Understanding How States Access the ACA Enhanced Medicaid Match Rates

Under the Affordable Care Act (ACA), Medicaid plays a major role in covering more uninsured people. Most notably, the ACA expands Medicaid to nearly all low-income individuals under age 65 with incomes up to 138% federal poverty level (FPL) ($16,105 per year for an individual in 2014). The June 2012 Supreme Court decision effectively made the Medicaid expansion an option. For states that implement the expansion, the federal government will finance 100% of the costs of those made newly eligible for Medicaid from 2014 to 2016 and then the federal contribution phases down to 90 percent by 2020 and beyond. States would continue to pay the traditional Medicaid match rate for increased participation among those currently eligible.

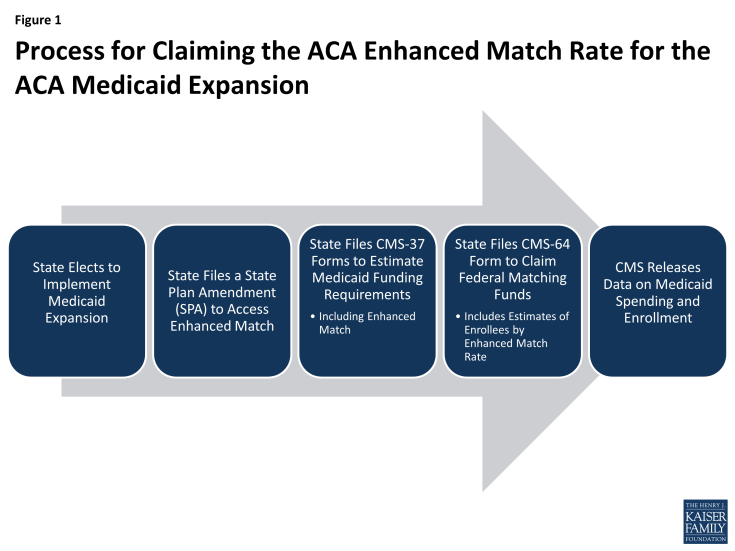

Over the last year, Centers for Medicare or Medicaid Services (CMS) has issued regulations, frequently asked questions, instructions for filing a State Plan Amendment (SPA) and a SPA template to help guide states in accessing the enhanced match. To date, most states have filed SPAs to claim the enhanced federal medical assistance percentages (FMAP). States were able to begin filing claims for the enhanced match in April 2014. CMS has revised the claim forms (the CMS-64 forms) to include claims for services at the new ACA match rates. Additionally, for the first time, the CMS-64 claim forms also request information about enrollment, including counts. The CMS Performance Indictor data has helped to provide more timely information about Medicaid and CHIP enrollment, however, the CMS-64 is the only data source that will have information on those counted as “newly eligible.” Since this data claiming and reporting is new, ensuring that the data are comparable and accurate across states may take time. At this time, it is not clear when this data will be publicly available. In addition, these counts of those “newly eligible” are for claiming purposes and may not reflect those who newly gained coverage. (Figure 1)

This brief reviews the rules around the enhanced FMAP provided in the ACA, the process for states to claim the enhanced matching funds and a discussion about what information the new data will provide looking forward.

Medicaid and CHIP Financing Under the ACA

Financing for the traditional Medicaid and CHIP programs is shared by the states and the federal government. The share that the federal government pays is based on a formula in the statute that relies on a states’ personal income. The CHIP match rate is enhanced relative to the Medicaid rate. The ACA specifies match rates for different populations in Medicaid and CHIP. Most significantly, the ACA provides full federal funding for those made newly eligible for Medicaid under the law. This rate phases down to 90 percent in 2020 and beyond. The following box highlights the traditional match rates and those established by the ACA.

