How Might Older Nonelderly Medicaid Adults with Disabilities Be Affected By Work Requirements in Section 1115 Waivers?

Most of the states with approved or pending Section 1115 waivers that condition Medicaid eligibility on work would apply those requirements to all or most nonelderly adults (ages 19-64) who are not receiving Supplemental Security Income (SSI) cash assistance, including older nonelderly adults (ages 50-64).1 Older nonelderly adults may be limited in their ability to satisfy a work requirement due to barriers resulting from age and/or disability. Previous analysis shows that many nonelderly Medicaid adults (ages 19-64) have functional limitations that may interfere with their ability to work but do not rise to the stringent SSI level of disability, making them potentially subject to work requirements. Older nonelderly adults are over twice as likely to have a disability than younger adults (17% vs. 7%).2 Furthermore, older nonelderly adults account for nearly half (45%) of all nonelderly Medicaid adults with a disability but not SSI who could be affected by a work requirement.3 This analysis examines the implications of work requirements for Medicaid adults ages 50 to 64 (referred to as “older nonelderly Medicaid adults”) and provides national and state level estimates of their disability, SSI, and work status using data from the 2016 American Community Survey (ACS).

Key Findings

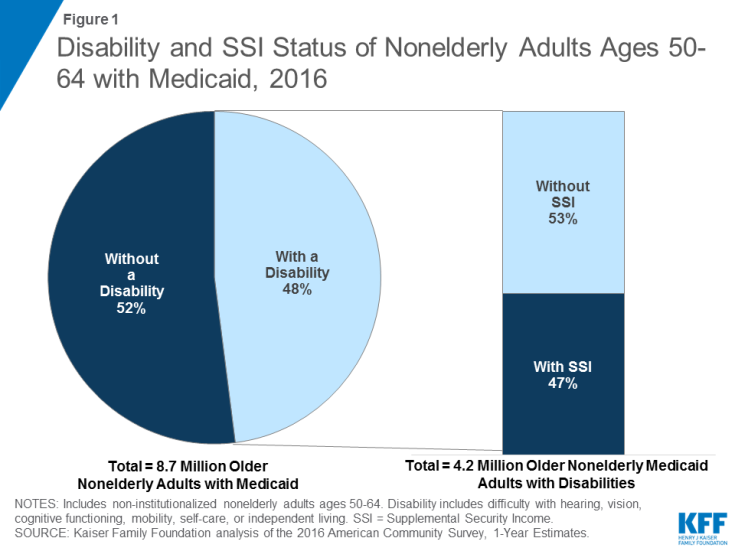

Of the 8.7 million older nonelderly Medicaid adults, nearly half (48%) report having a disability according to the ACS definition (Figure 1). The ACS classifies a person as having a disability if the person reports serious difficulty with hearing, vision, cognitive functioning (concentrating, remembering, or making decisions), mobility (walking or climbing stairs), self-care (dressing or bathing), or independent living (doing errands, such as visiting a doctor’s office or shopping, alone).4

Over half (53%) of older nonelderly Medicaid adults with a disability do not receive SSI cash assistance (Figure 1); these adults could be subject to a Medicaid work requirement, despite experiencing serious difficulty in at least one ACS functional area. Although the Centers for Medicare and Medicaid Services (CMS) work requirement guidance excludes people who are eligible for Medicaid based on a disability (such as those who receive SSI), many adults with disabilities will face Medicaid work requirements because they qualify for Medicaid on another basis (i.e., low-income).5 The CMS guidance allows states to apply work requirements to “working age” enrollees (those under age 65). The guidance provides that states “may” provide exemptions from a work requirement, such as an exemption based on age, but leaves that decision up to the states. People subject to work requirements must verify that they are meeting the required number of hours or meet a specified exemption.

