ACA Coverage Expansions and Low-Income Workers

Introduction

Approximately 145 million nonelderly adults ages 19 to 64 in the United States worked in 2014. Nearly one in three of these workers (30%) were in families that earned less than 250% of the Federal Poverty Level (FPL), or $30,790 for an individual in 2014. Since the end of the Great Recession in 2009, real (inflation-adjusted) hourly wages have largely stagnated or fallen for low-income workers.1 Furthermore, the wage gap between the highest income workers and low-income workers has been widening over the past three decades.2 Prior to 2014, health insurance coverage rates for low-income workers had been falling, largely due to reductions in employer-based health coverage.3

The implementation of the Affordable Care Act (ACA) in 2014 created new coverage opportunities for workers who were not offered insurance by their employer. The expansion of Medicaid to nearly all adults with incomes up to 138% FPL in Medicaid expansion states and the availability of premium tax credits through the Marketplaces led to large gains in coverage, particularly among low-income adults.4 Medicaid has always been an important source of coverage for low-income families and children; however, eligibility rules in place prior to the ACA excluded childless adults from coverage. The elimination of these rules in states that chose to adopt the expansion increased Medicaid eligibility for low-income working adults.

Although low-income workers are a diverse population, distinct characteristics and challenges differentiate low-income workers from their higher income counterparts, especially when it comes to health insurance coverage. Using data from the Census Bureau’s 2014 and 2015 Annual Social and Economic Supplement to the Current Population Survey (CPS ASEC), this brief compares the demographic and employment characteristics and health coverage status of nonelderly adult low-income workers with those of higher income workers. We define low-income workers as non-elderly adult workers (ages 19-64) in families that earned less than 250% FPL. Higher income workers are non-elderly adult workers in families that earned 250% FPL or more. This brief also examines the change in health coverage among low-income workers following implementation of the ACA and provides estimates of eligibility for ACA coverage options among low-income workers who remain uninsured.

Who are low-income workers?

Low-income workers are more likely to be young, people of color, and female and to have lower levels of educational attainment compared to higher-income workers, Nearly half (47%) of low-income workers are between the ages of 19 and 34, compared to just one third of higher income workers (31%) (Appendix Table 1). More than half (51%) of low-income workers are people of color compared to less than one third of higher income workers (30%) Female workers are also overrepresented at lower income levels. Women make up 47% of the workforce overall, but comprise half of low-income workers. Eighty-five percent of low-income workers lack a college degree, and nearly one in five (17%) has not graduated from high school.

These differences are even more pronounced for workers living below poverty. Very low income workers living below 100% FPL are even more likely to be young (53%), people of color (56%), and female (56%) than workers of any other income group (Appendix Table 1). This trend persists across all measures.

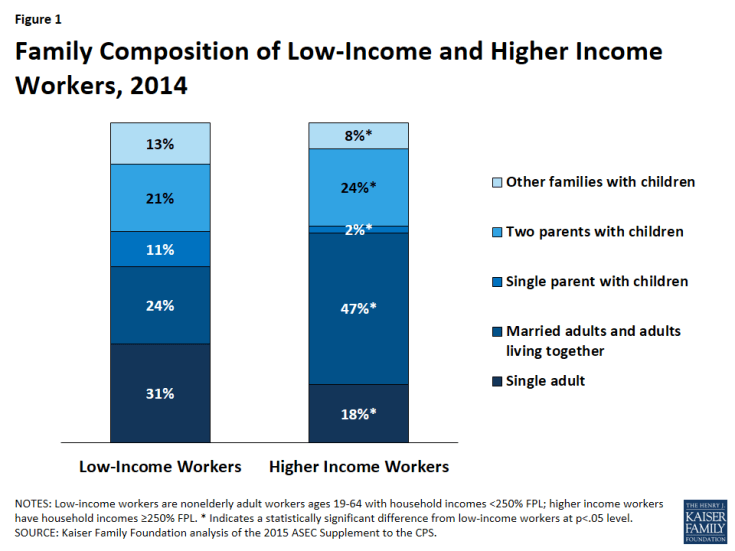

A larger share of low-income workers are members of families with dependent children than higher income workers; however, over half of low-income workers are adults without dependent children. Over four in ten (45%) low-income workers are members of families with dependent children, compared to one third (34%) of higher income workers (Figure 1). Low-income workers are also more likely to be single parents compared to higher income workers (11% versus 2%). At the same time, more than half (55%) of low-income workers are adults without dependent children, including 31% who are single adults. This group is particularly noteworthy because prior to the ACA, these low-income individuals were largely ineligible for Medicaid due to categorical eligibility limits.

