2021 Employer Health Benefits Survey

Section 13: Employer Practices, Telehealth and Employer Responses to the Pandemic

Employers frequently review and modify their health plans to incorporate new options or adapt to new circumstances. We continue to monitor new options, such as telemedicine, and ask about changes in the health or policy environments.

This year employers continue to deal with the coronavirus pandemic, with the accompanying economic and social disruptions and the uncertainty about when “normality” may return. For many employers, this means that some or even all of their employees began the year working remotely, with no clear guidance about when that may change. The approval and rapid dissemination of vaccines for coronavirus provide hope that the worst parts of the pandemic may be in the past, although low levels of vaccinations in some parts of the country (and throughout much of the world) and the emergence of new and more dangerous variants are reasons to remain cautious about new outbreaks.

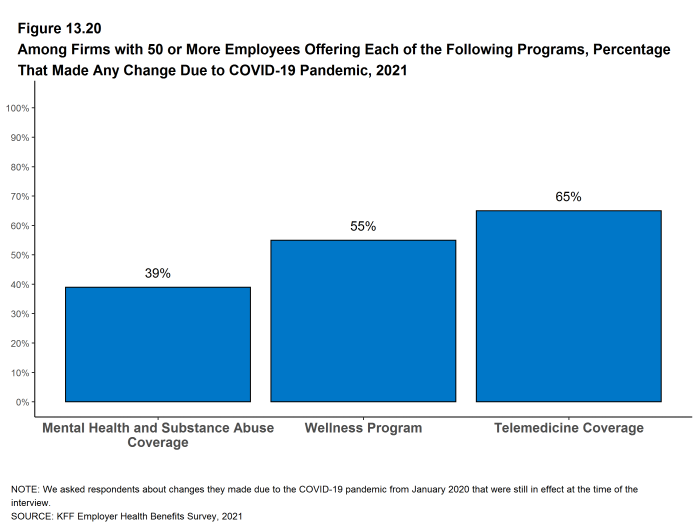

We modified the 2021 survey to gather information about changes that employers may have made to their health benefits in response to COVID-19. Two issues, in particular, that received attention over the last year are telemedicine and mental health. Telemedicine proved to be an important source of access to care, particularly during the early months of the pandemic as people sheltered at home and avoided public places, including physician offices and health facilities. The compound stresses from social isolation and economic and health uncertainties challenged many families, focusing attention on the adequacy of mental health supports.

The share of employers covering health services through telemedicine continued to grow in 2021. In addition, many employers made changes in their telemedicine benefits after the COVID-19 pandemic began to broaden coverage or make the benefit easier to use. Many employers also made changes in their mental health coverage to make it easier for employees to access services.

SHOPPING FOR HEALTH COVERAGE

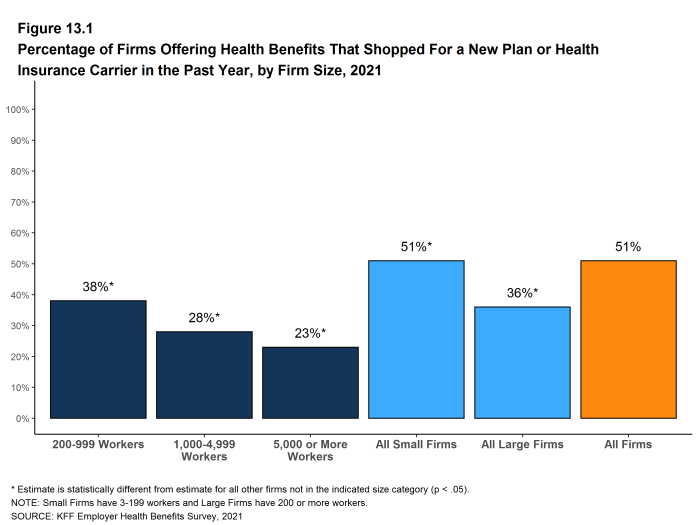

Fifty-one percent of firms offering health benefits reported shopping for a new health plan or a new insurance carrier in the past year, similar to the percentage last year. The likelihood that a firm reported shopping for a new health plans or carrier decreased with firm size. [Figure 13.1].