Eight of the 10 states with approved or pending Medicaid work requirement waivers as of March, 2018, would apply those requirements to all or most older nonelderly Medicaid adults.6 Just two states (Arkansas and Wisconsin) would exempt all older nonelderly (age 50+) Medicaid adults from work requirements. One state (Arizona) would exempt those age 55 and older, and two states (Indiana and Utah) would exempt those age 60 and older. Medicaid work requirements would apply to all older nonelderly Medicaid adults in the remaining five states (Kansas, Kentucky, Maine, Mississippi, and New Hampshire) under the current proposals (Table 1).

| Table 1: State Section 1115 Medicaid Work Requirement Waivers, as of March 13, 2018 | |||

| State | Waiver Status | Covered Populations* | Age Group Exemption |

| Arkansas | Approved – implementation June, 2018 | Expansion adults | 50+ |

| Arizona | Pending | Expansion adults | 55+ |

| Indiana | Approved – implementation 2019 | Expansion and traditional adults | 60+ |

| Kansas | Pending | Traditional adults (parents 0-38% FPL) | 65+ |

| Kentucky | Approved – implementation July, 2018 | Expansion and traditional adults | 65+ |

| Maine | Pending | Traditional adults (parents 0-105% FPL) | 65+ |

| Mississippi | Pending | Traditional adults (parents 0-27% FPL) | 65+ |

| New Hampshire | Pending | Expansion adults | 65+ |

| Utah | Pending | Traditional adults (parents 0-60% FPL; childless adults 0-100% FPL) | 60+ |

| Wisconsin | Pending | Traditional adults (childless adults 0-100% FPL) | 50+ |

| NOTE: *Other groups, such as Transitional Medical Assistance, family planning only, or former foster care youth, may be included in some states. SOURCE: Kaiser Family Foundation analysis of states’ Section 1115 waiver applications posted on Medicaid.gov. | |||

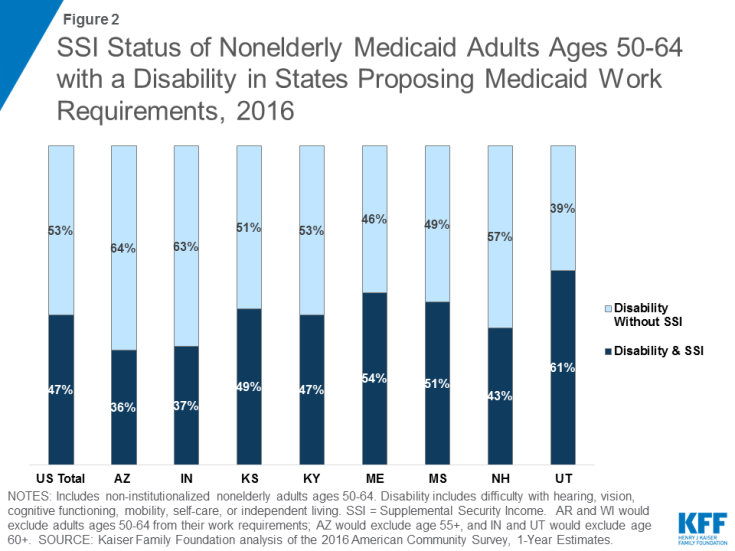

In the eight states that would apply Medicaid work requirements to all or most older nonelderly adults, substantial shares of these adults have a disability but do not receive SSI, making them subject to the work requirement unless they are otherwise exempt.7 The share of older nonelderly Medicaid adults with a disability but not SSI in these states ranges from 39% in Utah8 to 64% in Arizona.9 These shares are 63% in Indiana10 and 53% in Kentucky, the two states with CMS approval to implement work requirement waivers that include all or most older nonelderly Medicaid adults to date (Figure 2). (Arkansas also has CMS approval to implement a Medicaid work requirement, but, as indicated above, its waiver exempts adults ages 50 and over.)

Figure 2: SSI Status of Nonelderly Medicaid Adults Ages 50-64 with a Disability in States Proposing Medicaid Work Requirements, 2016

