Four Key Changes in the Biden Administration’s Final Rule on Medicare Enrollment and Eligibility

The Centers for Medicare & Medicaid Services (CMS) issued a final rule on October 28, 2022 to implement several changes in Medicare enrollment and eligibility that were included in the Consolidated Appropriations Act of 2021 (CAA). These changes are designed to minimize gaps in coverage for people who sign up for Medicare and improve access to care by shortening the gap between Medicare enrollment and coverage; creating new Special Enrollment Periods for individuals whose coverage would otherwise be delayed due to challenging circumstances, such as a natural disaster; and extending coverage of immunosuppressive drugs for certain beneficiaries with end-stage renal disease (ESRD) who would otherwise lose coverage for these drugs after their kidney transplant.

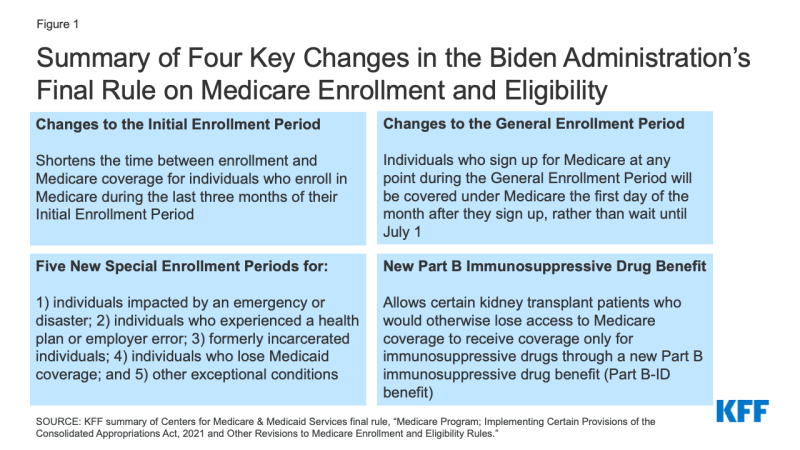

This brief highlights four key changes related to Medicare enrollment and eligibility under the final rule, and summarizes the estimated impact of these provisions on coverage and costs. These provisions are expected to reduce gaps in coverage for people when they first sign up for Medicare, and have a negligible impact on Medicare spending, according to CMS estimates.

Figure 1: Summary of Four Key Changes in the Biden Administration’s Final Rule on Medicare Enrollment and Eligibility

1. The final rule accelerates the start of Medicare coverage for beneficiaries who enroll during the Initial Enrollment Period

Individuals have several opportunities to enroll in Medicare. They can enroll when they first become eligible for Medicare during the Initial Enrollment Period, during the annual General Enrollment Period, or during a Special Enrollment Period. People are generally advised to sign up for Medicare during their Initial Enrollment Period, unless they have group health plan coverage from an employer. Individuals with insurance coverage through the Marketplace or COBRA are also advised to sign up for Medicare during their Initial Enrollment Period. Depending upon when they enroll in Medicare, individuals may face a gap in coverage and late enrollment penalties. Late enrollment penalties are added to a beneficiary’s monthly premium costs for the remainder of their Medicare enrollment. For Medicare Part B, 10% is added to the standard Part B monthly premium for each 12-month period a beneficiary delays enrollment in Part B. The new rule reduces the gaps in coverage between the date of enrollment and coverage during both the Initial Enrollment and General Enrollment Periods, effective January 1, 2023.

Policy prior to January 1, 2023

When an individual is turning 65, their first opportunity to sign up for Medicare is during a 7-month window called the Initial Enrollment Period. This period spans three months before the month of their 65th birthday, the month of their birthday, and three months after it. When Medicare coverage begins depends on when an individual enrolls during their Initial Enrollment Period. Under the policy in effect prior to January 1, 2023, individuals who enrolled during the last three months of their Initial Enrollment Period could face gaps between signing up and the start of Medicare coverage:

- If an individual signs up for Medicare during any of the first 3 months, their coverage begins the first day of the month they turn 65. If a beneficiary signs up during the month they turn 65, coverage starts the first day of the following month.

- If they sign up 1 month after they become eligible, coverage begins 2 months later, and if they sign up 2 or 3 months after they become eligible, coverage begins 3 months later.

