2017 Employer Health Benefits Survey

Report

2017 Employer Health Benefits Survey

Report

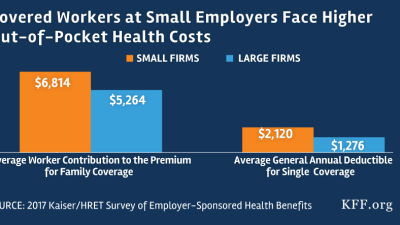

Excerpt: This annual Employer Health Benefits Survey (EHBS) provides a detailed look at trends in employer-sponsored health coverage, including premiums, employee contributions, cost-sharing provisions, and other relevant information. The 2017 survey finds average family health premiums rose 3 percent, the sixth straight year of relatively modest growth, to reach 18,764 annually on average.