Nine Changes to Watch in ACA Open Enrollment 2023

Blog

Nine Changes to Watch in ACA Open Enrollment 2023

Blog

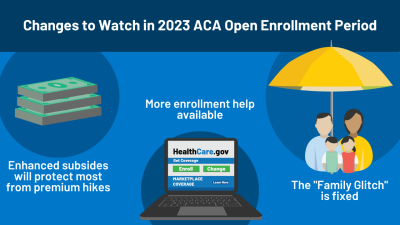

The 2023 Affordable Care Act (ACA) Open Enrollment period will run from November 1, 2022 to January 15, 2023 in most states, longer in some state-based marketplaces. This policy watch examines nine changes that may affect what enrollees pay for coverage, the size of tax credits for those eligible, and other changes that could affect enrollees’ experiences.