Paying for Prescribed Drugs in Medicaid: Current Policy and Upcoming Changes

Brian Bruen and Katherine Young

Published:

Executive Summary

Since the early 2000s, state Medicaid programs have made concerted efforts to control the cost of prescription drug spending. One crucial aspect in doing so is using a pharmacy reimbursement methodology that best reflects actual drug costs. Currently, states set pharmacy reimbursement policy within broad federal guidelines, resulting in a complex mix of reimbursement rules. Many states use list prices to set reimbursement levels, and these list prices increasingly have been criticized as not accurately reflecting the cost of the drug. Specifically, there are concerns that some benchmarks lead to inflated reimbursement levels. As a result, the federal government has proposed new rules that aim to make reimbursement policies more closely match the cost of obtaining and filling prescriptions. However, the change in policy may have varying effects on reimbursement, depending on the state’s current approach and the type of drug in question. This paper explains current Medicaid pharmacy reimbursement methodology and examines the potential effect of the proposed rule changes.

Medicaid Drug Reimbursement Policy

State Medicaid programs reimburse pharmacies for prescription drugs based on the ingredient costs for the drug and a dispensing fee for filling the prescription. States use a variety of benchmarks to set reimbursement for the ingredient costs. Concerns about the accuracy of drug pricing benchmarks commonly used, particularly average wholesale price (AWP) and wholesale acquisition cost (WAC), have led states and the federal government to look for new ways to determine payment levels. In February 2012, the Centers for Medicare & Medicaid Services (CMS), released a draft rule that would change the basis of payment for Medicaid-covered drugs from an “estimated acquisition cost” (EAC) to an “actual acquisition cost” (AAC). CMS proposed this change, because it feels that AAC will more accurately reflect the actual prices that pharmacies pay to acquire drugs.1 In addition to modifying the language of drug reimbursement, the draft rule suggested ways that states could determine AAC; a final rule is anticipated this year.

This paper explains current pharmacy reimbursement methodology; examines proposed and final rule changes that CMS has issued; reviews outside studies on drug pricing benchmarks and how they compare to each other; and provides independent analysis on how one possible AAC measure, the National Average Drug Acquisition Cost (NADAC), compares to previously used EAC measures.

| Box 1: Glossary of Acronyms |

|

Key Findings

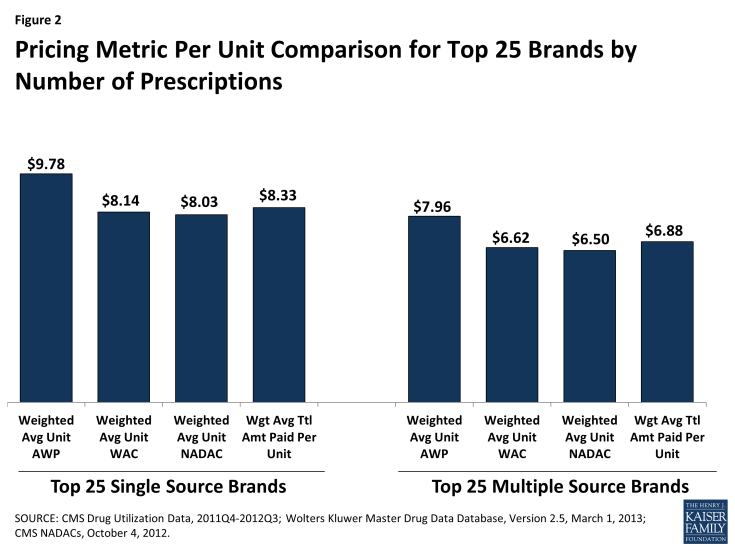

- While CMS has proposed to move from EAC to AAC, EAC is still currently used as the basis of payment for Medicaid-covered drugs in most states. Most states calculate EAC by applying a percentage reduction to Average Wholesale Price (AWP) or a percentage increase to Wholesale Acquisition Cost (WAC). In September 2013, 12 states used AWP as their primary reimbursement metric, 16 states used WAC, and only 6 states used AAC. 17 states used a combination of benchmarks in setting reimbursement levels.

