Coverage Expansions and the Remaining Uninsured: A Look at California During Year One of ACA Implementation

How do people view their coverage?

People’s views of their plan may affect not only their use of their coverage but also the likelihood that they re-enroll in coverage or change plans. Survey results reveal that newly insured adults were very sensitive to cost in choosing their plan, placing a priority on cost over benefits and provider networks. A minority of all insured adults reported problems in selecting their plan or using their plan. However, newly insured adults were more likely than previously to say they do not understand the details of their plan and were more likely to give their plan a low rating. These findings indicate that additional education may be needed to help people understand their coverage.

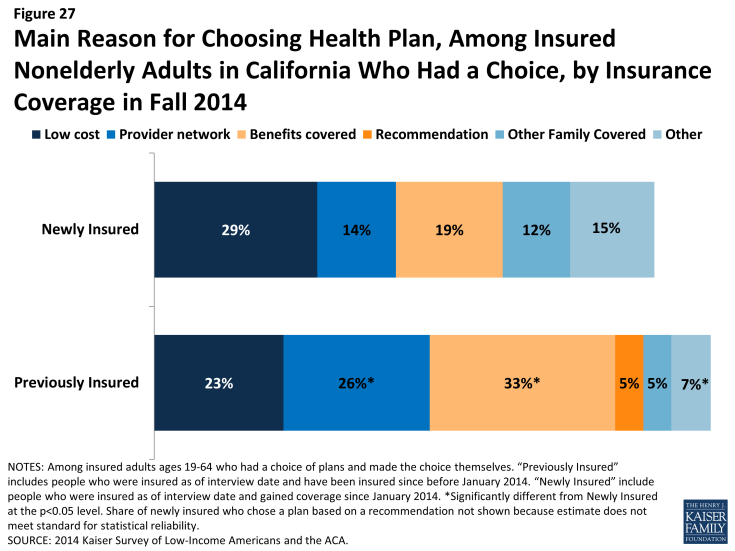

Newly insured adults were less likely to prioritize scope of coverage or provider networks in choosing their plan than previously insured adults. Among adults who say they had a choice of plans and made the choice themselves, less than a fifth (19%) of newly insured adults say they chose their plan because of the benefits covered, compared to 33% of previously insured adults, and only 14% say they chose their plan based on provider network (versus 26%) of previously insured. Newly insured adults were most likely to say they chose their plan because of low cost (29%); while this share was higher than the previously insured (23%), the difference was not statistically significant. Newly insured adults may have been less likely to choose based on benefits because new regulations set a minimum scope of coverage across new plans (so-called “essential health benefits”), but “grandfathered” pre-existing plans are not held to the same requirement. Alternatively, newly insured adults may be more sensitive to price than their previously insured counterparts, even with the availability of financial assistance for coverage.

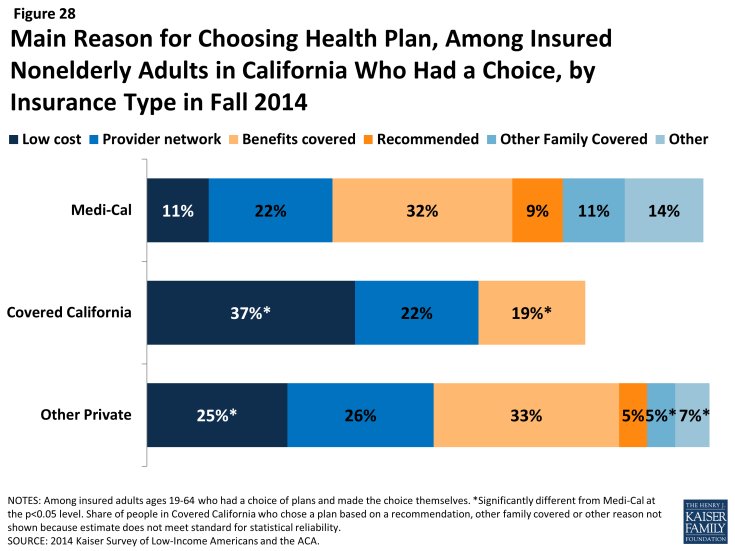

Price was a particularly important factor in choice of plans among Covered California enrollees, 37% of whom said they chose their plan because of cost (versus 11% of Medi-Cal and 25% of adults with private coverage). In Covered California, premiums varied by region, ZIP code, metal level and age, but benefits were standardized across plans.1 Compared to other coverage groups, Medi-Cal enrollees were less likely to choose a plan based on price and more likely to choose a plan based on other factors such as other family members being enrolled in the plan. In Medi-Cal, plan benefits are largely standardized. Further, enrollees face limited or no out-of-pocket costs for services, so the small share indicating that they chose based on price may indicate confusion about their plan.

