Kaiser Health Tracking Poll – November 2017: The Role of Health Care in the Republican Tax Plan

Poll Finding

Kaiser Health Tracking Poll – November 2017: The Role of Health Care in the Republican Tax Plan

Poll Finding

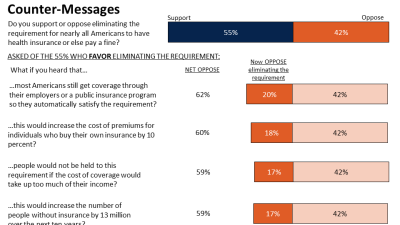

As Republicans in Congress continue efforts to pass tax reform, the November Kaiser Health Tracking Poll examines views of the plans and how they relate to health care issues. Overall, reforming the tax code is seen as a “top priority” for President Trump and Congress by about three in ten (28 percent), falling well-behind several health care issues such as reauthorizing funding for the State Children’s Health Insurance Program (CHIP) (62 percent) and stabilizing the ACA marketplaces (48 percent). In addition, the majority of the public (55 percent) support the idea of eliminating the requirement for all Americans to have health insurance or else pay a fine as part of the Republican tax plan, however views vary party. In contrast, the majority of the public (68 percent), including majorities across parties, oppose eliminating the tax deduction for individuals who have high health care costs. The poll also takes an early look at the public’s views of the potential consequence of Congress not passing tax reform or repealing the ACA before the 2018 midterms.