- To better understand the prices that pharmacies pay to acquire drugs, the US government and outside groups have conducted numerous studies comparing drug pricing benchmarks to each other, as well as measures of acquisition costs. These studies have shown that the relationships among list prices (WACs and AWPs) and average prices paid (Average Manufacturer Prices, or AMPs) depends on whether a drug is a single-source brand, multiple-source brand, or generic. They have also shown that AMPs were consistently less than AWPs and generic WACs, but much closer to brand WACs.

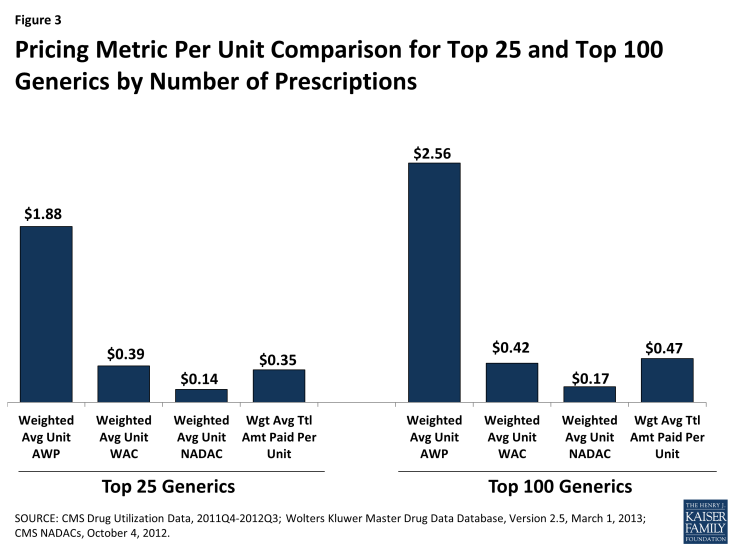

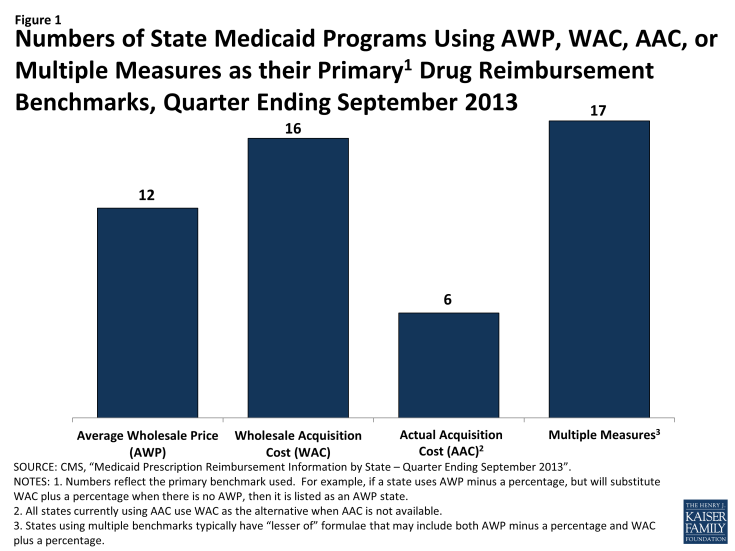

- Independent analysis in this brief finds that one proposed AAC measure, the NADAC, is below currently-used benchmarks for single-source drugs. For single-source drugs, NADACs are well below AWPs and just slightly less than WACs. We found that the difference between generic NADACs and generic benchmarks became more exaggerated. We also found that actual Medicaid payments to retail pharmacies for prescribed drugs are much closer to WAC and NADAC prices than to AWP.

- Any reimbursement formula that uses fixed percentages, such as AWP minus 16 percent or WAC plus 4 percent, results in pharmacy profits that vary based on the price of the drug.

- Dispensing fees are an important factor in overall pharmacy reimbursement. Today, dispensing fees range from $2 to $10, with an average of $5 or less per prescription. Changes in ingredient costs could have implications for dispensing fees; as states switch to using AACs for drug reimbursement, dispensing fees are likely to rise.

- Although reimbursement policy is important, there are other factors that also affect Medicaid spending on prescription drugs, such as the demand for extremely expensive specialty drugs.