Figure 27: Main Reason for Choosing Health Plan, Among Insured Nonelderly Adults in California Who Had a Choice, by Insurance Coverage in Fall 2014

Figure 28: Main Reason for Choosing Health Plan, Among Insured Nonelderly Adults in California Who Had a Choice, by Insurance Type in Fall 2014

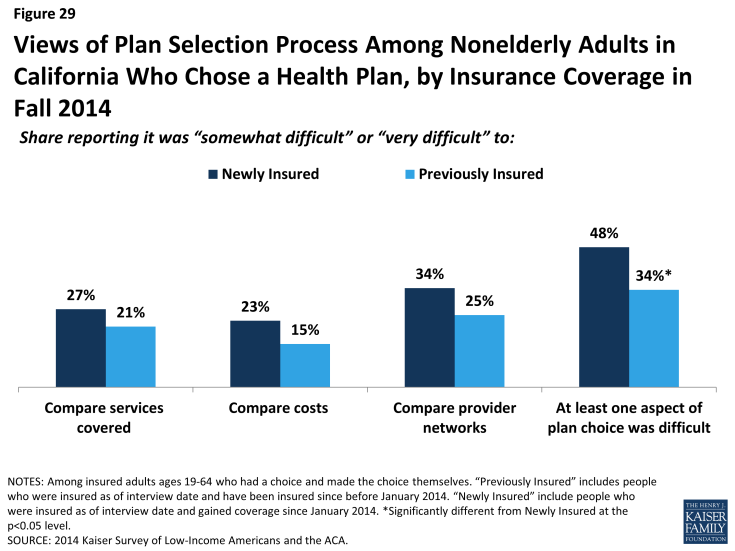

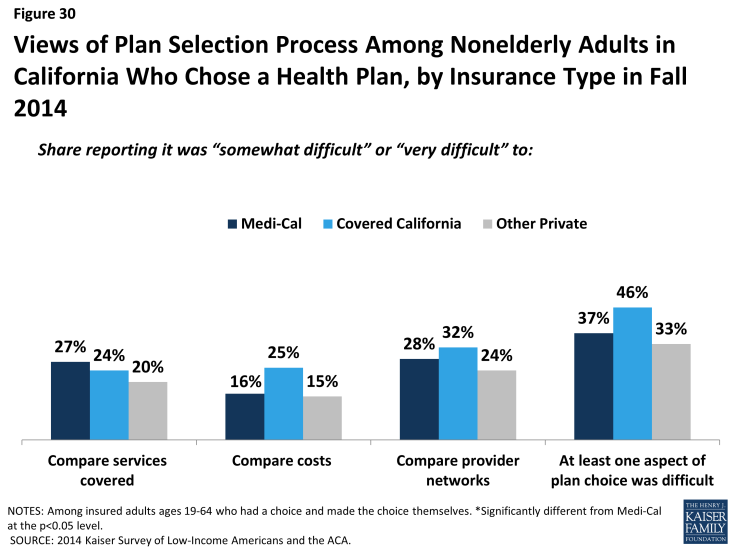

Across coverage groups, most insured adults did not report difficulty with the plan selection process. While rates of difficulty comparing services, costs, or provider networks across plans varied slightly by timing of coverage and coverage type, there were no significant differences across groups. Still, notable shares reported having difficulty with at least one aspect of plan choice, and the newly insured were more likely than the previously insured to report at least one difficulty (48% versus 34%). The most common difficulty across all coverage groups was comparing provider networks, a finding that echoes patterns nationwide. California, along with several other states, requires all participating Marketplace plans to offer standardized benefit designs, allowing consumers to accurately compare plans based on cost and network alone, since benefits are identical for all plans.2 In Medi-Cal, benefits and cost sharing are standardized across plans.

Figure 29: Views of Plan Selection Process Among Nonelderly Adults in California Who Chose a Health Plan, by Insurance Coverage in Fall 2014

Figure 30: Views of Plan Selection Process Among Nonelderly Adults in California Who Chose a Health Plan, by Insurance Type in Fall 2014

