A Final Look: California's Previously Uninsured after the ACA's Third Open Enrollment Period

Section 2: Financial Security, Health-Related Worries, Accessing Care, and Evaluations of Insurance Plans

By repeatedly contacting individuals who participated in a baseline survey, one of the strengths of the California Longitudinal Panel Survey is to track the experiences and perceptions of these individuals over time, while comparing their current experiences to previous experiences. One of the ways this is best illustrated is by comparing the change over time between individuals who recently got health insurance and those who remain uninsured.

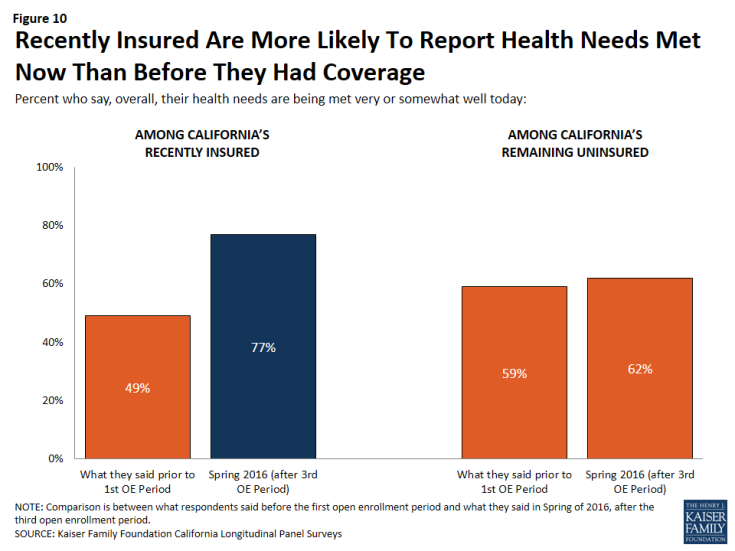

Overall, Californians who recently got health insurance are more likely to report that their health needs are being met today than in the past. About three-fourths (77 percent) of those who report now having coverage after the third open enrollment period say their health needs are being met either “very” or “somewhat” well today, while only half of them (49 percent) said the same thing when they were uninsured in summer 2013, prior to the first open enrollment period. This is compared to the remaining uninsured, in which a similar share say their health needs are being met well today as did in 2013 (62 percent compared to 59 percent).

Figure 10: Recently Insured Are More Likely To Report Health Needs Met Now Than Before They Had Coverage

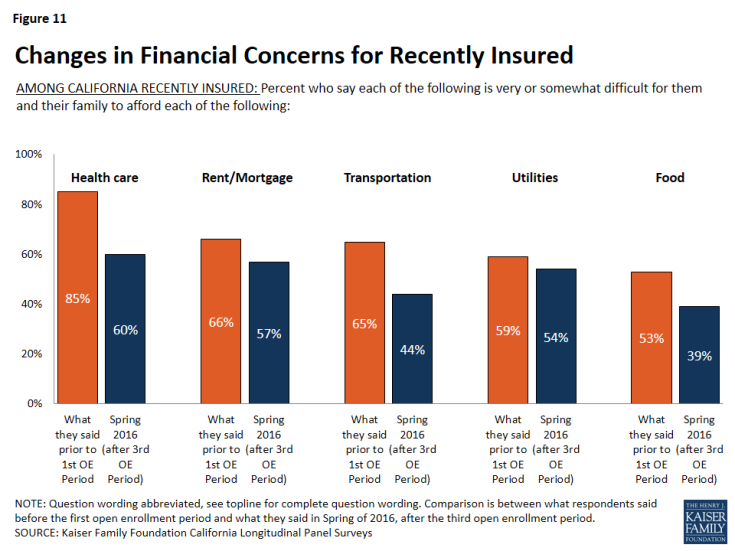

Californians who recently got health insurance are also less likely to report having difficulty affording a variety of household expenses, including health care, in 2016 than they did in 2013.

