Medicare

Federal Agencies That Make Medicare Work

A look at the key federal agencies that help make Medicare work — and at the DOGE-driven staffing and organizational changes that could affect the program, which serves over 68 million adults ages 65+ and younger people with disabilities.

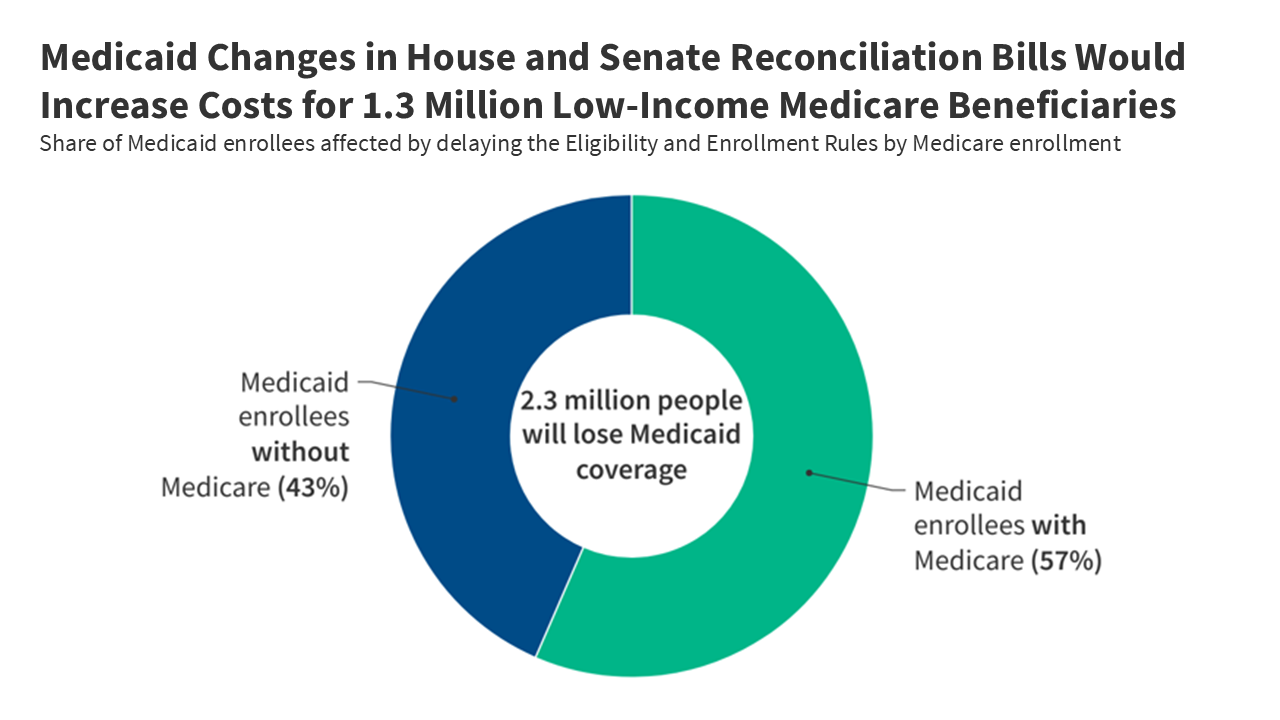

Reconciliation Bill Increases Costs for Low-Income Beneficiaries

The CBO says 1.3 million Medicare beneficiaries would lose Medicaid coverage that lowers their health costs if the reconciliation bill becomes law.

The CBO says 1.3 million Medicare beneficiaries would lose Medicaid coverage that lowers their health costs if the reconciliation bill becomes law.7.4 Million People Spend Over 10% of Income on Part B Premiums