Low-income workers are more likely to be non-citizens than their higher income counterparts. Sixteen percent of low-income workers are non-citizens, compared to just 6% of higher income workers (Appendix Table 1). Immigrants, particularly recent immigrants, may face language and other barriers that limit their employment options which may lead to lower paying jobs that lack comprehensive benefits, including health insurance. Immigrants, particularly those who are not citizens, also face disproportionate barriers to accessing health coverage and care.5

How much are low-income workers working?

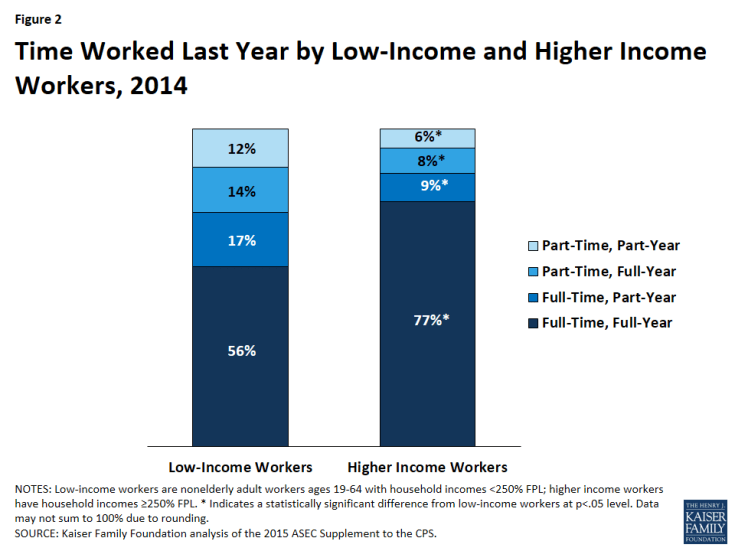

Low-income workers are more likely to work part-time or part-year and to report doing so for job-related reasons compared to higher income workers. Although the majority of low-income workers work both full-time (defined as 35 hours or more per week) and full-year (defined as 50 weeks or more per year), the share of full-time, full-year workers is significantly lower among low-income workers than among higher income workers (56% versus 77%) (Figure 2). While low and higher income workers worked similar numbers of hours per week (37 versus 40) in 2014, some low-income workers may be acquiring those hours through multiple part-time jobs rather than a single full-time job (Appendix Table 2). This distinction is important to note because part-time positions may pay lower wages and may provide more limited benefit packages than full-time positions. Furthermore, part-time positions may not be subject to the employer shared responsibility provision under the ACA. This provision requires that employers with 50 or more full-time equivalent employees provide affordable health coverage options to their employees or face a penalty.6

