Medicaid Enrollment & Spending Growth: FY 2018 & 2019

Background on Medicaid Financing

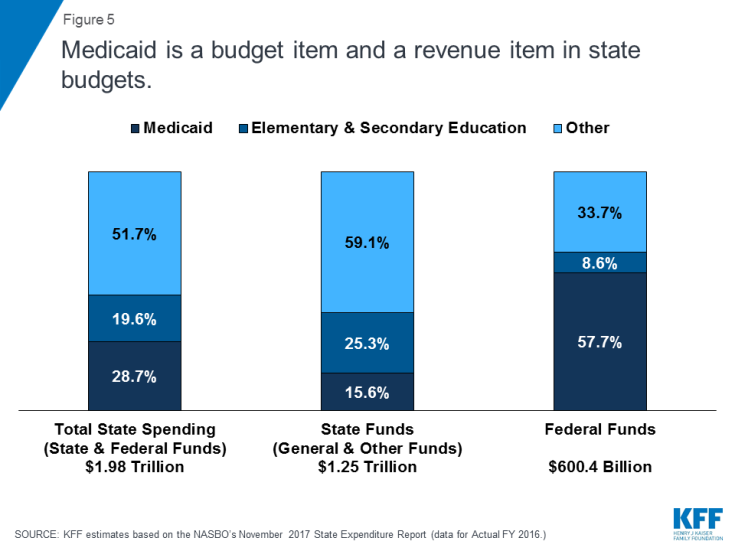

Medicaid Financing Structure. The federal government jointly funds the Medicaid program with states by matching qualifying state Medicaid expenditures. The federal match rate (known as the Federal Medical Assistance percentage, or FMAP) is calculated annually for each state using a statutory formula based on a state’s average personal income relative to the national average which results in higher FMAP rates for poorer states. The FMAP formula relies on three years of lagged personal income data, so data for FFYs 2014 to 2016 was used to calculate FFY 2019 FMAP rates which range from a floor of 50% (applicable to 14 states) to a high of 76.3% (for Mississippi).1 As a result of the federal matching structure, Medicaid is both a state budget expenditure item and a source of federal revenue for states. In FY 2016 (the latest year of actual data), Medicaid accounted for 28.7% of total state spending, but 15.6% of state funds (general fund plus other state funds), a far second to spending on K-12 education (25.3% of state funds). Medicaid is the largest single source of federal funds for states, accounting for half (57.7%) of all federal funds for states. (Figure 5).2

Medicaid and the Economy. Medicaid is a countercyclical program. During economic downturns, more people qualify and enroll in Medicaid, increasing program spending at the same time that state tax revenues may be stagnating or falling. To mitigate these budget pressures, Congress has twice passed temporary FMAP increases to help support states during economic downturns, most recently in 2009 as part of the American Recovery and Reinvestment Act (ARRA). The ARRA-enhanced FMAP rates were the primary vehicle for federal fiscal relief to states during the “Great Recession,” providing states over $100 billion in additional federal funds over 11 quarters, ending in June 2011.3

Medicaid and the ACA. Effective January 1, 2014, the ACA expanded Medicaid eligibility to millions of non-elderly adults with income at or below 138% of the federal poverty level (FPL) – about $16,753 per year for an individual in 2018. The law also provided 100% federal funding for expansion adults through 2016, phasing down to 90% in 2020 and future years. While the June 2012 Supreme Court ruling on the ACA effectively made the Medicaid expansion optional for states, as of September 2018, 34 states (including the District of Columbia) had adopted the expansion. The ACA also required all states to implement new streamlined and coordinated application, enrollment, and renewal processes, including transitioning to a new income standard (Modified Adjusted Gross Income or MAGI) and eliminating asset tests to determine Medicaid financial eligibility for non-elderly, non-disabled populations.