What's in Store for Medicare's Part B Premiums and Deductible in 2016, and Why?

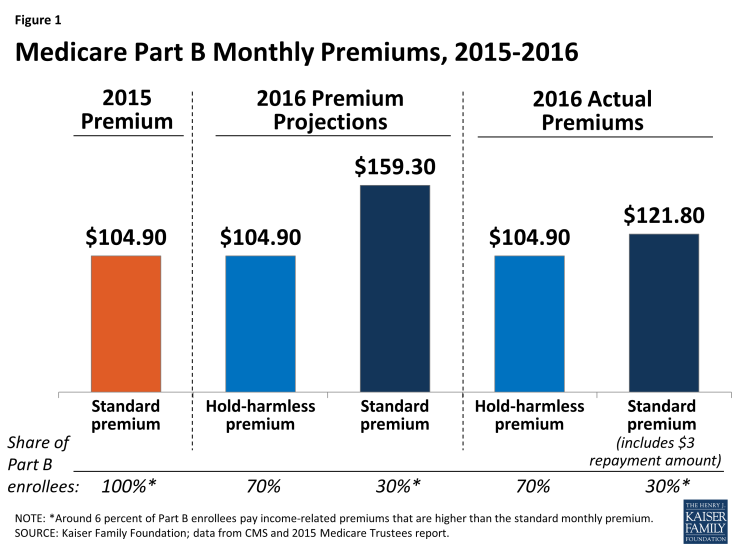

On November 10, 2015, the Centers for Medicare & Medicaid Services (CMS) announced the 2016 Medicare Part B monthly premium and annual deductible amounts of $121.80 and $166, respectively.1 The Medicare Trustees had projected that Part B premium and deductible amounts would increase by an unprecedented 52 percent between 2015 and 2016,2 before the Bipartisan Budget Act of 2015 (Public Law 114-74) was passed by Congress and signed into law on November 2, 2015. According to the Trustees, the magnitude of the projected increase in the standard premium was attributable to higher-than-expected Part B spending in 2014; a need to provide for adequate reserves in the Supplementary Medical Insurance trust fund; and the effect of having no cost-of-living adjustment (COLA) for Social Security benefits in 2016. The lack of a Social Security COLA means that 70 percent of Part B enrollees are prevented from paying higher Part B premiums in 2016 due to the so-called ‘hold-harmless’ provision in the Social Security law, while the other 30 percent will face higher premiums.3

As a result of the Bipartisan Budget Act of 2015, the Part B monthly premium will be increasing for 30 percent of Part B enrollees from $104.90 in 2015 to $121.80 in 2016—a 16 percent increase, but far less than the increase initially projected by the Medicare actuaries (Figure 1). This total amount includes a $3 repayment surcharge, which will be added to monthly premiums over time to cover the cost of the reduced premium rate in 2016. The 70 percent of Part B enrollees who are protected by the hold-harmless provision will pay a monthly premium of $104.90 in 2016, the same as in 2015, and no premium surcharge.

This brief explains how the Medicare Part B premium and deductible are changing for 2016, the circumstances that led lawmakers to modify the formula for determining these amounts for 2016, related provisions of the Bipartisan Budget Act of 2015, and the implications for beneficiaries’ premiums and deductibles in 2016 and future years.

How are Medicare Part B premiums calculated?

Medicare’s monthly standard Part B premium amount is derived from a monthly actuarial rate determined by the Secretary of the Department of Health and Human Services (HHS) in September of each year for the succeeding year, such that, in the aggregate, premiums will cover 25 percent of Part B program spending and provide for adequate reserves in the Supplementary Medical Insurance (SMI) Trust Fund, with general revenues covering the remaining 75 percent of program spending. Most beneficiaries pay the standard premium amount, while higher-income Part B enrollees pay a greater share of costs, ranging from 35 percent to 80 percent, depending on their income, and state Medicaid programs pay the premium on behalf of beneficiaries who are dually eligible for Medicare and Medicaid. Premiums are generally deducted from beneficiaries’ Social Security benefits.4

Over the 50-year history of the Medicare program, Part B premiums have changed nearly every year by varying percentages, ranging from a reduction of 13 percent to an increase of 39 percent. In general, premiums have increased from one year to the next, reflecting the growth in Part B program spending (see Appendix A for actual and projected Part B premiums and rates of growth between 1975 and 2024).