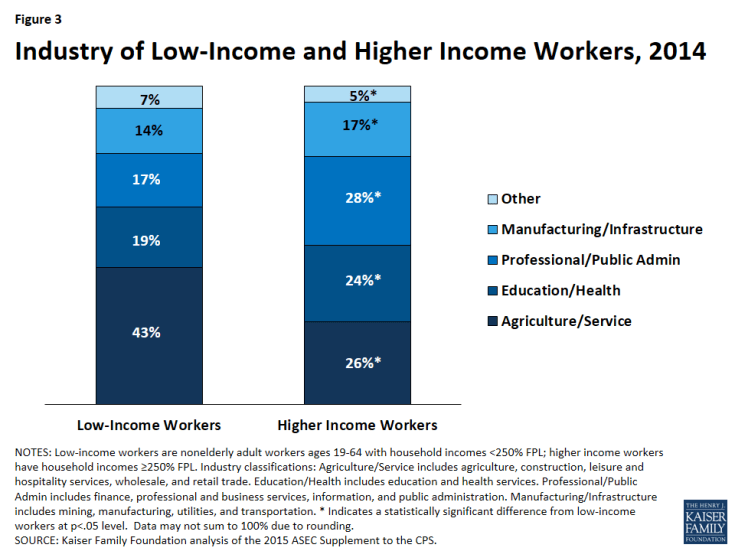

Low-income workers are more likely to work in the agriculture and service industries and for smaller firms compared to higher income workers. The share of low-income workers in the agriculture and service industries is far greater than the share of higher income workers employed in these fields (43% versus 26%) (Figure 3). This difference is important given that the agriculture and service industries are typically less likely to offer benefits like health insurance to employees.7 More than four in ten low-income workers work for firms with fewer than 50 employees, compared with just three in ten higher income workers (42% versus 30%). Firms with fewer than 50 workers are exempt from employer responsibility requirements for health coverage under the Affordable Care Act (ACA).8 Therefore, low-income workers may be less likely to receive health coverage through their employer if they work for a small firm.

What is the health insurance status of low-income workers?

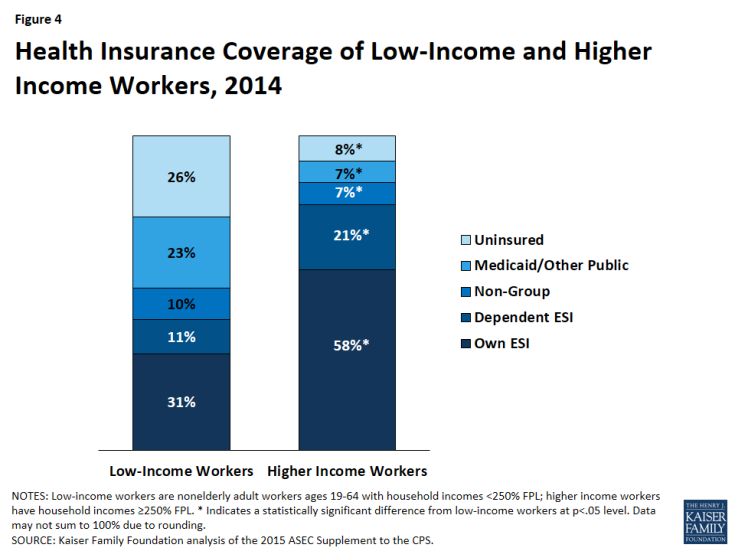

The share of low-income workers who have health coverage through their employers is lower than that of higher income workers. Less than one third (31%) of low-income workers had employer-sponsored insurance through their own job in 2014 compared to half (58%) of higher income workers (Figure 4). Low-income workers were also half as likely to have employer-sponsored insurance coverage as a dependent compared to higher income workers (11% versus 21%). As previously mentioned, low-income workers are more likely to be employed by smaller firms that are less likely to offer health benefits and are more likely to work in industries with lower levels of health coverage on average, such as the agriculture and service industries. Furthermore, low-income workers are more likely to work part-time than their higher income counterparts and may not be offered health benefits through their employers for this reason.

Under the ACA, employers with 50 or more full-time equivalent employees are required to offer health insurance coverage that meets minimum value and affordability standards to their full-time workers or pay a fine. These requirements were not in effect in 2014, but have been fully implemented in 2016. Coverage is deemed affordable under the ACA if the employee contribution for individual coverage for the lowest-priced plan offered is no more than 9.66% of the employee’s household income in 2016. Employees offered coverage that does not meet the affordability standard may qualify for premium tax credits to purchase coverage in the Marketplaces. However, if coverage offered by their employer meets these affordability standards, low-income workers are ineligible for premium tax credits to help pay for coverage in the Marketplace even if they perceive the employer coverage to be unaffordable to them.

