What Percent of New Medicare Beneficiaries Are Enrolling in Medicare Advantage?

People new to Medicare can receive their Medicare benefits through either traditional Medicare or private plans, such as HMOs or PPOs, known as Medicare Advantage plans. Older adults and younger beneficiaries with disabilities have said that they make this choice based on premiums and out-of-pocket costs, access to desired providers, the reputation of the company offering the plan, ads and other marketing materials, and the advice of brokers, family members and friends.1 Medicare Advantage offers one-stop shopping, with all Medicare benefits in one combined package, and enrollees may have lower out-of-pocket costs than those in traditional Medicare, with an out-of-pocket cap and coverage of some additional benefits, such as eyeglasses. Beneficiaries in traditional Medicare have open access to providers and fewer administrative hassles, such as prior authorization and referral requirements.2

One line of thinking has been that the Baby Boom Generation will enroll in Medicare Advantage plans over traditional Medicare at much higher rates than prior generations because they have had more experience with managed care during their working years. Our prior analysis found that, in 2011, nearly one in four people enrolled in Medicare Advantage plans during their first year on Medicare.3 This brief examines whether the rate has increased with more boomers aging onto Medicare, and whether these coverage decisions vary by geographic area and select characteristics. The analysis is based on a five percent sample of claims from 2010 to 2016.

Enrollment Rates

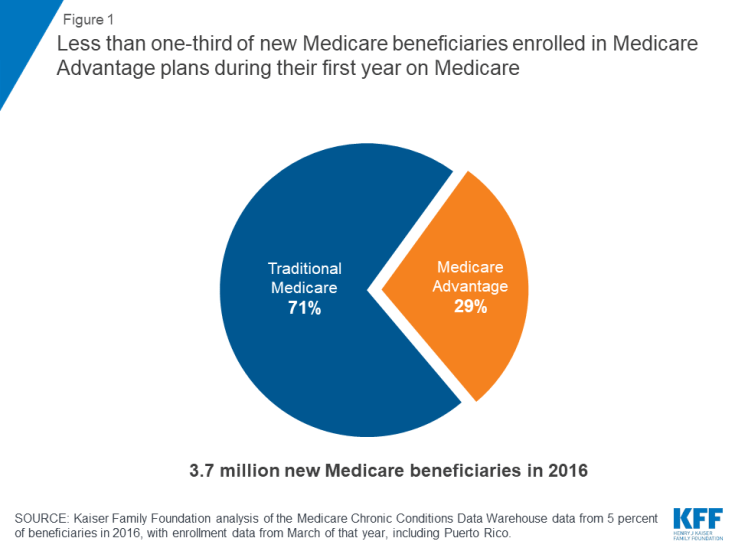

In 2016, Less than one-third (29 percent) of new beneficiaries enrolled in Medicare Advantage plans during their first year on Medicare, slightly more than the 23 percent observed in 2011, but far from a majority (Figure 1). Most new beneficiaries (71 percent) were covered under traditional Medicare for their first year on Medicare.

Figure 1: Less than one-third of new Medicare beneficiaries enrolled in Medicare Advantage plans during their first year on Medicare

Enrollment Rates, By Year

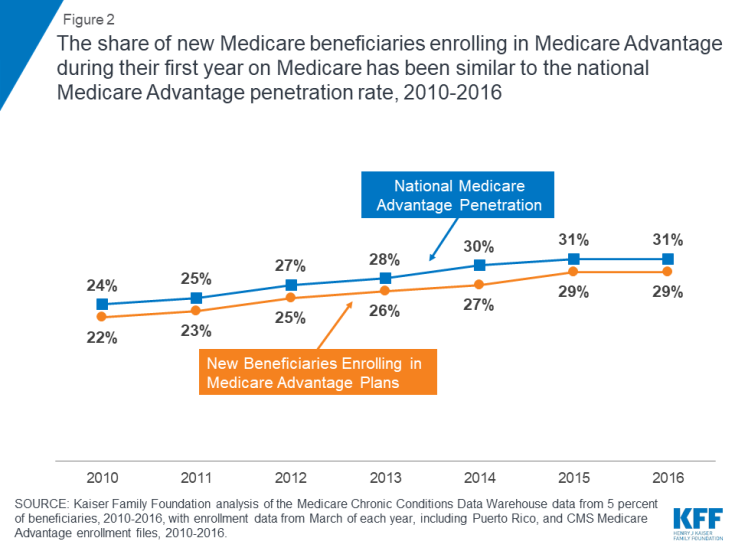

Enrollment in Medicare Advantage by new beneficiaries has tracked closely with the national Medicare Advantage penetration rate (Figure 2). In 2010, about 22 percent of new Medicare beneficiaries enrolled in Medicare Advantage plans, while that same year, a similar percentage of all Medicare beneficiaries (24 percent) enrolled in Medicare Advantage plans. More recently, in 2016, less than one-third of new Medicare beneficiaries (29 percent) enrolled in Medicare Advantage plans, which is similar to the national Medicare Advantage penetration rate among all Medicare beneficiaries that year (31 percent).

