The HPV Vaccine: Access and Use in the U.S.

Note: This factsheet was updated on October 08, 2024 to incorporate new data on HPV vaccine utilization.The human papillomavirus (HPV) vaccine is the first and only vaccination that helps protect individuals from getting several cancers that are associated with different HPV strains. The vaccine protects young people against infection from certain strains of HPV, the most common sexually transmitted infection (STI) in the United States. Since HPV vaccines were first introduced in the U.S. in 2006, there have been changes in the range of protection they offer and the dosing regimen. The vaccines were originally recommended only for girls and young women and were subsequently broadened to include boys, young men, and people of all genders. This factsheet discusses HPV and related cancers, use of the HPV vaccines for both females and males, and insurance coverage and access to the vaccines.

HPV and Cancer

HPV is the most common STI in the U.S. and is often acquired soon after initiating sexual activity. Approximately 42.5 million Americans are infected with HPV and there are at least 13 million new infections annually. There are more than 200 known strains of HPV, and while most cases of HPV infection usually resolve on their own, persistent infection with high-risk strains can cause cancer. HPV-related cancers have increased significantly in the past two decades — between 2015 and 2019, over 47,000 people in the United States developed an HPV-related cancer compared to 30,000 in 1999. While HPV-related cervical and vaginal cancer rates have decreased since 1999, rates for oropharyngeal and anal HPV-related cancers have increased.

Cervical Cancer

HPV is related to over 90% of cervical cancer cases, with two strains (16 and 18) responsible for approximately 66% of cervical cancer cases worldwide. In the U.S., it is estimated that 13,820 new cervical cancer cases will be diagnosed in 2024. While cervical cancer is usually treatable, especially when detected early, approximately 4,360 deaths from cervical cancer will occur in 2024. Current guidelines by the U.S. Preventive Services Task Force (USPSTF) and Women’s Preventive Services Initiative (WPSI) recommend that most women ages 21 to 65 receive Pap test once every three years and recommends that women over 30 get a high-risk HPV test every 5 years.

U.S. Preventive Services Task Force Cervical Cancer Screening Recommendation

The USPSTF recommends screening for cervical cancer in women age 21 to 29 years with cytology (pap smear) every 3 years, and for women 30 to 65 a screening with cytology alone every 3 years, or a high risk human papillomavirus (hrHPV) test every 5 years, or cytology in combination with a hrHPV every 5 years.

Despite widespread availability of Pap testing, racial disparities in cervical cancer incidence and mortality rates persist in the U.S. For example, although Hispanic women have the highest incidence rate of cervical cancer, their cervical cancer mortality rates are comparable to the national mortality rate. Black women, on the other hand, have the third highest incidence rate of cervical cancer, yet have the highest mortality rates of the disease (Figure 1). One notable paradox is that Black women also have the highest rates of recent Pap testing. In 2022, 64% of Black women ages 18 to 64 reported having received a Pap smear in the past two years compared to 59% of White women, 60% of Hispanic women, and 57% of Asian women. Lower rates in follow-up treatment after an abnormal pap smear, differences in treatment options, diagnosis at later stages of disease progression, and distrust in the medical system may account for some of the disproportionate impact of cervical cancer on Black women.

More than half of cervical cancer cases are detected in women who have never been screened or have not been screened as frequently as recommended in guidelines. Higher shares of Hispanic and Black women have never been screened for cervical cancer compared to White women (14% and 12% percent, respectively, compared to 6% of White women). Additionally, Hispanic women have one of the highest uninsured rates in the country (20%) compared to 6% of White women and 10% of Black women. Compared to women with insurance, uninsured women and women with Medicaid were less likely to access preventive health services such as Pap tests in 2022.

Cervical cancer screening rates declined during the early part of the COVID-19 pandemic. While cervical cancer screening rates have rebounded to a degree, they have not returned to pre-pandemic levels. A KFF survey of OBGYNs found that 71% of physicians reported that it was difficult to provide preventive reproductive health care services, like STI and cervical cancer screenings, during the COVID-19 pandemic. In that same survey, 38% of OBGYNs said they were somewhat or very worried that their patients who experienced delays in following up on abnormal pap smears because of the pandemic would face negative health care consequences.

In May 2024, the U.S. Food and Drug Administration (FDA) approved the use of HPV self-collection methods in healthcare settings, though these methods are not yet widely available. Self-collection will allow women to collect a vaginal swab sample within a healthcare facility without having to see a gynecologist. However, they would not replace screening with pap tests or traditional HPV testing; rather, they would provide patients with a more private, comfortable, and convenient option to test for cervical cancer as well as improve earlier detection of the disease. Currently, the National Cancer Institute is conducting a study to gauge the usability, acceptability, and effectiveness of self-collection methods throughout the United States.