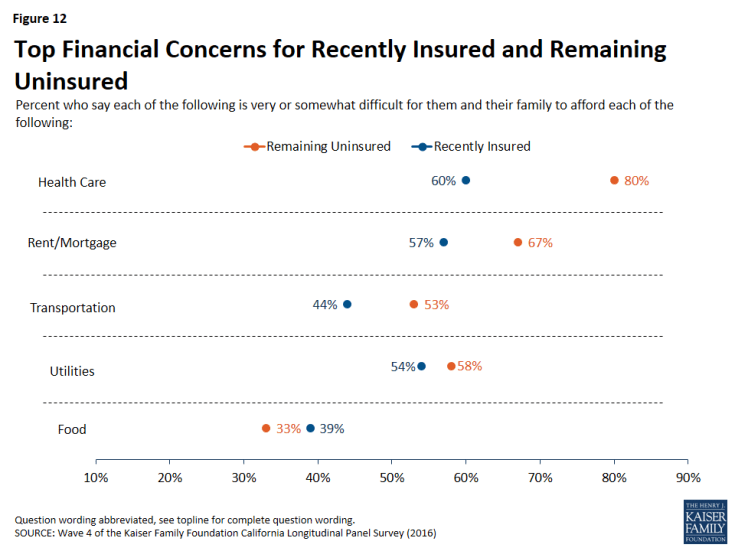

In 2016, 60 percent of California’s recently insured say it is difficult for them to afford health care. While this is still a majority, it is considerably less than the share of these individuals who reported the same in 2013 (85 percent). In comparison, of the remaining uninsured, the percent who say it is difficult for them to afford health care has remained stable (80 percent in 2016 v. 84 percent in 2013). For those who report having health insurance in spring 2016 after the third open enrollment period, affording health care falls among one of several household expenses people say they have difficulty affording. But, for those who remain uninsured, health care is by far the most frequently cited burdensome household expense, with eight in ten saying it is at least somewhat difficult to afford.