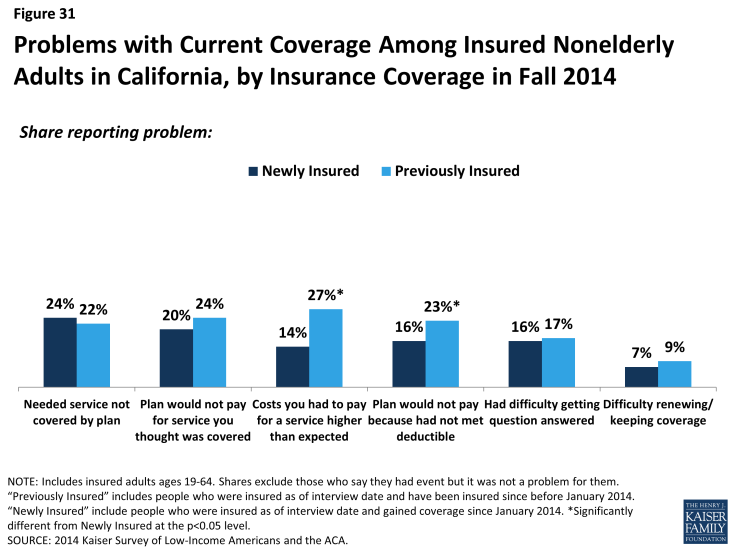

Newly insured adults were no more likely than previously insured to report a specific problem with their health plan. When asked specifically if they encountered various problems with their coverage, such as benefits, costs, or customer service, newly insured adults reported similar or lower rates than previously insured. Specifically, there were no significant differences in shares reporting needing a service that was not covered, being denied coverage for a service they thought was covered, having difficulty getting a question answered, or renewing coverage. Newly insured adults were less likely than previously insured to say they faced higher than expected out-of-pocket costs or that they had not yet met their deductible.

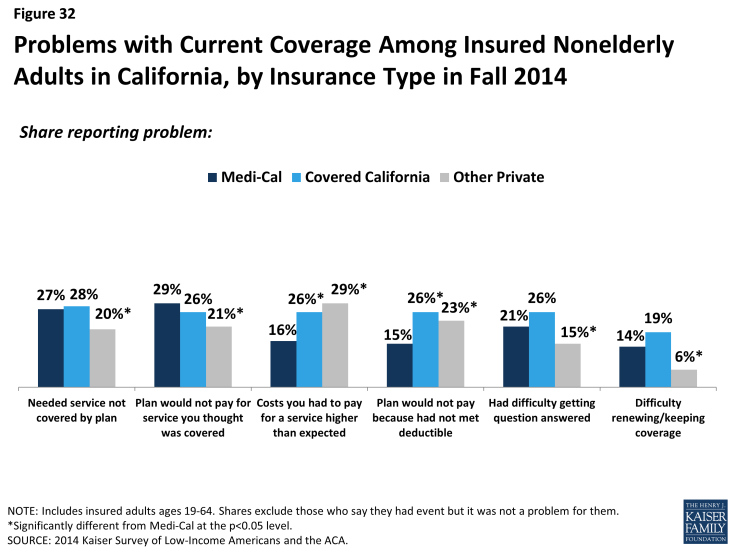

Comparing problems with plan by type of coverage reveals mixed results for different types of problems. Medi-Cal enrollees were less likely than those with Covered California or other private coverage to report cost-related problems, such as facing higher than expected costs or not meeting a deductible. In Medi-Cal, enrollees do not have deductibles and face very limited or no out-of-pocket costs; the fact that any Medi-Cal enrollees reported these problems may reflect service use outside their Medi-Cal plan or may reflect misunderstanding of their plan. On problems related to scope of coverage (e.g., needing a service not covered or being denied coverage for a service) or administrative issues (e.g., getting a question answered or renewing coverage), there were no significant differences between Medi-Cal and Covered California, but adults with other private coverage were less likely to report such problems.

Figure 31: Problems with Current Coverage Among Insured Nonelderly Adults in California, by Insurance Coverage in Fall 2014

Figure 32: Problems with Current Coverage Among Insured Nonelderly Adults in California, by Insurance Type in Fall 2014

