Medicaid’s Prescription Drug Benefit: Key Facts

Medicaid provides health coverage for millions of Americans, including many with substantial health needs. Prescription drug coverage is a key component of Medicaid for many beneficiaries, such as children, non-elderly adults, and people with disabilities, who rely on Medicaid drug coverage for both acute problems and for managing ongoing chronic or disabling conditions. (Medicaid beneficiaries who also have Medicare receive drug coverage through Medicare.). Though the pharmacy benefit is a state option, all states cover it, and, within federal guidelines about pricing and rebates, administer pharmacy benefits in different ways. After a sharp spike in 2014 due to specialty drugs and expansion under the Affordable Care Act (ACA), Medicaid drug spending growth has slowed, similar to the overall US pattern; however, state policymakers remain concerned about Medicaid prescription drug spending as spending is expected to grow in future years. Due to Medicaid’s role in financing coverage for high-need populations, it pays for a disproportionate share of some high cost specialty drugs, and due to the structure of pharmacy benefit, Medicaid must cover upcoming “blockbuster” drugs. Policymakers’ actions to control drug spending have implications for beneficiaries’ access to needed prescription drugs. This fact sheet provides an overview of Medicaid’s prescription drug benefit and recent trends in spending and utilization.

How does Pricing and Payment for Prescribed Drugs Work in Medicaid?

The total amount paid by Medicaid for a given drug is a factor of several inputs: 1) the dispensing fee paid to the pharmacist; 2) the amount paid to the pharmacy for the ingredients of a drug; and 3) the rebate received from the manufacturer. States have flexibility to set professional dispensing fees, but there are federal requirements for the other inputs.

Ingredient Costs and Payment

Medicaid reimburses pharmacies for the cost of drugs dispensed to beneficiaries based on the actual acquisition cost (AAC) for a drug. In general, Medicaid does not purchase drugs directly from manufacturers or wholesalers; rather, Medicaid pays for the cost of drugs dispensed to Medicaid beneficiaries through pharmacies. The federal government requires states to use AAC to set payment to pharmacies and encourages states to use the National Average Drug Acquisition Cost (NADAC) data as the measure of AAC.1,2 The NADAC is intended to be a national average of the prices at which pharmacies purchase a prescription drug from manufacturers or wholesalers, including some rebates.

Pharmacies that dispense drugs to Medicaid beneficiaries purchase drugs from manufacturers or wholesalers, negotiating prices for drugs. Payment between the pharmacy and the manufacturer or wholesaler (to acquire and stock the drug) is a proprietary process, negotiated based off the manufacturer-set list prices for a drug. Manufacturers do not provide public information on how they set this list price and historically have not been required to explain changes in a product’s list price. While the list prices most directly affect the wholesaler and pharmacy, they also affect Medicaid reimbursement schedules, as they are an input into the AAC.

The Medicaid Drug Rebate Program

Federal law requires manufacturers who want their drugs covered under Medicaid to rebate a portion of drug payments to the government,3 and in return, Medicaid must cover almost all FDA-approved drugs produced by those manufacturers.4,5 The formula for the amount of the rebate is set in statute6 and varies by type of drug (brand or generic).7 The structure of the federal Medicaid rebate factors in the “best price” charged to any other buyers and ensures that Medicaid will always receive a higher rebate than other payers, with some exceptions.8 It also includes an inflationary component that requires additional rebates when average manufacturer prices for a drug increase faster than inflation.9 Rebates apply regardless of whether a state pays for prescription drugs on a fee-for-service basis or includes them in capitation payments to managed care plans.

In addition to federal statutory rebates, most states negotiate with manufacturers for supplemental rebates. Some states have formed multi-state purchasing pools when negotiating supplemental Medicaid rebates to increase their negotiating power. In addition, Medicaid managed care plans may negotiate their own rebate agreements with manufacturers.

