Medicare Part D in Its Ninth Year: The 2014 Marketplace and Key Trends, 2006-2014

Section 2: Part D Premiums

National Premium Trends

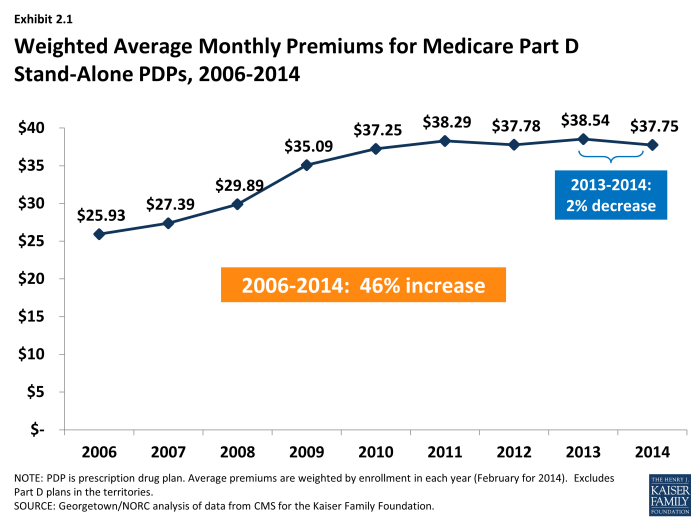

Since 2006, the average PDP premium, weighted by enrollment, has increased by 46 percent, but the 2014 average is 2 percent lower than in 2013. The weighted average monthly premium paid by beneficiaries for stand-alone Part D coverage has increased since the start of the program, from $25.93 in 2006 to $37.75 in 2014 (Exhibit 2.1).1,2 Premiums have been essentially flat since 2010, up only 1 percent from 2010 to 2014. A key factor driving slow premium growth in recent years is the availability of generic versions of many drugs used for common chronic conditions, which helps to limit growth in total plan costs and hence premiums.3 National per capita expenditures on prescription drugs have grown considerably more slowly than Part D premiums from 2006 to 2014, up just 15 percent.4

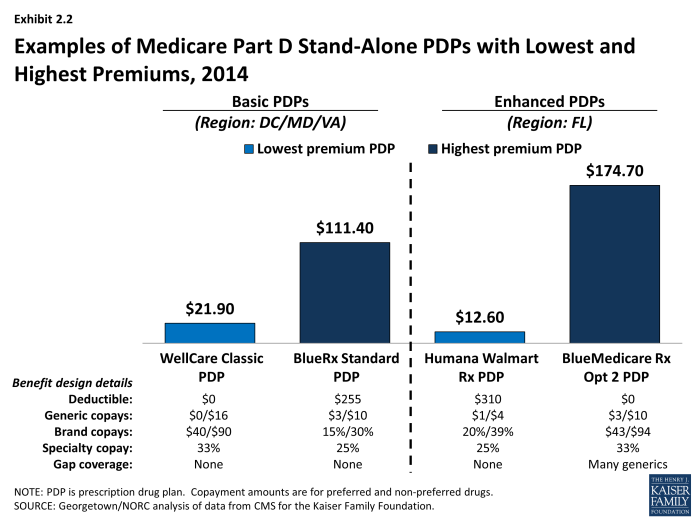

PDP premiums vary widely. Nationwide, the least expensive PDP has a $12.50 monthly premium, while the most expensive PDP has a $174.70 premium, a 14-fold difference. Although the difference can be explained partly by the relative generosity of the benefits offered or the relative efficiency across plans, these factors seem unlikely to explain the full difference. Even among plans with equivalent benefits (those offering the basic Part D benefit), premiums vary from $12.80 to $111.40 per month. As illustrated in the lowest and highest-premium PDPs in selected regions, benefit differences are modest relative to the large premium differences (Exhibit 2.2). Although enrollees in the highest-premium enhanced plan have some coverage in the gap for generic drugs and no deductible, they face cost sharing similar to that in the lowest-premium PDPs. Those enrolled in the highest-premium basic PDP have a $255 deductible while those in the lowest-premium PDP have no deductible.