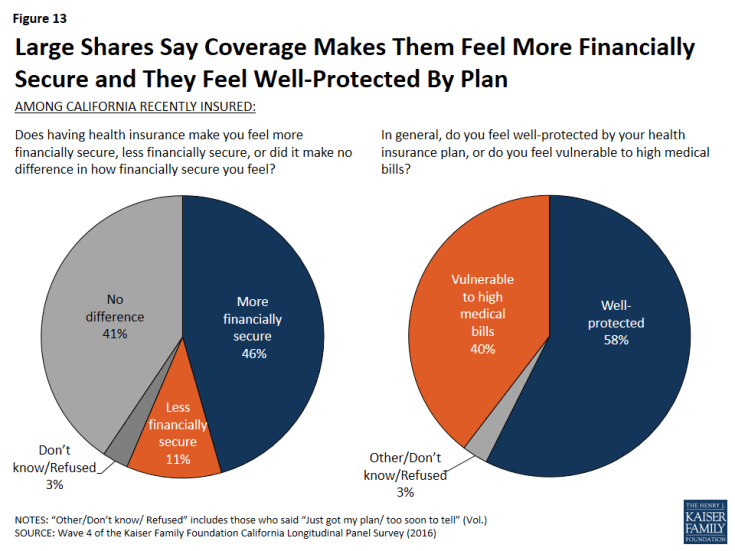

Financial Security

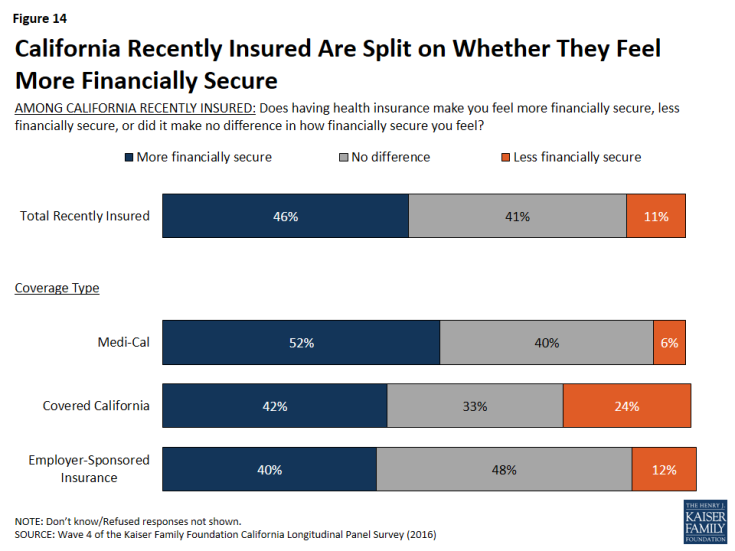

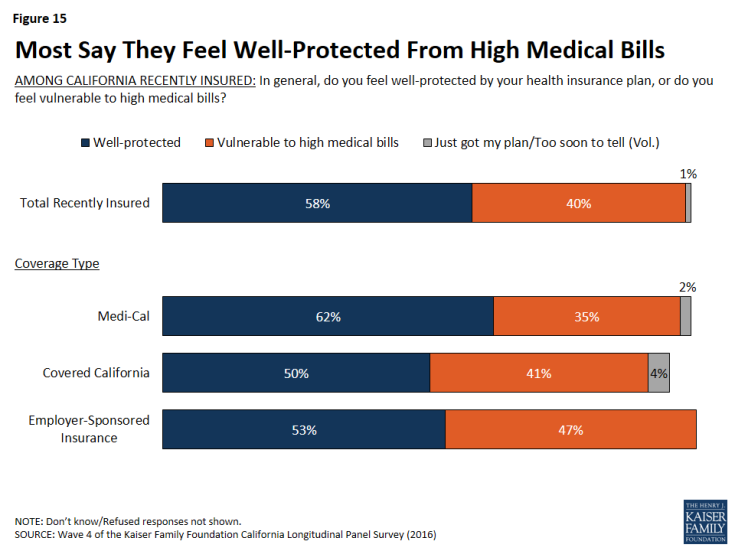

Even with some saying coverage is difficult to afford, overall, about half (46 percent) of previously uninsured Californians who have recently gained coverage say that having health insurance makes them feel more financially secure. About four in ten (41 percent) say it doesn’t make a difference, and a smaller share (11 percent) say it makes them feel less financially secure. In addition, most (58 percent) of those now with insurance say they feel well-protected by their health insurance, but 40 percent say they feel vulnerable to medical bills. The share of the insured who say they feel vulnerable to medical bills has increased slightly since 2015 (33 percent).

Figure 13: Large Shares Say Coverage Makes Them Feel More Financially Secure and They Feel Well-Protected By Plan

Among the recently insured, a larger share (52 percent) of individuals who have Medi-Cal report that getting insured made them feel more financially secure compared to those with Covered California (42 percent) and those with employer-sponsored insurance (40 percent).

Similarly, a larger share of individuals with Medi-Cal feel well protected by their health insurance plan from high medical bills than those with Covered California and those with employer-sponsored insurance (62 percent compared to 50 percent and 53 percent, respectively). This is likely due to lower cost sharing for those with Medi-Cal.

For Some, Health Care-Related Worries Persist

While many who have recently gained insurance report feeling more financially secure as a result of their coverage, one-fifth of the recently insured report forgoing needed medical care in the past year due to cost. But this share is smaller than the share of those remaining without insurance (32 percent) who report not getting medical care due to costs. The share of those with insurance who have foregone medical care due to costs is similar across insurance type, with about one in five of those with Medi-Cal (17 percent), and about one in four with those with Covered California (23 percent) and employer-sponsored insurance (24 percent) saying they have not gotten care due to costs.