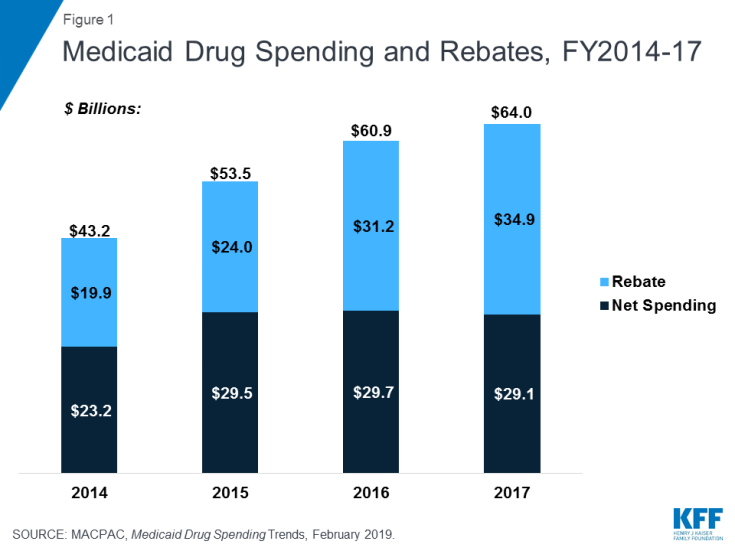

Statutory and supplemental rebates account for a sizeable share of gross prescription drug spending, accounting for 55% of aggregate drug spending in 2017 (Figure 1).10 In recent years, rebates as a share of gross Medicaid drug spending have increased (Figure 1), leading to flat or declining net Medicaid spending for prescription drugs. The specific rebate on a given drug is proprietary for both statutory and supplemental rebates.

How do states administer the Medicaid pharmacy benefit?

States are not required to cover prescription drugs under Medicaid, but all states opt to include this service in Medicaid. Within federal rules regarding the federal rebate agreement and medical necessity requirements, states have flexibility to administer and manage the pharmacy benefit within their Medicaid programs. States generally rely on two, intersecting levers to do so: 1) use of managed care and/or pharmacy benefit managers (PBMS) and 2) utilization controls.

Managed Care and Pharmacy Benefit Managers

As more states have enrolled additional Medicaid populations into managed care arrangements over time and states have included pharmacy benefits in managed care contracts, managed care organizations (MCOs) have played an increasingly significant role in administering the Medicaid pharmacy benefit. Most states contract with MCOs to provide services to Medicaid beneficiaries. Under some of these arrangements, states pay MCOs a monthly fee (capitation rate) to cover the cost of services provided to enrollees and any administrative expenses. States may include all Medicaid services in these contracts or they may “carve-out” certain services from capitation rates. Under the ACA, states are able to collect rebates on prescriptions purchased by MCOs and as a result, many states have chosen to “carve-in” the pharmacy benefit to their managed care benefits. Of the 39 states contracting with comprehensive risk-based MCOs in 2018, 35 states reported that the pharmacy benefit was carved in, with some states reporting exceptions such as high-cost or specialty drugs.11

Many states also use pharmacy benefit managers (PBMs) in their Medicaid prescription drug programs. PBMs perform financial and clinical services for the program, administering rebates, monitoring utilization, and overseeing preferred drug lists.12 PBMs may be used regardless of whether the state administers the benefit through managed care or on a fee-for-service basis.

Utilization Management

Most states use an array of measures to control utilization of prescription drugs in Medicaid. Because most manufacturers participate in the Medicaid Drug Rebate Program,13 Medicaid essentially maintains an open formulary in which, states are required to provide nearly all prescribed drugs made by manufacturers.14,15 However, state Medicaid programs have used drug utilization management techniques to contain pharmacy costs for many years. Most commonly, state Medicaid programs maintain a preferred drug list (PDL) of outpatient prescription drugs,16 which is a list of drugs states encourage providers to prescribe over other drugs. A state may require a prior authorization for a drug not on a preferred drug list. Often, drugs on PDLs are cheaper or include drugs for which a manufacturer has provided supplemental rebates. Other strategies include implementing prescription limits or using state Maximum Allowable Cost (MAC)17 programs.

What are recent trends in Medicaid prescription drug utilization and spending?