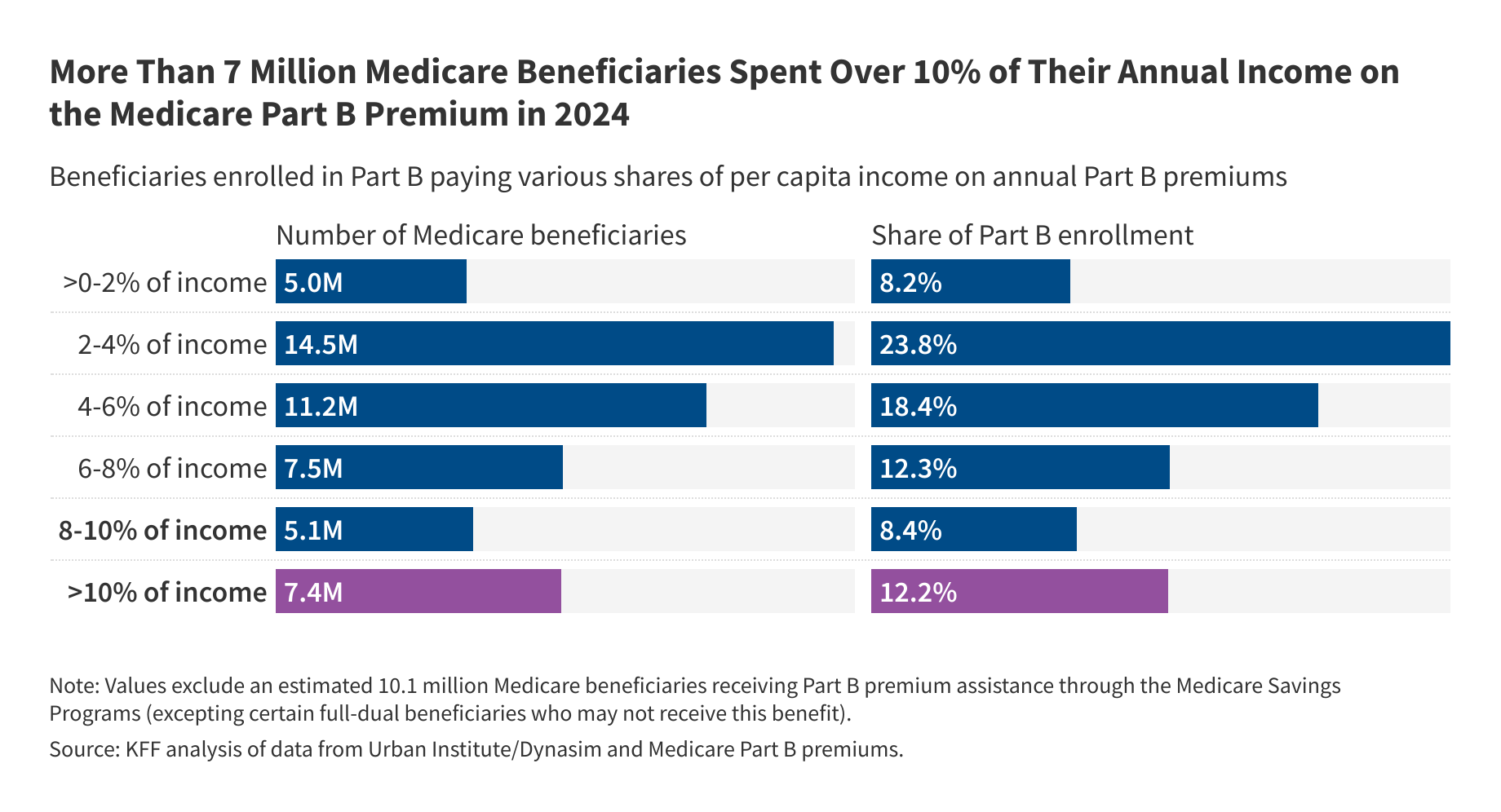

7.4 million Medicare beneficiaries spent over 10% of their annual per capita income on Part B premiums. People with low incomes can qualify for gov’t help paying premiums but the reconciliation bill would result in 1.3M losing access to this assistance.

7.4 million Medicare beneficiaries spent over 10% of their annual per capita income on Part B premiums. People with low incomes can qualify for gov’t help paying premiums but the reconciliation bill would result in 1.3M losing access to this assistance.State Profiles for Dual-Eligible Individuals

The KFF State Profiles for Dual-Eligible Individuals database offers the latest national and state data and statistics on dual-eligible individuals who receive their primary health insurance coverage through Medicare and some assistance from their state Medicaid program.

The KFF State Profiles for Dual-Eligible Individuals database offers the latest national and state data and statistics on dual-eligible individuals who receive their primary health insurance coverage through Medicare and some assistance from their state Medicaid program.

Data Visualization

The Facts About Medicare Spending

This interactive provides the facts on Medicare spending. Medicare, which serves 67 million people and accounts for 12 percent of the federal budget and 21 percent of national health spending, is often the focus of discussions about health expenditures, health care affordability and the sustainability of federal health programs.

Explore data on enrollment growth, Medicare spending trends overall and per person, growth in Medicare spending relative to private insurance, spending on benefits and Medicare Advantage, Part A trust fund solvency challenges, and growth in out-of-pocket spending by beneficiaries.

Related: FAQs on Medicare Financing and Trust Fund Solvency

Read More

Latest News

-

In Rush To Satisfy Trump, GOP Delivers Blow to Health Industry

-

KFF Health News' 'What the Health?': Digesting Trump’s Big Budget Law

-

An Arm and a Leg: The Prescription Drug Playbook, Part II

-

KFF Health News' 'What the Health?': Trump’s Bill Reaches the Finish Line

-

KFF Health News' 'What the Health?': Live From Aspen — Governors and an HHS Secretary Sound Off

-

Dual Threats From Trump and GOP Imperil Nursing Homes and Their Foreign-Born Workers