The independent source for health policy research, polling, and news.

Average Family Premiums Rose 4% to $21,342 in 2020, Benchmark KFF Employer Health Benefit Survey Finds

Average Deductible Stands at $1,644, Unchanged in Past Year but Up Significantly Over Time

San Francisco – Annual family premiums for employer-sponsored health insurance rose 4% to average $21,342 this year, according to the 2020 benchmark KFF Employer Health Benefits Survey. On average, workers this year are contributing $5,588 toward the cost of family coverage, with employers paying the rest.

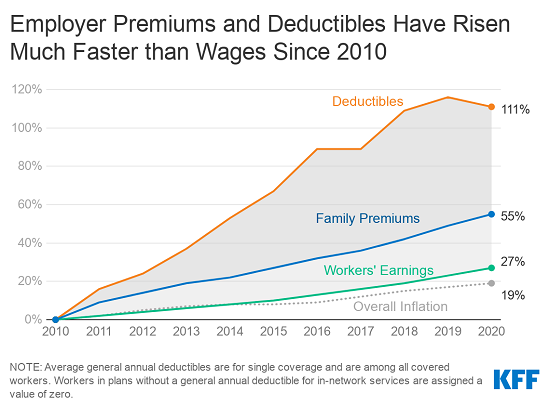

The survey was conducted from January to July as the COVID-19 pandemic and economic crisis unfolded and may not capture its full impact on costs and coverage. The annual change in premiums is similar to the year-to-year rise in workers’ earnings (3.4%) and inflation (2.1%), though over time what employers and workers pay toward premiums continues to rise more quickly than wages and inflation. Since 2010, average family premiums have increased 55%, at least twice as fast as wages (27%) and inflation (19%).

This year 83% of covered workers have a deductible in their plan, similar to last year and up from 70% a decade ago. The average single deductible stands at $1,644 for workers who have one, similar to last year’s $1,655 average but up sharply from the $917 average of a decade ago. These two trends result in a 111% increase in the burden of deductibles across all covered workers.

“Conducted partly before the pandemic, our survey shows the burden of health costs on workers remains high, though not getting dramatically worse,” KFF President and CEO Drew Altman said. “Things may look different moving forward as employers grapple with the economic and health upheaval sparked by the pandemic.”

About 157 million Americans rely on employer-sponsored coverage, and the 22nd annual survey of nearly 1,800 small and large employers provides a detailed picture of the trends affecting it. Plan details such as premiums and deductibles largely reflect decisions made by employers before they felt the full impact of the COVID-19 pandemic and economic crisis. Next year’s survey will provide the first full look at how the pandemic may have affected workers’ health benefits.

In addition to the full report and summary of findings released today, the journal Health Affairs is publishing an article online with select findings that will also appear in its November issue. KFF is also releasing an updated interactive graphic that charts the survey’s premium trends by firm size, industry, and other firm characteristics.

The survey finds a large majority (83%) of offering employers say they are satisfied with the overall choice of providers available through their insurance plans, though significantly fewer (67%) say the same about their mental health and substance abuse networks.

About one in five (19%) describe their mental health networks as somewhat or very narrow, potentially leaving workers with limited options at a time when worry and stress related to the pandemic is affecting many working Americans.

“The coronavirus pandemic has increased the need for access to mental and behavioral health services, for which the provider networks are often more narrow than for other services,” said Gary Claxton, a KFF senior vice president and director of the Health Care Marketplace Project, the lead author of the study and Health Affairs article. “Some plans have been able to increase access by supporting telehealth, though it’s unclear whether such options will become a permanent feature.”

Other survey findings include:

- Offer rate holds steady. The survey finds 56% of employers offer health benefits, largely unchanged over the past five years. The larger an employer is, the more likely it is to offer health benefits to at least some of its workers, with about half (53%) of firms with fewer than 50 workers and nearly all (99%) firms with at least 200 or more workers offering coverage.

- Out of pocket maximums. Virtually all covered workers are in plans with a limit on in-network cost sharing (called an out-of-pocket maximum) for single coverage. Those limits vary widely, with 11% of covered workers in plans with maximums of less than $2,000 and 18% of covered workers in plans with maximums of at least $6,000.

- Wellness programs. Most large firms (81%) offer at least one type of wellness or health promotion program. Among those that offer such a program, relatively few (11%) view the programs as very effective at reducing the firm’s health care costs.

Methodology

KFF conducted the annual employer survey between January and July of 2020, with about half of the interviews conducted before the full extent of the coronavirus pandemic had been felt by employers. It included 1,765 randomly selected, non-federal public and private firms with three or more employees that responded to the full survey. An additional 1,817 firms responded to a single question about offering coverage. For more information on the survey methodology, see the Survey Design and Methods Section.

ABOUT HEALTH AFFAIRS:

Health Affairs is the leading peer-reviewed journal at the intersection of health, health care, and policy. Published monthly by Project HOPE, the journal is available in print and online. Late-breaking content is also found through healthaffairs.org, Health Affairs Today, and Health Affairs Sunday Update.

Project HOPE is a global health and humanitarian relief organization that places power in the hands of local health care workers to save lives across the globe. Project HOPE has published Health Affairs since 1981.