Following an uptick in 2014 and 2015 that reflected both the introduction of high-cost specialty drugs and increased utilization due to the ACA expansion, Medicaid prescription drug utilization and spending growth slowed in 2016 and 2017. From 2014 to 2017, Medicaid prescription drug utilization and spending largely tracked each other in the aggregate: Medicaid outpatient drug utilization increased from 621.7 million prescriptions in 2014 to 752.9 million in 2017 while spending before rebates also increased from $45.9 billion to $63.6 billion over the same period. Growth in both utilization and spending was higher from 2014-2015 than from 2015-2017. However, these aggregate amounts belie underlying changes in utilization patterns and spending for Medicaid prescription drugs. Most notably, recent years have seen changes in the mix of generic versus brand drugs and the rise of specialty drugs and biologics.

Trends in Brand and Generic Drugs

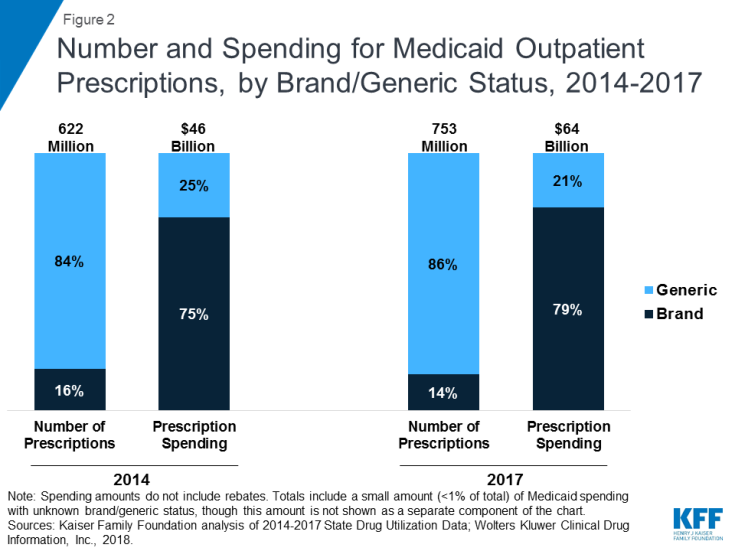

Though generic drugs account for the large majority of drug utilization in Medicaid, brand name drugs account for most drug spending. Because generic drugs are lower cost but still therapeutically equivalent to brand name drugs, most state Medicaid programs require generic substitution unless the prescriber specifies that the brand is medically necessary.18,19 Generic drugs accounted for the vast majority of prescription drug volume in Medicaid from 2014 through 2017. In addition, the average annual increase in number generic prescription drugs covered through Medicaid outpaced brand name drugs, leading to a small increase in their share of total prescription volume (from 84% to 86%) (Figure 2). However, generic drugs accounted for a relatively small share of Medicaid spending on drugs before rebates from 2014 through 2017, and this share declined slightly over time (from 25% to 21%) (Figure 2). This growth in brand spending reflects national trends caused by the launch of expensive new drugs during the period and price increases for some brand name drugs, such as insulin, for which there are no generic versions.20

Figure 2: Number and Spending for Medicaid Outpatient Prescriptions, by Brand/Generic Status, 2014-2017

While generics are less expensive than brand name drugs, the cost of generics has also been rising in recent years.21 These price increases reflect a combination of factors including decreasing competition within the generic market and drop in the number of generic manufacturers, as well as delays in FDA generic approvals, supply or manufacturing challenges for come drugs, among others.22 Despite the inflationary component in the rebate calculation, the complex, interrelated nature of pricing and reimbursement means that cost increases are not necessarily limited for generic drugs in Medicaid. Additionally, some believe that even limiting Medicaid spending for generics to inflation is problematic, as the expectation is that the price of generic drugs will decline over time due to competition.

Trends in Specialty Drugs and Biologics

In recent years, much attention in Medicaid pharmacy issues has been focused on high-cost blockbuster or “specialty” drugs, which are generally drugs that are expensive and/or require special administration. The most notable example of this attention is direct acting antivirals (DAAs), such as Sovaldi and Harvoni, used to treat hepatitis C (HCV). These drugs were a major advance in the treatment of HCV but carried a list price (initially $84,000 for a course of treatment with Sovaldi) that posed a challenge to state Medicaid program financing, even with the required rebate. Because a disproportionate number of people with HCV are enrolled in public programs, Medicaid financed a large share of DAA treatment.23 Increased competition within the class has led to some decline in list prices,24 but DAAs remain expensive, and antivirals account for a substantial share of Medicaid drug spending.25 Some states, such as Louisiana and Washington, are pursuing new approaches to further manage DAA costs while extending or maintaining access for people with HCV (see Box 1).

