Coverage Expansions and the Remaining Uninsured: A Look at California During Year One of ACA Implementation

How does coverage affect financial security?

Health care costs can be a major burden for low-income families. While many newly insured adults report difficulty affording their monthly premium, they also report lower rates of problems with medical bills and lower rates of worry about future medical bill than their uninsured counterparts. However, newly insured adults still face financial insecurity: they are more likely than those who had coverage before 2014 to worry about future medical bills, and they face general financial insecurity at rates similar to the uninsured. These patterns may indicate that while coverage can ameliorate some of the financial challenges that low and moderate-income adults face, many will continue to face financial challenges in other areas of their lives.

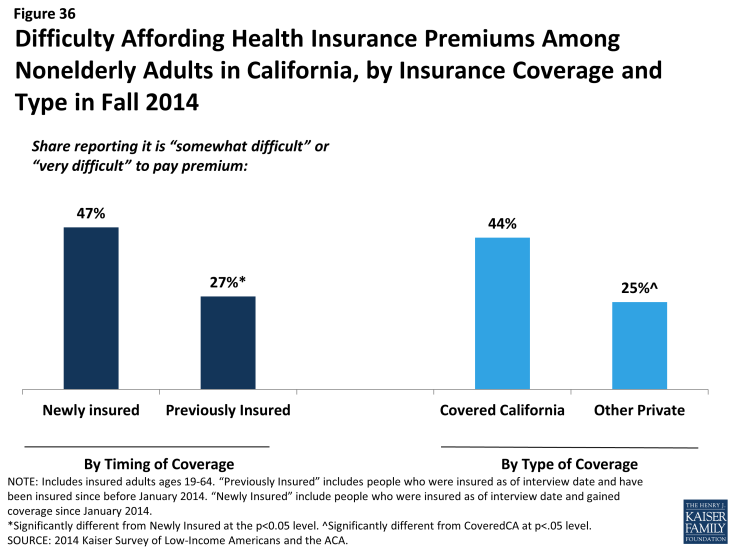

Many Covered California enrollees report difficulty paying their monthly premium. Among adults who say that they pay a monthly premium for their health coverage, nearly half of newly insured adults (47%) say it is somewhat or very difficult to afford this cost, compared to just 27% of adults who were insured before 2014. When looking specifically by type of coverage, 44% of Covered California enrollees (not all of whom are newly insured) report difficulty paying their monthly premium, versus a quarter of adults with other types of private coverage. Medi-Cal enrollees do not pay monthly premiums for their coverage. Statewide, the average premium rate for the second-lowest cost silver plan in Covered California was $325 per month,1 compared to $226 nationally.2 While most people in Covered California received premium subsidies to offset some or most of this cost,3 subsidy levels are set at the federal level and do not account for the relatively high cost of living in the state that requires a greater share of family finances to go to other areas such as housing, food, or transportation.4

Figure 36: Difficulty Affording Health Insurance Premiums Among Nonelderly Adults in California, by Insurance Coverage and Type in Fall 2014

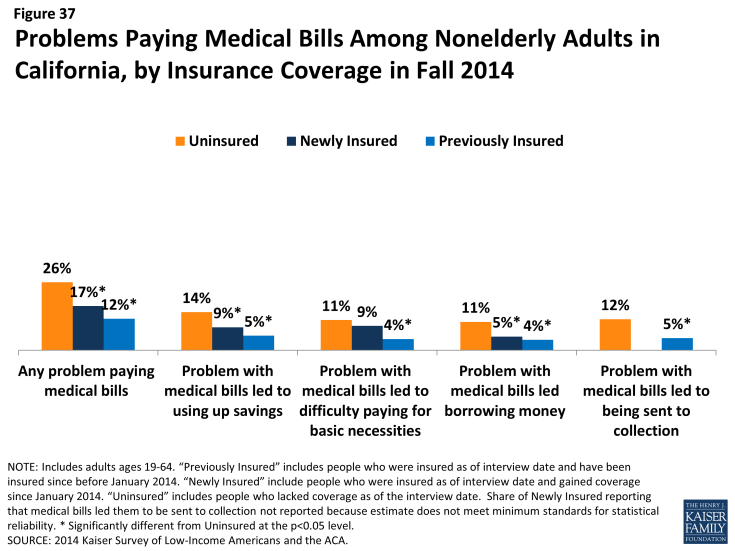

However, coverage does provide financial protection from medical bills and eases concern over affording medical care. Compared to the uninsured, both newly insured and previously insured adults report lower rates of difficulty paying medical bills. Despite being less likely to use services, over a quarter (26%) of uninsured adults report a problem paying medical bills, a rate higher than both the newly insured and previously insured. Uninsured adults were also more likely to report serious consequences from medical bills, such as using up their savings, having difficulty paying for necessities, borrowing money, or being sent to collection. The uninsured were significantly more likely than the previously insured to report that medical bills led to difficulty paying for basic necessities; however, compared to the newly insured, there was no significant difference in medical bills leading to problems paying for necessities.

