How Much Do Medicare Beneficiaries Spend Out of Pocket on Health Care?

Many policymakers and presidential candidates are discussing proposals to build on Medicare in order to expand insurance coverage and reduce health care costs, and improve financial protections and lower out-of-pocket costs for people currently covered by Medicare. More than 60 million people ages 65 and older and younger people with long-term disabilities currently rely on Medicare to help cover their costs for health care services, including hospitalizations, physician visits, prescription drugs, and post-acute care. However, Medicare beneficiaries face out-of-pocket costs for their insurance premiums, cost sharing for Medicare-covered services, and costs for services that are not covered by Medicare, such as dental care and long-term services and supports.

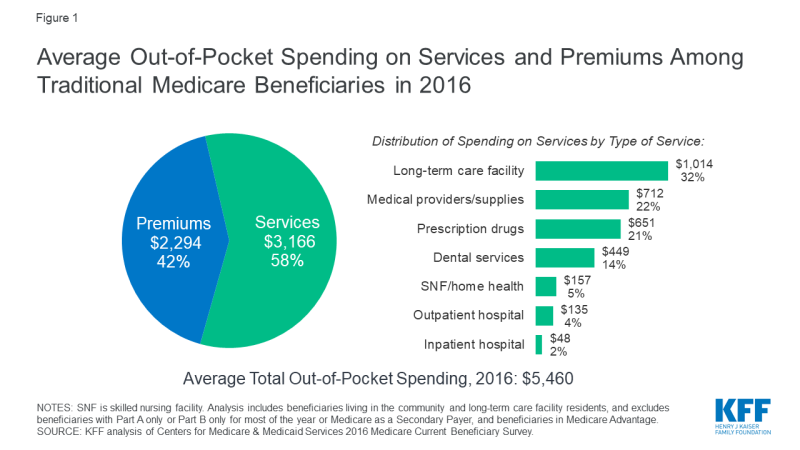

In 2016, the average person with Medicare coverage spent $5,460 out of their own pocket for health care (Figure 1). This average includes spending by community residents and beneficiaries residing in long-term care facilities (5% of all beneficiaries in traditional Medicare). Among community residents alone, average out-of-pocket spending on premiums and health care services was $4,519 in 2016. But some groups of beneficiaries spent substantially more than others. Current Medicare-for-all proposals in Congress and from presidential candidates would largely eliminate out-of-pocket costs for premiums and patient cost sharing, including for people now covered under Medicare.

Figure 1: Average Out-of-Pocket Spending on Services and Premiums Among Traditional Medicare Beneficiaries in 2016

This analysis presents the most current data on out-of-pocket health care spending by Medicare beneficiaries, both overall and among different groups of beneficiaries. The analysis addresses three main questions:

- How much do Medicare beneficiaries spend out of pocket in total on health care premiums and health-related services, on average?

- How much do Medicare beneficiaries spend out of pocket on different types of health-related services?

- What share of income do Medicare beneficiaries spend on out-of-pocket health care costs?

The analysis is based on the most current year of out-of-pocket spending data available (2016) from the Medicare Current Beneficiary Survey (MCBS), a nationally representative survey of Medicare beneficiaries. The analysis includes beneficiaries living in the community and long-term care facility residents, and excludes beneficiaries enrolled in Medicare Advantage due to unverified reporting of events and spending for these beneficiaries in the MCBS. (See Methodology for details). All results presented in the text are statistically significant (see Appendix to access a downloadable table of results).

How much do Medicare beneficiaries spend out of pocket in total on premiums and services?

The graphic below shows how much the average person with traditional Medicare spent out of pocket for health care in 2016. Total out-of-pocket spending includes spending on medical and long-term care facility services and insurance premiums, with comparisons across different groups of beneficiaries.

Average Out-of-Pocket Health Care Spending by Traditional Medicare Beneficiaries in 2016

Average total out-of-pocket spending varies considerably across different groups of beneficiaries.

- The oldest beneficiaries in traditional Medicare, people ages 85 and older, spent more than twice as much out of pocket as beneficiaries between the ages of 65 and 74 ($10,307 versus $5,021). This difference was primarily due to significantly higher spending on long-term care facility services among beneficiaries in the oldest age group.

- Out-of-pocket spending by women in traditional Medicare was higher than out-of-pocket spending by men ($5,748 versus $5,104).

- Beneficiaries in poorer self-reported health, those with multiple chronic conditions, and those with any inpatient hospital utilization faced higher out-of-pocket costs than the average traditional Medicare beneficiary. For instance, beneficiaries with at least one inpatient stay in 2016 spent $7,613 out of pocket, on average, compared to $5,044 among those without an inpatient stay.

- Beneficiaries with no supplemental insurance spent more out of pocket than beneficiaries with some type of supplemental coverage. In 2016, nearly one in five (6.1 million) Medicare beneficiaries did not have any source of supplemental coverage, which placed them at greater risk of incurring high medical expenses. People without any source of supplemental coverage were also more likely to have modest incomes and be ages 85 or older. Out-of-pocket spending averaged $7,473 among beneficiaries with no supplemental coverage in 2016, compared to $5,202 among beneficiaries with employer-sponsored coverage, who also tend to have higher incomes, higher education levels, and are disproportionately white. Beneficiaries with Medicaid, however, incurred the lowest average out-of-pocket costs in 2016 ($2,665) compared to those with other coverage types or none whatsoever. Higher out-of-pocket spending among those with no supplemental coverage is due to higher spending on health-related services, because supplemental coverage helps Medicare beneficiaries pay their out-of-pocket costs for Medicare-covered services. For example, beneficiaries with employer-sponsored coverage spent $2,476 on health-related services in 2016, on average, while those with no supplemental coverage spent $5,776.