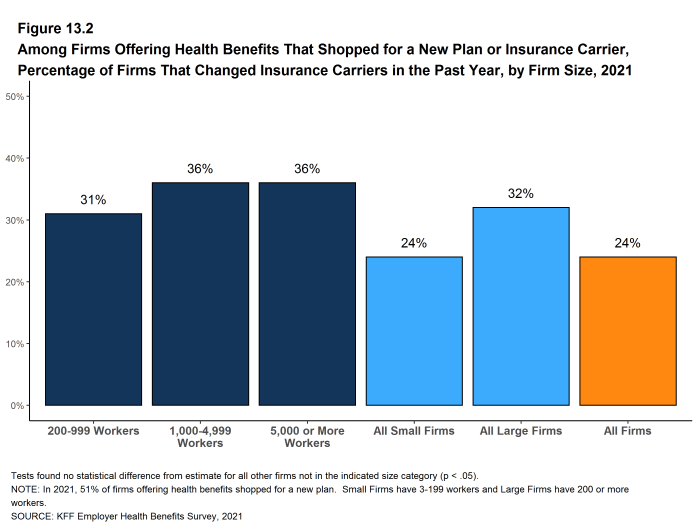

- Among firms that offer health benefits and who shopped for a new plan or carrier in the past year, 24% changed insurance carriers [Figure 13.2].

Figure 13.1: Percentage of Firms Offering Health Benefits That Shopped for a New Plan or Health Insurance Carrier in the Past Year, by Firm Size, 2021

TELEMEDICINE

While telemedicine was becoming an increasingly popular benefit prior to the COVID-19 pandemic, its use skyrocketed during the pandemic as people sheltered at home and refrained from seeking non-emergency health care. Both state and federal policymakers took steps to reduce regulatory barriers to the provision of telemedicine services, while employers and insurers also took steps to make it easier for patients to use them. We expanded the telemedicine questions on the survey for 2021 to ask about changes employers made to their telemedicine benefits after the beginning the COVID-19 pandemic.

We define telemedicine as the delivery of health care services through telecommunications to a patient from a provider who is at a remote location, including video chat and remote monitoring. This generally does not include the mere exchange of information via email, exclusively web-based resources, or online information that a plan may make available unless a health professional provides information specific to the enrollee’s condition. We note that during the coronavirus pandemic, some plans have eased their definitions to allow more types of digital communication to be reimbursed.

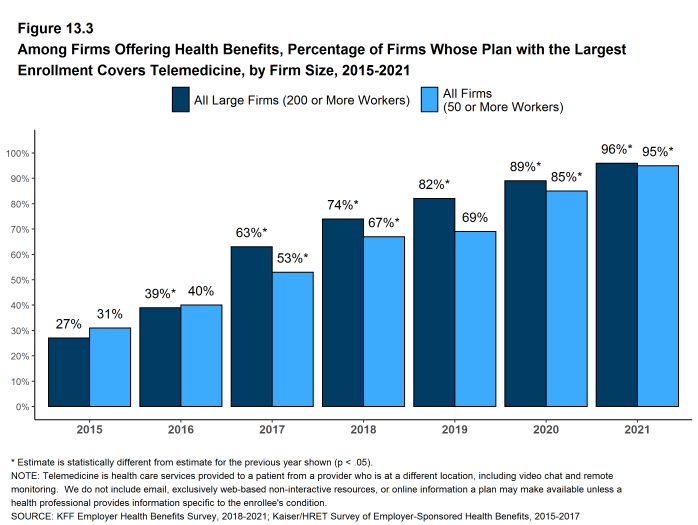

- Ninety-five percent of firms with 50 or more workers that offer health benefits cover the provision of some health care services through telemedicine in their largest health plan, higher than the percentage (85%) in 2020 [Figure 13.3].

- The percentages of small firms (50-199 workers) and large firms reporting that they cover services through telemedicine are much higher than they were three years ago (94% v. 65% for small firms and 96% v. 74% for large firms) [Figure 13.3].

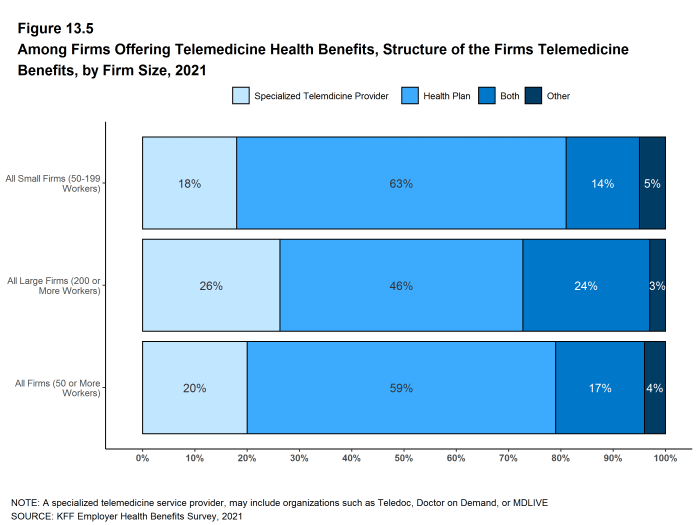

- Among firms with 50 or more employees offering telemedicine services, 20% offer telemedicine services through a specialized telemedicine service provider, such as Teledoc, Doctor on Demand, OR MDLIVE, 59% offer services through their health plan, 17% offer services through both a specialized telemedicine provider and their health plan, and 4% provide services through some other arrangement [Figure 13.5].