Oropharyngeal and Anal Cancers

Approximately 20,805 cases of oropharyngeal (throat) cancer occur annually in the U.S, most of which (70%) are probably caused by HPV. Oropharyngeal cancers are the most common HPV-associated cancer among men and are more common among men than women (Figure 2). However, it’s important to note that anyone who heavily uses both tobacco and alcohol is at much higher risk of developing these cancers. Research suggests that HPV vaccines can help protect against throat cancer, since many are associated with HPV 16 and 18, two of the strains that the vaccine protects against.

HPV is also responsible for the majority (91%) of the over 7,500 annual cases of anal cancer in the U.S. Most cases of anal cancer are among women (Figure 2), but men who have sex with men are also at higher risk of HPV strains 16 and 18. Additional risk factors for anal cancer include a history of cervical cancer and having a suppressed immune system. Like oropharyngeal cancer, there has been an increase in the rate of anal cancers in the past 15 years.

HPV Vaccines

Since 2016, Gardasil®9 is the only HPV vaccine available in the U.S. The HPV vaccine, as well as all other routine vaccines, may be administered on the same day as any of the COVID-19 vaccines.

The FDA approved first-generation Gardasil®—produced by Merck—in 2006, which prevented infection of four strains of HPV: 6, 11, 16, and 18. In December 2014, Gardasil®9 was approved by the FDA. This vaccine protects against 9 strains of HPV: the four strains approved in the previous Gardasil vaccine, as well as 31, 33, 45, 52, and 58. These strains are associated with the majority of cervical cancer, anal cancer, and throat cancer cases as well as most genital warts cases and some other HPV-associated ano-genital diseases. The vaccine was initially approved for cervical cancer prevention, but in 2020 the FDA broadened its approval to include the prevention of oropharyngeal cancer and other head and neck cancers.

Gardasil®9 has been approved by the FDA for use in individuals ages nine to 45 years (Table 1). The federal Advisory Committee on Immunization Practices (ACIP)—an independent body of experts that issues immunization recommendations for the U.S. population—recommends that all girls and boys get vaccinated at age 11 or 12, or as early as age nine, and that adolescents and young adults ages 13 to 26 be given a “catch-up” vaccination series. ACIP recommends a two-dose series over 6 to 12 months for individuals who received their first vaccine at ages nine to 14. Teens and young adults who initiate vaccination at age 15 or older should receive three doses over six months. These recommendations are designed to promote immunization when the vaccine is most effective – before the initiation of sexual activity. Those already infected with HPV can also benefit from the vaccine because it can prevent infection against HPV strains they may not have contracted, but the vaccine does not treat existing HPV infections.

While the FDA expanded it’s approval of the HPV vaccine to include adults ages 27 to 45, ACIP does not recommend routine catch-up vaccinations for all adults in this age group. ACIP recommends that adults ages 27 to 45 who have not been properly vaccinated and who may be at risk for new HPV infections consult with a medical professional about receiving the vaccine.

Current global research suggests Gardasil®9 protection is long-lasting: more than 10 years of follow-up data in both boys and girls indicate the vaccines are still effective and there is no evidence of waning protection, although it is still unknown if recipients will need a booster in the future. Other HPV vaccines show similar effectiveness. In Scotland, recipients of the bivalent HPV vaccine Cervarix®—which protects against HPV 16 and 18—who became fully vaccinated against HPV at age 12 or 13 have had no cases of cervical cancer since the vaccine program started in 2008. Additionally, new data from the American Society of Clinical Oncology shows that the vaccine reduced the risk of all HPV-associated cancers—including oropharyngeal, head, and neck cancers—by 50% in men.

Outreach and Utilization

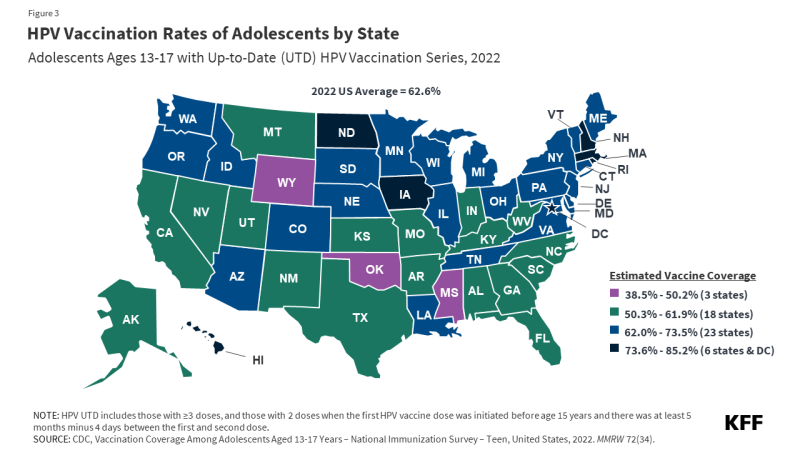

HPV vaccination rates vary by state, from a low of 39% of adolescents being HPV UTD in Mississippi to a high of 85% in Rhode Island (Figure 3). Some states, such as Hawaii, Rhode Island, Virginia, and D.C., have laws that require HPV vaccination for school entry. In California, the Cancer Prevention Act requires schools to notify families of 6th grade children about HPV vaccine recommendations and advise them to follow guidelines but does not require them to adhere to them for school entry. Vaccine exemptions due to religious or personal beliefs are permitted in most states.