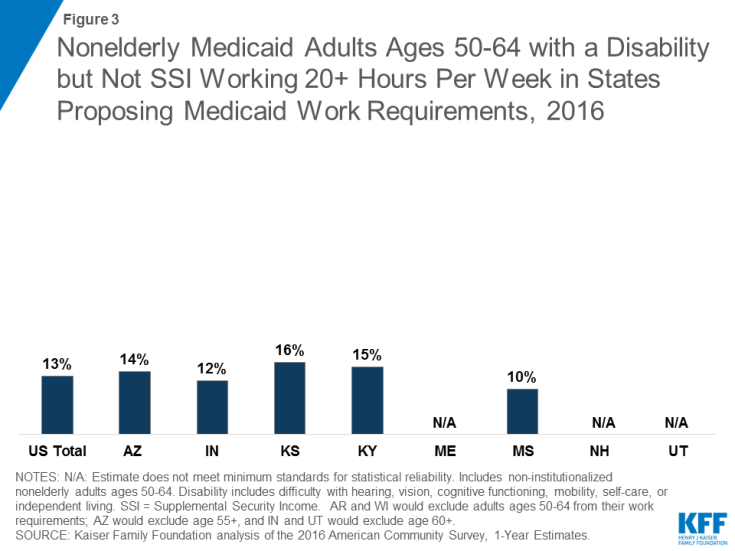

Just over 1 in 10 (13%) older nonelderly Medicaid adults with disabilities but not SSI are working 20 or more hours per week (Figure 3). The majority (83%) of older nonelderly Medicaid adults with a disability but not SSI are not working (unemployed or not in the labor force) (Table 3). For comparison, Kentucky’s approved waiver requires enrollees under age 65 to work 80 hours per month (equivalent to 20 hours per week), and Indiana’s approved waiver scales up to a requirement of 20 hours per week (after 18 months of enrollment) for those under age 60. Work rates vary, but are generally low, in the eight states with approved or pending Medicaid work requirement waivers that do not exempt any older nonelderly Medicaid adults based on age. In these states, the share of older nonelderly Medicaid adults with a disability but not SSI who are working 20 or more hours per week ranges from 10% in Mississippi to 16% in Kansas. (Figure 3).

Figure 3: Nonelderly Medicaid Adults Ages 50-64 with a Disability but Not SSI Working 20+ Hours Per Week in States Proposing Medicaid Work Requirements, 2016

Discussion

Most of the states with approved or pending Medicaid work requirement waivers would apply those requirements to all or most older nonelderly adults. Older nonelderly adults may face age-related barriers to complying with work requirements, and these barriers may be compounded for those who also have a disability. For example, people with low incomes are likely to be working in jobs with physical demands, such as being on one’s feet all day, walking, carrying or lifting heavy items, or performing repetitive motions. These jobs can be increasingly difficult to perform as people age. In addition, over half of older nonelderly Medicaid adults have a disability but do not receive SSI cash assistance. This population could be subject to work requirements despite experiencing a disability that limits their ability to work, such as a serious difficulty in the ability to hear; see; concentrate, remember, or make decisions; walk or climb stairs; or perform daily self-care and/or independent living tasks.

In Indiana and Kentucky, the two states with approved work requirement waivers that apply to all or most older nonelderly Medicaid adults, substantial shares of this population (63% in IN,11 and 53% in KY) have a disability but do not receive SSI. They therefore could be adversely affected if they do not comply with the work and documentation requirements or obtain an exemption, which depends on what the state exemption policies are and how they are implemented. By contrast, small shares of older nonelderly Medicaid adults with a disability but not SSI in these states are currently working at a level likely to satisfy the work requirement (20 or more hours per week, 13% in IN,12 and 15% in KY). Some older nonelderly adults with disabilities but not SSI might be exempt from the work requirement if they are determined to be “medically frail.” However, it is unclear whether everyone in this group will qualify for an exemption, how the process will work, and what specific criteria will apply.

Kentucky plans to implement its work requirement in July, 2018, and Indiana plans to implement in 2019. As these waivers are implemented, it will be important to monitor the impact on Medicaid beneficiaries, especially those whose older age and/or health status could affect their ability to comply. It will be important to assess how the work requirements and exemptions affect older nonelderly Medicaid adults with disabilities and the impact on access to coverage and care.

| Table 2: Older Nonelderly Medicaid Adults by Disability and SSI Status, 2016 | ||||

| Total Older Nonelderly Medicaid Adults Ages 50-64 | Total Older Nonelderly Medicaid Adults with a Disability | Older Nonelderly Medicaid Adults with a Disability but Not SSI | ||

| As a Share of Older Nonelderly Medicaid Adults with a Disability | Number | |||

