% | 35% |

| Memorial Hermann Health Insurance Company | 1,116 | 1% | 2 | 100% | 16% | 31% |

| UnitedHealth Group | 11,613 | 9% | 2 | 100% | 35% | 54% |

| Universal American | 37,346 | 30% | 3 | 100% | 50% | 75% |

| WellCare | 8,362 | 7% | 2 | 100% | 40% | 61% |

| Anthem | 4,550 | 4% | 1 | 100% | 24% | 52% |

| Jefferson | ||||||

| BCBS | 10,318 | 29% | 2 | 100% | 56% | 90% |

| Cigna | 5,383 | 15% | 2 | 0% | 44% | 61% |

| Humana | 1,342 | 4% | 2 | 0% | 31% | 55% |

| UnitedHealth Group | 6,129 | 17% | 2 | 0% | 44% | 61% |

| VIVA Medicare | 12,690 | 35% | 4 | 75% | 52% | 75% |

| King | ||||||

| BCBS | 18,273 | 25% | 7 | 100% | 34% | 47% |

| Group Health Cooperative | 19,714 | 27% | 4 | 100% | 27% | 31% |

| Humana | 6,640 | 9% | 5 | 100% | 40% | 50% |

| Soundpath Health | 4,310 | 6% | 4 | 0% | 50% | 50% |

| UnitedHealth Group | 24,366 | 33% | 2 | 100% | 64% | 81% |

| Anthem | 673 | 1% | 1 | 100% | 36% | 51% |

| Los Angeles | ||||||

| Aetna | 1,735 | <1% | 2 | 100% | 45% | 44% |

| BCBS | 29,463 | 8% | 2 | 100% | 26% | 31% |

| Anthem | 4,581 | 1% | 2 | 100% | 55% | 58% |

| Care1st Health Plan | 14,580 | 4% | 2 | 100% | 52% | 56% |

| Central Health Medicare Plan | 12,850 | 3% | 2 | 100% | 39% | 36% |

| Citizens Choice Health Plan | 6,340 | 2% | 3 | 100% | 37% | 36% |

| Health Net | 30,421 | 8% | 5 | 100% | 40% | 47% |

| Humana | 7,426 | 2% | 3 | 0% | 5% | 2% |

| Inter Valley Health Plan | 5,103 | 1% | 1 | 0% | 17% | 19% |

| Kaiser Permanente | 122,794 | 32% | 1 | 100% | 8% | 10% |

| SCAN Health Plan | 46,013 | 12% | 2 | 100% | 41% | 49% |

| UnitedHealth Group | 74,072 | 19% | 4 | 100% | 39% | 53% |

| Universal American | 723 | <1% | 1 | 100% | 37% | 34% |

| WellCare | 7,944 | 2% | 2 | 100% | 41% | 37% |

| Anthem | 17,990 | 5% | 2 | 0% | 12% | 18% |

| Mecklenburg | ||||||

| Aetna | 3,756 | 14% | 4 | 100% | 90% | 98% |

| BCBS | 7,717 | 29% | 5 | 100% | 70% | 92% |

| Humana | 6,145 | 23% | 2 | 100% | 80% | 92% |

| UnitedHealth Group | 8,917 | 34% | 4 | 100% | 80% | 92% |

| Miami-Dade | ||||||

| Aetna | 11,487 | 6% | 6 | 100% | 45% | 60% |

| AvMed Medicare | 14,446 | 7% | 1 | 100% | 75% | 65% |

| BCBS | 3,992 | 2% | 1 | 100% | 82% | 88% |

| Cigna | 44,416 | 22% | 1 | 100% | 46% | 70% |

| CarePlus Health Plans | 14,994 | 7% | 2 | 100% | 54% | 73% |

| Freedom Health | <50 | <1% | 2 | 100% | 21% | 36% |

| HealthSun Health Plans | 22,221 | 11% | 3 | 100% | 43% | 57% |

| Humana | 33,361 | 16% | 3 | 100% | 58% | 74% |

| Optimum HealthCare | <50 | <1% | 2 | 100% | 18% | 36% |

| UnitedHealth Group | 52,113 | 25% | 3 | 100% | 55% | 70% |

| WellCare | 924 | <1% | 2 | 100% | 64% | 70% |

| Anthem | 6,549 | 3% | 3 | 100% | 44% | 61% |

| Milwaukee | ||||||

| Anthem | 823 | 3% | 1 | 100% | 69% | 87% |

| Humana | 4,677 | 14% | 2 | 100% | 56% | 70% |

| UnitedHealth Group | 27,020 | 83% | 3 | 100% | 75% | 81% |

| Multnomah | ||||||

| BCBS | 6,407 | 15% | 4 | 100% | 63% | 60% |

