Medicare Part D: A First Look at Prescription Drug Plans in 2020

Findings

Part D Plan Availability

A larger number of Part D plans will be offered in 2020 than in recent years.

- The average beneficiary will have a choice of 28 PDPs in 2020, one more PDP option than in 2019 and six more than in 2017 (a 29% increase) (Figure 2). Although the number of PDP options in 2020 is half of what it was at the peak in 2007 (when there were 56 PDP options, on average), this is the third year in a row with an increase in the average number of stand-alone drug plan options. In 2020, beneficiaries will also have access to 24 MA-PDs, on average, a 44% increase in MA-PD options since 2017 (excluding MA plans that do not offer the drug benefit; overall, an average of 28 MA plan options will be available in 2020).

Figure 2: The Average Medicare Beneficiary Has a Choice of 28 Stand-alone Drug Plans and 24 Medicare Advantage Drug Plans in 2020

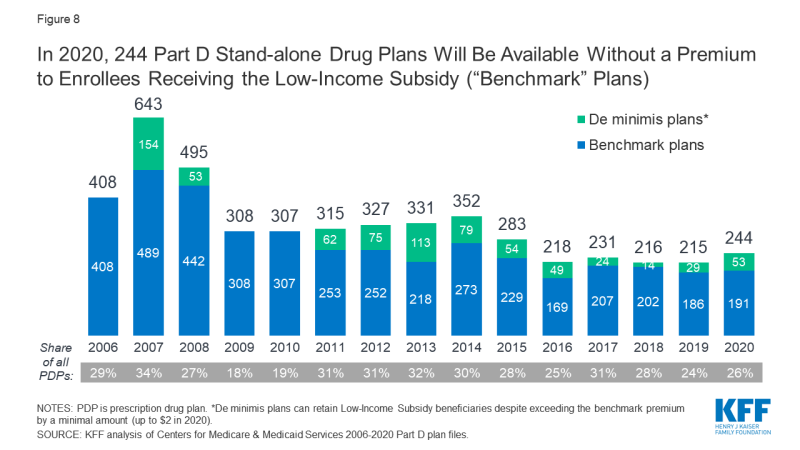

- A total of 948 PDPs will be offered in the 34 PDP regions in 2020 (plus another 11 PDPs in the territories), an increase of 47 PDPs (5%) over 2019, and 202 more PDPs (a 27% increase) since 2017 (Figure 3). This increase is primarily due to the elimination of the “meaningful difference” requirement for enhanced benefit PDPs offered by the same organization in the same region. Eliminating this requirement means that PDP sponsors no longer have to demonstrate that their enhanced PDPs offered in the same region are meaningfully different in terms of enrollee out-of-pocket costs. In 2020, 60% of PDPs (566 plans) will offer enhanced Part D benefits—a 46% increase in the availability of enhanced-benefit PDPs since 2017, when just over half of PDPs (387 plans) offered enhanced benefits.

- The number of PDPs per region in 2020 will range from 24 PDPs in Alaska to 32 PDPs in California, and will be the same or higher in 32 of the 34 PDP regions compared to 2019 (see map; Table 1).

- In 2020, nearly nine out of 10 PDP enrollees (88%) are projected to be in PDPs operated by five firms: UnitedHealth, Humana, WellCare, CVS Health, and Cigna (based on PDP enrollment as of September 2019). All five firms offer PDPs in all 34 PDP regions in 2020.

Figure 3: A Total of 948 Medicare Part D Stand-alone Drug Plans Will Be Offered in 2020, a 27% Increase in Plan Availability Since 2017

.