A related area of focus in recent years is biologics, which are products, such as drugs or vaccines, derived from living organisms with chemical structures more complicated than traditional small molecule drugs. While biologics cannot, by nature, have a technical generic equivalent, there are “biosimilars,” or products deemed “highly similar” or “interchangeable” with a referenced biologic.26 Biologics tend to be priced expensively and face less competition from biosimilars than small molecule brand drugs face from generics. Additionally, although biosimilar competition does lower the price of biologics, it does so to a lesser degree compared with the effect of generic entry on small-molecule drug market.27 As a result, Medicaid spending on biologics (14% of prescription drug spending) is outsized compared to the number of prescriptions that Medicaid fills (less than 1 percent of total Medicaid prescriptions).28

What are recent policy initiatives in Medicaid pharmacy benefits?

Both state and federal policymakers are undertaking efforts to control prescription drug costs. Much state activity in Medicaid pharmacy benefits is focused on the goal of obtaining greater supplemental rebates from manufacturers. Some states are focusing their efforts on high-cost drugs. State are also pursuing broader drug cost initiatives that have implications for Medicaid. At the federal level, the Trump Administration has proposed or undertaken a number of actions targeted at prescription drug costs, many of which have implications for Medicaid.29 Congress is considering a host of legislative proposals related to prescription drugs, such as action to make technical changes to Medicaid rebate rules. (See examples in Box 1).

As policymakers move ahead with efforts to address Medicaid prescription drug spending, understanding the basic structure of the pharmacy benefit and recent trends can help illuminate potential direct and indirect effects, including those on access to care.

Box 1: Examples of State and Federal Actions on

Medicaid Prescription Drug Costs

State Efforts

Negotiate greater supplemental rebates from manufacturers:

- New York uses a spending growth cap, under which the state targets drugs with high or quickly-growing costs for additional supplemental rebates or strict utilization review.

- Other states, including California, are looking into leveraging purchasing power across state programs to obtain greater rebates.

Streamline the supply chain:

- Ohio and Kentucky have undertaken efforts to streamline the supply chain by eliminating or renegotiating contracts with PBMs.

Focus on high-cost drugs:

- Louisiana is pursuing a subscription payment model (often called the “Netflix” model) for HCV drugs30, where the state pays a fixed cost to a manufacturer in exchange for an unlimited number of prescriptions for DAAs for individuals in Medicaid or state prisons.31

- Massachusetts32 and Oklahoma,33 are using or proposing value-based contracts for specific drugs, in which payment and rebates are based on a drug’s effectiveness or patient outcomes.

Broader state initiatives:

- Some states have targeted the rising cost of generics including proposed laws to prevent price gouging and lawsuits to recoup damages from alleged collusion in price increases.

- Policies to make pricing information more broadly available34 often apply beyond Medicaid but could provide information to help policymakers identify Medicaid pharmacy spending.

Federal Efforts

Trump Administration actions/proposals:35

- The FDA has taken steps and announced plans to increase competition among generics36 and biosimilars.37,38

- The Administration has called for a new Medicaid demonstration authority limited to five states that would allow state Medicaid agencies to create their own Medicaid formularies.

- Proposed changes to safe harbor rules to encourage point-of-sale rebates for Medicare beneficiaries would also affect Medicaid pharmacy prices.

Congressional/legislative proposals:

- Technical changes would make it harder for manufacturers to lower their rebate obligations.39

- Other policy proposals include elimination of the drug rebate cap, which would increase the rebates due to the inflationary component, and creation of a grace period following introduction of new drugs during which states are not required to cover that drug.