| Table 2: Likelihood Of Forgoing Medical Care and Worries About Health Costs | |||||

| REMAINING UNINSURED | RECENTLY INSURED | ||||

| Total Recently Insured | Medi-Cal | Covered California | Employer-Sponsored Insurance | ||

| Was there a time over the past twelve months when you needed medical care, but did not get it because of the cost, or not? | |||||

| YES | 32% | 20% | 17% | 23% | 24% |

| NO | 68 | 79 | 82 | 77 | 76 |

| Percent who say they are very worried about not being able to do the following: | |||||

| Pay medical bills for health care services | 55 | 39 | 47 | 29 | 28 |

| Pay medical bills in the event of a serious illness or accident | 72 | 53 | 61 | 44 | 47 |

| Find a doctor or health professional who will treat you | 44 | 35 | 42 | 23 | 30 |

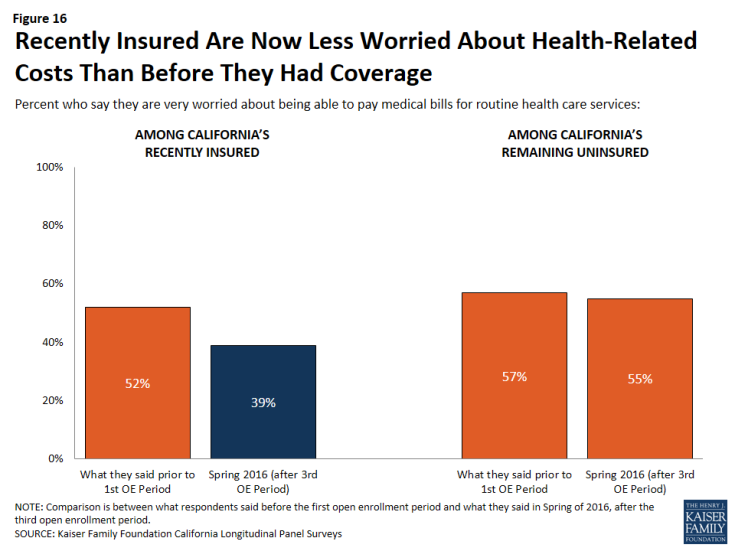

Having health insurance also leads to lower rates of reporting being worried about a series of health-care related concerns. Forty-four percent of California’s remaining uninsured saying they are “very worried” they will not be able to find a doctor or health professional to treat them, 55 percent are “very worried” they won’t be able to pay medical bills for health care services, and 72 percent are “very worried” they won’t be able to pay medical bills in the event of a serious illness or accident. This is compared to smaller shares of recently insured individuals who report being “very worried” about all of these health-related concerns. In addition, California’s recently insured now report a lower rate of being “very worried” about being able to pay medical bills for routine health care services than they did in 2013 (39 percent in 2016 compared to 52 percent in 2013), while the share of the remaining uninsured who are very worried has not changed and is 55 percent now compared to 57 percent in 2013.

Figure 16: Recently Insured Are Now Less Worried About Health-Related Costs Than Before They Had Coverage

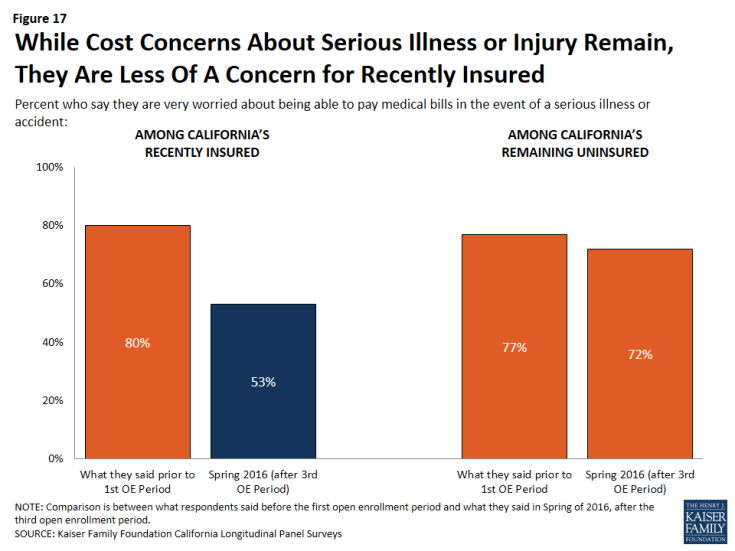

While half (53 percent) of California’s recently insured are still “very worried” that they would not be able to pay medical bills in the event of a serious illness or accident, this is a smaller share than the percent of these people who reported being “very worried” in 2013 (80 percent) and smaller than the share of the remaining uninsured who now report being “very worried” (72 percent). A larger share of individuals with Medi-Cal coverage (61 percent) say they are “very worried” about medical expenses for a serious illness compared to 47 percent of those with employer-sponsored coverage and 44 percent of individuals with Covered California health insurance coverage.