New policy

This rule shortens the time between enrollment and Medicare coverage for individuals who enroll in Medicare during the last three months of their Initial Enrollment Period. Individuals who sign up for Medicare during the last three months of their Initial Enrollment Period will be covered under Medicare the first day of the month following the month in which they enroll.

Examples of how this new policy will affect Medicare coverage

- Mary turned 65 on April 1, 2022, before the new rule took effect. Her 7-month Initial Enrollment Period started three months before her birthday (January) and ended three months after the month she turned 65 (July). Mary signed up for Medicare on July 1, the seventh month of her Initial Enrollment Period. Her Medicare coverage started on October 1, leaving her without Medicare coverage for three months after she enrolled in Medicare, and six months after her 65th

- Mary’s younger sister, Anne, is turning 65 on April 1, 2023. Under this new rule, if Anne enrolls in Medicare on July 1, 2023, the seventh month of her Initial Enrollment Period, her Medicare coverage will take effect on August 1 (the first day of the month following enrollment), a shorter gap in coverage than her older sister Mary experienced before the final rule took effect.

2. The final rule shortens the gap between enrollment and Medicare coverage for beneficiaries who enroll during the General Enrollment Period

Policy prior to January 1, 2023

If an individual misses their Initial Enrollment Period for Medicare, they can enroll during the General Enrollment Period, which runs from January 1 to March 31 each year. Under the policy in effect until January 1, 2023, for individuals who enrolled at any point during the General Enrollment Period, Medicare coverage would begin on July 1, resulting in up to a six-month gap between Medicare enrollment and the start of coverage.

New policy

Individuals who sign up for Medicare at any point during the General Enrollment Period will be covered under Medicare the first day of the month after they sign up, rather than waiting until July 1.

Examples of how this new policy will affect Medicare coverage

- John’s 65th birthday was June 15, 2021 (prior to the effective date of the new rule), but he missed his 7-month Initial Enrollment Period, which started three months before his birthday in March 2021 and ended September 2021. His next opportunity to enroll in Medicare was during the next General Enrollment Period, between January 1 and March 31, 2022. John signed up for Medicare during the first week of January, and his Medicare coverage started on July 1, leaving him without Medicare coverage for more than a year after his 65th birthday and six months after he signed up during the General Enrollment Period.

- John’s brother, Mike, turned 65 on June 15, 2022. He also missed the opportunity to enroll in Medicare during his Initial Enrollment Period and instead plans to sign up during the next General Enrollment period, January-March 2023. If Mike signs up during January, his coverage will begin the following month, on February 1, 2023, rather than on July 1, as it would have under the old policy. The final rule will reduce the number of months people like Mike would have to wait to be covered by Medicare.

3. The final rule establishes new Special Enrollment Periods to reduce gaps in coverage for people who missed their Medicare enrollment period due to certain circumstances

Medicare’s Special Enrollment Periods allow beneficiaries to sign up for Medicare Part B and Premium-Part A or change the type of Medicare coverage they have under certain situations, without being subject to a late enrollment penalty. The time period for enrollment under these Special Enrollment Period, as well as the types of coverage changes that can be made, vary based on circumstances. For example, individuals who did not enroll in Medicare during their Initial Enrollment Period because they received health insurance through a qualified group health plan have an 8-month Special Enrollment Period to sign up for Medicare after they stop working or lose their group health plan coverage. Examples of other circumstances that grant existing Medicare beneficiaries a Special Enrollment Period to change their coverage include moving into or out of a facility (e.g., skilled nursing facility) or if Medicare terminates the beneficiary’s current Medicare Advantage plan. Generally, during a Special Enrollment Period, Medicare coverage, or the change in coverage, begins the first day of the month following enrollment.

Policy prior to January 1, 2023

Prior to the enactment of the Consolidated Appropriations Act of 2021, CMS did not have broad authority to create new Special Enrollment Periods, which potentially created gaps in coverage for individuals seeking to enroll in Medicare who had extenuating circumstances not specified in law (such as those listed above). As a result, some individuals with extenuating circumstances beyond their control, such as someone living in an area struck by a disaster, could miss their Initial Enrollment Period for Medicare and be subject to a late enrollment penalty as a result.