- Proposals focused on drug spending in Medicare, including proposals to develop alternative payment structures, such as value-based payments would affect Medicaid’s best price requirement.40

Endnotes

Covered Outpatient Drugs Final Rule, Federal Register, Vol. 81, No. 20, February 1, 2016, https://www.gpo.gov/fdsys/pkg/FR-2016-02-01/pdf/2016-01274.pdf.

See “Retail Price Survey,” CMS, accessed February 15, 2018, https://www.medicaid.gov/medicaid/prescription-drugs/retail-price-survey/index.html.

Participating manufacturers pay rebates directly to states, and states retain a share of the rebate in proportion to their share of the cost of the drug (based on the federal matching rate). The federal share of the rebate is obtained through a reduction in state claims on federally-matched quarterly Medicaid expenditures.

42 USC § 1396r-8(a)(1).

There are some exceptions to this rule. For example, states can opt to exclude certain classes of drugs (e.g., cosmetic or hair growth drugs, fertility drugs, smoking cessation or weight loss drugs). States can also require generic substitution

42 U.S.C. 1396r-8 (c)

For brand name drugs, the rebate formula is 1) the greater of either i) 23.1% * (Average Manufacturer Price, AMP) or ii) AMP-Best Price, plus 2) the inflationary component, with the exception of certain clotting factors and drugs approved exclusively for pediatric indications. For generic drugs, the rebate formula is 13%*AMP, plus the inflationary component.

Medicaid statute defines Best Price as “the lowest price available from the manufacturer during the rebate period to any wholesaler, retailer, provider, health maintenance organization, nonprofit entity, or government entity within the United States.” There are many important exclusions, including the Department of Veterans Affairs, the 340B program, the Department of Defense, the Public Health Service, the Indian Health Service. The Best Price includes rebates in general, but not Medicaid supplemental rebates or rebates provided through the Medicaid Drug Rebate Program. 42 U.S.C. 1396r-8 (c)(1)(C).

42 U.S.C. 1396r-8 (c). See also “Medicaid Payment for Outpatient Prescription Drugs,” (Washington D.C., MACPAC, March 2017), https://www.macpac.gov/wp-content/uploads/2015/09/Medicaid-Payment-for-Outpatient-Prescription-Drugs.pdf.

MACStats: Medicaid and CHIP Data Book, MACPAC, December 2018, “Exhibit 28: Medicaid Gross Spending and Rebates for Drug by Delivery System, FY 2017 (millions)”, https://www.macpac.gov/wp-content/uploads/2018/12/December-2018-MACStats-Data-Book.pdf.

Kaiser Family Foundation and Health Management Associates, Sates Focus on Quality and Outcomes Amid Waiver Changes: Results from a 50-State Medicaid Budget Survey for State Fiscal Years 2018 and 2019, https://www.kff.org/medicaid/report/states-focus-on-quality-and-outcomes-amid-waiver-changes-results-from-a-50-state-medicaid-budget-survey-for-state-fiscal-years-2018-and-2019/

States that use PBMs in administering the prescription drug benefit in a fee-for-service setting pay the PBM administrative fees for these services. See Medicaid Pharmacy Trend Report, Second Edition, (Magellan Rx Management, 2017), https://www1.magellanrx.com/media/671872/2017-mrx-medicaid-pharmacy-trend-report.pdf.

“Medicaid Drug Rebate Program,” CMS, https://www.medicaid.gov/medicaid/prescription-drugs/medicaid-drug-rebate-program/index.html.

“Assuring Medicaid Beneficiaries Access to Hepatitis C (HCV) Drugs,” Medicaid Drug Rebate Program Notice, CMS, November 5, 2015, https://www.medicaid.gov/Medicaid-CHIP-Program-Information/By-Topics/Benefits/Prescription-Drugs/Downloads/RxReleases/State-Releases/state-rel-172.pdf.

Under the rebate agreement, states may opt to not cover certain specific drugs that are listed in the statute.

Kaiser Family Foundation and Health Management Associates, Sates Focus on Quality and Outcomes Amid Waiver Changes: Results from a 50-State Medicaid Budget Survey for State Fiscal Years 2018 and 2019, https://www.kff.org/medicaid/report/states-focus-on-quality-and-outcomes-amid-waiver-changes-results-from-a-50-state-medicaid-budget-survey-for-state-fiscal-years-2018-and-2019/

State Maximum Allowable Costs are upper limits states apply to multiple-source drugs included on state maximum allowable cost lists.

