A View from the States: Key Medicaid Policy Changes: Results from a 50-State Medicaid Budget Survey for State Fiscal Years 2019 and 2020

Medicaid covers one in five Americans, accounts for one in six dollars spent on health care in the United States, and makes up more than half of all spending on long-term services and supports.1 Medicaid is a state budget driver as well as the largest source of federal revenue to states. The program is constantly evolving in response to federal policy changes, the economy, and state budget and policy priorities. As states began state fiscal year (FY) 2020, the economy in most states was strong. With fewer budget pressures, many states reported expansions or enhancements to provider rates and benefits. As several states implemented, adopted, or continued to debate the ACA Medicaid expansion, a number of states also continued to pursue work requirements and other policies promoted by the Trump administration that could restrict eligibility. Other key areas of focus highlighted in the report include Medicaid initiatives to address social determinants of health, control prescription drug spending, improve birth outcomes and reduce infant mortality, and address the opioid epidemic.

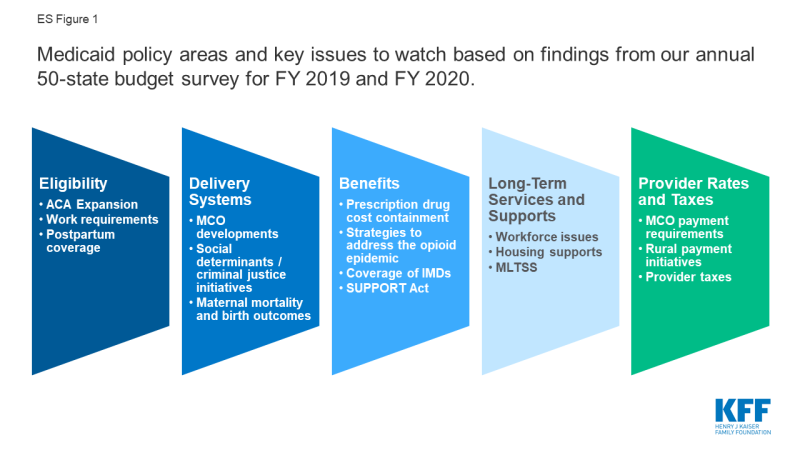

This report provides an in-depth examination of the changes taking place in Medicaid programs across the country. The findings are drawn from the 19th annual budget survey of Medicaid officials in all 50 states and the District of Columbia conducted by the Kaiser Family Foundation (KFF) and Health Management Associates (HMA), in collaboration with the National Association of Medicaid Directors (NAMD). This report highlights certain policies in place in state Medicaid programs in FY 2019 and policy changes implemented or planned for FY 2020. The District of Columbia is counted as a state for the purposes of this report. Given differences in the financing structure of their programs, the U.S. territories were not included in this analysis. Key findings from the report are pulled from five sections: eligibility, delivery systems, benefits, long-term services and supports, and provider rates and taxes. Each section highlights key issues to watch for future policy development (ES Figure 1).

ES Figure 1: Medicaid policy areas and key issues to watch based on findings from our annual 50-state budget survey for FY 2019 and FY 2020.

Eligibility & Premiums

Since 2014, most major eligibility policy changes have been related to adoption of the ACA Medicaid expansion. Maine and Virginia implemented the ACA Medicaid expansion in FY 2019, bringing the total number of states with the expansion in place to 34 as of July 2019. Three additional states have adopted the expansion but have not yet implemented it, including Idaho which plans to implement the ACA Medicaid expansion to 138% of the federal poverty level (FPL) in FY 2020. Most other Medicaid eligibility expansions for FY 2019 and FY 2020 were narrow and targeted to a limited number of beneficiaries. In contrast, eligibility restrictions implemented in FY 2019 (by 7 states) or planned for implementation in FY 2020 (by 6 states) generally target broader Medicaid populations including expansion adults and parents/caretakers. All states implementing or planning eligibility policies that are counted as restrictions in FY 2019 or FY 2020 are doing so through Section 1115 waiver authority, whereas most states implementing or planning eligibility expansions are doing so through state plan authority.

What to watch:

- Medicaid expansion. Utah and Nebraska adopted the Medicaid expansion through 2018 ballot initiatives but both states are pursuing waivers to implement the expansion with program elements that differ from what is allowed under federal law, leading to implementation delays. Idaho also adopted the Medicaid expansion through a 2018 ballot initiative but submitted a Section 1332 waiver seeking to make changes to the expansion. In August 2019, CMS rejected Idaho’s waiver request; the state will implement the Medicaid expansion to 138% FPL effective January 2020. Medicaid expansion debates are active in Kansas, Missouri, and North Carolina.

- Coverage for postpartum women. In FY 2020, three states are seeking waivers to extend coverage for postpartum women beyond the current statutory requirement of 60 days after delivery.