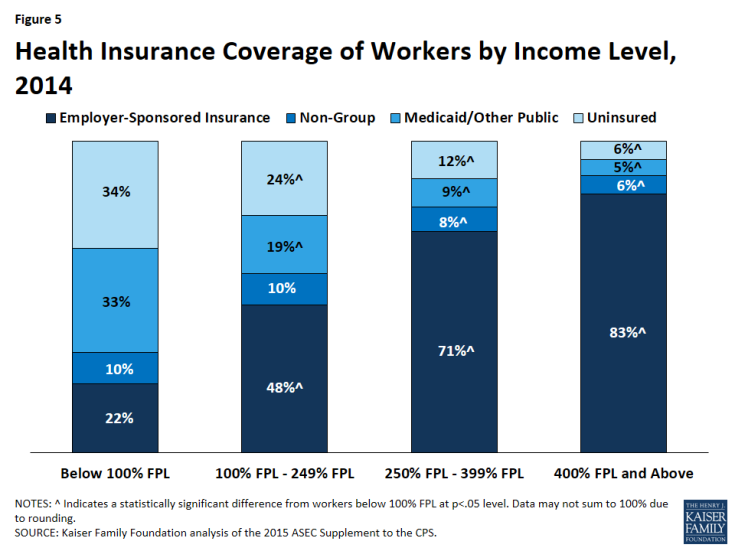

Medicaid plays an important role in providing health coverage for low-income workers, particularly those who make less than 100% FPL. In 2014, more than one-fifth (23%) of low-income workers received Medicaid or other public coverage, compared to just 7% of higher income workers (Figure 4). Medicaid is even more important as a source of health coverage for workers with very low incomes. One in three (33%) low-income workers below poverty relied on Medicaid or other public coverage in 2014 (Figure 5). Without Medicaid, many vulnerable workers living below poverty would likely remain uninsured.

Following implementation of the ACA’s coverage expansions in January 2014, low-income workers experienced large gains in coverage. Under the ACA, health coverage was extended to individuals who did not previously have access to affordable coverage through an expansion of Medicaid to low-income individuals under 138% FPL ($27,310 for a family of three in 2014) and through premium tax credits available to individuals with incomes 100%-400% FPL who purchase coverage in the Marketplaces. While the Medicaid expansion was intended to be implemented nationwide, a June 2012 Supreme Court ruling essentially made it optional for states. As of 2014, 27 states (including DC) had adopted the Medicaid expansion.9 10

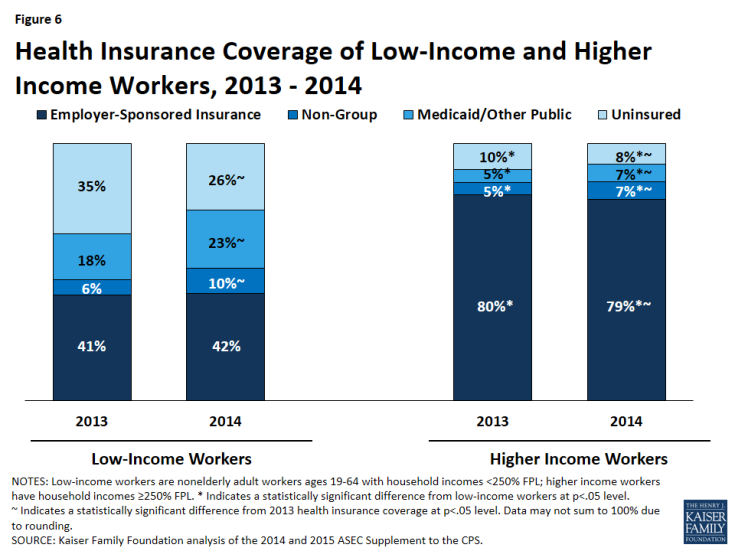

From 2013 to 2014, the share of low-income workers enrolled in Medicaid and other public coverage grew from 18% to 23%, and the share of low-income workers who purchased health insurance in the individual or non-group market (a category that includes coverage through the health insurance Marketplaces in 2014) rose from 6% to 10% (Figure 6). Over the same period, the share of low-income workers who were uninsured dropped from 35% in 2013 to 26% in 2014. The share of low-income workers with employer-sponsored insurance remained relatively constant over this period. Even with these gains in coverage, over a quarter (26%) of low-income workers (more than 11 million) remained uninsured in 2014.