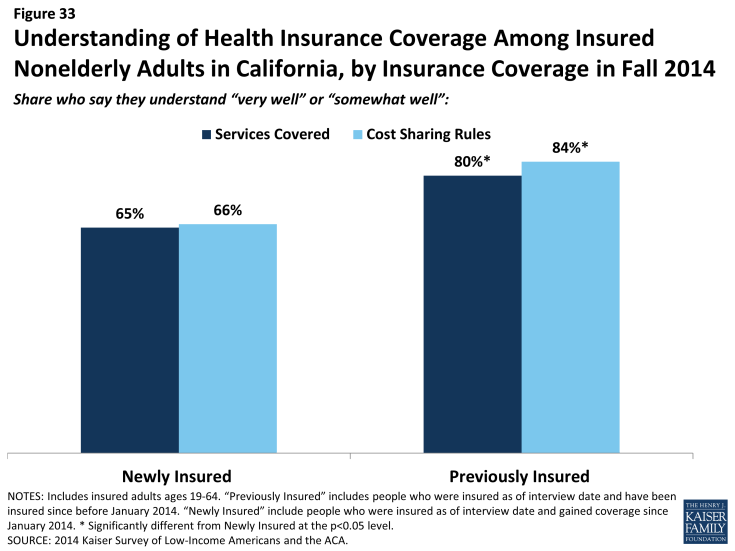

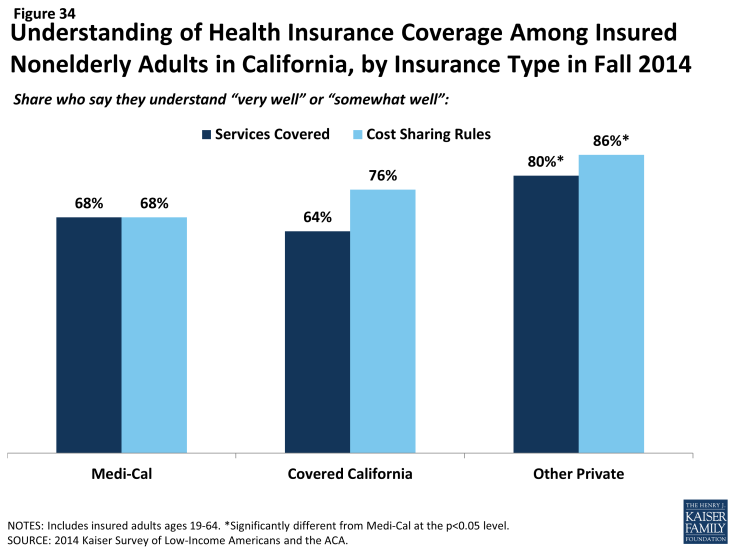

Newly insured adults were also more likely than previously insured to not understand the details of their plan. About two thirds of newly insured adults said they understand the services their plan covers (65%) or how much they would have to pay when they visit a health care provider (66%) “very well” or “somewhat well.” In contrast, previously insured adults were more likely to say they understood the scope of benefits (80%) or cost sharing rules (84%) of their plans. It is possible that newly insured adults face challenges in understanding the complexity of insurance coverage, especially since many adults who were uninsured before the ACA reported that they had never had health insurance.3 When looking by coverage type, there are no significant differences in the share of Medi-Cal or Covered California enrollees reporting understanding these features of their plans. However, adults with other private coverage (most of whom are previously insured) were more likely to understand their plan.

Figure 33: Understanding of Health Insurance Coverage Among Insured Nonelderly Adults in California, by Insurance Coverage in Fall 2014

Figure 34: Understanding of Health Insurance Coverage Among Insured Nonelderly Adults in California, by Insurance Type in Fall 2014

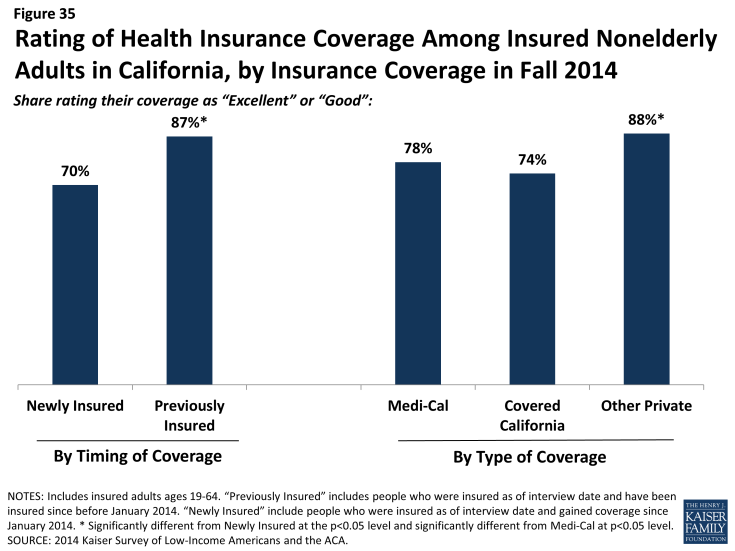

Though most newly insured adults give their health plan high ratings, they were less likely than the previously insured to do so. Seven in ten newly insured adults rate their coverage as “excellent” or “good” (versus “not so good” or “poor”). While these findings show high rates of satisfaction, adults who had coverage before 2014 were more likely to give their plan a high rating, with 87% saying their coverage was excellent or good. There were no significant differences between Medi-Cal and Covered California) in the share of people giving their plan a high rating; those with private coverage, on the other hand, were more likely to give their plan a high rating. Findings that newly insured adults were less likely to understand their plan but no more likely to have experienced difficulty with their plan indicate that health insurance literacy may be affecting plan ratings.