- Small firms are more likely than larger firms to provide telemedicine services only through their health plan (63% v. 46%) while large firms are more likely than smaller firms to provide telemedicine services through both a specialized telemedicine provider and their health plan (24% v. 14%) [Figure 13.5].

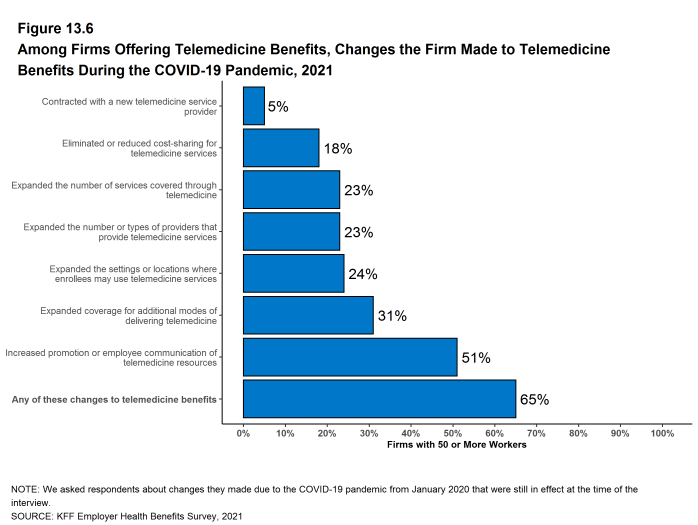

- As noted above, telemedicine has became an important source of health care services during the COVID-19 pandemic. Employers with 50 or more employees offering telemedicine services were asked about changes they made to their programs after the beginning the COVID-19 pandemic [Section 13.6]. Among these firms:

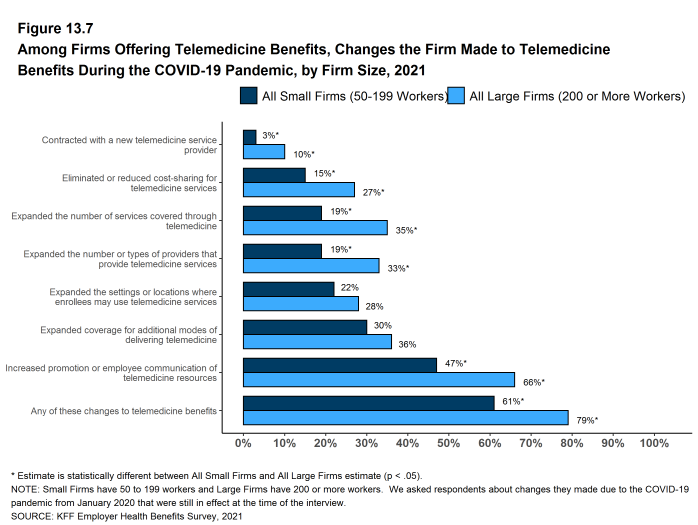

- Nineteen percent of smaller employers and 35% of large employers expanded the number of services covered through telemedicine [Section 13.7].

- Nineteen percent of smaller employers and 33% of large employers expanded the number or type of providers that could provide telemedicine services [Section 13.7].

- Fifteen percent of smaller employers and 27% of large employers reduced or eliminated cost sharing for telemedicine services [Section 13.7].

- Twenty-four percent of employers expanded the settings or locations where enrollees may use telemedicine services [Section 13.6].

- Thirty-one percent of employers expanded coverage for additional modes of delivering telemedicine, such as by telephone [Section 13.6].

- Three percent of smaller employers and 10% contracted with a new telemedicine service provider, such as a specialized telemedicine vendor [Section 13.7].

- Forty-seven percent of smaller employers and 66% of large employers increased promotion or employee communication of telemedicine resources [Section 13.7].

- Nineteen percent of smaller employers and 35% of large employers expanded the number of services covered through telemedicine [Section 13.7].

