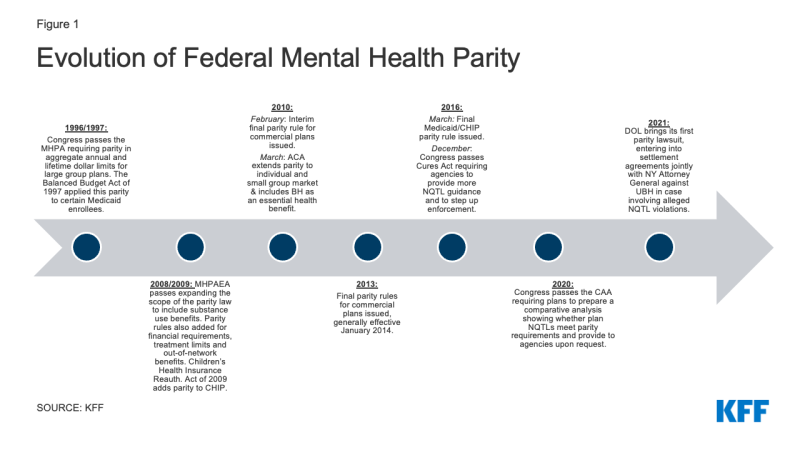

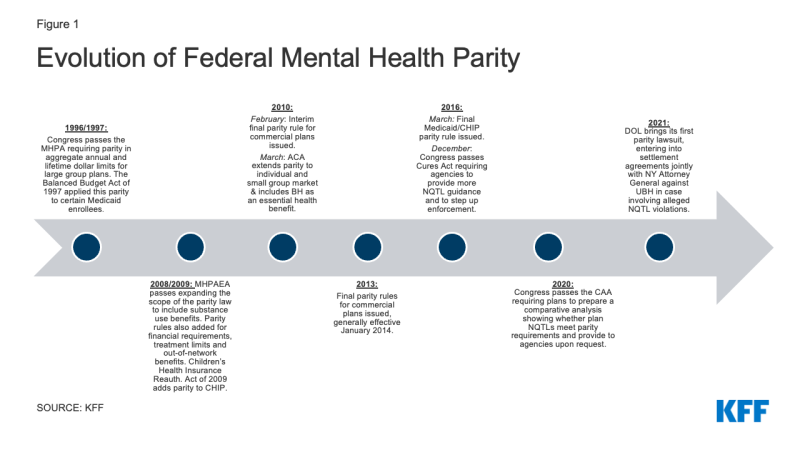

Figure 1: Evolution of Federal Mental Health Parity

| Topic |

Commercial |

Medicaid |

| Definition of behavioral health |

Plans define what is considered behavioral health versus medical care. |

State Medicaid agencies can define what is behavioral health versus medical care. MCOs, PHIPs and PAHPs must follow the state’s definition. |

| Long term care services |

Long term care services are considered “excepted benefits” that do not have to comply with parity. |

Long term care services generally must meet parity standards. |

| Out-of-network classifications |

Plans must evaluate parity for out-of-network inpatient care and out-of-network outpatient care. |

The two out-of-network classifications do not apply to Medicaid MHPAEA. |

| Network tiers |

Plans can determine parity separately for each provider network tier in a classification. |

Medicaid parity regulations do not give Medicaid plans with network tiers the ability to evaluate parity within each tier. Parity is evaluated for all care within a classification. |

| Cumulative Quantitative Treatment Limits |

Quantitative treatment limits (such as a limit on the number of visits for a service per year) cannot accumulate separately for behavioral health and medical. |

Quantitative treatment limits can accumulate separately for behavioral and medical services if certain standards are met. |

| Disclosure of reasons for denial of a claim |

Plans subject to ERISA must provide the denial reason in the form/manner included in ERISA claims review rules that are separate from commercial parity rules. NonERISA plans that follow this form and manner are deemed to comply with this parity requirement. |

Medicaid is subject to its own form/manner notice standards for providing the reason for a claim denial in adverse action notice regulations that are separate from Medicaid parity rules. |

| Cost exemption |

Plans can qualify for a temporary exemption from meeting the MHPAEA standards if they meet certain requirements for cost increases. |

Medicaid regulations do not apply the cost exemption to Medicaid. |

| SOURCE: 70 Federal Register 68240-68296; 80 Federal Register 18390-18445 |

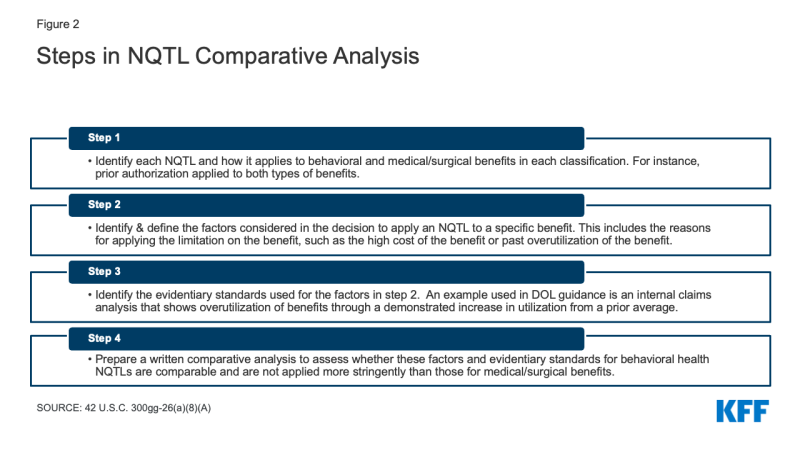

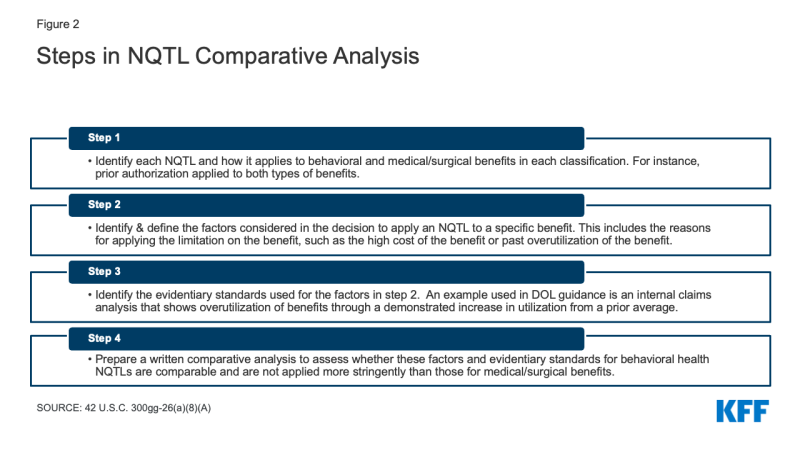

Figure 2: Steps in NQTL Comparative Analysis