| CareOregon Advantage | 558 | 1% | 1 | 100% | 63% | 60% |

| FamilyCare Health Plans | 124 | <1% | 5 | 0% | 25% | 20% |

| Health Net | 6,973 | 16% | 4 | 0% | 63% | 42% |

| Humana | 956 | 2% | 2 | 0% | 13% | 10% |

| Kaiser Permanente | 10,385 | 24% | 2 | 0% | 0% | 0% |

| MODA Health Plan | 387 | 1% | 3 | 100% | 100% | 100% |

| PacificSource Medicare | <50 | <1% | 1 | 0% | 38% | 30% |

| Providence Health Plans | 10,188 | 23% | 5 | 0% | 13% | 16% |

| UnitedHealth Group | 7,942 | 18% | 3 | 0% | 71% | 65% |

| New Haven | ||||||

| Aetna | 8,387 | 24% | 4 | 100% | 73% | 97% |

| Anthem | 390 | 1% | 1 | 100% | 64% | 89% |

| ConnectiCare | 16,688 | 48% | 5 | 100% | 64% | 94% |

| UnitedHealth Group | 7,400 | 21% | 4 | 0% | 45% | 25% |

| WellCare | 1,879 | 5% | 2 | 100% | 73% | 94% |

| Pima | ||||||

| BCBS | 9,203 | 17% | 1 | 100% | 36% | 65% |

| Health Net | 5,454 | 10% | 2 | 100% | 36% | 69% |

| Humana | 6,262 | 11% | 3 | 100% | 40% | 77% |

| Phoenix Health Plans | 70 | <1% | 2 | 100% | 36% | 65% |

| SCAN Health Plan | 659 | 1% | 1 | 100% | 43% | 66% |

| UnitedHealth Group | 28,645 | 51% | 2 | 100% | 36% | 65% |

| Anthem | 5,461 | 10% | 2 | 0% | 14% | 28% |

| Queens | ||||||

| Access Medicare | 554 | 1% | 2 | 100% | 55% | 55% |

| Aetna | 2,435 | 3% | 3 | 100% | 82% | 87% |

| Affinity Health Plan | 82 | <1% | 3 | 0% | 55% | 47% |

| AgeWell New York | <50 | <1% | 1 | 0% | 27% | 22% |

| AlphaCare of New York | 140 | <1% | 1 | 0% | 45% | 48% |

| Amida Care | <50 | <1% | 1 | 100% | 45% | 49% |

| Anthem | 16,640 | 21% | 2 | 100% | 73% | 72% |

| Centers Plan for Healthy Living | <50 | <1% | 1 | 0% | 36% | 42% |

| Easy Choice Health Plan of New York | 104 | <1% | 1 | 0% | 27% | 28% |

| Elderplan | 3,048 | 4% | 2 | 100% | 55% | 68% |

| EmblemHealth Medicare | 10,202 | 13% | 5 | 100% | 71% | 79% |

| Fidelis Care | 1925 | 2% | 3 | 0% | 73% | 66% |

| Healthfirst Medicare Plan | 11,271 | 14% | 3 | 67% | 70% | 74% |

| Humana | 220 | <1% | 1 | 100% | 18% | 26% |

| Liberty Health Advantage | 1,051 | 1% | 1 | 100% | 27% | 32% |

| MetroPlus Health Plan | 256 | <1% | 1 | 0% | 36% | 42% |

| Quality Health Plans | <50 | <1% | 2 | 100% | 18% | 26% |

| Touchstone Health | 1,977 | 2% | 4 | 0% | 36% | 34% |

| UnitedHealth Group | 29,417 | 36% | 4 | 50% | 77% | 77% |

| Anthem | 1,259 | 2% | 1 | 100% | 64% | 68% |

| Salt Lake | ||||||

| Aetna | 3,550 | 8% | 1 | 100% | 38% | 51% |

| BCBS | 7,548 | 17% | 4 | 100% | 61% | 77% |

| Humana | 3,949 | 9% | 3 | 67% | 27% | 38% |

| Molina Healthcare | 242 | 1% | 1 | 100% | 38% | 51% |

| SelectHealth | 8,130 | 18% | 1 | 0% | 31% | 36% |

| UnitedHealth Group | 20,835 | 47% | 3 | 100% | 69% | 86% |

| NOTES: AMCs are Academic Medical Centers. BCBS are BlueCross BlueShield affiliates. Denominator of Medicare Advantage enrollees only includes plans that were analyzed as part of this analysis. SOURCE: Kaiser Family Foundation analysis of Medicare Advantage plans’ hospital networks in 20 counties, 2016. |

||||||