Premiums

National Premium Trends

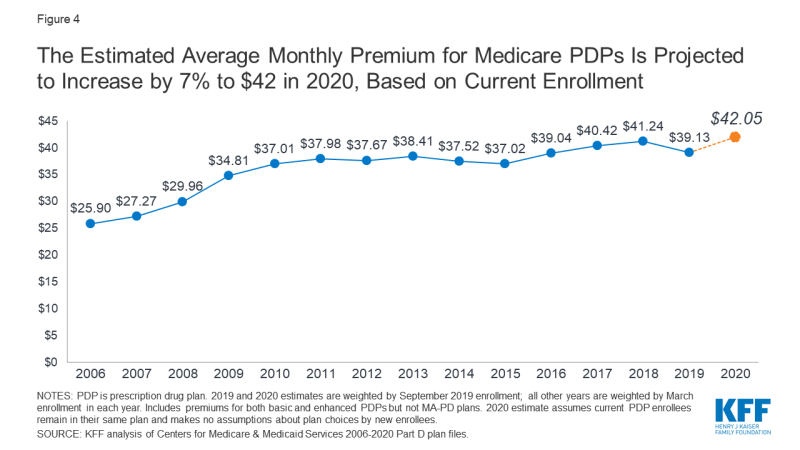

The estimated national average monthly PDP premium is expected to increase by 7% to $42 in 2020.

- The estimated average monthly PDP premium for 2020 is projected to be $42.05, weighted by September 2019 enrollment (Figure 4). The 2020 premium estimate represents a 7% increase ($2.92) from the weighted average monthly premium of $39.13 in 2019. It is likely that the actual average weighted premium for 2020, after taking into account enrollment choices by new enrollees and plan changes by current enrollees, will be somewhat lower than the estimated average.

- Since 2006, the first year of the Medicare Part D drug benefit, the weighted average monthly premium for PDPs has increased by 62%, but much of the increase occurred between 2006 and 2011; since then, the average monthly premium has been relatively stable, between $37 and $41.

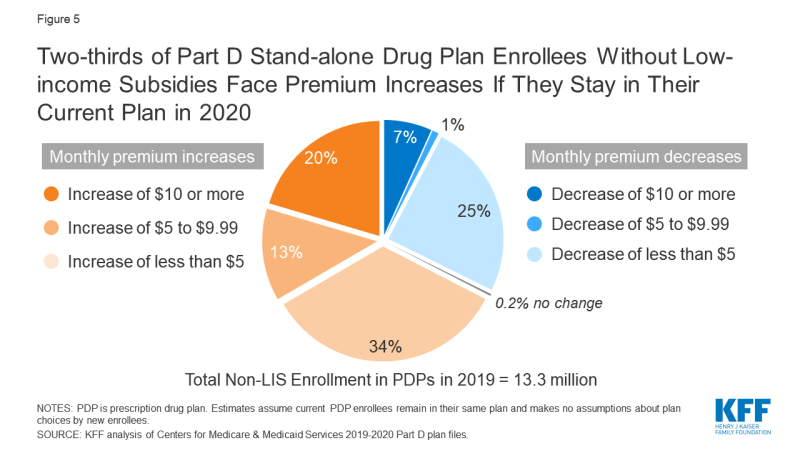

- Two-thirds of the 13.3 millionPart D PDP enrollees who are responsible for paying the entire premium (which excludes Low-Income Subsidy (LIS) recipients) (67%, or 9.0 million enrollees) will see their monthly premium increase if they remain in their current plan in 2020, while one-third (32%, or 4.3 million enrollees) will see a premium reduction if they stay in the same plan (Figure 5). Twenty percent of non-LIS enrollees, or 2.7 million enrollees, will see a premium increase of $10 or more per month; 0.9 million non-LIS enrollees (7%) will see a premium reduction of the same magnitude.

- About three in 10 (29%) non-LIS enrollees (3.8 million) are projected to pay monthly premiums of at least $60 if they stay in their current plans. More than 215,000 (2% of non-LIS enrollees) are projected to pay monthly premiums of at least $100.