Figure 2: The share of new Medicare beneficiaries enrolling in Medicare Advantage during their first year on Medicare has been similar to the national Medicare Advantage penetration rate, 2010-2016

Enrollment Rates, By State

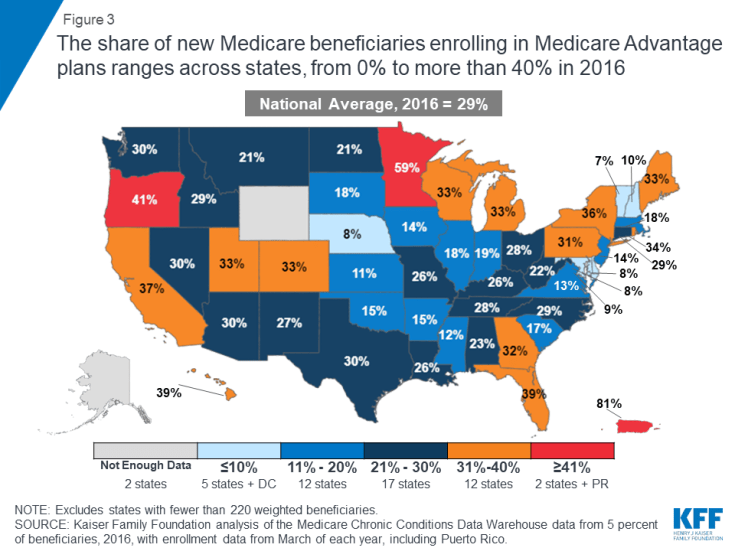

The share of new beneficiaries enrolling in Medicare Advantage plans during their first year on Medicare varies greatly across the country (Figure 3). In two states (Oregon and Minnesota) and Puerto Rico, more than 40 percent of new beneficiaries enrolled in Medicare Advantage in 2016. However in five states (Delaware, Maryland, Nebraska, New Hampshire, and Vermont) and the District of Columbia, less than 11 percent of new beneficiaries enrolled in Medicare Advantage plans, while the vast majority were instead choosing traditional Medicare when they first enrolled in Medicare.

Figure 3: The share of new Medicare beneficiaries enrolling in Medicare Advantage plans ranges across states, from 0% to more than 40% in 2016

Enrollment Rates Across Counties

The share of new beneficiaries that enrolled in Medicare Advantage plans also varied across counties. In counties as diverse as Atlantic, NJ (Atlantic City), Baltimore City, MD, Monterey, CA, and Shawnee, KS (Topeka), less than 11 percent of new beneficiaries enrolled in Medicare Advantage plans in 2016. In contrast, in counties such as Monroe, NY (Rochester), Miami-Dade, FL (Miami), Allegheny, PA (Pittsburgh), and Multnomah, OR (Portland), more than half of new beneficiaries enrolled in a Medicare Advantage plan during their first year on Medicare. Additionally, these large differences in Medicare Advantage enrollment among new beneficiaries may help explain why some believe most new beneficiaries are enrolling in Medicare Advantage, which is the case in a minority of counties.