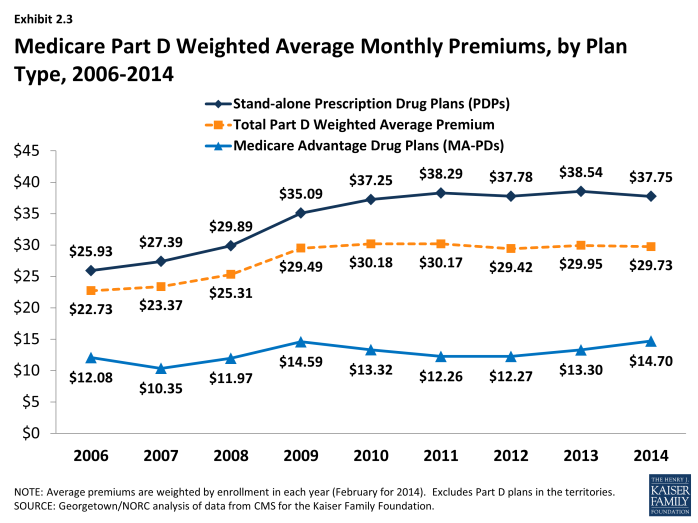

Average Part D premiums, including both PDPs and MA-PDs, are lower than average premiums for PDPs because MA-PD plan premiums are less than half of those for PDPs. The combined average has been essentially flat since 2010, hovering around $30 (Exhibit 2.3). The average 2014 monthly premium amount attributable to drug benefits in MA-PD plans is $14.70, up 11 percent from $13.30 in 2013, and higher than in any year since the program began.5 The MA-PD average monthly premium is about $23 below the PDP average monthly premium, in part because many MA-PD plans reduce or eliminate their premiums by using a portion of rebates from the Medicare Advantage payment system.6 The modest increase in the MA-PD premium from 2013 to 2014 may reflect changes in the Medicare Advantage payment rules, which may have lowered these rebates. Nearly half (46 percent) of all MA-PD plans charge no premium for their drug benefit.

Plan-Level Premium Trends

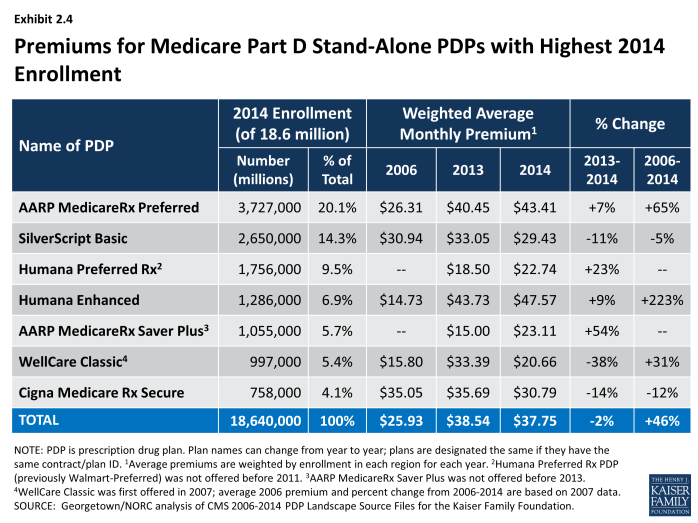

Four of the seven PDPs with the highest enrollment charged higher average premiums in 2014 compared to 2013, whereas three lowered their average premiums. More generally, the modest decrease in the average premium for all Part D enrollees hides larger changes at the plan level (Exhibit 2.4). The plan with the highest enrollment, UnitedHealth’s AARP MedicareRx Preferred PDP, increased the monthly premium by 7 percent compared to 2013 (from $40.45 to $43.41). By contrast, UnitedHealth’s Saver Plus PDP increased its average premium by 54 percent (from $15.00 to $23.11). WellCare’s Classic PDP had the largest decrease among PDPs with the most enrollment, lowering its premium from $33.39 to $20.66, a 38 percent decrease.