Figure 37: Problems Paying Medical Bills Among Nonelderly Adults in California, by Insurance Coverage in Fall 2014

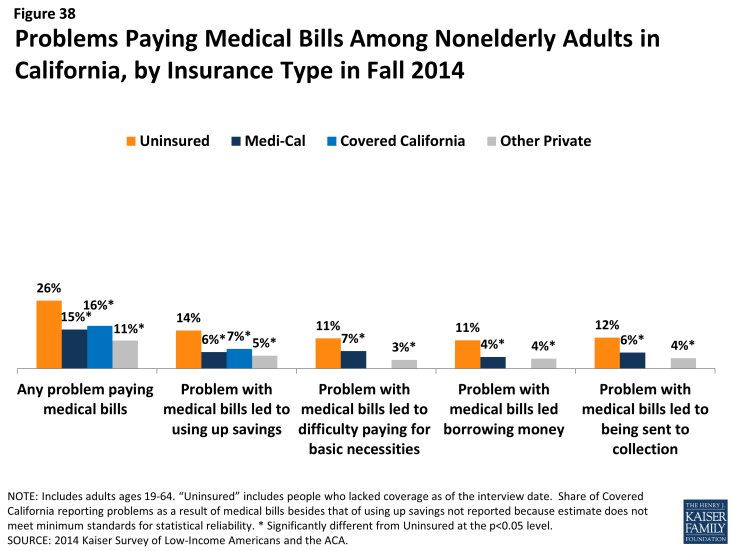

Figure 38: Problems Paying Medical Bills Among Nonelderly Adults in California, by Insurance Type in Fall 2014

When comparing the uninsured to adults with different types of coverage, including Medi-Cal, Covered California, or other private coverage, adults with each type of coverage were less likely than the uninsured to report problems paying medical bills. However, likely reflecting differences in income between these groups, adults with Medi-Cal coverage were significantly more likely than those with other private coverage to report difficulty paying for basic necessities as a result of medical bills (7% versus 3%) and problems paying medical bills (15% versus 11%). As mentioned earlier, Medi-Cal enrollees pay nothing or very little for their medical care, so the share reporting problems related to medical bills may indicate confusion about their plan or services they received that are not covered by their plan. Compared to 2013, there was no significant change in the share of uninsured or Medi-Cal respondents reporting problems with medical bills.5

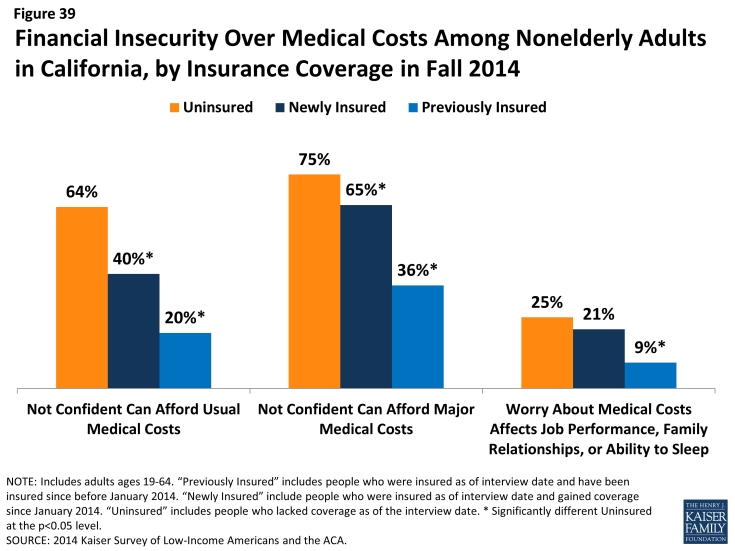

Figure 39: Financial Insecurity Over Medical Costs Among Nonelderly Adults in California, by Insurance Coverage in Fall 2014

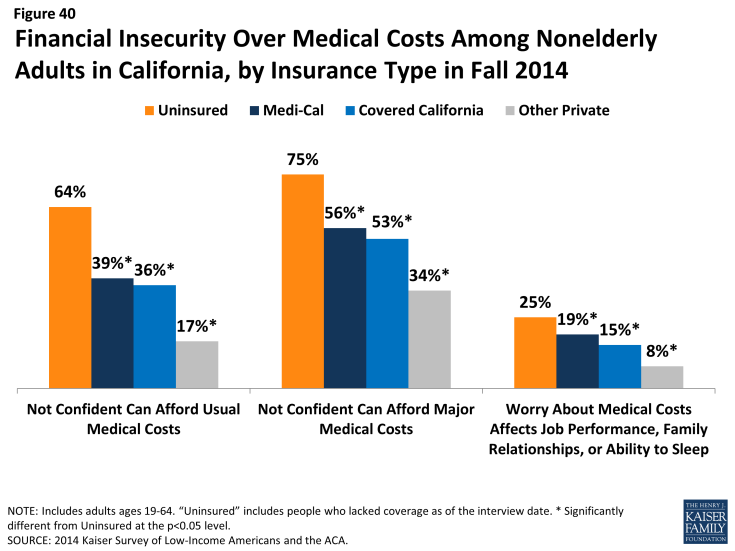

Figure 40: Financial Insecurity Over Medical Costs Among Nonelderly Adults in California, by Insurance Type in Fall 2014