| US Total | 8,730,300 | 4,161,500 | 53% | 2,222,700 |

| Alabama | 117,300 | 75,100 | 43% | 32,400 |

| Alaska | 14,600 | 6,700 | 54% | 3,600 |

| Arizona | 214,200 | 97,600 | 64% | 62,100 |

| Arkansas | 103,300 | 53,100 | 53% | 28,300 |

| California | 1,455,700 | 506,400 | 57% | 286,400 |

| Colorado | 134,200 | 59,000 | 61% | 36,100 |

| Connecticut | 108,300 | 41,300 | 66% | 27,100 |

| Delaware | 27,700 | 12,400 | 52% | 6,400 |

| DC | 33,400 | 14,900 | 66% | 9,800 |

| Florida | 465,700 | 251,400 | 48% | 120,400 |

| Georgia | 192,900 | 121,000 | 39% | 47,300 |

| Hawaii | 34,800 | 11,200 | 57% | 6,500 |

| Idaho | 22,100 | 13,500 | 40% | 5,500 |

| Illinois | 344,600 | 156,100 | 64% | 99,600 |

| Indiana | 153,000 | 83,900 | 63% | 53,100 |

| Iowa | 75,100 | 36,500 | 56% | 20,400 |

| Kansas | 41,000 | 26,700 | 51% | 13,600 |

| Kentucky | 192,900 | 104,400 | 53% | 55,500 |

| Louisiana | 143,700 | 84,100 | 47% | 39,200 |

| Maine | 41,600 | 25,500 | 46% | 11,800 |

| Maryland | 148,000 | 71,900 | 56% | 40,200 |

| Massachusetts | 275,700 | 105,800 | 56% | 59,000 |

| Michigan | 344,200 | 180,400 | 54% | 97,300 |

| Minnesota | 135,200 | 56,300 | 64% | 36,300 |

| Mississippi | 83,900 | 53,300 | 49% | 26,000 |

| Missouri | 110,400 | 70,200 | 59% | 41,600 |

| Montana | 28,000 | 15,500 | 60% | 9,300 |

| Nebraska | 20,700 | 13,000 | 49% | 6,400 |

| Nevada | 76,700 | 34,700 | 59% | 20,300 |

| New Hampshire | 25,900 | 11,500 | 57% | 6,500 |

| New Jersey | 216,500 | 87,500 | 46% | 40,000 |

| New Mexico | 85,400 | 40,500 | 56% | 22,600 |

| New York | 811,100 | 290,400 | 53% | 154,100 |

| North Carolina | 199,800 | 116,300 | 50% | 57,800 |

| North Dakota | 10,300 | 5,700 | 51% | 2,900 |

| Ohio | 331,200 | 162,100 | 64% | 103,100 |

| Oklahoma | 61,000 | 41,300 | 50% | 20,800 |

| Oregon | 140,100 | 63,400 | 58% | 36,500 |

| Pennsylvania | 360,500 | 199,700 | 52% | 104,800 |

| Rhode Island | 41,100 | 21,700 | 40% | 8,700 |

| South Carolina | 109,700 | 67,700 | 47% | 32,100 |

| South Dakota | 11,700 | 7,100 | 39% | 2,800 |

| Tennessee | 178,100 | 114,300 | 47% | 53,200 |

| Texas | 411,400 | 246,300 | 43% | 106,300 |

| Utah | 32,200 | 18,900 | 39% | 7,300 |

| Vermont | 26,800 | 9,800 | 52% | 5,100 |

| Virginia | 99,400 | 57,700 | 58% | 33,700 |

| Washington | 205,200 | 98,700 | 61% | 60,000 |

| West Virginia | 84,900 | 45,900 | 54% | 24,600 |

| Wisconsin | 140,000 | 68,200 | 54% | 36,800 |

| Wyoming | 9,100 | 5,100 | 34% | 1,700 |

| NOTES: Includes non-institutionalized nonelderly adults ages 50-64. SSI = Supplemental Security Income. Disability includes serious difficulty with hearing, vision, cognitive functioning, mobility, self-care, or independent living. SOURCE: Kaiser Family Foundation analysis based on the 2016 American Community Survey, 1-Year Estimates. | ||||

| Table 3: Work Status of Older Nonelderly Medicaid Adults with a Disability but Not SSI, 2016 | ||||||

| Total Non-SSI Medicaid Adults with Disabilities, Ages 50-64 | Total Working | Share Working | Share Working 20+ Hours/Week | Share Working <20 Hours/Week | Share Unemployed or Not in Labor Force | |