Higher income workers experienced coverage gains from 2013 to 2014 as well, resulting in a two-percentage-point reduction in the share who were uninsured (10% to 8%). However, since the ACA coverage provisions primarily targeted people in the low-income range, coverage gains among the higher income worker population were more limited than those observed among low-income workers.

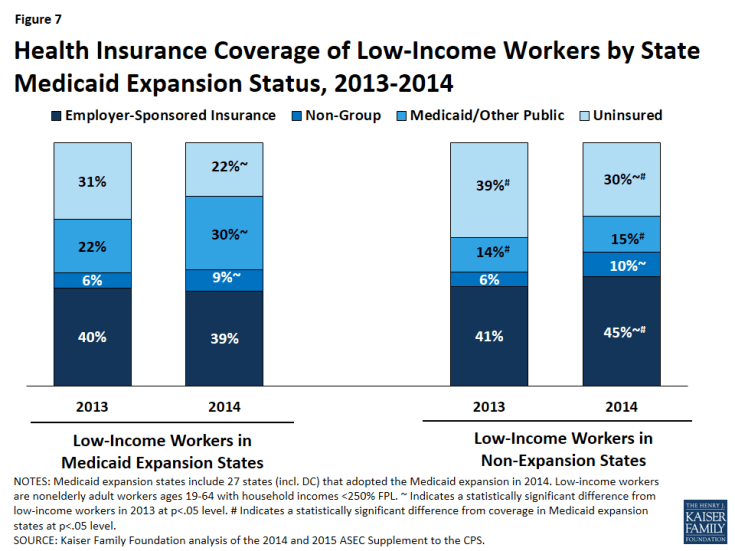

Low-income workers who live in states that have expanded Medicaid under the ACA are more likely to have health coverage than in than those who live in states that have not expanded Medicaid. In states that adopted the Medicaid expansion in 2014, the share of low-income workers covered by Medicaid or other public coverage increased from 22% in 2013 to 30% in 2014 (Figure 7). The percentage of individuals covered in the non-group market also increased from 6% in 2013 to 9% in 2014. These coverage expansions contributed to a decline in the uninsured rate in Medicaid expansion states from 31% in 2013 to 22% in 2014.

Figure 7: Health Insurance Coverage of Low-Income Workers by State Medicaid Expansion Status, 2013-2014

In states that did not adopt the Medicaid expansion, Medicaid and other public coverage covered just 15% of the low-income working population in 2014. While coverage of low-income workers did increase in non-expansion states, these coverage gains were seen in the non-group and employer-sponsored insurance markets. Without the coverage gains in Medicaid, low-income workers in non-expansion states were more likely to remain uninsured in 2014 than those in Medicaid expansion states—30% of low-income workers were uninsured in non-expansion states in 2014, compared to 22% in expansion states (Figure 7).