In addition to being less likely to report experiencing financial strain due to medical bills, insured adults are less likely than uninsured to report living with worry about their ability to afford medical care in the future. Nearly two-thirds (64%) of uninsured adults say they lack confidence in their ability to afford the cost of care for services they typically require, and three-quarters say they lack confidence in their ability to afford the cost of a major illness. In contrast, both newly insured and previously insured adults reported lower rates of insecurity, a finding that holds across types of coverage. Compared to 2013, uninsured adults in 2014 were less likely to say they lack confidence in affording major medical costs, perhaps reflecting an improving economy.6

Newly insured adults were no more likely than uninsured adults to say that worry over affording medical costs has affected their job performance, family relationships or ability to sleep, a finding that may reflect their difficulty paying premiums. Further, in contrast to reported problems with medical bills, newly insured adults were more likely than previously insured adults to report financial insecurity over future medical bills. It is possible that newly insured adults have less confidence in the protection offered by their coverage, that their recent experience without coverage led them to be more concerned about future coverage and costs, or that their lower incomes leads to general financial insecurity.

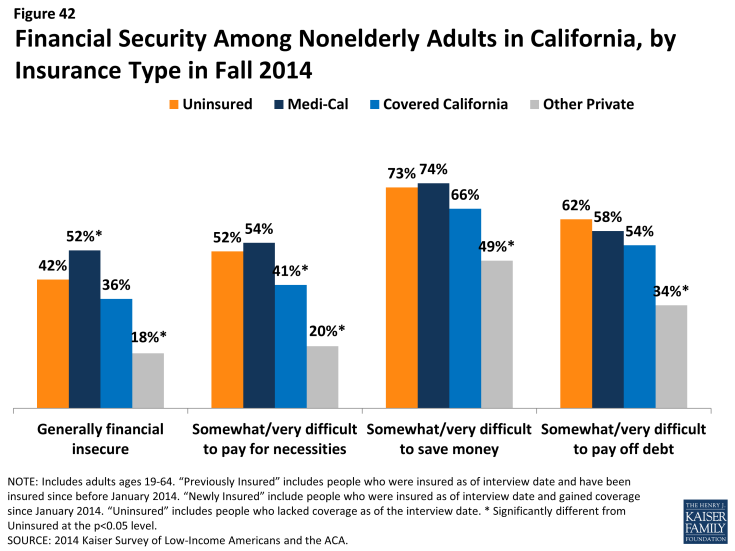

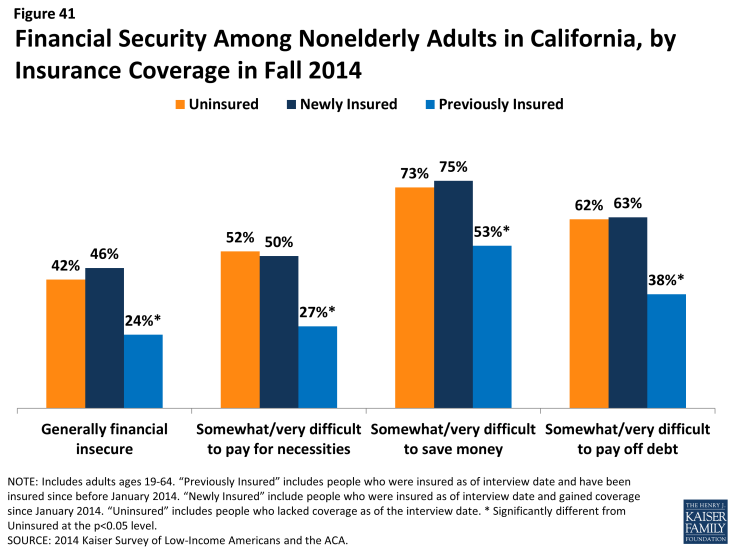

Many newly insured adults still face financial insecurity in areas outside of health care costs. While coverage provides some financial protection from medical bills, there are no significant differences between newly insured adults and uninsured adults with respect to general financial challenges in other areas of their lives. For example, there are no significant differences in the share of uninsured and newly insured adults reporting general financial insecurity or in the share reporting difficulty paying for necessities, saving money, or paying off debt. However, previously insured adults were less likely than uninsured to report these financial challenges. Compared to 2013, uninsured adults in 2014 were less likely to report being generally financially insecure, perhaps reflecting improving economic conditions. In addition, compared to 2013, both Medi-Cal beneficiaries and uninsured adults in 2014 reported lower rates of difficulty affording basic necessities and of saving money (there was no change in the share reporting difficulty paying off debt).7

Figure 41: Financial Security Among Nonelderly Adults in California, by Insurance Coverage in Fall 2014

Looking by coverage type, Medi-Cal beneficiaries are more likely than the uninsured to report being generally financially insecure and as likely to report difficulty affording necessities, saving money, or paying off debt. This finding is not surprising, given that Medicaid is targeted to adults with the lowest incomes.