In July 2015, the Medicare Board of Trustees projected that the monthly Part B premium would increase by an unprecedented 52 percent for 30 percent of Part B enrollees, triggered by the lack of a Social Security cost-of-living adjustment (COLA) for 2016, while the other 70 percent of Part B enrollees would pay the same premium in 2016 that they pay in 2015 ($104.90) because of the hold-harmless provision in the Social Security law.5

What is the connection between the Medicare Part B premium, the Social Security COLA, and the hold-harmless provision?

Social Security recipients typically receive an annual cost-of-living increase that reflects higher costs associated with inflation (see Appendix A for actual and projected Social Security COLAs between 1975 and 2024). The COLA is based on the change in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) between the third quarter (July-September) of the current year and the third quarter of the most recent year a cost-of-living adjustment was determined.6 For 2016, the COLA is based on the change in the CPI-W between the third quarters of 2014 and 2015, a period marked by dramatic declines in energy prices (primarily the price of gasoline) that outweighed modest price increases in other consumer goods.7 As a result, on October 15, 2015, Social Security announced there will be no COLA for 2016.8 The zero percent COLA for Social Security recipients in 2016 is the first year with no COLA since 2011 and only the third such year since 1975.

The absence of a COLA affects the amount of the Medicare Part B premium charged to enrollees because it triggers the broader application of a provision in the Social Security law known as the hold-harmless provision. In a year where the Social Security COLA is insufficient to cover the amount of the Medicare Part B premium increase for an individual, the law prohibits an increase in the Part B premium that would result in a reduction in that individual’s monthly Social Security benefits from one year to the next. (For an example of how the hold-harmless provision works in a typical year with a Social Security COLA, see Appendix B.) The hold-harmless provision affects a different number of beneficiaries each year, depending on the level of their Social Security benefits, the size of the COLA, and the increase in the Medicare Part B premium. In years with no COLA, a majority of beneficiaries are protected by the hold-harmless provision.

Which Medicare beneficiaries will not be protected by the hold-harmless provision in 2016?

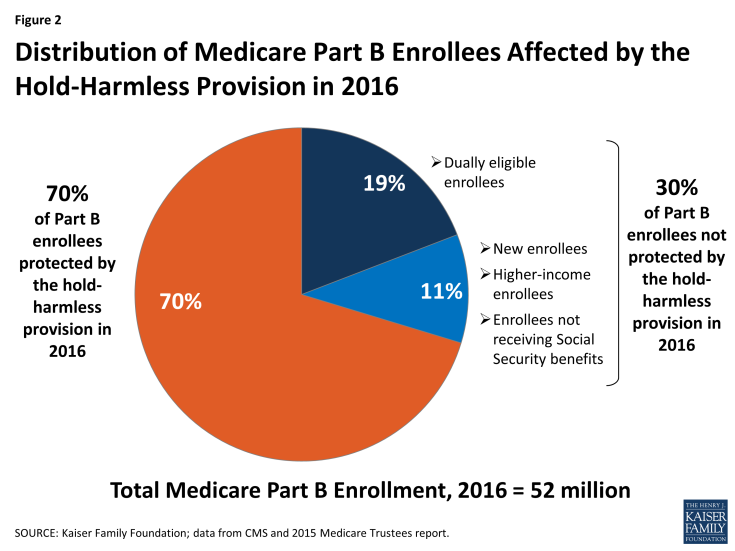

In 2016, 30 percent of all Part B enrollees will not be protected by the hold-harmless provision,9 including (Figure 2):

- Medicare beneficiaries who are dually eligible for Medicare and Medicaid, for whom State Medicaid programs (funded jointly by states and the Federal government) pay the monthly Part B premium, and any increase in the premium, on their behalf. There are approximately 10 million dually eligible beneficiaries, representing 19 percent of Part B enrollees and two-thirds of those who are not protected by the hold-harmless provision.

- Higher-income Medicare beneficiaries, with a modified adjusted gross income greater than $85,000 for individuals and $170,000 for couples in 2016, who are required to pay an income-related surcharge in addition to the standard monthly Part B premium amount.