Enrollment Rates, By Medicare Advantage Penetration in the County

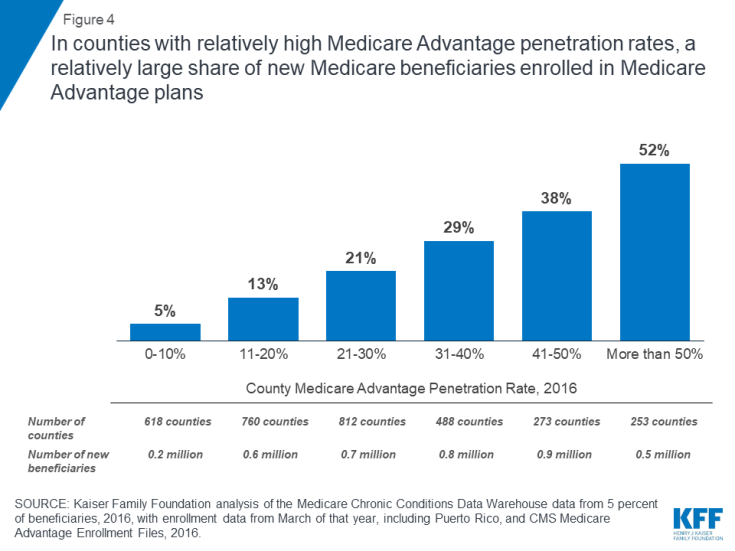

On average, the share of new beneficiaries enrolling in Medicare Advantage plans is higher in counties with higher Medicare Advantage penetration rates (Figure 4). In counties where more than half of all beneficiaries were enrolled in Medicare Advantage plans, 52 percent of new beneficiaries enrolled in Medicare Advantage plans, on average, in 2016. In contrast, in counties where 10 percent or fewer beneficiaries were enrolled in Medicare Advantage plans, only 5 percent of new beneficiaries enrolled in Medicare Advantage plans, on average.

Figure 4: In counties with relatively high Medicare Advantage penetration rates, a relatively large share of new Medicare beneficiaries enrolled in Medicare Advantage plans

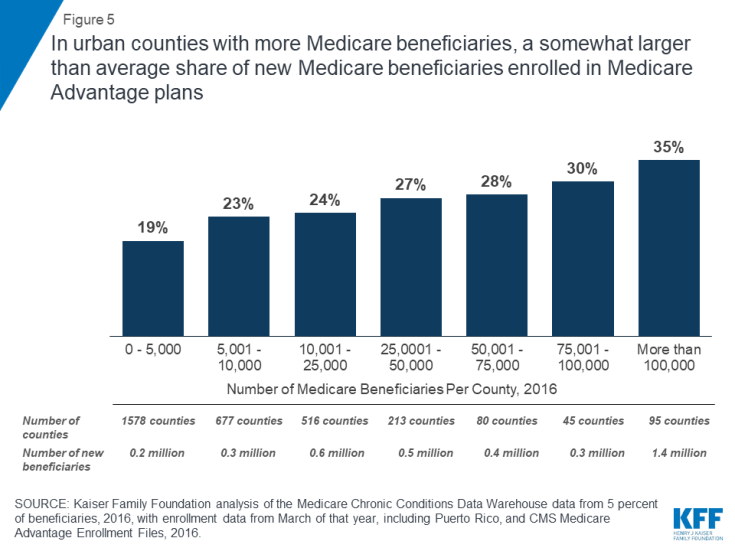

Enrollment rates, By Number Of Medicare Beneficiaries In The County

New beneficiaries enroll in Medicare Advantage plans at higher rates in areas with more Medicare beneficiaries (Figure 5). In counties with more than 100,000 Medicare beneficiaries, about one-third (35 percent) of new Medicare beneficiaries enrolled in Medicare Advantage plans, on average, in 2016. In smaller counties with 5,000 or fewer beneficiaries, about one-fifth (19 percent) of new beneficiaries enrolled in Medicare Advantage plans, on average.

Figure 5: In urban counties with more Medicare beneficiaries, a somewhat larger than average share of new Medicare beneficiaries enrolled in Medicare Advantage plans

Enrollment Rates Across Select Characteristics

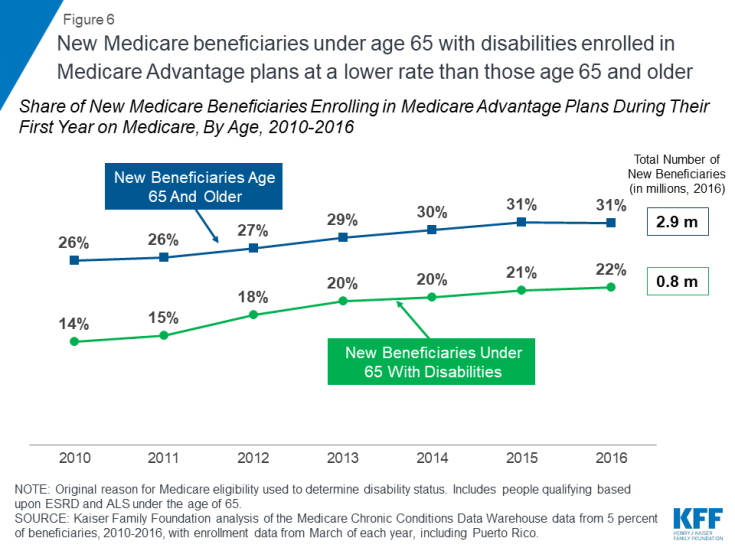

enrollment rates, BY AGE

People under the age of 65 who became eligible for Medicare because of a serious disability enrolled in Medicare Advantage plans at consistently lower rates than new beneficiaries who qualified for Medicare because they were age 65 or older (22 versus 31 percent, respectively, in 2016; Figure 6). It is not clear why younger beneficiaries with serious disabilities enroll in Medicare Advantage plans at lower rates than people ages 65 and older, but these findings warrant further attention.