Issue Brief

Background

At nearly $16 billion in FY 2010, prescription drug spending is a significant component of Medicaid total spending.1 Although in recent years, Medicaid prescription drug spending has been growing more slowly than in the early 2000s, it remains an area of concern. Medicaid prescription drug spending is driven by many factors, including utilization and reimbursement. Medicaid programs reimburse pharmacies for outpatient drugs based upon a drug ingredient cost and a dispensing fee. Revising drug ingredient cost reimbursement methodology continues to be an area for potential cost savings. In 2011, U.S. Department of Health and Human Services Secretary Kathleen Sebelius wrote to the state governments to inform them that the federal government would help states identify cost drivers and provide states with new ways to achieve cost savings. More effective drug ingredient costs were one of many items relating to pharmaceutical services in a long list.2

Reimbursement methodology is just one factor that determines how much states and the federal government spend on Medicaid outpatient prescription drugs. Rebates at the federal and state levels offset some of this spending; in FY 2010, rebates accounted for over 40 percent of the $27 billion in pre-rebate Medicaid drug spending.3 Since 1991, federal law has required manufacturers wishing to have their products covered by any Medicaid program to participate in the Federal Medicaid Drug Rebate Program. In 2010, Congress raised the minimum required rebate level as part of the Affordable Care Act, and expanded the rebate requirement to include drugs paid for by Medicaid managed care plans.4

When managed care plans cover drugs as part of the package of services for which they receive capitated payments from the state Medicaid agency, the plans establish the reimbursement levels paid to pharmacies. Prior to passage of the Affordable Care Act, several states with comprehensive Medicaid managed care plans carved out their prescription drug benefits—i.e., paid for drugs on a fee-for-service basis rather than including them in the package of services for which plans received capitated payments—in order to collect manufacturers’ rebates, because these discounts were not required when managed care plans paid for the prescription. The Affordable Care Act required manufacturers to provide rebates on all Medicaid-covered drugs purchased by managed care plans for their Medicaid clients, effective March 23, 2010. Proponents of incorporating drug benefits into the package of managed care services tend to highlight potential advantages from better coordination of pharmacy services with other medical care and administrative tasks handled by managed care plans. Arguments for carving out drugs generally focus on potential differences in formularies, prior authorization, benefit management processes among health plans, and concerns that plans may not have the same incentives to maximize federal or state rebates. 5 Although this paper primarily focuses drug reimbursement, it is important to keep in mind that there are other policies that affect Medicaid drug spending.

In this paper, we examine current Medicaid pharmaceutical reimbursement policy and explain how and why the policy is changing. We then consider research on how Medicaid drug pricing metrics compare. Finally, we conduct our own analysis on how the recently created NADAC compares to other pricing metrics.

Current Reimbursement Policy

Medicaid payments to retail pharmacies for prescription drugs are determined by a complex set of policies developed at both the federal and state levels. Reimbursement is a factor of ingredient cost, dispensing fees, and any cost sharing paid by the beneficiary. States set policies on dispensing fees and, within federal guidelines, beneficiary cost-sharing. With respect to ingredient costs, with the exception of some multiple-source drugs1 for which there are specific federal or state limits, federal regulations require Medicaid programs to reimburse pharmacies based on the lesser of the (1) estimated acquisition cost (EAC) plus a reasonable dispensing fee; or (2) the pharmacy’s “usual and customary charge” to the public. 2

Ingredient Cost

Estimated Acquisition Cost (EAC)

EAC is intended to reflect the price that providers and retail pharmacies generally and currently pay to procure a particular drug from its supplier. Most states determine EAC using formulas that apply either a percentage reduction from the average wholesale price (AWP) for the drug or a percentage increase to the wholesale acquisition cost (WAC) for the drug. (See Figure 1).