Medicaid Match Rates and the ACA

Traditional Matching Rate. The traditional Medicaid program is jointly funded by states and the federal government. The federal matching percentage (FMAP) varies by state (ranging from a statutory floor of 50 percent up to 73.05 percent for FFY 2014.) The FMAP is based on a formula in the law that relies on a states’ personal income; states with lower per capita incomes on average receive a higher matching rate. For every $2 that states pay for a Medicaid-covered service, they receive at least $1 back from the federal government. The traditional match rate applies to new enrollment of individuals eligible based on rules as of December 1, 2009 and to new coverage of foster care children up to age 26 who are eligible as former foster care children.

Newly-Eligible Matching Rate. The ACA provides 100 percent federal financing for those made newly eligible for Medicaid under the law. The federal match rate falls to 95 percent in 2017, 94 percent in 2018, 93 percent in 2019, and then 90 percent in 2020 and beyond. Beginning in 2014, it is available for non-elderly adults with income up to 138 percent of the FPL who are not eligible for Medicaid under the rules that a state had in place on December 1, 2009. Since April 1, 2010, states have had the option of moving early to provide Medicaid coverage through a state plan amendment or through a waiver to people up to 138 percent of the FPL. States that take up the early option will receive the regular Medicaid matching rate for this population until January 1, 2014, and then still qualify for even more generous federal support.

“Expansion” States Matching Rate. The “expansion” or “transition” matching rate is designed to provide some additional federal help to “expansion” states (states that had expanded coverage to adults statewide up to at least 100 percent FPL as of March 23, 2010, when the ACA was enacted). These states can receive a phased-in increase in their federal matching rate for adults without children under age 65 beginning on January 1, 2014 so that by 2019 it will equal the enhanced matching rate available for newly-eligible adults. (Appendix Table 1)

Special Match Rate for States with No Newly-Eligible Individuals. Expansion states that do not have any newly-eligible Medicaid beneficiaries because they already cover people up to 138 percent of the federal poverty level or higher will also (in addition to the expansion state match rate) receive a temporary (January 1, 2014 through December 31, 2015) 2.2 percentage point increase in their federal matching rate for all populations. It is likely that these states will include at least Massachusetts and Vermont, which already use Medicaid to provide coverage to people with income at or above 138 percent of the federal poverty level.

CHIP Matching Rate. The CHIP matching rate is available for children who are covered through a Medicaid expansion or through a separate CHIP program. It ranges from 65 percent to 83 percent, and, in effect, it reduces the cost to a state of covering a child by 30 percent when compared to the regular Medicaid matching rate. It will remain available to states through the end of fiscal year 2015. If Congress reauthorizes CHIP and extends funding past 2015, the CHIP match rate will increase by an additional 23 percentage points (capped at 100 percent).

How Do States Access the Enhanced FMAP?

States need to update their state plans (and sometimes waiver programs) to reflect who is eligible as of January 1, 2014. States also need to submit state plan amendments (SPAs) describing how they will claim the appropriate federal medical assistance percentage (FMAP) for expenditures for the new adult group. In addition, states will need to submit their budget estimates related to the new adult group, so CMS can provide funding at the appropriate levels.

SPA for FMAP Claiming

CMS has issued regulations, a SPA template and instructions, as well as frequently asked questions to provide guidance on the rules and process for states to claim the enhanced FMAP associated with newly eligible adults.1

States implementing the Medicaid expansion and seeking to claim newly eligible and/or expansion state FMAP for enrollees in the adult group must submit a FMAP Claiming SPA to CMS. SPAs do not need to be submitted until the end of the quarter to be made effective retroactive to the beginning of the quarter. The SPA must describe the state’s methodology for determining which expenditures may be claimed at the higher FMAP. The SPA template includes five parts:

Part 1 – Adult Group Individual Income-Based Determinations

According to final rules released on April 2, 2013, the individual income-based determination is based on a comparison of the individual’s income to the income standard in effect on December 1, 2009, converted to an equivalent MAGI-based income standard. Individuals with incomes at or below the converted MAGI-based income standard will not be considered newly eligible and individuals with incomes above the converted standard are newly eligible and therefore eligible for the enhanced match rate. This method is applied to 5 population groups: parents / caretaker relatives, institutionalized disabled persons, non-institutionalized disabled persons, children ages 19 or 20 and childless adults.

