2016 Employer Health Benefits Survey

Section Five: Market Shares of Health Plans

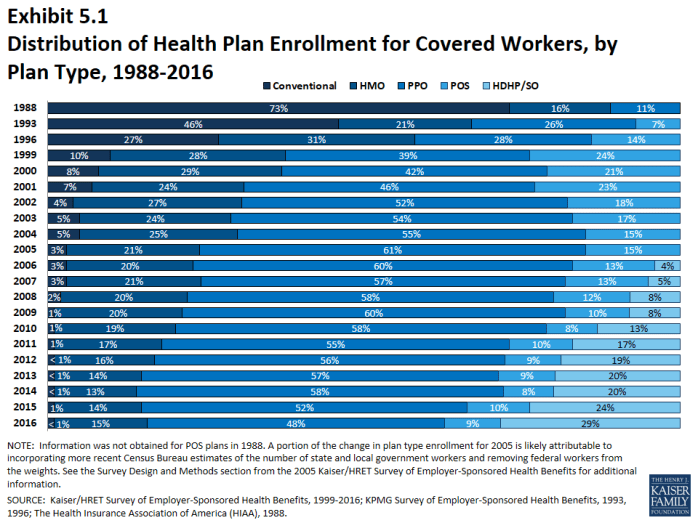

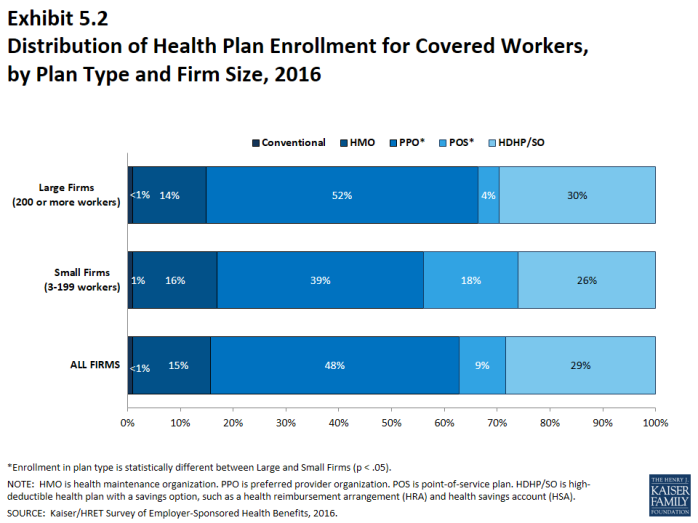

Enrollment remains highest in PPO plans, covering just under half of covered workers, followed by HDHP/SOs, HMO plans, POS plans, and conventional plans. Enrollment distribution varies by firm size: for example, PPOs are relatively more popular for covered workers at large firms (200 or more workers) than small firms (3-199 workers) (52% vs. 39%) and POS plans are relatively more popular among small firms than large firms (18% vs. 4%). Enrollment in HDHP/SOs has increased significantly over the past two years while enrollment in PPOs has fallen.

- Forty-eight percent of covered workers are enrolled in PPOs, followed by HDHP/SOs (29%), HMOs (15%), POS plans (9%), and conventional plans (< 1%) (Exhibit 5.1). More covered workers are enrolled in HDHP/SO plans than in HMOs in both small firms and large firms (Exhibit 5.2).

- The percentage of covered workers enrolled in HDHP/SOs in is similar to last year but has grown significantly since 2014 (29% vs. 20%).1 Since 2014, enrollment in PPOs has fallen significantly (48% vs. 58%) (Exhibit 5.1).

- Plan enrollment patterns vary by firm size.

- Covered workers in large firms are more likely than covered workers in small firms to enroll in PPOs (52% vs. 39%). Covered workers in small firms are more likely than covered workers in large firms to enroll in POS plans (18% vs. 4%) (Exhibit 5.2).

- The share of covered workers in HDHP/SOs is similar for large firms and small firms (Exhibit 5.2).

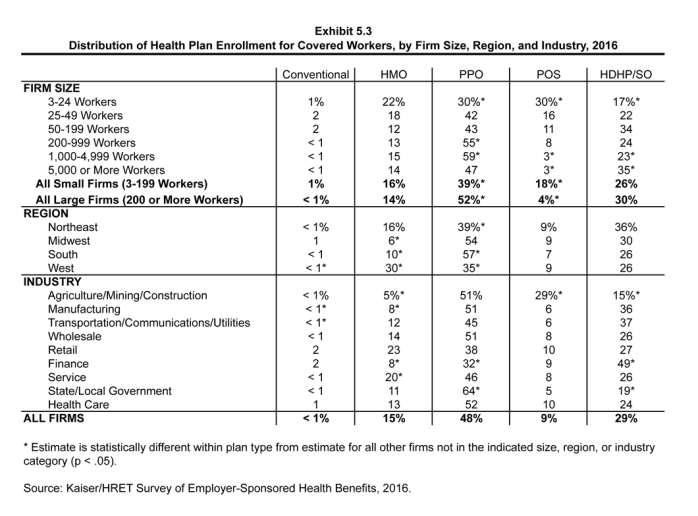

- Plan enrollment patterns also differ across regions.

- HMO enrollment is significantly higher in the West (30%) and significantly lower in the South (10%) and Midwest (6%) (Exhibit 5.3).

- Covered workers in the South (57%) are more likely to be enrolled in PPOs than workers in other regions; covered workers in the West (35%) and the Northeast (39%) are less likely to be enrolled in a PPO (Exhibit 5.3).

- Enrollment in HDHP/SOs is similar across regions (Exhibit 5.3).

- Plan enrollment patterns differ by industry as well.

- Covered workers in the agriculture/mining/construction, (5%), manufacturing (8%) and finance (8%) are less likely to be enrolled in an HMO plan than covered workers in other industries. Covered workers in the service industry (20%) are more likely to be enrolled in an HMO than covered workers in other industries (Exhibit 5.3).

- Covered workers in the state/local government (64%) are more likely to be enrolled in a PPO plan than covered workers in other industries. Covered workers in the finance industry (32%) are less likely to be enrolled in a PPO than covered workers in other industries (Exhibit 5.3).

- Covered workers in the state/local government (19%) and agriculture/mining/construction industries (15%) are less likely to be enrolled in an HDHP/SO plan than covered workers in other industries. Covered workers in the finance industry (49%) are more likely to be enrolled in an HDHP/SO than covered workers in other industries

x

Exhibit 5.1

x

Exhibit 5.2

x