Figure 17: While Cost Concerns About Serious Illness or Injury Remain, They Are Less Of A Concern for Recently Insured

Accessing Health Care

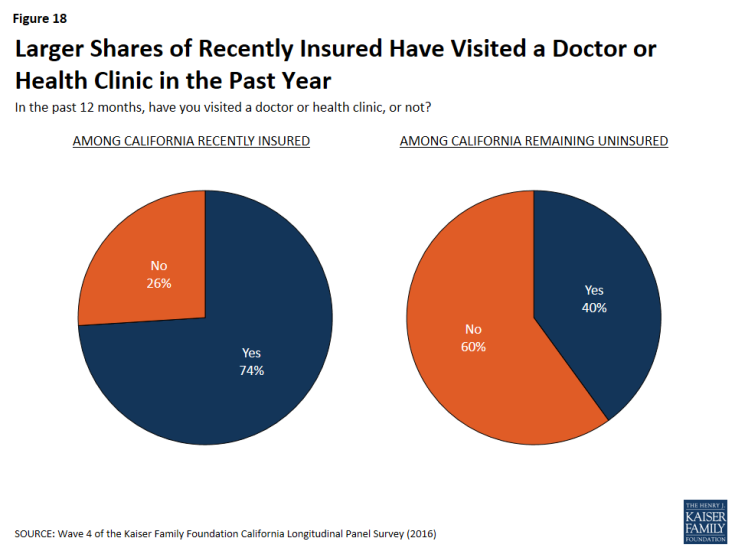

Three-fourths of California’s recently insured have visited a doctor or health clinic in the past 12 months compared to 40 percent of California’s remaining uninsured.

Figure 18: Larger Shares of Recently Insured Have Visited a Doctor or Health Clinic in the Past Year