New policy

The Consolidated Appropriations Act of 2021 gives CMS the authority to create new Special Enrollment Periods for individuals who meet certain exceptional conditions. Using this authority, CMS finalized five new Special Enrollment Periods in this final rule that will provide people who missed a Medicare enrollment period because of exceptional circumstances an opportunity to enroll without having to wait for the General Enrollment Period. These Special Enrollment Periods are generally effective for circumstances that occur on or after January 1, 2023, and Medicare coverage will begin the first day of the month following the month of enrollment. For all of these Special Enrollment Periods, individuals will not be subject to a late enrollment penalty.

- Individuals impacted by an emergency or disaster: The rule creates a Special Enrollment Period for individuals who missed an enrollment opportunity because they were impacted by certain government-declared emergencies and disasters. To qualify, an individual must demonstrate that they themselves, their authorized representative, legal guardian, or a person who makes health care decisions on behalf of them, lives in (or lived) in that impacted area. This Special Enrollment Period will begin on the date an emergency or disaster is declared and ends 6 months after the declaration has ended.

- Individuals who experienced a health plan or employer error: This Special Enrollment Period is intended for individuals who did not enroll in Medicare because of misrepresentation by, or incorrect information from their employer, a group health plan, or agents and brokers of health plans. These individuals can enroll in Medicare without penalty starting from the date they notify the Social Security Administration of this error up to 6 months later.

- Formerly incarcerated individuals: This Special Enrollment Period affects: (1) individuals who become newly eligible for Medicare while incarcerated who miss their Initial Enrollment Period while incarcerated; and (2) individuals who were enrolled in Medicare prior to their incarceration, who stop paying their Medicare premiums during incarceration (because Medicare does not cover services during incarceration), and have their Medicare coverage terminated. Both groups of individuals are required to enroll or re-enroll during the General Enrollment Period once they are no longer incarcerated and face a gap in coverage and penalty for late enrollment. This new Special Enrollment Period allows incarcerated individuals who become newly eligible for Medicare to enroll, and current Medicare beneficiaries who drop Medicare coverage while incarcerated to re-enroll, starting the day they’re released and up to 12 months later.

- Individuals who lose Medicaid coverage: This Special Enrollment Period applies to Medicare-eligible individuals who lose Medicaid eligibility on or after January 1, 2023 or the end of the COVID-19 public health emergency (whichever is earlier). Under this Special Enrollment Period, Medicaid enrollees who lose Medicaid eligibility may sign up for Medicare without paying a late enrollment penalty, if they enroll at any time from the date they are notified that their Medicaid eligibility will be terminated up to 6 months after Medicaid eligibility ends. This new Special Enrollment Period was created in response to the expected disenrollment of many Medicaid enrollees who turned 65 during the public health emergency but did not lose their Medicaid coverage on account of requirements in the Families First Coronavirus Response Act. This law required Medicaid programs to keep people continuously enrolled through the end of the month in which the COVID-19 public health emergency ends, in exchange for enhanced federal funding. The public health emergency is currently in effect until January 11, 2023, and is expected to be extended again.

- Other exceptional conditions: Under this rule, if an individual has an extenuating circumstance that caused them to miss a Medicare enrollment period, CMS can grant them a Special Enrollment Period on a case-by-case basis. The duration for this Special Enrollment Period can vary but will be no less than 6 months.

Examples of how these changes will affect Medicare coverage

- Vanessa assists in making health care decisions on behalf of her mother. In August 2023, the governor in Vanessa’s state declares a state of emergency because of a hurricane affecting the county where she lives. Due to the impact of the hurricane, she is unable to help her mother, who lives in a state that was not affected by the hurricane, sign up for Medicare during her Initial Enrollment Period. This new policy will allow Vanessa to help her mom sign up for Medicare up to 6 months after the end of the emergency, reducing the gap between Medicare enrollment and coverage her mother would have otherwise faced, and eliminating any late-enrollment penalties that would otherwise have applied.

- Robert, a 65-year-old man, is enrolled in Medicaid because of his low income. He does not have any dependent children or disabilities and is only eligible for Medicaid through the Affordable Care Act. He turned 65 in June 1, 2022 but did not enroll in Medicare because he was still enrolled in Medicaid. Prior to his 65th birthday, his state was supposed to send out a letter saying that he would no longer be eligible for Medicaid through the Affordable Care Act, but that he would be eligible for Medicare. However, his state doesn’t send the letter until after the public health emergency ends and Robert has missed his Initial Enrollment Period (March 2022-September 2022). This new rule will allow him to sign up for Medicare from the date he receives the letter notifying him of his Medicaid termination up to 6 months after his Medicaid benefits are terminated, without paying the late enrollment penalty or waiting until the next General Enrollment Period in 2024 to sign up.