- Work requirements. An appeal is underway in the DC Circuit after the DC federal district court stopped implementation of Arkansas’ work and reporting requirement waiver in March 2019, and prohibited Kentucky’s waiver from going into effect in April as planned. In July 2019, the DC federal district court also set aside New Hampshire’s work requirement waiver, stopping the implementation of the work requirement. Litigation challenging Indiana’s work requirements was also recently filed in the same court. Work requirement waiver requests from six non-expansion states – which may have much lower levels of eligibility based on income for parents and do not cover childless adults – are now pending. The outcomes of these requests will have implications for other states seeking to adopt similar policies.

Delivery Systems

As of July 1, 2019, among the 40 states with comprehensive risk-based managed care organizations (MCOs), 33 states reported that 75% or more of their Medicaid beneficiaries were enrolled in MCOs. States continue to carve-in behavioral health services to MCO contracts and nearly all states have in place managed care quality initiatives like pay for performance or capitation withholds. Medicaid programs have been expanding their use of other service delivery and payment reform models to achieve better outcomes and lower costs. Forty-four states had one or more delivery system or payment reform initiatives in place in FY 2019 (most often patient centered medical homes or ACA Health Homes) with 14 states adding or expanding such reforms in FY 2020.

What to watch:

- MCO developments. North Carolina reported plans to implement a new MCO program in FY 2020. In FY 2019, 21 states set a target percentage of MCO provider payments or covered lives that must be in alternative payment models (APMs), three additional states plan to do so in FY 2020, and several states noted that their APM targets would increase in the future.

- Social determinants of health and criminal justice. Over three-quarters of the 41 MCO states as of FY 2020 (35 states) are leveraging MCO contracts to promote at least one strategy to address social determinants of health. Non-MCO states also report moving forward with initiatives to identify and address social determinants of health. States are also working with their MCO and corrections partners to coordinate care for justice-involved individuals prior to release with the goal of improving continuity of care and smoothing community transitions.

- Maternal mortality and birth outcomes. About two-thirds of states reported new or expanded Medicaid initiatives to improve birth outcomes and/or reduce maternal mortality in FY 2019 or FY 2020.

Benefits & Cost-Sharing

The number of states reporting benefit expansions (23 in FY 2019 and 28 in FY 2020) continues to significantly outpace the number of states reporting benefit restrictions (4 in FY 2019 and 2 in FY 2020). The most common benefit enhancements reported were for mental health/substance use disorder (SUD) services, but other service expansions include dental services, pregnancy and postpartum benefits, and diabetes prevention and care. Eleven states reported policies to eliminate or reduce a cost-sharing requirement for FY 2019 or FY 2020, compared to five states that reported new or increased cost-sharing requirements.

What to watch:

- Prescription drug cost containment. Twenty-four states in FY 2019 and 26 states in FY 2020 reported newly implementing or expanding at least one initiative to contain prescription drug costs. Strategies cited included efforts to address pharmacy benefit manager (PBM) transparency and the impact of spread pricing in managed care and implementation of new purchasing arrangements, including value-based contracts linking pharmacy reimbursement to patient outcomes. Some states reported unique models, including a modified subscription model for hepatitis C drugs in Louisiana and a drug spending cap in New York.

- Strategies to address the opioid epidemic. All states reported using pharmacy benefit management strategies (such as adoption of opioid prescribing guidelines prospective drug utilization review, prior authorization based on clinical criteria/step therapy, retrospective drug utilization review and state prescription drug monitoring programs (PDMP)) to prevent opioid-related harms. States also reported a variety of initiatives to expand access to medication-assisted treatment (MAT), including removing or relaxing prior authorization for MAT drugs.

- Institutions for Mental Disease (IMDs). In an effort to address the opioid epidemic as well as broader behavioral health issues, CMS and Congress have provided states additional flexibility to provide services in settings that would otherwise qualify as “institutions for mental disease,” or IMDs, and thus be ineligible for federal Medicaid funding. A large majority of states (43 states) reported they plan to use at least one of the flexibilities (MCO “in lieu of authority, Section 1115 waiver authority, or The Substance Use Disorder Prevention that Promotes Opioid Recovery and Treatment for Patients and Communities [SUPPORT Act] state plan option) to provide services in IMDs in FY 2020.

- SUPPORT Act. States are implementing new SUPPORT Act requirements including pharmacy benefit management strategies to reduce prescription opioid abuse and misuse and providing coverage for all FDA approved MAT drugs. Some states are also pursuing options such as enhanced matching funds for implementation of PDMPs or coverage of residential pediatric recovery centers (RPRC) for services provided to infants under age one with neonatal abstinence syndrome (NAS) and their families.