- Medicare Part B enrollees who are not receiving Social Security benefits, including people covered under Medicare Part B who have chosen to defer receiving Social Security benefits, and others who are covered under Medicare but not Social Security. In 2013, half of all people on Medicare not receiving Social Security benefits had incomes below $33,000.10

- New Medicare enrollees in 2016. Because people who are new to Medicare in 2016 have not been paying Part B premiums in 2015, the increase in the Part B premium cannot result in a decrease in their Social Security benefits in 2016. This group includes people reaching age 65 in 2016 who enroll in Medicare Part B, and people who worked beyond age 65 and sign up for Part B in 2016. It also includes people younger than age 65 who have been receiving Social Security Disability Insurance (SSDI) payments who will exit the 24-month waiting period and go on Medicare in 2016. The Medicare actuaries project the number of Part B enrollees will increase by 1.4 million between 2015 and 2016,11 all of whom will pay a higher Part B premium unless they qualify for both Medicare and Medicaid, in which case states pay the premium on their behalf.

How did the Bipartisan Budget Act of 2015 affect Medicare Part B premiums in 2016 and beyond?

In response to the unusual circumstances surrounding the projected Medicare Part B premium increase for 2016, the recently-passed Bipartisan Budget Act of 2015 modified the way in which the Part B premium and deductible amounts are calculated for 2016. The law requires Medicare to calculate the standard Part B premium for 2016 as if the hold-harmless provision were not in effect and as if all Part B enrollees (rather than just 30 percent) were paying a higher amount. This approach has the effect of reducing the standard Part B premium amount for the 30 percent of Part B enrollees who are not protected by the hold-harmless provision.

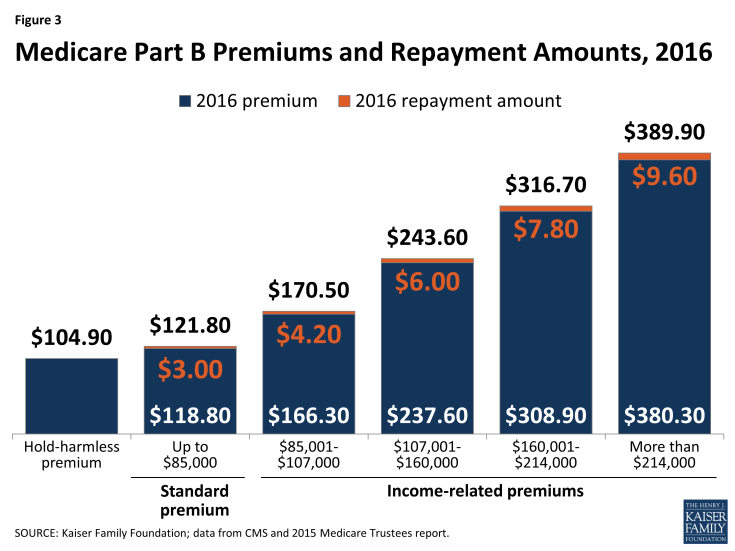

In accordance with the new law, CMS announced that the total Part B monthly premium amount for 2016 will be $121.80, which includes a $3 repayment amount that will be added to monthly premiums over time to cover the cost of the reduced premium rate in 2016, as described below. This total premium will be paid by (or on behalf of) the 30 percent of Part B enrollees who are not protected by the hold-harmless provision in 2016. The total (including the repayment amount) represents a 16 percent ($16.90) increase from the 2015 standard monthly premium of $104.90, and $37.50 less than actuaries had projected for 2016 earlier this year. Based on CMS’s calculation of the 2016 actuarial rate of $237.60, the monthly premium rate alone, excluding the $3 repayment amount, is $118.80, or 13 percent more than the 2015 monthly premium (Figure 3).

Thus, under the new law, beneficiaries who are not protected by the hold-harmless provision will pay more than the 2015 standard Part B premium in 2016, but not as much as was projected in the 2015 Trustees report. Beneficiaries who are protected by the hold-harmless provision will pay $104.90 per month in 2016, the same as the standard Part B premium in 2015, and no repayment amount.

According to CMS, this change in the calculation of the Part B premium for 2016 will cost $7.4 billion in federal outlays because there will be a shortfall in beneficiary premium payments in 2016.12 CMS also estimated that states will save a total of $1.8 billion on premium payments for dually-eligible beneficiaries due to the actual premium for 2016 being lower than what was initially projected.