- CMS reported that the average premium for basic Part D coverage offered by PDPs and MA-PDs will be an estimated $30 in 2020. Our premium estimate is higher because it is based on PDPs only and includes PDPs offering both basic and enhanced coverage (enhanced plans have higher premiums than basic plans, on average). In contrast, the CMS estimate includes MA-PDs and excludes plans offering enhanced coverage. In addition, our premium estimates are weighted based on current enrollment and do not incorporate any assumptions about plan changes by current enrollees, reassignment of Low-Income Subsidy enrollees by CMS, or plan choices by new enrollees.

- In prior years, the average premium that we have calculated after taking into account enrollment changes made during the open enrollment period and subsequent months has been somewhat lower than our projection based on current enrollment. For example, the weighted average premium calculated in September 2019 was $39.13, 5% ($2.08) below the projected premium for 2019 of $41.21 calculated prior to enrollment changes. The reduction is due to current enrollees switching to lower premium plans, new enrollees choosing low-premium plans, and reassignment of some LIS beneficiaries to lower-premium plans.

Premium Variation and Changes for National PDPs

PDP premiums will continue to vary widely across plans in 2020, as in previous years.

- Among the 20 PDPs available nationwide in 2020, average premiums will range sixfold, from a low of $13 per month for Humana Walmart Value Rx Plan to a high of $83 per month for Express Scripts Medicare Choice (Figure 1; Table 2).

Changes to premiums from 2019 to 2020, averaged across regions and weighted by September 2019 enrollment, also vary widely across PDPs, as do the absolute amounts of monthly premiums for 2020.

- The 2.1 million non-LIS enrollees in the largest PDP, CVS Health’s SilverScript Choice (which had a total of 4.4 million enrollees in 2019, including those receiving low-income subsidies) will face a $2 (7%) decrease in their average monthly premium, from $31 in 2019 to $29 in 2020.

- In contrast, the 2.0 million non-LIS enrollees in the second largest PDP, AARP MedicareRx Preferred, will face a $4 (6%) increase in their average monthly premium between 2019 and 2020, from $75 to $79. This is the second highest monthly premium among the national PDPs in 2020.

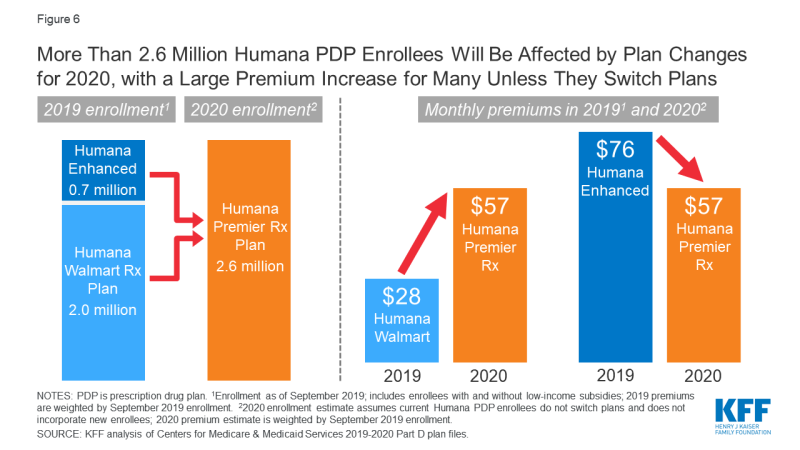

- Plan changes and consolidations will affect the premiums paid by many current enrollees in Humana’s PDPs. For 2020, Humana is consolidating two of its PDPs (Humana Walmart Rx and Humana Enhanced) into one PDP and renaming it Humana Premier Rx. It is also renaming Humana Preferred Rx to Humana Basic Rx, and introducing an entirely new PDP, Humana Walmart Value Rx Plan.

- The weighted average monthly premium for Humana Premier Rx will be $57 in 2020. For the 1.9 million non-LIS enrollees in the Humana Walmart Rx plan (the third most popular PDP in 2019) who will be automatically enrolled in Humana Premier Rx, the monthly premium will more than double, from $28 to $57, if they do not switch plans for 2020 (Figure 6). Beneficiaries enrolled in Humana Walmart Rx in 2019 will not be automatically enrolled in the new Humana Walmart Value Rx plan, which has a substantially lower premium ($13 per month); they will have to switch during the open enrollment period if they want this lower-premium plan option.