Long-Term Services and Supports

Nearly all states in FY 2019 (48 states) and in FY 2020 (47 states) are employing one or more strategies to expand the number of people served in home and community-based settings. Of these states, the vast majority report using home and community-based services (HCBS) waivers and/or state plan options (i.e., 1915(c), Section 1115, 1915(i), and 1915(k)) to serve more individuals in the community. As of July 1, 2019, 25 states covered LTSS through one or more capitated managed care arrangements, and another two states operated managed fee-for-service LTSS models.

What to watch:

- Workforce issues. States continue to work to address challenges finding and retaining LTSS direct care workers. Roughly half of states reported raising wages for direct care workers in FY 2019 and FY 2020, a notable increase from prior years. In addition, 15 states had direct care workforce development strategies (e.g., recruiting, training, credentialing) in place in FY 2019, and 10 states reported expanding (7 states) or implementing new workforce development strategies (3 states) in FY 2020.

- Housing supports. Housing supports remain an important component of state LTSS rebalancing efforts. Thirty-seven states offer housing-related supports, such as community transition services, case management, or transitional supports as part of their HCBS and Section 1115 waiver programs. States were set to phase out their Money Follows the Person (MFP) programs in federal FY 2020, but Congress provided additional funding for a short-term extension of the program; however, the uncertain future of MFP may place some of the initiatives funded through MFP at risk.

- Managed Long-Term Services and Supports (MLTSS). Several states will expand their MLTSS programs in FY 2019 and FY 2020. Pennsylvania is positioned to complete its statewide expansion of MLTSS in FY 2020, and several other states (Idaho, Illinois, and Tennessee) reported geographic or population expansions for FY 2020.

Provider Rates and Taxes

A strong economy and state revenue growth allowed most states to implement and plan more fee-for-service (FFS) provider rate increases for FY 2019 (50 states) and FY 2020 (45 states). This holds true across all major provider types. As more states increasingly rely on capitated managed care, however, FFS rate changes are a less meaningful measure of provider payment unless the state establishes MCO payment requirements. Nearly half of MCO states reported doing so: 19 states reported mandating minimum provider reimbursement rates in their MCO contracts for inpatient hospital, outpatient hospital, or primary care physicians and 17 states reported requiring MCOs to change provider payment rates in accordance with FFS payment rate changes for one or more of these provider types. As in prior years, all states except Alaska rely on provider taxes and fees to fund a portion of the non-federal share of the costs of Medicaid. Six states indicate plans for new provider taxes in FY 2020.

What to watch:

- Rural payment initiatives. About half of states reported at least one policy related to payment adjustments in place to promote access to rural hospitals or other rural providers.

- Provider taxes. With the addition of California in FY 2019, eight states reported that they have a provider tax on ground emergency medical transportation, or on ambulance providers.

Looking Ahead

While national attention on health care is focused on broader debates involving prescription drug pricing and the presidential candidates’ health plans, states continue to administer and make changes to Medicaid programs, adapting to state budget and policy priorities as well as new federal Medicaid options. When asked about key priorities for state Medicaid programs, over half of states reported that delivery system and payment reforms are a key priority. A number of states also pointed to developing and implementing demonstration waivers as well as controlling Medicaid costs as key areas of focus. States are also pursuing a broad range of policies to help address increased Medicaid demands associated with an aging population.

When asked about potential for Medicaid block grant waivers, only a limited number of states expressed interest in such an option, particularly since CMS guidance on such policies has not been released. When asked about potential challenges or opportunities related to federal or state-level coverage expansions such as Medicare-for-All, few states had assessed the implications for state Medicaid programs of these broader health reforms. At the time of the survey, litigation challenging the ACA was pending before the U.S. Court of Appeals for the 5th Circuit that could have complex and far-reaching consequences for Medicaid and the entire health care system if the ACA is overturned. Looking ahead, the trajectory of the economy, the direction of federal policies around Section 1115 Medicaid waivers, and the focus of the debate and attention to health care issues in the lead up to the November 2020 elections will also be factors that continue to shape Medicaid in FY 2020 and beyond.

Acknowledgements

Pulling together this report is a substantial effort, and the final product represents contributions from many people. The combined analytic team from the Kaiser Family Foundation and Health Management Associates (HMA) would like to thank the Medicaid directors and Medicaid staff in all 50 states and the District of Columbia. In a time of limited resources and challenging workloads, we truly appreciate the time and effort provided by these dedicated public servants to complete the survey, to participate in structured interviews, and to respond to our follow-up questions. Their work made this report possible. We also thank the leadership and staff at the National Association of Medicaid Directors (NAMD) for their collaboration on this survey. We offer special thanks to Jim McEvoy at HMA who developed and managed the survey database and whose work is invaluable to us.