The law calls for a transfer of funds from general revenues to the SMI trust fund to temporarily cover the $7.4 billion cost, but also requires Part B enrollees to repay this amount over time in the form of a modest premium surcharge. Beginning in 2016, a $3 repayment surcharge will be added to the monthly premium payment for the 30 percent of beneficiaries who are not protected by the hold-harmless provision; beneficiaries who pay income-related premiums will pay somewhat higher repayment amounts.

In 2017 and later years until the total cost is repaid, the repayment surcharge will be added to the monthly Part B premium amount paid by all Part B enrollees who are not protected by the hold-harmless provision. For those years where there is a Social Security cost-of-living increase, the vast majority of Part B enrollees will not be protected by the hold-harmless provision and will be required to pay these repayment amounts.

How will Part B premiums change for higher-income Medicare beneficiaries in 2016?

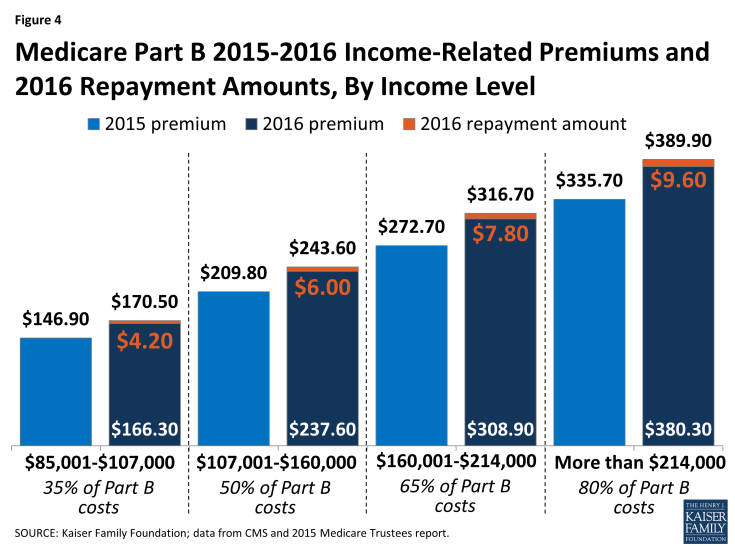

Approximately 6 percent of Part B enrollees are estimated to pay income-related Part B premiums in 2016.13 Beneficiaries are required to pay a higher Part B premium if their income is equal to or greater than $85,000 for an individual and $170,000 for a couple. These beneficiaries pay a higher share of Part B program costs, ranging from 35 percent to 80 percent, depending on their income level. For 2015, the income-related Part B premium amounts range from $146.90 for beneficiaries paying 35 percent of program costs to $335.70 for beneficiaries paying 80 percent of costs.

For 2016, the monthly income-related premiums (including the repayment amounts) will increase by 16 percent, the same percentage increase at each level as for the standard Part B premium. For higher-income beneficiaries, monthly premiums will range from $170.50 (for those with incomes between $85,001 and $107,000) to $389.90 (for those with incomes greater than $214,000) (Figure 4). These amounts include the monthly surcharges, which range from $4.20 for beneficiaries paying 35 percent of program costs to $9.60 for beneficiaries paying 80 percent of costs.

Figure 4: Medicare Part B 2015-2016 Income-Related Premiums and 2016 Repayment Amounts, By Income Level

How is the Medicare Part B deductible changing in 2016?