- Conversely, the 0.6 million non-LIS enrollees in Humana Enhanced who will also be enrolled automatically in the consolidated plan, will see a 25% reduction in their monthly premium, from $76 to $57, if they remain enrolled in the Humana Premier Rx Plan for 2020.

Premium Variation by Region

Average PDP monthly premiums for 2020 will vary across the 34 PDP regions, from $33 in Hawaii to $49 in New Jersey (see map; Table 1).

.

- All 34 PDP regions have at least one PDP with a premium under $20. For example, the new Humana Walmart Value Rx Plan is available in all regions with a monthly premium of $13.20, while the new WellCare Wellness Rx PDP is available nationwide with premiums ranging from $13.10 to $15.70. At the high end, seven PDPs, with a total of 100,000 enrollees in 2019 (less than 1% of total PDP enrollment), have monthly premiums of at least $125. The highest is $191.40 for BlueCross Rx Plus PDP, which is offered in the South Carolina region.

- Average premiums are projected to be higher in 33 out of 34 regions, increasing by between $1 and $6 in 32 out of 34 regions. In California, the average premium will decrease by less than $1 from the 2019 average, while in Virginia, the average premium will increase by less than $1 from the 2019 average.

Benefit Design and Cost Sharing

In 2020, all PDPs will offer an alternative benefit design, different from the defined standard benefit, which has a $435 deductible (an increase from $415 in 2019) and 25% coinsurance for all covered drugs between the deductible and the initial coverage limit. Part D plans can also provide enhanced benefits, including a lower (or no) deductible, reduced cost sharing, and/or a higher initial coverage limit than under the standard benefit design.

In 2020, all PDPs will have a benefit design with five or six tiers for covered generic, brand-name, and specialty drugs and cost sharing other than the standard 25% coinsurance. As of 2020, Part D enrollees will no longer be exposed to a coverage gap, sometimes called the “doughnut hole,” when they fill their prescriptions; coinsurance in the coverage gap phase will be 25% for both brands and generics.

Basic versus Enhanced Benefits

- In 2020, 60% of PDPs, or 566 plans (excluding plans in the territories), will offer enhanced benefits, an increase in the number of enhanced-benefit PDPs compared to prior years (Table 3). As noted earlier, this increase is a response by Part D plan sponsors to the elimination of the requirement to demonstrate a “meaningful difference” (measured by enrollee out-of-pocket costs) between enhanced plans offered by the same firm in the same region. The overall share of PDPs offering basic Part D benefits in 2020 is roughly the same as in 2019 (40%), but the number of basic-benefit plans in 2020 will be higher than in 2019 (382 vs. 348). As in recent years, no plans will offer the defined standard benefit.

- The average premium in 2020 for enhanced benefit PDPs ($57) is 85% higher than the monthly premium for PDPs offering the basic benefit ($31) (weighted by September 2019 enrollment).

Deductibles

- The number and share of PDPs that charge a deductible is increasing, from 71% in 2019 to 86% in 2020 (Table 3). A larger share of PDPs (69%) will charge the standard deductible in 2020 than in 2019 (52%). The standard deductible amount is $435 in 2020; the average deductible is increasing by nearly $100 between 2019 and 2020, from $238 to $335 (weighted by September 2019 enrollment).

- There are some notable changes in deductibles among the national PDPs for 2020.

- In 2020, only two of the 20 national plans will charge no deductible in all regions (AARP MedicareRx Preferred and WellCare Medicare Rx Value Plus), down from five national PDPs that charged no deductible in all or most regions in 2019.

- Enrollees in SilverScript Choice paid no deductible in 28 out of 34 regions in 2019, but in 2020, enrollees in this plan will pay deductibles ranging by region from $215 to $435 (the maximum deductible amount).