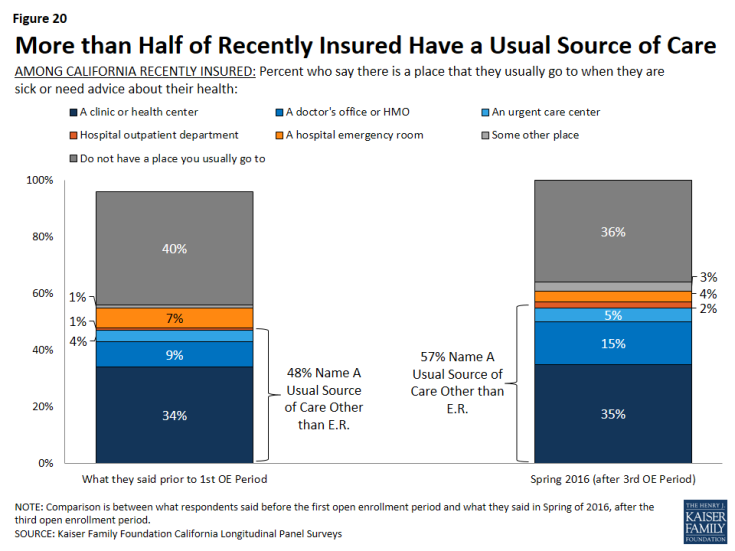

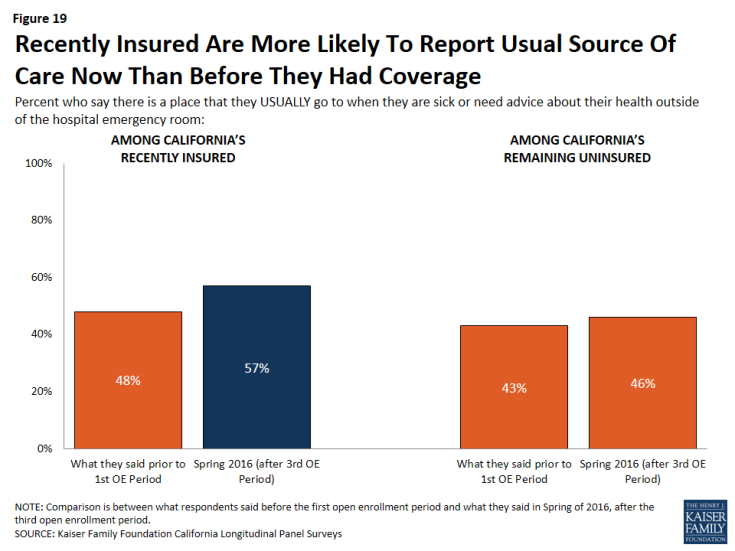

Among California’s recently insured, 57 percent say they have a usual source of care outside of the hospital emergency room, which is slightly higher than the share of these individuals who reported having a usual source of care outside of the hospital emergency room in 2013 (48 percent).

Figure 19: Recently Insured Are More Likely To Report Usual Source Of Care Now Than Before They Had Coverage

A larger share of California’s recently insured now report there is a place they usually go to, outside of the hospital emergency room, when they are sick or need advice about their health. In 2016, nearly six in ten (57 percent) of the recently insured report a usual source of care outside of the emergency room. In 2013, 48 percent of these individuals reported the same.

Problems Accessing Medical Care Among Recently Insured

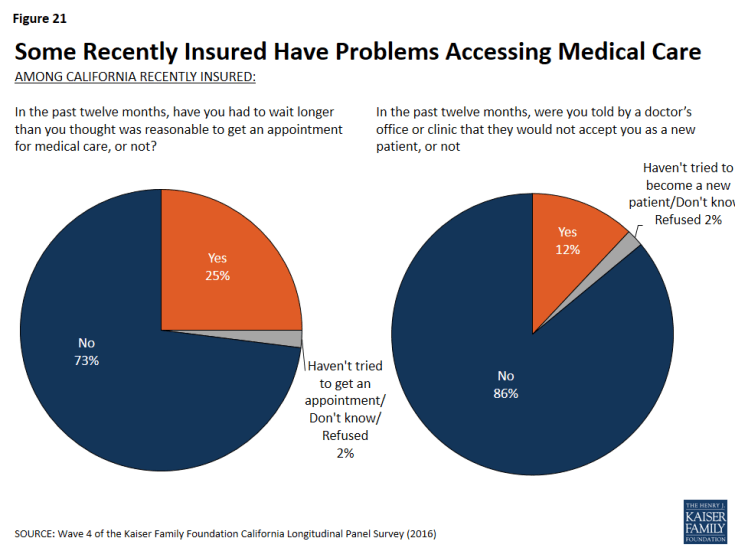

Yet, for some of the recently insured, some problems accessing medical care remain. One-fourth of the recently insured say they have had to wait longer than a reasonable time to get an appointment for medical care and about one in ten (12 percent) say they have been told by a doctor’s office or clinic in the past 12 months that they would not be accepted as a new patient.