Older, established plans generally have raised premiums more rapidly than the national average, while newer plans are more likely to set premiums low in order to build enrollment. As a result, beneficiaries who stay in the same plan tend to pay more over time, as earlier research finds relatively few enrollees switch plans voluntarily in a given year.7 Established plans tend to retain enrollees as they age, when they typically use more drugs, whereas newer plans attract younger enrollees who are likely to have lower drug use and also more likely to shop based on premiums when they first enter the market. Premiums for some new plans have increased rapidly within a year or two of entering the market. For some plan sponsors, this strategy may be a conscious attempt to attract younger enrollees in newer, less expensive plans while still retaining their existing enrollees in older, more expensive plans.

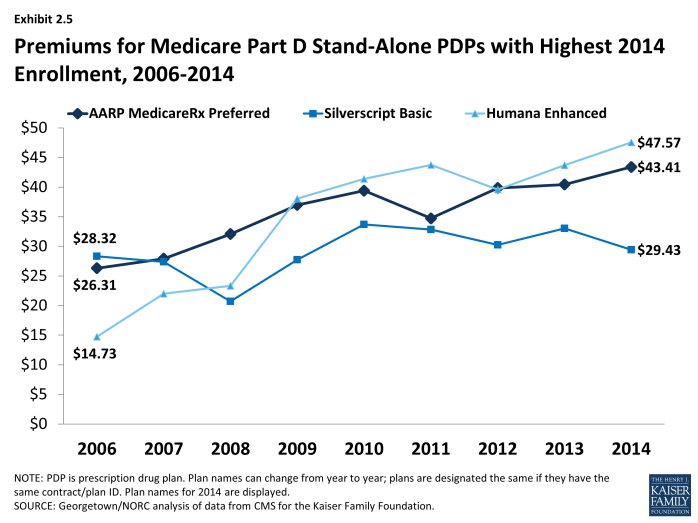

Most plans that have been in the program since 2006 have increased premiums by more than the national average. Overall, of 398 PDPs that have operated under the same contract and plan numbers from 2006 to 2014 (despite some corporate acquisitions and name changes), about half have monthly premiums in 2014 that are at least double the premium in 2006, and three-fourths have raised premiums over this period by more than the national average increase. For example, the average monthly premium for Humana’s Enhanced PDP in 2014 is more than three times its 2006 average ($47.57 versus $14.73) (Exhibit 2.5). By contrast, one in six of these continuously operating PDPs has a lower premium in 2014 than in 2006. Silverscript Value PDP had nearly the same premium in 2006 and 2014 ($28.32 versus $29.43) (although there was some premium variation in the intervening years).

Enrollment in UnitedHealth’s AARP Medicare Saver Plus PDP was up by 46 percent between 2013 and 2014 even with an increase of $8 (54 percent) in the premium. Some of the enrollment gain came from random assignment of LIS enrollees, but enrollment by non-LIS beneficiaries was up by 20 percent as well. Of the three large PDPs with premium decreases from 2013 to 2014, two added enrollees.8 Our analysis of plan switching from 2006 to 2010 found that 87 percent of beneficiaries in any particular annual enrollment period did not change plans.9 Those whose premiums were increasing by $10 or more were more likely to change to plans with lower premiums; 21 percent of those with a $10 to $20 premium increase and 28 percent of those with a premium increase of $20 or more made a change of plans.