Part 2 – Population-Based Adjustments to the New Adult Group

States may make the following population based adjustments:

Resource Proxy Adjustment. The MAGI methodology prohibits asset limits. The rule allows states to use a resource proxy methodology to adjust and account for individuals who would not have been eligible for Medicaid because of the application of resource criteria (asset test) in effect on December 1, 2009. The resource proxy test applies to people in the new category of coverage which can include some people who were eligible under 2009 rules and therefore are not treated as newly eligible.

Enrollment Cap Adjustment. An enrollment cap adjustment applies to states that, as of December 1, 2009, had a section 1115 demonstration enrollment cap in effect and provided demonstration populations with full benefits, benchmark benefits, or benchmark-equivalent benefits. This adjustment does not apply to states that had waivers offering more narrow benefits. For any population group that was subject to an enrollment cap as of December 1, 2009, states must provide details about the waiver and enrollment cap level in effect. The FMAP the state can claim is based on the ratio of those subject to the enrollment cap relative to the total enrolled in the new adult eligibility group. The regulation provides an example: if the total expenditures are $10 million for the new adult group of 4,000 childless adults and the cap in place on December 1, 2009 was 1,000 then the state would claim the regular match rate for 25 percent of the enrollees ($2.5 million) and newly eligible match rate for 75 percent of the enrollees ($7.5 million).

Special Circumstance Adjustments. Special circumstances adjustments are available to states that may need to make additional adjustments to the claiming methodology. For example, the FMAP SPA for the District of Columbia used the a special circumstance adjustment to accurately account for those previously and newly eligible due to waivers in place prior to the ACA and the adoption of the early expansion option. States that adopted a targeted enrollment strategy such as using administrative transfers from SNAP to Medicaid may also require a special circumstances adjustment.

Part 3 – Transitions of Previously Covered Populations to the New Adult Group

States must also indicate if they will be transitioning existing Medicaid coverage (either a Section 1115 demonstration or another SPA) to the new adult group and describe how the FMAP will be determined. All states with section 1115 demonstrations will have a CMS-approved transition plan covering all changes going into effect on January 1, 2014. States with these transitions must submit a description of the methodology the state will use for claiming FMAP for any time period between the transfer and the MAGI determination.

Part 4 – Applicability of Special FMAP Rates

The SPA instructions allow for states to indicate (and include the CMS letter confirming this designation) if they qualify for the temporary 2.2 percentage point increase in the FMAP.

Part 5 – State Attestations Regarding the Adult Group FMAP Methodology

In the last section of the SPA, states must attest that they understand and will comply with the requirements for claiming newly eligible or expansion state FMAP for the new adult group.

Process to Claim Enhanced FMAP

Budget Estimates and the CMS-37 Report

States will submit their budget estimates for the new adult group using the CMS-37 report. The CMS-37 is a quarterly financial report submitted by states to provide an estimate of the state’s Medicaid funding requirements for the quarter. CMS reviews a state’s CMS-37 submission and issues a grant award authorizing federal funding to the state for the quarter. If a state’s initial submission is insufficient, the state can submit a revised CMS-37 report and CMS can issue a supplemental grant award. The CMS-37 includes information for total computable, federal share and state share of medical assistance payments (MAP) and administrative expenses. The report also calls for an estimated number of eligible during the year.

Approval of the eligibility SPA for the new adult group provides the authority to include these expenditures in the grant award. After CMS issues the grant award reflecting estimated new adult expenditures, states can draw federal funds during the quarter, in advance of submitting claims for such expenditures.