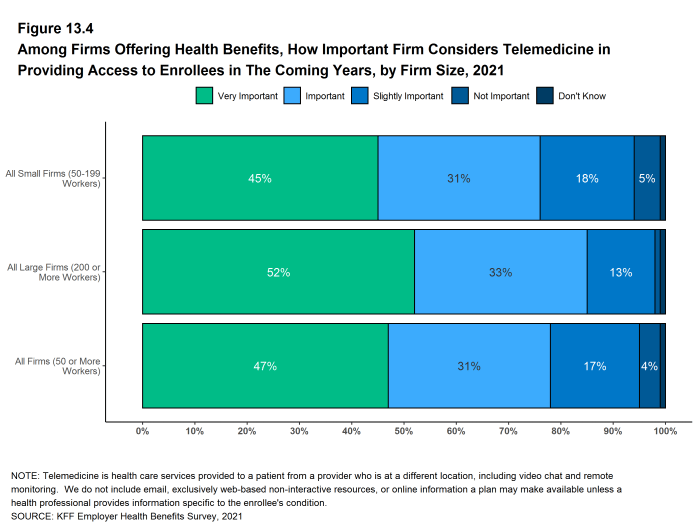

- Employers with 50 or more employees offering telemedicine services were asked how important they felt telemedicine would be in providing their employees with access to health care in the coming years. Almost half of these employers (47% felt telemedicine would be very important in providing access in the future, while only 4% said that telemedicine would be unimportant in providing access in the future [Figure 13.4].

Figure 13.3: Among Firms Offering Health Benefits, Percentage of Firms Whose Plan With the Largest Enrollment Covers Telemedicine, by Firm Size, 2015-2021

Figure 13.4: Among Firms Offering Health Benefits, How Important Firm Considers Telemedicine in Providing Access to Enrollees in the Coming Years, by Firm Size, 2021

Figure 13.5: Among Firms Offering Telemedicine Health Benefits, Structure of the Firms Telemedicine Benefits, by Firm Size, 2021

Figure 13.6: Among Firms Offering Telemedicine Benefits, Changes the Firm Made to Telemedicine Benefits During the COVID-19 Pandemic, 2021

COVID-19 IMPACTS AND POLICIES

The COVID-19 pandemic and the associated social and financial disruptions have challenged employers in many ways. Employers have made changes to their employment policies and to their health plans, and have seen changes in enrollment and utilization of plan services.

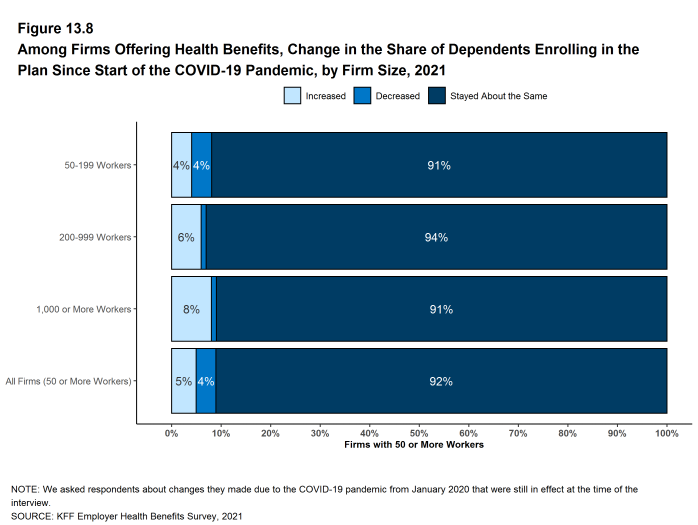

Enrollment of Dependents. Only small shares of employers say that they saw an increase or decrease in the share of dependents enrolling in their health plans after the start of the COVID-19 pandemic. Among firms with 50 or more employees offering health benefits to dependents, 5% said that the share of dependents enrolling in their health plans increased, 4% said that the share of dependents enrolling in their health plans decreased, and 92% said that the share remained about the same. Small firms were more likely than large firms to say that the share of dependents in their health plan decreased [Figure 13.8].