Evaluations of Health Insurance

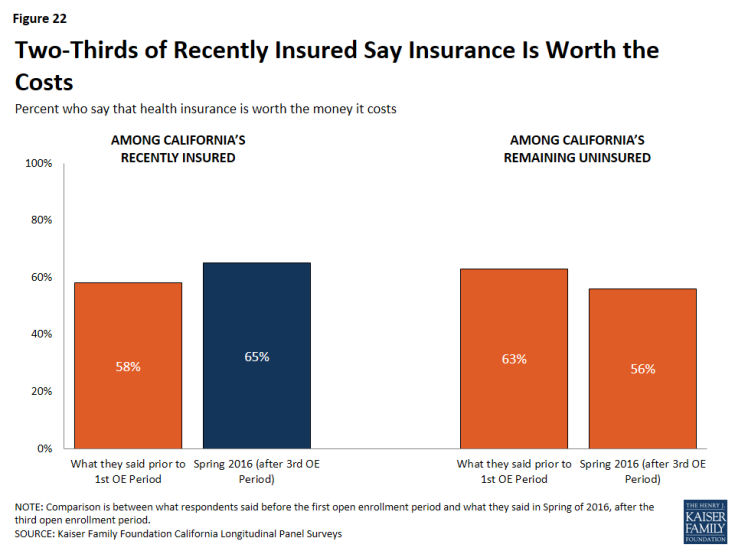

Sixty-five percent of California’s recently insured say health insurance is worth the money that it costs. This is slightly larger than the share in 2013, in which 58 percent of these individuals reported that health insurance is worth the money that it costs. Among the remaining uninsured, 56 percent say health insurance is worth the money it costs.

In addition, 85 percent of California’s recently insured say health insurance is something they need compared to 75 percent of those who remain uninsured. There are differences by gender within insurance status. Of the men who were recently insured, eight in ten say health insurance is something they need compared to 69 percent of men who remain uninsured. More than eight in ten women, regardless of insurance status, say health insurance is something they need.

| Table 3: Gender Differences in Perceptions of Whether Health Insurance is Needed | ||||||

| RECENTLY INSURED | REMAINING UNINSURED | |||||

| Total | Men | Women | Total | Men | Women | |

| Health insurance is something I need | 85% | 80% | 90% | 75% | 69% | 82% |

| I’m healthy enough that I don’t really need health insurance | 14 | 20 | 8 | 22 | 28 | 15 |

Satisfaction with Current Health Insurance Plan

Of the recently insured, the majority say their experiences with their current health insurance plan have been positive. About one-third (31 percent) say their experiences have been “very positive” with an additional 48 percent saying their experiences have been “somewhat positive.” Only 15 percent say their experiences have been negative: 10 percent say “somewhat negative” and 5 percent “very negative.” When looking at differences among coverage type, slightly larger shares of recently insured individuals with Medi-Cal say their experiences have been either very or somewhat positive (85 percent), compared to about three-fourths of those with employer-sponsored insurance and 70 percent of those with Covered California.

Figure 23: Most California Recently Insured Say Their Experience With Their Current Plan Has Been Positive

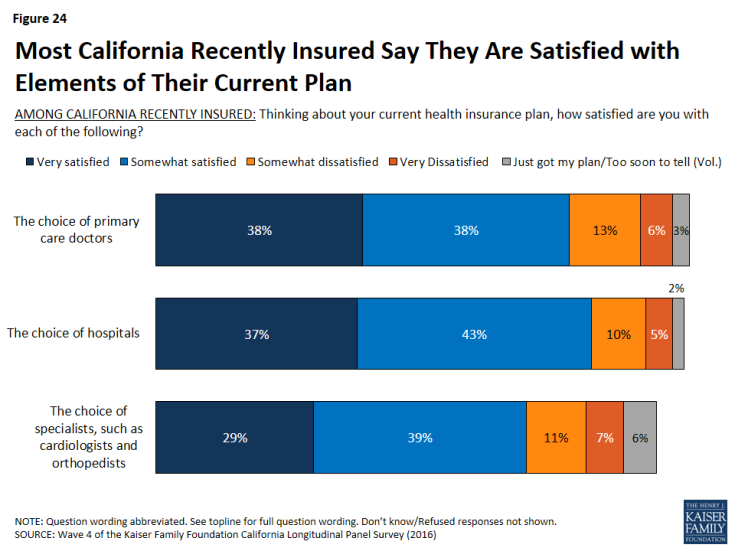

In addition, the majority of the recently insured report that they are either “very satisfied’ or “somewhat satisfied” with various aspects of their current plan including their choice of hospital (80 percent), their choice of primary doctors (76 percent), and their choice of specialists (68 percent).