4. The final rule extends Medicare coverage of immunosuppressive drugs for certain kidney transplant patients

Adults under the age of 65 with end-stage renal disease (ESRD) qualify for Medicare coverage on the basis of their ESRD diagnosis. Medicare covers all of their covered medical services, not just those related to their ESRD, including kidney transplants, which requires immunosuppressive drugs to prevent the body from rejecting the transplanted kidney. In 2022, there were more than 230,000 Medicare beneficiaries under age 65 with ESRD, including those who qualified on the basis of their ESRD only, representing about 3% of beneficiaries under age 65.

Policy prior to January 1, 2023

When a Medicare beneficiary under the age of 65 with ESRD receives a kidney transplant, their Medicare coverage has ended 36 months after the month in which they received their transplant, unless they’re eligible for Medicare on another basis, such as turning 65 or having a disability. Termination of Medicare coverage can lead to gaps in coverage and adverse health outcomes (e.g., organ rejection) for patients who have received a kidney transplant and continue to need immunosuppressive drugs beyond the point at which their Medicare coverage ends, unless they are able to obtain coverage through another source.

New policy

The final rule allows certain Medicare beneficiaries who have undergone a kidney transplant and would otherwise lose access to Medicare coverage beyond the 36-month post-transplant period to receive coverage only for immunosuppressive drugs after this point through a new Part B benefit referred to as the immunosuppressive drug benefit, or the Part B-ID benefit. Beneficiaries who qualify for the new Part B-ID benefit will not receive coverage for Medicare-covered items and services other than immunosuppressive drugs. The monthly premium for this benefit ($97.10 for 2023) will be less than the standard Part B premium ($164.90 in 2023) and will be higher for those with higher incomes. The standard Part B deductible will apply ($226 in 2023), after which beneficiaries will be responsible for 20% coinsurance for immunosuppressive drugs. There are no late enrollment penalties regardless of when an individual enrolls in the benefit. The rule also allows low-income beneficiaries who are eligible for the Part B-ID benefit to enroll in the Medicare Savings Programs if they qualify, which will help to alleviate the financial burden of costs associated with the new Part B-ID benefit.

If a beneficiary’s Medicare coverage ends before January 1, 2023, they can enroll in the new immunosuppressive drug benefit from October 1, 2022 through December 31, 2022 and coverage will start on January 1, 2023. If a beneficiary’s coverage ends on or after January 1, 2023, they can enroll at any time afterwards, and coverage will begin the month their Part A benefits ends.

Eligible beneficiaries: To be eligible for the new Part B-ID benefit, a beneficiary must be enrolled, or previously enrolled, in Medicare on the basis of their ESRD status, undergo a kidney transplant, and NOT be enrolled, or expect to be enrolled, in certain specific forms of health insurance or other programs that cover immunosuppressive drugs. For example, individuals enrolled in a group health plan, TRICARE for Life program, or a state plan that provides benefits for immunosuppressive drugs will not qualify for this new benefit. Additionally, beneficiaries who become eligible for Medicare based on other reasons (e.g., turning 65, having a disability) will not be eligible for this benefit because they have access to broader Medicare coverage.

Example of how this new Policy will affect Medicare coverage

- Janet is a 35-year-old who became eligible for Medicare because she was diagnosed with ESRD. She received a kidney transplant on January 1, 2019. Her Medicare coverage terminated on January 1, 2022, 36 months after her transplant, because she did not meet other criteria to remain on Medicare. Since then, she has been uninsured and lacked coverage for her immunosuppressive drugs. Under this new policy, Janet will be able to sign up to receive Medicare coverage for her immunosuppressive drugs through this new Part B-ID benefit. She can sign up starting on October 1, 2022, and her coverage will begin January 1, 2023.

What is the estimated impact of the final rule on Medicare enrollment and costs?

These provisions of the final rule are expected to improve gaps in Medicare coverage with minimal impact on Medicare spending. Table 1 provides an overview of CMS’s estimates on the number of individuals impacted, costs to beneficiaries, and costs to Medicare resulting from these changes.