Some people begin the vaccine series but do not complete it. In 2023, 78.5% of adolescent girls and 75% of boys received at least one dose of the HPV vaccine. Trends in vaccination coverage show that overall HPV vaccination initiation slightly declined in 2022 for the first time since 2013 among some subgroups of adolescents aged 13-17. While vaccine initiation among adolescents overall remained steady, initiation rates in 2022 decreased among adolescents who were uninsured or covered by Medicaid (Figure 4).

Data from the Vaccines for Children Program (VFC), a federally-funded program that covers the cost of ACIP-recommended vaccines for eligible populations through age 18, show that, compared to 2019, VFC provider orders for the HPV vaccine decreased from 2020 to 2022. Research suggests that the COVID-19 pandemic disrupted the delivery and administration of the HPV vaccine, as well as parents’ and patients’ abilities to attend well-child visits before vaccines became overdue, resulting in lower rates of vaccination.

Vaccine hesitancy during this time may have also contributed to the decline in HPV vaccine initiation. Prior to the COVID-19 pandemic, parents’ top reasons for not vaccinating their children were perceptions of safety concerns and the belief that the vaccine was not needed. Since the COVID-19 pandemic began, some providers have observed an increase in vaccine hesitancy or refusal in parents of adolescents due to difficulties caused by COVID-19 or mistrust in vaccines.

Compared to 2022, national HPV UTD rates among adolescents aged 13-17 remained steady in 2023, with just over 60% being up-to-date. HPV vaccination rates among teen boys are lower than for girls (59% vs. 64% HPV UTD in 2023), but they have been rapidly rising since 2016. Although HPV UTD rates in adolescents overall has remained steady, recent data shows a decline in vaccination rates by birth year. Compared to 13-year-olds born in 2007, HPV UTD coverage in 13-year-olds born in 2010 decreased by 7.1% overall and 10.3% among those eligible for the VFC program. The Centers for Disease Control and Prevention (CDC) suggest that additional outreach focused on populations that experienced declines in vaccination is needed to further understand the impact of the COVID-19 pandemic on access to and initiation of recommended vaccines.

Vaccine Financing

There are multiple sources of private and public financing that assure that nearly all children and young adults in the U.S. have coverage for the HPV vaccine. Many of the financing entities base their coverage on ACIP recommendations.

The Affordable Care Act (ACA) requires public and private insurance plans to cover a range of recommended preventive services and ACIP recommended immunizations without consumer cost-sharing. Plans must cover the full charge for the HPV vaccine, as well as pap tests and HPV testing for women.

Public Financing

Vaccines for Children — Through the VFC program, the CDC purchases vaccines at a discounted rate and distributes them to participating healthcare providers. All children are eligible through age 18 if they are uninsured, underinsured, Medicaid-eligible, Medicaid-enrolled, or American Indian or Alaska Native.

Medicaid — Medicaid covers ACIP recommended vaccines for enrolled individuals under age 21 through the Early and Periodic Screening Diagnosis and Treatment program (EPSDT). Adults 21 and older who are insured through Medicaid are covered for approved adult ACIP-recommended vaccinations without cost-sharing.

Public Health Service Act — Section 317 of the Public Health Service Act provides grants to states and local agencies to help extend the availability of vaccines to uninsured adults in the United States. These are often directed towards meeting the needs of priority populations, such as underinsured children and uninsured adults.

Merck Vaccine Patient Assistance Program — Merck has established assistance programs to provide free vaccines in the United States. To qualify, individuals must be aged 19 or older, uninsured, and low-income.

Children’s Health Insurance Program (CHIP) — Children who qualify for CHIP are part of families whose incomes are too high to qualify for Medicaid but too low to afford private insurance. Each state has its own set of specific qualifications for CHIP. The program is managed by the states and is jointly funded by the states and the federal government. CHIP programs that are separate from the Medicaid Expansion must cover ACIP-recommended vaccines for beneficiaries since they are not eligible for coverage under the federal VFC.

The HPV vaccine has been available in the U.S. for nearly two decades and uptake has risen over that time, though more recently since the COVID-19 pandemic there have been notable declines in vaccination rates. Since its introduction in 2006, the vaccine covers more strains of HPV, its use has been extended to males, the dosage has dropped from three to two shots, and the cost is fully covered by private insurance and public programs. With these improvements, the vaccine holds the promise to safely and dramatically reduce the rates of and prevent many kinds of cancers that have long been responsible for the deaths of women and men.