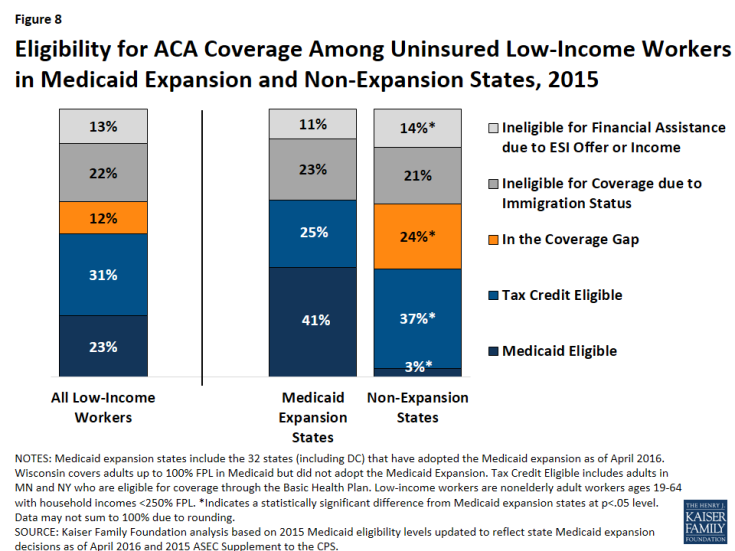

Over half of uninsured low-income workers are eligible for coverage either through Medicaid or subsidized Marketplace coverage. Among uninsured low-income workers, nearly one quarter (23%) are estimated to be eligible for Medicaid and three in ten (31%) are estimated to be eligible for tax credits in the Marketplace (Figure 8). For low-income workers in particular, outreach and education about available coverage options is important to build upon the coverage gains experienced by this population in 2014. Misperceptions about cost, lack of awareness of financial assistance, and confusion about eligibility rules were cited as barriers to some eligible uninsured individuals gaining coverage.11 Others reported that coverage was still too costly, even with the availability of financial assistance.12

Figure 8: Eligibility for ACA Coverage Among Uninsured Low-Income Workers in Medicaid Expansion and Non-Expansion States, 2015

Over one in ten low-income workers fall into the coverage gap. Because the ACA envisioned all people below 138% FPL receiving coverage through Medicaid, it does not provide financial assistance to people below 100% FPL for coverage in the Marketplace. Consequently, 12% of all low-income workers (24% of low-income workers in non-expansion states) have incomes above Medicaid eligibility limits but below the lower limit for Marketplace premium tax credits and fall into the “coverage gap.”13 Workers with incomes less than 100% FPL are even more vulnerable; 61% of workers with incomes below poverty fall into the coverage gap in non-expansion states (data not shown).

Another 22% of uninsured low-income workers are undocumented immigrants who are ineligible for ACA coverage under federal low. The remaining 13% are ineligible for financial assistance in the Marketplaces due to an offer of employer-sponsored coverage or due to income. These workers could purchase unsubsidized coverage in the Marketplaces; however, that coverage is likely unaffordable to them.

Conclusion

Low-income workers make up almost one third of the American workforce, yet distinct characteristics and challenges differentiate this population from their higher income counterparts. Low-income workers are more likely to be young, people of color, female, and to have lower levels of education than those with higher incomes. They also may not have access to jobs that provide full-time, full-year employment. Low-income workers are more likely than higher income workers to work in the agriculture and service industries and to work for small firms that are typically less likely to provide comprehensive benefit packages (including health insurance) as consistently as other employers.

Coverage expansions implemented under the ACA have produced large health coverage gains for low-income workers and a corresponding reduction in the uninsured. These coverage gains have been particularly large in states that have expanded their Medicaid programs. Low-income workers who live in states that have expanded their Medicaid programs are more likely to have health coverage than those who live in states that have not expanded Medicaid. Even with these promising improvements in health coverage rates under the ACA, coverage rates among the low-income worker population continue to lag behind the rates among higher income workers. Despite the fact that they are working nearly as many hours per week and weeks per year as higher income workers, low-income workers are far less likely to receive health insurance through their employers and far more likely to be uninsured than higher income workers. While Medicaid provides coverage to nine million low-income workers without other affordable coverage options, not all low-income workers are eligible for coverage. Nearly one quarter of uninsured workers in non-expansion states fall into the coverage gap, with incomes too high for Medicaid but too low for subsidies in the Marketplace. Although these individuals are working, they do not have access to an affordable coverage option and will likely remain uninsured.

Given the differences between low and higher income workers in a range of demographic characteristics (including race, age, and gender), addressing the challenges that many low-income workers face in accessing health insurance could help to reduce existing economic and health disparities between demographic groups. Broadening coverage through the Medicaid expansion, combined with additional outreach and enrollment efforts targeted at this population and efforts to improve the affordability of existing coverage options, could help to connect the remaining uninsured to affordable health coverage throughout the country.