As with PDPs, average premiums vary considerably by MA-PD plan sponsor. Plans offered by UnitedHealth, with 20 percent of the MA-PD market, have a weighted average premium of $2.94 for the drug benefit (in addition to a Part C premium of $3.93 that covers the medical benefits normally provided by traditional Medicare). By contrast, Humana, the second largest company in this market segment (19 percent of MA-PD enrollees) has an average premium of $15.05 (plus $18.27 for Part C). The next two largest MA-PD sponsors are Kaiser Permanente, with a 6 percent market share and a $4.46 average premium (plus $39.27 for Part C), and Aetna, with a 4 percent market share and a $9.26 average premium (plus $10.39 for Part C).10

Geographic Variations in Premiums

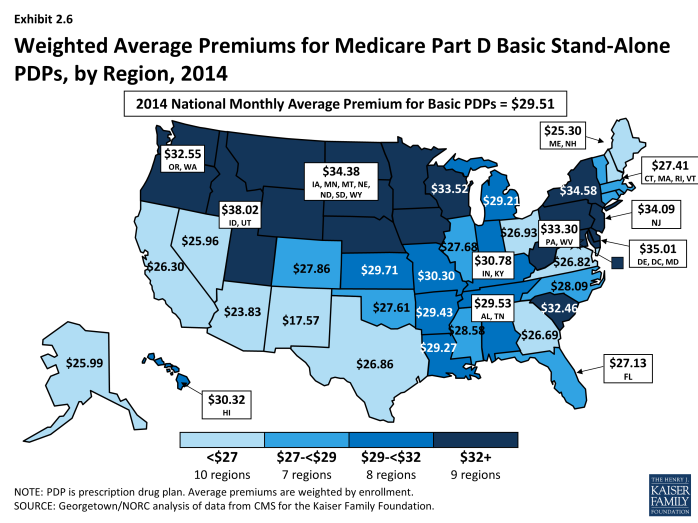

Average premiums are considerably higher in certain regions than in others in 2014. Beneficiaries enrolled in a basic PDP in New Mexico in 2014 pay an average of $17.57 per month; those in the Idaho/Utah PDP region pay $38.02, more than double the average in New Mexico (Exhibit 2.6).11 Regional differences in premiums have generally persisted from year to year and continued to grow wider in 2014. New Mexico and Arizona have been among the regions with the lowest average premiums since the program began, while the Idaho/Utah region has been among the most expensive regions.

At the same time, some regions have seen significant changes in their average PDP premiums relative to other regions. The average PDP premium in New York, for example, was below the national average from 2006 to 2010, and then increased to be above average each year since then. Regional differences in the average PDP premium were smaller in the program’s first two years, before plan sponsors could look at actual claims experience for guidance in setting premium levels. Although persistent regional differences in premiums are driven in part by underlying regional differences in drug utilization, further explanations are not readily apparent.

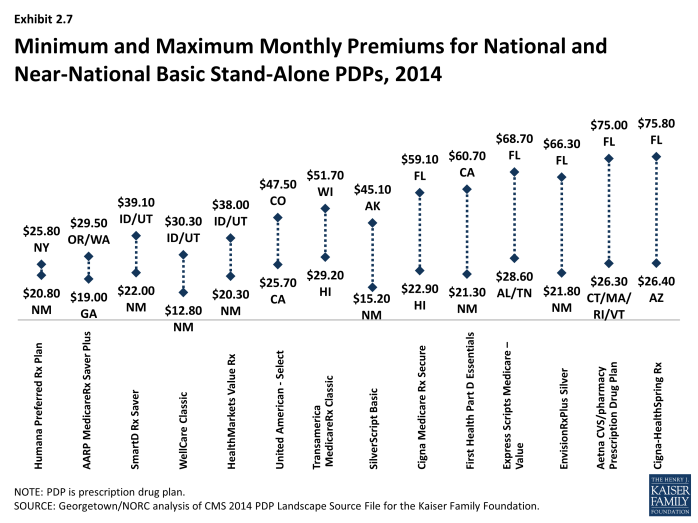

Geographic differences in premiums are greater for some plan sponsors than others; some sponsors charge as much as two or three times more for the identical basic PDP from one region to another. Fourteen plan sponsors offer a basic PDP in at least 29 of the 34 PDP regions. For eight of these national or near-national PDPs, premiums for the identical plan design are more than two times greater in one region than in another (Exhibit 2.7). The largest absolute premium difference is for the Cigna-HealthSpring PDP, which charges beneficiaries $26.40 in Arizona and $75.80 in Florida for the same coverage. By contrast, the Humana Preferred Rx PDP has a difference of only $5.00 between its lowest and highest regions ($20.80 in New Mexico and $25.80 in New York). For five of these national or near-national PDPs, the highest premium is in Florida, even though Florida premiums overall are below the national average.