- Enrollees in Humana Enhanced paid no deductible in 2019, but those who remain in the new Humana Premier Rx plan in 2020 will be charged the standard $435 deductible in 33 out of 34 regions.

- In contrast to these increases, enrollees in Express Scripts Medicare Choice will see a reduction in their deductible, from $350 in 2019 to $250 in 2020.

- The average premium in 2020 for PDPs that charge no deductible ($81) is more than double the monthly premium for PDPs that charge the standard deductible ($36) or a partial deductible ($32) (weighted by September 2019 enrollment).

Cost Sharing

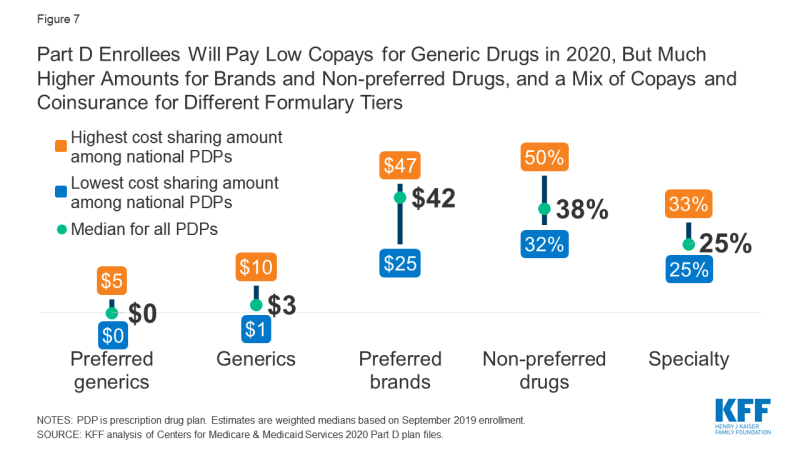

- As in recent years, all PDPs in 2020 will use tiered cost sharing. The typical five-tier design includes tiers for preferred generics, generics, preferred brands, non-preferred drugs (which includes both brands and generics), and specialty drugs. Five-tier formularies have been the most common type since 2013. Part D enrollees will face modest cost-sharing amounts for generic drugs in 2020 but much higher cost sharing for brands and non-preferred drugs, and a mix of copayments and coinsurance for different formulary tiers (Figure 7).

- Overall, PDP cost-sharing amounts in 2020 are relatively similar to 2019 levels (Table 4). For generic tiers, median copayments across all PDPs are $0 for the preferred generic tier and $3 for the generic tier in 2020.

- Nine of the 20 national PDPs, including the largest PDP (SilverScript Choice), have a $0 copayment for preferred generic drugs in 2020. Median copayments for generics range from $1 to $10 among the 20 national PDPs; most charge $5 or less for generics.

- Most PDPs charge copayments for preferred brand tiers, but nearly one in 10 PDP enrollees (9%) will be in plans that charge coinsurance in 2020 (based on September 2019 enrollment). For preferred brand tiers, the median copayment in 2020 is $42; the median coinsurance rate is 25%.

- Of the 18 national PDPs that charge copayments for preferred brands, the amounts range from $25 to $47; 11 of these 18 PDPs charge $40 or more, including four that charge $47 (Humana Walmart Value Rx Plan. SilverScript Choice, WellCare Medicare Rx Select, and WellCare Medicare Rx Value Plus).

- Virtually all PDPs are using coinsurance for the non-preferred drug tier in 2020. The median coinsurance PDPs charge for non-preferred drugs in 2020 is 38%.

- Among the 20 national PDPs, coinsurance for non-preferred drugs in 2020 varies from 32% (AARP MedicareRx Walgreens) to 50% (Cigna-HealthSpring Rx Secure-Extra), the maximum allowed for this tier by CMS guidelines (which is higher than the maximum coinsurance allowed for specialty drugs). Half of the national PDPs (10) charge 40% or more for non-preferred drugs.