Figure 13.8: Among Firms Offering Health Benefits, Change in the Share of Dependents Enrolling in the Plan Since Start of the COVID-19 Pandemic, by Firm Size, 2021

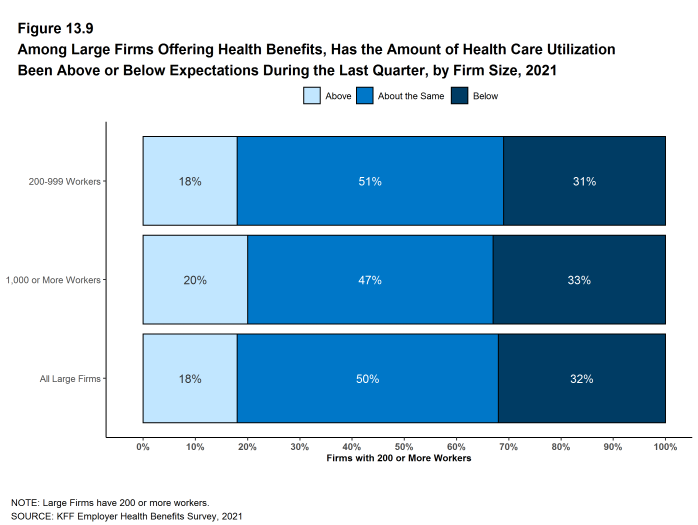

Health Service Use. As was widely reported, the use of health care services fell significantly during 2020 as people sheltered at home and avoided health care settings. Entering into 2021, some of the questions for employers involved whether, and if so by how much, service use might rebound. We asked large employers (200 or more employees) offering health benefits how the level of service use in their health plans during the most recent quarter matched their expectations. Eighteen percent of these employers say that the level of service use in the last quarter was higher than expected, 50% say that the level was about what they expected, and 32% say that the level was below the level that they expected [Figure 13.9].

Figure 13.9: Among Large Firms Offering Health Benefits, Has the Amount of Health Care Utilization Been Above or Below Expectations During the Last Quarter, by Firm Size, 2021

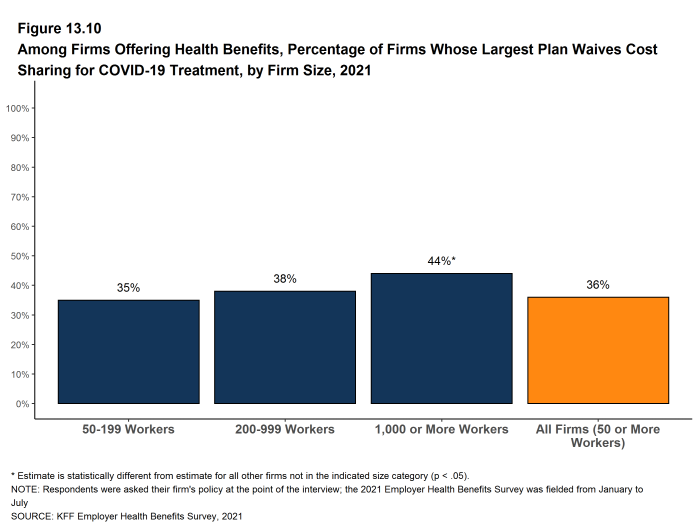

Cost Sharing for COVID Treatment. Many employers and health plans waived cost sharing last year for their enrollees who became infected with COVID-19. Employers with 50 or more employees were asked if they currently waive cost sharing for COVID-19 treatment.

- Thirty-five percent of employers with 50 to 199 workers and 45% of employers with 5,000 or more workers currently waive cost sharing for treatment of employees infected with COVID-19. Firms with 1,000 or more employees are more likely to waive cost sharing for COVID-19 treatment than smaller firms [Figure 13.10].

Figure 13.10: Among Firms Offering Health Benefits, Percentage of Firms Whose Largest Plan Waives Cost Sharing for COVID-19 Treatment, by Firm Size, 2021