| US Total | 2,222,700 | 370,200 | 17% | 13% | 3% | 83% |

| Alabama | 32,400 | 2,500 | 8% | 7% | N/A | 92% |

| Alaska | 3,600 | N/A | N/A | N/A | N/A | 85% |

| Arizona | 62,100 | 10,600 | 17% | 14% | 3% | 83% |

| Arkansas | 28,300 | 3,200 | 11% | 9% | N/A | 89% |

| California | 286,400 | 53,300 | 19% | 16% | 3% | 81% |

| Colorado | 36,100 | 7,100 | 20% | 14% | 5% | 80% |

| Connecticut | 27,100 | 4,100 | 15% | 12% | N/A | 85% |

| Delaware | 6,400 | 1,600 | 24% | 23% | N/A | 76% |

| DC | 9,800 | N/A | N/A | N/A | N/A | 84% |

| Florida | 120,400 | 13,500 | 11% | 9% | N/A | 89% |

| Georgia | 47,300 | 4,600 | 10% | 8% | N/A | 90% |

| Hawaii | 6,500 | N/A | N/A | N/A | N/A | 85% |

| Idaho | 5,500 | N/A | N/A | N/A | N/A | 84% |

| Illinois | 99,600 | 16,200 | 16% | 13% | 3% | 84% |

| Indiana | 53,100 | 8,500 | 16% | 12% | N/A | 84% |

| Iowa | 20,400 | 5,500 | 27% | 19% | 8% | 73% |

| Kansas | 13,600 | 2,400 | 18% | 16% | N/A | 82% |

| Kentucky | 55,500 | 9,300 | 17% | 15% | N/A | 83% |

| Louisiana | 39,200 | 4,000 | 10% | 8% | N/A | 90% |

| Maine | 11,800 | N/A | N/A | N/A | N/A | 87% |

| Maryland | 40,200 | 9,000 | 22% | 19% | N/A | 78% |

| Massachusetts | 59,000 | 12,900 | 22% | 16% | 6% | 78% |

| Michigan | 97,300 | 18,300 | 19% | 14% | 5% | 81% |

| Minnesota | 36,300 | 11,000 | 30% | 22% | 9% | 70% |

| Mississippi | 26,000 | 3,000 | 11% | 10% | N/A | 89% |

| Missouri | 41,600 | 4,300 | 10% | 8% | N/A | 90% |

| Montana | 9,300 | 1,600 | N/A | N/A | N/A | 83% |

| Nebraska | 6,400 | N/A | N/A | N/A | N/A | 76% |

| Nevada | 20,300 | 1,900 | 10% | N/A | N/A | 90% |

| New Hampshire | 6,500 | N/A | N/A | N/A | N/A | 81% |

| New Jersey | 40,000 | 7,400 | 18% | 15% | 4% | 82% |

| New Mexico | 22,600 | 5,800 | 26% | 23% | N/A | 74% |

| New York | 154,100 | 32,800 | 21% | 18% | 3% | 79% |

| North Carolina | 57,800 | 5,500 | 10% | 8% | N/A | 90% |

| North Dakota | 2,900 | N/A | N/A | N/A | N/A | 92% |

| Ohio | 103,100 | 17,500 | 17% | 13% | 3% | 83% |

| Oklahoma | 20,800 | 2,100 | 10% | 10% | N/A | 90% |

| Oregon | 36,500 | 7,800 | 21% | 17% | N/A | 79% |

| Pennsylvania | 104,800 | 19,000 | 18% | 12% | 6% | 82% |

| Rhode Island | 8,700 | 2,300 | 26% | 25% | N/A | 74% |

| South Carolina | 32,100 | 3,800 | 12% | 10% | N/A | 88% |

| South Dakota | 2,800 | N/A | N/A | N/A | N/A | 84% |

| Tennessee | 53,200 | 6,700 | 13% | 11% | 2% | 87% |

| Texas | 106,300 | 14,500 | 14% | 11% | 3% | 86% |

| Utah | 7,300 | N/A | N/A | N/A | N/A | 87% |

| Vermont | 5,100 | N/A | N/A | N/A | N/A | 69% |

| Virginia | 33,700 | 3,800 | 11% | 10% | N/A | 89% |

| Washington | 60,000 | 11,300 | 19% | 13% | 6% | 81% |

| West Virginia | 24,600 | 3,700 | 15% | 12% | N/A | 85% |

| Wisconsin | 36,800 | 6,200 | 17% | 13% | 4% | 83% |

| Wyoming | 1,700 | N/A | N/A | N/A | N/A | 75% |

| NOTES: Includes non-institutionalized nonelderly adults ages 50-64. SSI = Supplemental Security Income. Disability includes serious difficulty with hearing, vision, cognitive functioning, mobility, self-care, or independent living. SOURCE: Kaiser Family Foundation analysis based on the 2016 American Community Survey, 1-Year Estimates. | ||||||