- Specialty tier coinsurance ranges from 25% to 33% for all PDPs, the maximum allowed by CMS guidelines. Most (15) of the national PDPs charge 25% for specialty tier drugs in 2020; two charge 33%. In 2020, the threshold for drugs to qualify for placement on a specialty tier is $670 for a one-month supply of the drug, the same amount since 2017.

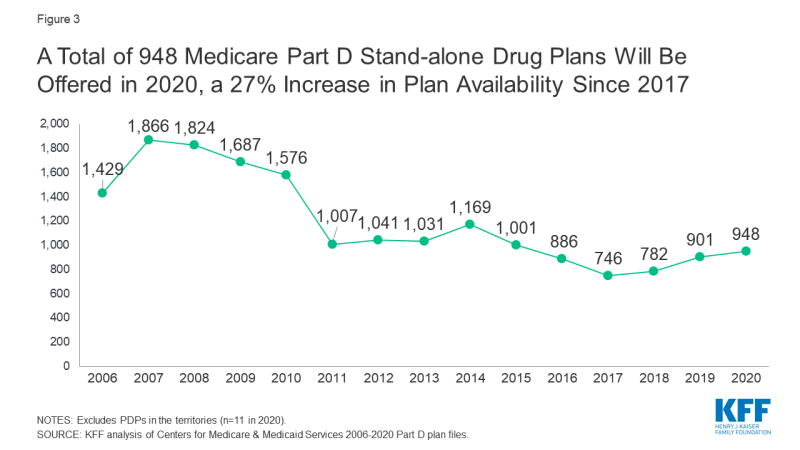

Low-income Subsidy (Benchmark) Plans

In 2020, a larger number of PDPs will be premium-free benchmark plans—that is, PDPs available for no monthly premium to beneficiaries receiving the Low-Income Subsidy (LIS)—than in recent years.

- On average (weighted by Medicare enrollment), LIS beneficiaries have seven benchmark plans available to them for 2020, or one-fourth the average number of PDP choices available overall. All LIS enrollees can select any plan offered in their area, but if they enroll in a non-benchmark plan, they must pay some portion of their chosen plan’s monthly premium.

- In 2020, a total of 244 PDPs will be premium-free benchmark plans. This number represents roughly a quarter of all PDPs in 2020. The number of benchmark plans in 2020 is 29 more than in 2019 (a 13% increase) and the largest number of benchmark plans available to LIS enrollees since 2015 (Figure 8, Table 1).

- Of the 244 benchmark plans in 2020, 53 plans qualify through the “de minimis” policy, close to twice the number in 2019 (29). The de minimis policy makes it easier for plans to qualify as benchmark plans and retain their current LIS enrollees by allowing them to waive a premium amount of up to $2 above the regional LIS benchmark. Although benchmark plans that qualify through the de minimis policy can keep their existing LIS enrollees, they cannot receive auto-assigned enrollees. This means that only 191 PDPs in 2020 (20% of all PDPs, or 78% of all benchmark plans) are eligible for auto-assignment.

Benchmark Plans by Region

- The number of benchmark plans available in 2020 will vary by region, from just two benchmark PDPs in Ohio (out of 28 PDPs overall) to 12 benchmark PDPs in Arizona (out of 31 PDPs) (see map; Table 1). Benchmark plan availability will be the same or higher in 32 of 34 regions between 2019 and 2020.

- In 2020, 95% of LIS PDP enrollees are projected to be in PDPs operated by five firms: CVS Health, WellCare, Humana, UnitedHealth, and Cigna (based on enrollment as of September 2019). All five sponsors offer PDPs that qualify as benchmark plans in all 34 PDP regions in 2020.