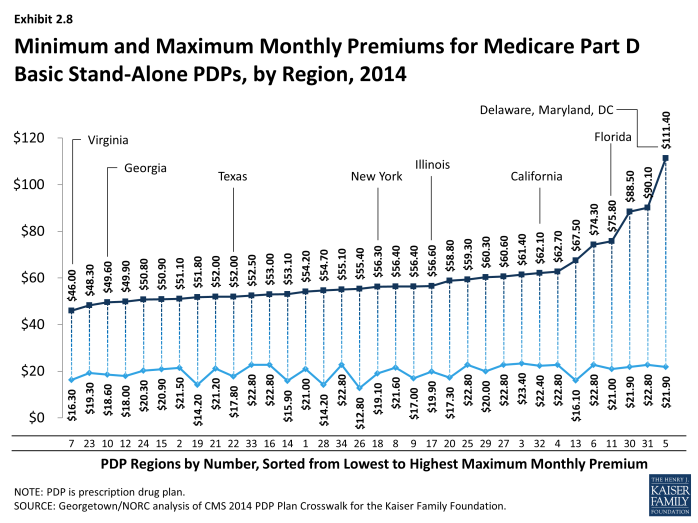

Within each region, some plan sponsors charge several times more than competing sponsors for their basic PDPs (Exhibit 2.8). In Virginia, the highest premium for a basic PDP is $46.00 for the new Transamerica MedicareRx Classic PDP, which is nearly three times the $16.30 premium for the WellCare Classic PDP. The highest premium for a basic PDP is even higher in the region that includes Delaware, Maryland, and Washington, DC, where the BlueRx Standard plan charges $111.40, five times the lowest premium in its region ($21.90 for WellCare Classic PDP). By law, all basic PDPs provide a benefit with the same actuarial value. Different utilization patterns by plan enrollees (adverse selection, beyond what can be compensated for by the risk-adjustment system used by CMS) may be a key factor driving the larger premium differences.

Premium Variations by Plan Type

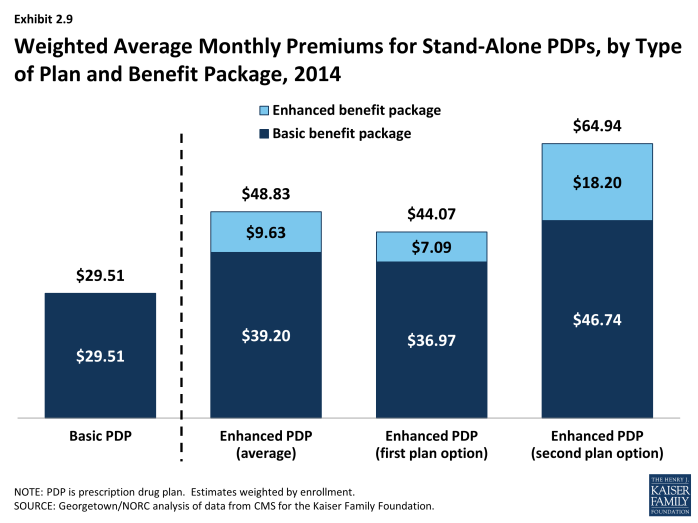

Beneficiaries selecting PDPs with an enhanced benefit package pay higher premiums on average for their Part D coverage, even for the part attributable to the basic benefit package. The weighted average monthly premium for PDPs with enhanced benefits is $48.83, compared to $29.51 for PDPs offering the basic benefit package (Exhibit 2.9). Thus, enrollees pay about 65 percent more to get enhanced benefits.