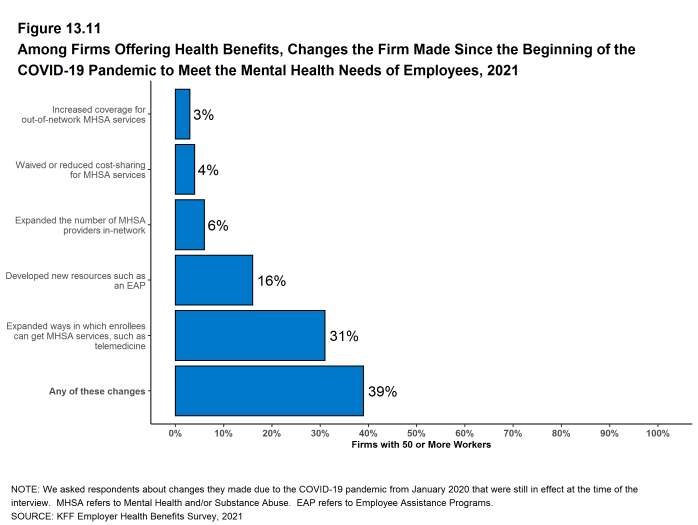

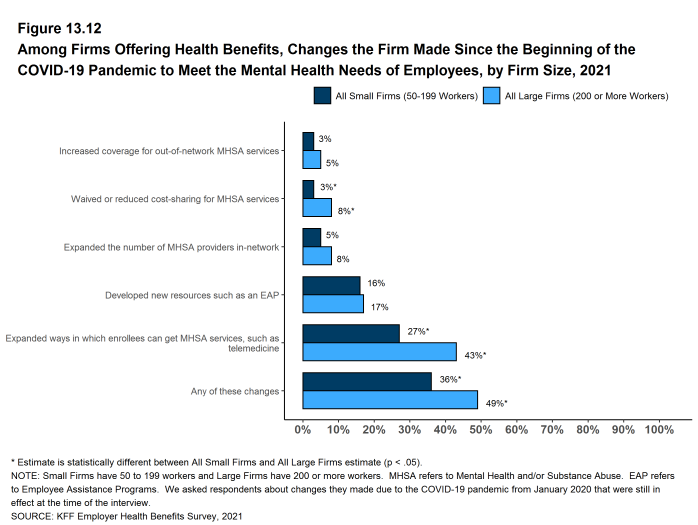

Mental and Behavioral Health. The COVID-19 pandemic and the accompanying social and economic disruptions have placed an unprecedented level of stress on people all over the world. Many employers took steps to assist employees and family members facing these stresses, such as providing information on assistance and resources that they make available through their health plans and employee assistance programs or by creating new programs to support employees and family members needing assistance.

- Employers with at least 50 employees offering health benefits were asked about changes they made to their health plans after the start of the COVID-19 pandemic to support the mental health of their employees. Sixteen percent of employers developed new resources, such as an employee assistance program [Figure 13.11].

- Three percent of employers increased coverage for out-of-network mental health or substance abuse services. Firms with 1,000 or more employees were more likely than smaller firms (50 to 199 employees) to increase coverage for out-of-network services (9% v. 3%) [Figure 13.11].

- Six percent of employers, including (16% of employers with 5,000 or more employees, expanded the number of mental health or substance abuse providers in their plans’ networks [Figure 13.11].

- Four percent of employers waived or reduced cost-sharing for mental health or substance abuse services. The percentage of firms waiving or reducing cost sharing for these services increased with firm size [Figure 13.11].

- Thirty-one percent of employers expanded the ways through which enrollees could get mental health or substance abuse services, such as through telemedicine. The percentage of firms expanding the methods of access for these services increased with firm size [Figure 13.11].

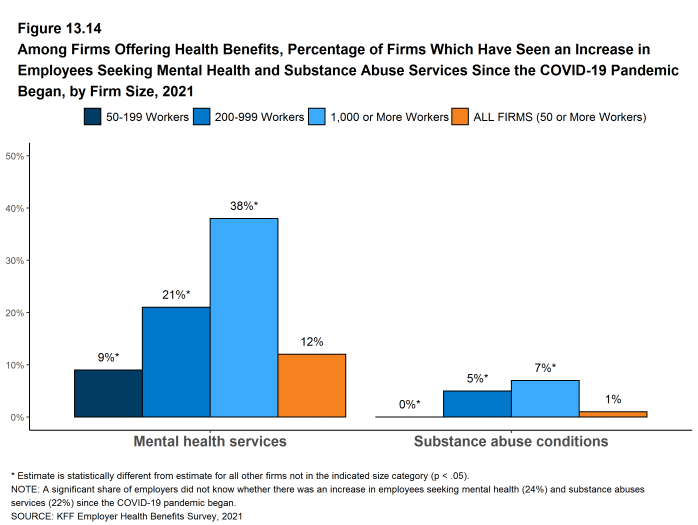

- Twelve percent of employers with at least 50 employees offering health benefits reported seeing an increase in the share of employees using mental health services since the COVID-19 pandemic began. This percentage increases with firm size, with 46% of firms with 5,000 or more employees seeing such an increase. We note that the percentage if firms reporting “don’t know” to this question is relatively high (24%) [Figure 13.14].

- A much smaller share of these employers (1%) reported seeing an increase in the share of employees using services for substance-abuse-related conditions since the COVID-19 pandemic began. This percentage increases with firm size, with 11% of firms with 5,000 or more employees seeing the share increase. We note that the percentage if firms reporting “don’t know” to this question is relatively high (22%) [Figure 13.14].