Medicaid Drug Utilization Review State Comparison/Summary Report FFY 2014 Annual Report, Prescription Drug Fee-For Service Programs, CMS, September 2015, https://www.medicaid.gov/medicaid-chip-program-information/by-topics/prescription-drugs/downloads/2014-dur-summary-report.pdf; Medicaid Drug Utilization Review State Comparison/Summary Report FFY 2015 Annual Report, Prescription Drug Fee-For-Service Programs, CMS, December 2016, https://www.medicaid.gov/medicaid-chip-program-information/by-topics/prescription-drugs/downloads/2015-dur-summary-report.pdf; Medicaid Drug Utilization Review State Comparison/Summary Report FFY 2016 Annual Report, Prescription Drug Fee-For-Service Programs, CMS, October 2017, https://www.medicaid.gov/medicaid-chip-program-information/by-topics/prescription-drugs/downloads/2016-dur-summary-report.pdf; Medicaid Drug Utilization Review State Comparison/Summary Report FFY 2017 Annual Report, Prescription Drug Fee-For-Service Programs, CMS, October 2018, https://www.medicaid.gov/medicaid/prescription-drugs/downloads/drug-utilization-review/2017-dur-summary-report.pdf. See also “Attachment 4 – Generic Drug Substitution Policies” in state DUR Reports, https://www.medicaid.gov/medicaid/prescription-drugs/drug-utilization-review/annual-reports/index.html.

Of the states that required more the restrictive requirements, a majority required preauthorization to enable a pharmacist to provide a brand drug when a generic was available. States included other requirements, such as requiring the submission of a MedWatch Form and requiring a medical reason to override the use of a generic, and some implement more than one restrictive requirement. Ibid.

Insulin is a biologic drug that has been regulated as a small molecule drug. In March 2020, it will be regulated as biologic drug, which will allow for manufacturers to produce insulin biosimilars. “FDA ‘Confident’ that Interchangeable Insulin Will Be Available After March 2020,” FDANews Drug Daily Bulletin, December 21, 2018, https://www.fdanews.com/articles/189628-fda-confident-that-interchangeable-insulin-will-be-available-after-march-2020.

See U.S. Congress, Senate, Special Committee on Aging, Sudden Price Spikes in Off-Patent Prescription Drugs: The Monopoly Business Model that Harms Patients, Taxpayers, and the U.S. Healthcare System, December 2016, https://www.aging.senate.gov/imo/media/doc/Drug%20Pricing%20Report.pdf.

Katherine Young and Rachel Garfield. Snapshots of Recent State Initiatives in Medicaid Prescription Drug Cost Control. (Washington, DC: Kaiser Family Foundation): February 2018, https://www.kff.org/medicaid/issue-brief/snapshots-of-recent-state-initiatives-in-medicaid-prescription-drug-cost-control/.

U.S. Congress, Senate, Committee on Finance, The Price of Sovaldi and Its Impact on the U.S. Health Care System, 114th Congress, 1st session, 2015, http://www.finance.senate.gov/imo/media/doc/1%20The%20Price%20of%20Sovaldi%20

and%20Its%20Impact%20on%20the%20U.S.%20Health%20Care%20System%20(Full%20Report).pdf.The FDA approved Olysio (Janssen) in November 2013, Sovaldi (Gilead Sciences) in December 2013, Harvoni (Gilead Sciences) in October 2014, Viekira Pak (AbbVie) in December 2014, Technivie (AbbVie) in July 2015, Daklinza (Bristol-Myers Squibb) in July 2015, Zepatier (Merck) in January 2016, Epclusa (Gilead Sciences) in June 2016, and Mavyret (AbbVie) in August 2017.

Katherine Young. Utilization and Spending Trends in Medicaid Outpatient Prescription Drugs. Kaiser Family Foundation, February 2019, https://www.kff.org/medicaid/issue-brief/utilization-and-spending-trends-in-medicaid-outpatient-prescription-drugs/

Ibid.