State of Expenditures and the CMS-64 Report

The CMS-64 form is a statement of expenditures for which states are entitled to federal Medicaid reimbursement. Once states have all applicable SPAs (eligibility, benefits, and FMAP) approved, they can claim expenditures on the CMS-64 after the quarter has closed. States with section 1115 waivers cannot claim retroactively. Typically CMS-64 data is available publicly through CMS.2 State-by-state total expenditures (by total computable, federal and state shares) are available for MAP by service and for administrative payments (by category). This data has historically not included information about enrollment or spending by eligibility group and the latest available data is available for FY 2012.

To account for the newly eligible FMAP, CMS has revised the CMS-64 form to require states to claim by service for those newly eligible. The form also allows states to account for the adjustments discussed above (the resource proxy, enrollment cap and any special circumstances). In addition, for the first time, the CMS-64 form includes counts of Medicaid eligibles by newly eligible (parent / caretaker relatives and childless adults) and non-newly eligible (parent / caretaker relatives, disabled (institutionalized and non-institutionalized), children age 19-20, childless adults, other) and aged/blind and disabled.

Discussion and Looking Ahead

The enhanced FMAP provides significant funding for states to implement the Medicaid expansion in the ACA. Over the last year, CMS has issued regulations, frequently asked questions, SPA instructions and a SPA template to help guide states in accessing the enhanced match. To date, most states have filed SPAs and are beginning to submit new claims. Looking forward, there is anticipation that this data (spending and enrollment counts based on the new ACA match rates) will be available more quickly.

Efforts to release more current data as part of the Medicaid and CHIP performance indicator process has been key to obtaining information about changes in enrollment since before open enrollment; however, since this data is new, CMS has been able to report on a small number of indicators. The enrollment counts in this data include Medicaid and CHIP and exclude partial coverage enrollees (like those covered through waivers and dual eligible). To date, CMS has been able to report on applications, determinations, and total enrollment. In May 2014, CMS began reporting information about enrollment of children. CMS is collecting data in a number of other areas, including breaks for MAGI and non-MAGI populations; however, one key element that is not captured in this data set is the number of enrollees in the MAGI group that are newly eligible.

The new CMS-64 data is requesting data about spending and enrollment of newly eligible versus non-newly eligible and aged/blind and disabled as part of the traditional claiming process. Historically, states only had to submit spending claim data (and not enrollment data) through the CMS-64. For a number of reasons, those newly eligible enrollment counts included in the CMS-64 may not reflect the most accurate measure of who may be newly eligible. For example, states that had covered populations under a limited benefit waiver or other states who had more comprehensive coverage for childless adults may be able to access enhanced matching funds for these populations that had already been covered. In these cases, the amount of federal financing is shifting, but they are not newly covered. This may be a subject of some confusion in numbers for states where this is applicable.

Looking ahead, data collected through the CMS performance measures and new data collected from the new CMS-64 will provide a look at the effects of the ACA on Medicaid coverage and spending. Given that this reporting is new for states, ensuring that the data are comparable and accurate across states may take time before CMS can release a broader set of performance measures as well as data from the CMS-64.

Appendix Table 1: Enhanced Matching Rates for Parents and Childless Adults, 2014 and Beyond

| Year | Newly-Eligible Parents & Childless Adults (up to 138% FPL) | Medicaid-Eligible Childless Adults in “Expansion” States Only(I.e., States that Had Already Expanded to Adults >100% FPL as of March 23, 2010) | ||

| Transition Percentage used to Calculate Enhanced Match | Example: State with 50% Original FMAPRegular FMAP + [(Newly-Eligible Enhanced Match Rate – Regular FMAP) x Transition Percentage] | Example: State with 60% Original FMAPRegular FMAP + [(Newly-Eligible Enhanced Match Rate – Regular FMAP) x Transition Percentage] | ||

| 2014 | 100% | 50% | 75% | 80% |

| 2015 | 100% | 60% | 80% | 84% |

| 2016 | 100% | 70% | 85% | 88% |

| 2017 | 95% | 80% | 86% | 88% |

| 2018 | 94% | 90% | 89.6% | 90.6% |

| 2019 | 93% | 100% | 93% | 93% |

| 2020 on | 90% | 100% | 90% | 90% |