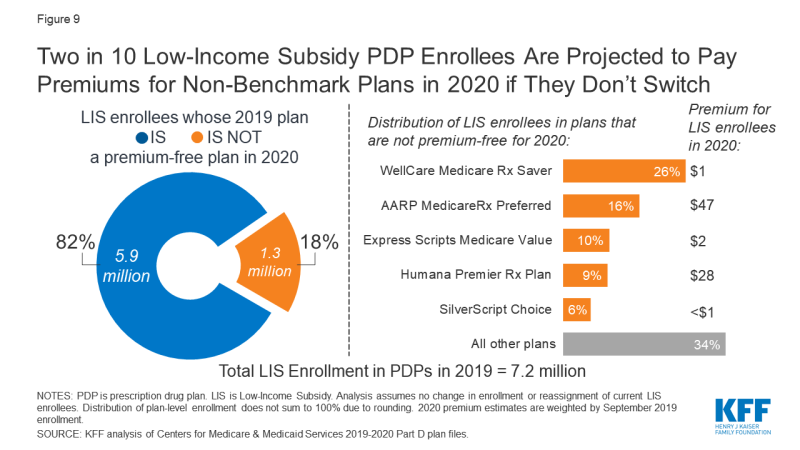

Impact of Benchmark Plan Changes for Low-Income Subsidy Enrollees

- More than one million LIS beneficiaries—1.3 million, or nearly 20% of LIS enrollees in PDPs—are enrolled in PDPs in 2019 that will not qualify as benchmark plans in 2020 (Figure 9). CMS will reassign these LIS beneficiaries to another plan if they were randomly assigned to their current plan, but those who have chosen their current plan must switch on their own to avoid paying a premium if they remain in their 2019 plan.

- These 1.3 million LIS beneficiaries face monthly PDP premiums that average $18 if they remain in their current plan for 2020. More than 200,000 of these LIS beneficiaries are enrolled in the AARP MedicareRx Preferred PDP, and they will pay a monthly premium of more than $47, on average, if they stay in this PDP for 2020.

Discussion

Our analysis of the Medicare Part D stand-alone drug plan landscape for 2020 shows that millions of Part D enrollees without low-income subsidies will face premium and other cost increases in 2020 if they stay in their current stand-alone drug plan. There are more plans available nationwide in 2020, with Medicare beneficiaries having nearly 30 PDP choices during this year’s open enrollment period. Most Part D enrollees will be in a plan with the standard $435 deductible and will face low copayments for generic drugs but substantially higher costs for brands, including as much as 50% coinsurance for non-preferred drugs.

Some Part D enrollees who choose to stay in their current plans may see lower premiums and other costs for their drug coverage, but two-thirds of non-LIS enrollees will face higher premiums if they remain in their current plan, and many will also face higher deductibles and cost sharing. As in prior years, all Part D enrollees could benefit from the opportunity to compare plans during open enrollment, since plans vary in a number of ways that can have a significant effect on an enrollee’s out-of-pocket spending.

| Juliette Cubanski and Tricia Neuman are with KFF. Anthony Damico is an independent consultant. |

Methods

This analysis focuses on the Medicare Part D stand-alone prescription drug plan marketplace in 2020 and trends over time. The analysis includes 20.5 million enrollees in stand-alone PDPs, as of September 2019. The analysis excludes 17.4 million MA-PD enrollees (non-employer), and another 4.6 million enrollees in employer-group only PDPs and 2.3 million in employer-group only MA-PDs for whom plan premium and benefits data are unavailable (as of March 2019).

Data on Part D plan availability, enrollment, and premiums were collected from a set of data files released by the Centers for Medicare & Medicaid Services (CMS):

– Part D plan landscape files, released each fall prior to the annual enrollment period

– Part D plan and premium files, released each fall

– Part D plan crosswalk files, released each fall

– Part D contract/plan/state/county level enrollment files, released on a monthly basis

– Part D Low-Income Subsidy enrollment files, released once annually

– Medicare plan benefit package files, released each fall

– Medicare penetration files, released on a monthly basis

In this analysis, premium estimates are weighted by September 2019 enrollment unless otherwise noted. Percentage increases are calculated based on non-rounded estimates and in some cases differ from percentage calculations calculated based on rounded estimates presented in the text.