What are the Implications of Long COVID for Employment and Health Coverage?

Blog

What are the Implications of Long COVID for Employment and Health Coverage?

Blog

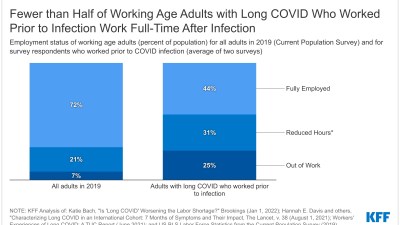

Long COVID has been described as our “next national health disaster” and the “pandemic after the pandemic,” but we know little about how many people are affected, how long it will last for those affected, and how it could change employment and health coverage landscapes. This policy watch reviews what we know and outlines key questions to watch for regarding employment and coverage outcomes. We continue to follow the research on who is most at risk of long COVID and whether there are interventions that can reduce its incidence, length, or severity.