How much do Medicare beneficiaries spend out of pocket on different types of health-related services?

The graphic below shows average out-of-pocket spending for specific health and long-term care services by traditional Medicare beneficiaries in 2016, with comparisons across different groups of beneficiaries.

Average Out-of-Pocket Health Care Spending by Traditional Medicare Beneficiaries in 2016, by Type of Service

Of the total average per capita spending on health and long-term care services in 2016 ($3,166), Medicare beneficiaries spent the most on long-term care (LTC) facility services, which are not covered by Medicare ($1,014, or 32% of average out-of-pocket spending on services), followed by medical providers and supplies ($712; 22%), prescription drugs ($651; 21%), and dental services ($449; 14%). These estimates are averaged across all traditional Medicare beneficiaries including users and non-users of each service; average spending among users would be higher than the averages presented here.

Average out-of-pocket spending by service varies across different groups of beneficiaries. For example:

- Not surprisingly, beneficiaries living in long-term care facilities (5% of traditional Medicare beneficiaries overall) spent significantly more on LTC services than the average beneficiary in traditional Medicare in 2016 ($19,632 versus $1,014). Out-of-pocket spending was much higher among LTC facility residents who did not have Medicaid ($41,782), which is the primary source of public support for long-term care. Out-of-pocket spending on long-term care facility services was also higher among beneficiaries with certain types of chronic conditions, in particular, Alzheimer’s disease or other dementia ($9,565 on average; $27,308 among LTC residents only) and Parkinson’s disease ($4,120 on average; $28,165 among LTC residents only)—as these beneficiaries are more likely to reside in a long-term care facility than those with other conditions. Notably, these estimates of out-of-pocket spending on long-term care facility services are lower than the median estimated annual cost of a private room in a long-term care facility, which was $92,000 in 2016. One reason for the discrepancy is that the average out-of-pocket spending estimates from the MCBS include beneficiaries who resided in a LTC facility for less than a full year.

- Average spending on prescription drugs was higher for beneficiaries with multiple chronic conditions and those in relatively poor self-reported health status. In 2016, traditional Medicare beneficiaries with five or more chronic conditions spent $1,065 on prescription drugs, on average, compared to $416 among those with one or two chronic conditions; those in poor self-reported health spent $1,018 on drugs compared to $410 among those in excellent self-reported health. In a separate analysis of the out-of-pocket cost burden for specialty drugs, we found that out-of-pocket drug costs for Part D enrollees taking medications for selected conditions, including cancer, hepatitis C, multiple sclerosis, and rheumatoid arthritis, can exceed thousands of dollars annually on a single medication.

- In 2016, traditional Medicare beneficiaries spent an average of $449 out of pocket on dental services, which are typically not covered by Medicare. Out-of-pocket spending on dental care increased with income, likely because higher-income beneficiaries are better able to afford dental services, while those with lower incomes are more likely to go without needed dental care due to costs.

What share of income do Medicare beneficiaries spend on out-of-pocket health care costs?

The graphic below shows out-of-pocket spending on health-related services as a share of total per capita income, at the median, with comparisons across different subgroups of beneficiaries.

Median Out-of-Pocket Spending as a Share of Income for Traditional Medicare Beneficiaries in 2016

The median out-of-pocket health care spending burden varies by beneficiary subgroups. For example:

- The financial burden of health care as a share of income falls disproportionately on lower-income Medicare beneficiaries. Half of traditional Medicare beneficiaries with incomes below $10,000 spent at least 18% of their total per capita income on health care costs in 2016, compared to 7% for those with incomes of $40,000 or more. Having Medicaid coverage, however, significantly reduces the out-of-pocket spending burden among low-income beneficiaries. Beneficiaries with Medicaid spent just 5% of their total income on out-of-pocket health care costs in 2016.

- Medicare beneficiaries in older age groups face a higher out-of-pocket spending burden than younger beneficiaries. Half of traditional Medicare beneficiaries ages 85 and older spent at least 16% of their total income on out-of-pocket health care costs in 2016, compared to 12% among those ages 65 to 74.

- People with multiple chronic conditions or in poorer health spend more on health care out-of-pocket than those in better health. For example, beneficiaries with five or more chronic conditions spent 14% of their income on out-of-pocket health care costs in 2016, compared to 8% among those with zero conditions. Those with any inpatient hospital stay in 2016 spent 17% of their income on out-of-pocket health care costs, compared to 11% among those without a hospital stay that year.

Discussion

In 2016, people with traditional Medicare spent an average of $5,460 out of pocket for health care expenses, including premiums, cost sharing, and costs for services not covered by Medicare. Half of all traditional Medicare beneficiaries spent at least 12% of their total per capita income on health care. Although Medicare has helped make health care more affordable for people with Medicare, many beneficiaries face high out-of-pocket costs for care they receive, including costs for services that are not covered by Medicare—in particular, long-term care services. Some groups of beneficiaries face substantially higher out-of-pocket costs than others, including women, those ages 85 and over, those who are in poorer self-reported health and who have multiple chronic conditions, and those with no supplemental coverage.

The fact that traditional Medicare does not have an annual out-of-pocket limit and does not cover certain services that older adults are more likely to need may undermine the financial security that Medicare provides, especially for people with significant needs and limited incomes. Addressing these gaps would help to alleviate the financial burden of health care for people with Medicare, although doing so would also increase federal spending and taxes.

Juliette Cubanski, Wyatt Koma, and Tricia Neuman are with KFF.

Anthony Damico is an independent consultant.