Figure 6: New Medicare beneficiaries under age 65 with disabilities enrolled in Medicare Advantage plans at a lower rate than those age 65 and older

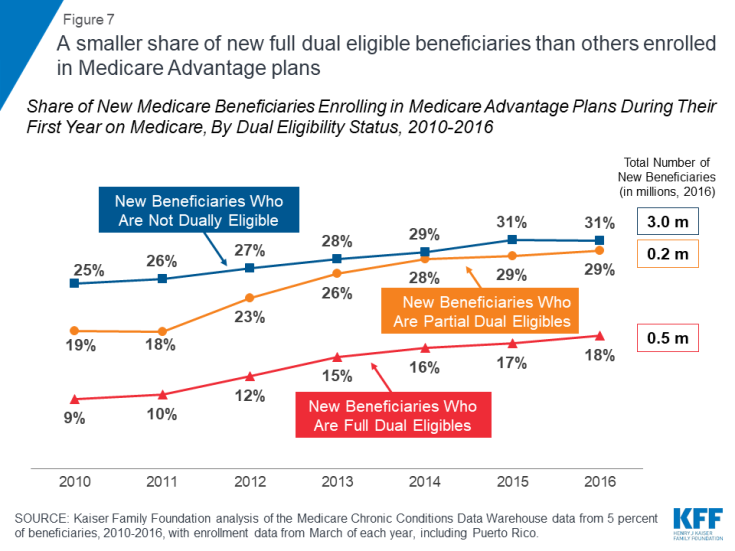

Enrollment rates, By Medicare-Medicaid Status

The Medicare Advantage enrollment rate among new beneficiaries who received full Medicaid benefits (“full dual eligibles”) was lower than among new beneficiaries not eligible for Medicaid in 2016 (18 percent versus 31 percent, respectively, Figure 7). New beneficiaries who receive partial Medicaid benefits (“partial dual eligibles”) opted into Medicare Advantage during their first year on Medicare at about the same rate as those who were not eligible for Medicaid. It is unclear why full dual eligibles are opting into Medicare Advantage plans at lower rates than others; it may be because they have significant health needs and are reluctant to join a plan with a limited provider network. Those who are less healthy may also be less attracted to plans’ extra benefits, such as gym memberships, and full dual eligibles may be less drawn to plans’ out-of-pocket limits if Medicaid is covering their cost-sharing requirements.

Figure 7: A smaller share of new full dual eligible beneficiaries than others enrolled in Medicare Advantage plans

Discussion

Less than one-third (29 percent) of new Medicare beneficiaries enrolled in Medicare Advantage plans during their first year on Medicare, a rate slightly lower than the national Medicare Advantage penetration rate in 2016. While the Congressional Budget Office is projecting a steady increase in Medicare Advantage enrollment, rising to 47 percent by 2029, even with an aging Baby Boom Generation, the majority of new beneficiaries are opting for traditional Medicare in the year they first go on Medicare. The relatively low enrollment rates among new beneficiaries with high needs may warrant further scrutiny. While Medicare Advantage enrollment among new beneficiaries is rising, these findings suggest that ongoing attention to traditional Medicare is needed to meet the needs of the lion’s share of the Medicare population.

Gretchen Jacobson, Tricia Neuman, and Meredith Freed are with KFF.

Anthony Damico is an independent consultant.

| Data and Methods

The brief uses claims data from a five percent sample of Medicare beneficiaries from the Master Beneficiary Summary Files of Chronic Conditions Data Warehouse of the Center for Medicare and Medicaid Services (CMS) for 2010 through 2016. The data was used in conjunction with the Medicare Advantage landscape file and enrollment file for each year. The analysis includes new beneficiaries residing in areas where no Medicare Advantage plans were available for individual enrollment, totaling about 30,000 new beneficiaries in 2016. The analysis was unable to exclude beneficiaries with retiree health coverage, who would likely use whichever coverage option, Medicare Advantage or traditional Medicare, their former employer or union would fund. The analysis included new beneficiaries who were automatically enrolled into Medicare-Medicaid demonstration plans in the denominator of Medicare Advantage enrollees because they did not make a voluntary choice. |