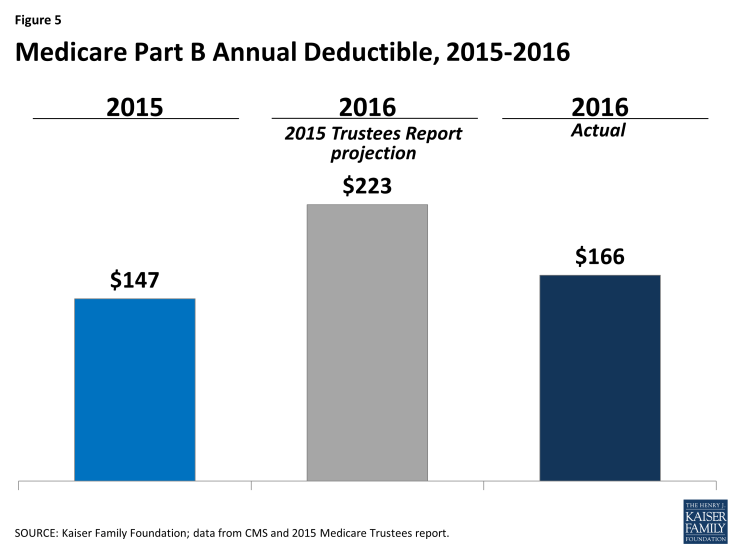

The Medicare Part B deductible was projected to rise by 52 percent in 2016, because the premium and deductible amounts are indexed to increase at the same rate. Thus, changes to the calculation of the standard Part B premium made in the Bipartisan Budget Act of 2015 also affected the deductible. The annual Part B deductible will be $166 in 2016, increasing by $19 over the 2015 amount of $147 (Figure 5). This represents the same rate of increase (13 percent) as the increase in the monthly Part B premium excluding the repayment surcharge. The annual deductible for 2016 is $57 lower than the $223 amount that was projected by the Medicare Trustees in the 2015 report.

The hold-harmless provision does not apply to the Part B deductible increase, thus all Part B enrollees who use Part B services will be charged this higher amount. An exception is Medicare Advantage enrollees, who typically pay the Part B premium but may not face the same cost-sharing requirements for Medicare-covered services as beneficiaries in traditional Medicare, including deductibles and coinsurance or cost sharing. Beneficiaries in traditional Medicare who have Medigap supplemental coverage or employer-sponsored plans that help cover their Medicare cost-sharing requirements may not pay the higher Part B deductible directly out of their own pockets, but they could face an increase in their Medigap or employer plan premiums as a result of their plans covering the higher deductible.

What is the expected outlook for 2017?

The Medicare Trustees projected that the Part B monthly premium will be $120.70 in 2017 and the Part B deductible will be $169—similar to the actual amounts in 2016. With the addition of the $3 repayment amount, the total monthly premium in 2017 would be $123.70. This total amount represents an 18 percent ($18.80) increase for the majority of beneficiaries who are protected by the hold-harmless provision in 2016 and a more modest 2 percent ($1.90) increase for all others who are subject to the higher premium amount in 2016—including states, which pay the Part B monthly premium on behalf of dually eligibles beneficiaries.

For the coming years, the Trustees project Medicare’s monthly Part B premium and deductible will increase at an average annual rate of 5.4 percent between 2017 and 2024. This projected rate of growth is roughly in line with the rate of growth in Medicare Part B per capita spending, and also reflects the expectation that Social Security recipients will receive a cost-of-living increase each year between 2017 and 2024. If Part B spending grows faster or slower than projected, premiums would grow faster or slower as a result.

The Social Security Trustees project a 3.1 percent COLA for 2017, which would result in an increase in monthly Social Security benefits in 2017.14 With an increase in the COLA projected for 2017, fewer Medicare Part B enrollees will be affected by the hold-harmless provision than in 2016, which means the beneficiary premium portion of Part B program spending is likely to be spread across a greater share of Part B enrollees in 2017 than in 2016, and the repayment surcharges will be paid by a larger share of beneficiaries as well.

Conclusion

The Bipartisan Budget Act of 2015 averted an unprecedented increase in the 2016 Medicare Part B premium for the 30 percent of Part B enrollees who would have otherwise have faced a 52 percent increase in their premiums. It also reduced the level of increase in the Part B deductible that would have affected virtually all beneficiaries in traditional Medicare. Although the hold-harmless provision protects most beneficiaries against an increase in the Part B premium in a year with no COLA, some beneficiaries could see an actual reduction in their Social Security benefits in 2016 due to rising Part D drug plan premiums—which are increasing by 13 percent on average between 2015 and 201615—because the hold-harmless provision applies only to premiums for Part B, not Part D. And the absence of a COLA for 2016 in and of itself has direct financial implications for roughly 60 million Social Security recipients, many of whom live on fixed incomes and rely on Social Security benefits as their primary source of income.16 Thus, in the face of flat Social Security benefits and rising out-of-pocket costs, many people on Medicare could have greater difficulty affording their medical care costs in the coming year.