Plan sponsors mostly add value in their enhanced plans by lowering deductibles and sometimes adding coverage in the gap. Most enhanced plans lower or eliminate plan deductibles; 89 percent of enhanced PDPs have no deductible, compared to 6 percent of basic PDPs. If eliminating the deductible were the only difference, beneficiaries would be paying an additional premium of $19.32 per month ($48.83 versus $29.51) or $232 annually to eliminate a $310 deductible. Some enhanced plans also expand the coverage of drugs during the coverage gap beyond the amount included in the basic benefit (36 percent of enhanced PDPs). Plans may also use lower cost sharing as part of an enhanced benefit, but this is a less common feature of enhanced PDPs in 2014. Analysis of enhanced PDPs in earlier years sometimes revealed only small benefit differences compared to the same sponsor’s basic PDPs.12

Starting with PDPs offered in 2011, CMS has required sponsors to ensure that benefits in enhanced PDPs are meaningfully different than the basic benefits and have a measurable added value. This policy has led to a larger spread between premiums for enhanced PDPs and basic PDPs than in previous years. In 2014, an enhanced PDP must have cost-sharing differences that result in at least $21 lower monthly out-of-pocket costs than the corresponding basic PDP—an amount that modestly exceeds the $14.56 premium difference between basic plans and less extensive enhanced PDPs ($29.51 versus $44.07).

Some PDP sponsors offer two enhanced plans, a less generous first option and a more generous second option; average monthly premiums for the more generous enhanced PDPs are higher than the premium of the first option ($64.94 versus $44.07). As part of its policy on meaningful differences, CMS allows sponsors to offer a second enhanced PDP only if expected out-of-pocket cost sharing amounts are lower (by $18 per month) than for the first enhanced PDP and the second enhanced PDP has coverage for at least some brand drugs in the coverage gap. The $20 difference in premiums slightly exceeds the required difference in out-of-pocket costs.13

Although higher premiums partly reflect the cost of offering enhanced benefits, the portion of the premium that corresponds to the basic benefit ($39.20 on average for enhanced PDPs) is higher than the premium for basic PDPs ($29.51) (Exhibit 2.9). For some sponsors, the difference is much greater. Risk selection may be a factor in these higher premiums to the extent that the enhanced plans have attracted beneficiaries with higher drug needs beyond differences captured by risk adjustment.

Some plan sponsors offer enhanced PDPs that have the minimum level of enhanced coverage required by the meaningful difference tests and are offered at low premiums with the apparent goal of attracting beneficiaries with low expected drug costs.14 In 2014, monthly premiums for two of these enhanced plans are less than those for the same sponsors’ basic plans. Humana’s new enhanced PDP is offered at $12.60 per month, whereas its basic PDP (Preferred Rx) is $22.74. Similarly, the enhanced PDP offered by Aetna/First Health is $44.53 per month, compared to $51.09 for the comparable basic PDP. For several other plan sponsors, the portion of the premium attributable to a plan’s basic benefits (thus excluding the value of any enhanced benefit) is lower for their enhanced PDPs compared to their basic PDPs.

A key reason for lower premiums in these enhanced plans is favorable risk selection that occurs because they are attractive to non-LIS beneficiaries who are using few drugs and because there are few LIS beneficiaries enrolled in enhanced plans. CMS does not automatically enroll LIS beneficiaries in enhanced plans. LIS beneficiaries may choose an enhanced plan but must pay the full premium amount attached to the enhanced portion of the benefit, even if the total premium is below the LIS benchmark (which is the case for 43 PDPs in 2014). In 2014, LIS enrollees represent 68 percent of all enrollees in basic PDPs, but only 11 percent of those in enhanced PDPs. In its May 2014 rulemaking, CMS noted its intention to continue monitoring the incentives for favorable risk selection and assessing the need for policy measures to address any market segmentation.15