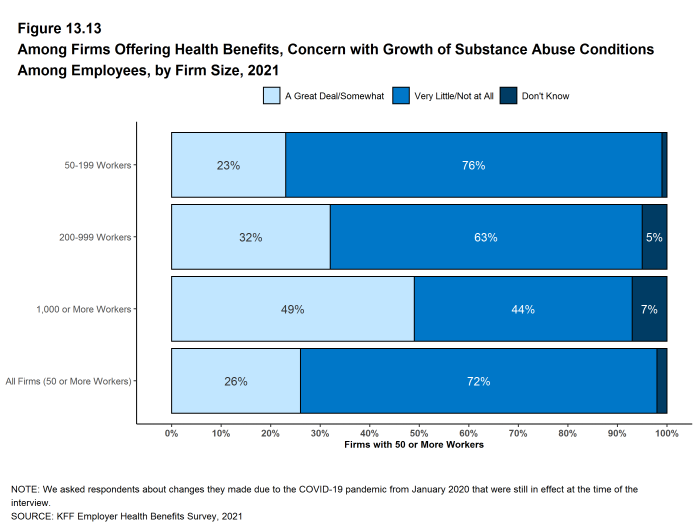

- Despite the lower percentage of employers reporting that they saw an increase in the share of employees using services for substance-abuse-related conditions, there is concern among employers that substance abuse has grown among their employees since the COVID-19 pandemic began. Twenty-six percent of employers, including 59% of firms with 5,000 or more workers, say that they are concerned “a great deal” or are “somewhat” concerned that substance abuse conditions have increased among their employees [Figure 13.13].

Figure 13.11: Among Firms Offering Health Benefits, Changes the Firm Made Since the Beginning of the COVID-19 Pandemic to Meet the Mental Health Needs of Employees, 2021

Figure 13.12: Among Firms Offering Health Benefits, Changes the Firm Made Since the Beginning of the COVID-19 Pandemic to Meet the Mental Health Needs of Employees, by Firm Size, 2021

Figure 13.13: Among Firms Offering Health Benefits, Concern With Growth of Substance Abuse Conditions Among Employees, by Firm Size, 2021

PRIVATE EXCHANGES

A private exchange is a virtual market that allows employers to provide their workers with a choice of several different health benefit options, often including voluntary or ancillary benefits options. Private exchanges generally are created by consulting firms, insurers, or brokers, and are different than the public exchanges run by the states or the federal government. There is considerable variation in the types of exchanges currently offered: some exchanges allow workers to choose between multiple plans offered by the same carrier while in other cases multiple carriers participate. Private exchanges have been operating for several years, but enrollment remains modest.

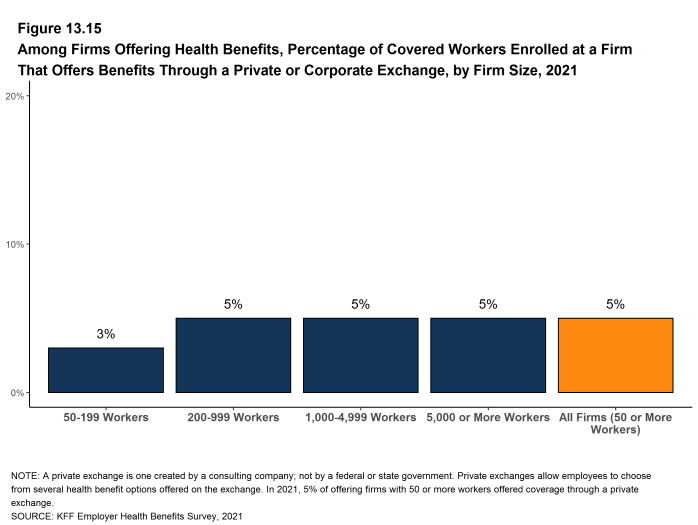

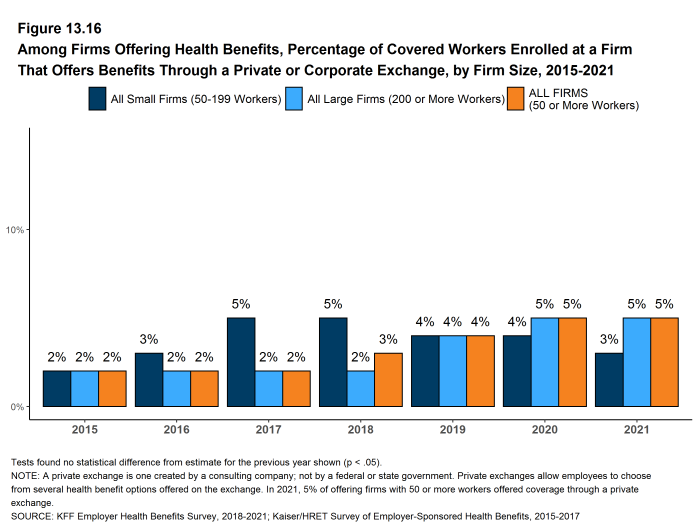

- Five percent of firms offering health benefits with 50 or more workers offer coverage through a private exchange. These firms provide coverage to 5% of covered workers in firms with 50 or more workers. These percentages are similar to those in the past few years.