See Andrew Mulcahy, Zachary Predmore, and Soeren Mattke, “The Cost Savings Potential of Biosimilar Drugs in the United States,” (Rand Corporation, 2014), https://www.rand.org/content/dam/rand/pubs/perspectives/PE100/PE127/RAND_PE127.pdf.

Young, op. cit.

Katherine Young, How Does the Trump Administration Drug Pricing Blueprint Affect Medicaid? Kaiser Family Foundation, May 2018, https://www.kff.org/medicaid/issue-brief/how-does-the-trump-administration-drug-pricing-blueprint-affect-medicaid/

Carolyn Y. Johnson, “Louisiana adopts ‘Netflix’ model to pay for hepatitis C drugs,” Washington Post, January 10, 2019, https://www.washingtonpost.com/health/2019/01/10/louisiana-adopts-netflix-model-pay-hepatitis-c-drugs/?utm_term=.b962a75edc5d.

Eric Sagnowsky, Louisiana Has Picked its ‘Netflix’ Hepatitis C Partner: Gilead’s New Generics Unit, https://www.fiercepharma.com/pharma/louisiana-picks-gilead-subsidiary-to-partner-netflix-model-for-hep-c-drugs

Martha Bebinger, Baker Outlines Steps to Lower Medicaid Drug Prices, https://www.nepr.net/post/baker-outlines-steps-lower-medicaid-drug-prices#stream/0

Jennifer Reck, “Oklahoma Signs the Nation’s First State Medicaid Value-Based Contracts for Rx Drugs,” September 25 2018, NASHP, https://nashp.org/oklahoma-signs-first-medicaid-value-based-contracts-for-rx-drugs/.

Pfizer, Inc. v. Texas Health and Human Services Commission, and Charles Smith, Executive Commissioner, Findings and Facts and Conclusions of Law, In the United States District Court for the Western District of Texas Austin Division, Filed September 29, 2017.

Katherine Young. How Does the Trump Administration Drug Pricing Blueprint Affect Medicaid? Kaiser Family Foundation, May 2018, https://www.kff.org/medicaid/issue-brief/how-does-the-trump-administration-drug-pricing-blueprint-affect-medicaid/

Beginning in June 2017, the FDA has maintained a list of off-patent, off-exclusivity drugs lacking generic competition. Also in June 2017, the FDA announced it would expedite ANDA reviews until there were three generics on the market for a given brand. The agency is also intending on issuing guidance in the future addressing other activities that diminish generic competition. “FDA Tackles Drug Competition to Improve Patient Access,” FDA News Release, June 27, 2017, https://www.fda.gov/newsevents/newsroom/pressannouncements/ucm564725.htm and Henry Waxman, Bill Corr, Kristi Martin, Sophia Duong, “What Commissioner Gottlieb’s FDA is Doing to Lower Prescription Drug Prices and Steps Congress Can Take to Help,” April 2018, https://www.commonwealthfund.org/sites/default/files/documents

/___media_files_publications_issue_brief_2018_apr_waxman_gottlieb_plan_fda_ib.pdf.Aware of the importance of biologics when considering drug costs, the FDA released the “Biologics Action Plan” in July 2018, which includes items such as providing guidance to improve biosimilar labeling and to provide clarity for manufacturers to demonstrate interchangeability, as well as providing education to health care professionals to explain concepts such as biosimilars and interchangeability “Biosimilars Action Plan: Balancing Innovation and Competition,” FDA, July 2018. See also “FDA Releases Biosimilar Action Plan,” http://www.centerforbiosimilras.com/news/fda-releases-biosimilar-action-plan.

Zachary Brennan, “FDA Sets Record for Number of Generic Drug Approvals Again,” October 11, 2018, https://www.raps.org/news-and-articles/news-articles/2018/10/fda-sets-record-number-of-generic-drug-approvals-a.

MACPAC, Improving Operations of the Medicaid Drug Rebate Program, June 2018, https://www.macpac.gov/publication/improving-operations-of-the-medicaid-drug-rebate-program/

“Patient Affordability Value and Efficiency Act,” https://www.cassidy.senate.gov/imo/media/doc/PAVE%20Act.pdf.