Figure 13.15: Among Firms Offering Health Benefits, Percentage of Covered Workers Enrolled at a Firm That Offers Benefits Through a Private or Corporate Exchange, by Firm Size, 2021

HEALTH CARE PRICE TRANSPARENCY

New federal rules will require health plans (including self-funded plans) to make information available to enrollees about the estimated cost of services and cost-sharing on a “real-time” basis. Large employers (200 or more employees) were asked about the potential effectiveness and burdens of these new transparency requirements.

- Among large employers offering health benefits, 26% say that providing employees with additional information about the cost of services will help their health care decision making “a great deal” and an additional 50% say that it will help their decision making “somewhat” [Figure 13.17].

- Among large employers offering health benefits, 8% say that implementing the new transparency rules would involved “a great deal” of difficulty and an additional 45% say that it will be “somewhat” difficult [Figure 13.17]. Among firms with 5,000 or more employees, 21% say that implementing the new transparency rules would involved “a great deal” of difficulty.

- Among large employers offering health benefits, only 3% say that the new transparency rules will reduce health spending “a great deal”, while 15% say that they will be reduce health spending “not at all.” Thirty-eight percent of these firms say that the new rules will reduce spending “somewhat” and 40% say that they will reduce spending “very little” [Figure 13.17].

PRESCRIPTION DRUG MANAGEMENT

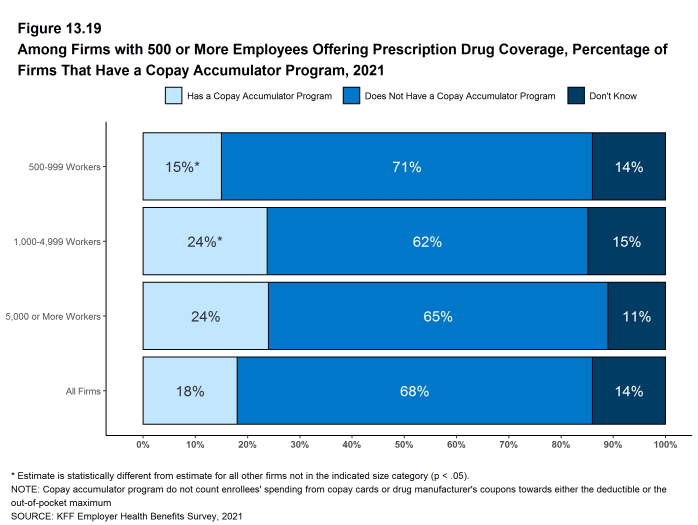

Employers, health plans and their prescription benefit managers continue to add new features to manage the costs of prescription drugs. This year we included questions for larger employers (500 or more workers) about programs that exclude the value of pharmaceutical manufacturer subsidies (e.g., coupons) when determining if deductibles or out-of-pocket limits are met and programs that delay formulary placement for certain high-cost medications until they are proven effective.

- Among employers with 500 or more employees offering prescription drug benefits in 2021, 13% have made a change to their prescription program in the last two years to delay the inclusion of new high-cost drug therapies until the therapy is proven effective. A fairly large share of employers with 500 or more workers (21%) did not know if they had made such a change to their programs [Figure 13.18].

- Among employers with 500 or more employees offering prescription drug benefits in 2021, 18% have a programs that excludes subsidies from prescription drug manufacturers, such as coupons, from counting towards an enrollee’s deductible or out-of-pocket limit. About the same share of employers with 500 or more workers (14%) did not know if their programs included this feature [Figure 13.19].

Figure 13.18: Among Firms With 500 or More Employees Offering Drug Benefits, Percentage of Firms That Changed Their Formulary Over the Last Two Years to Delay the Inclusion of New High-Cost Drug Therapies Until They Are Proven Effective, 2021

Figure 13.19: Among Firms With 500 or More Employees Offering Prescription Drug Coverage, Percentage of Firms That Have a Copay Accumulator Program, 2021