AWPs and WACs are prices published in commercially available drug pricing compendia. Although its name suggests that it is the actual price that wholesalers charge for a drug, critics and experts alike have noted that AWP is more akin to the sticker price on a car: it represents a starting point for negotiations. It does not include any discounts or rebates that would typically be incorporated in the actual price that the wholesaler charges. It is not defined in federal regulations. Similarly, WAC is not based on actual sales data. However, unlike AWP, WAC is defined in federal regulations.3

Numbers of State Medicaid Programs Using AWP, WAC, AAC, or Multiple Measures as their Primary1 Drug Reimbursement Benchmarks, Quarter Ending September 2013

Federal Upper Limits (FUL)

Multiple-source drugs are drugs that are available from more than one manufacturer. The Federal Upper Limit (FUL) program caps reimbursement for certain multiple-source drugs, with the intent of making the government a prudent buyer – and reducing Medicaid expenditures – by basing payments on market prices for these drugs. CMS calculates a FUL amount for specific forms and strengths for each multiple-source drug that meets the established criteria. The federal government establishes maximum payment amounts for about 700 multiple-source drugs, which include both generics and originator brands for which generic versions are available. According to CMS, FUL drugs accounted for $2.4 billion in Medicaid expenditures in 2010,4 9% of Medicaid spending on prescription drugs. 5

Traditionally, the FUL for a multiple-source drug was set at 150% of the lowest price published in national drug pricing compendia. The Deficit Reduction Act (DRA) of 2005 included provisions to substantially reduce FULs, based in part on findings from a federal study that indicated that FULs based on published prices (AWP or WAC) were significantly higher than pharmacies’ acquisition costs.6 CMS did not implement these rules because of an injunction and subsequent changes to federal law. The Affordable Care Act and subsequent proposed rules limit reimbursement to no less than 175% of the weighted average of the most recently reported average manufacturer prices (AMP) for that drug. Federal law defines AMP as the average price paid to the manufacturer for the drug in the United States by (1) wholesalers for drugs distributed to retail community pharmacies and by (2) retail community pharmacies that purchase drugs directly from the manufacturer.7 CMS began publishing draft FULs based on these rules in September 2011 and continues to release updates for review and comment,8 but as of the date of this publication, FUL amounts continue to be based on published prices.

State Maximum Allowable Costs

Nearly all states apply maximum allowable cost (state MAC, or SMAC) limits to multiple-source drugs, which establish ceilings on reimbursement for the drug products included on state MAC lists. These state MAC amounts generally are part of a complex “lesser of” formula, where the state agency sets reimbursement for multiple-source drugs at the lowest amount for each drug based on (1) the state’s EAC formula, (2) the FUL (if applicable), (3) the state MAC or (4) the pharmacy’s usual and customary charge to the public. State MAC programs frequently include other drugs that do not have established FULs: a 2013 analysis by the U.S. Department of Health and Human Services’ Office of Inspector General (OIG) found that state MAC programs include 50-60 percent more drugs than FULs. Of 41 states that identified a pricing benchmark for their state MAC programs, 29 used pharmacy acquisition costs as part of the benchmark to set state MAC prices.9

Dispensing Fees

The dispensing fee is intended to cover reasonable costs associated with providing the drug to a Medicaid beneficiary, including the pharmacist’s services and overhead associated with maintaining the facility and equipment necessary to operate the pharmacy. States establish dispensing fees for the pharmacies that fill prescriptions for Medicaid beneficiaries. In late 2013, these fees range from $2 or less per prescription in Arizona, Connecticut, New Hampshire, Ohio, and Pennsylvania to more than $10 in Alabama, Alaska, Colorado, Idaho, Iowa, Louisiana, and Oregon; most other states pay dispensing fees that average around $5 or less per prescription.10 In setting their fees, states look to the fees paid by other state Medicaid programs, as well as fees paid in private insurance programs and Medicare Part D plans. Although exact pricing for most plans is proprietary information, surveys from groups such as the Pharmacy Benefit Management Institute and the Kaiser Family Foundation, and drug benefit trend reports from pharmacy benefit managers (PBMs) such as CVS/Caremark and Express Scripts, offer insight into typical benefit designs including general pricing trends and dispensing fees.11,12,13,14Variation in fees also reflect differences in states’ approaches to EAC: except for Alaska, the states with the highest fees also use AAC-based reimbursement.

Pharmacies often argue that dispensing fees do not adequately cover their “cost of dispensing”. Estimates from a study supported by retail pharmacies indicate that retail pharmacies’ average cost of dispensing nationwide was $10.50 per prescription (each pharmacy’s average cost weighted by prescription volume) or $12.10 per pharmacy (each pharmacy’s average cost counted once) in 2006.15 State-specific averages per pharmacy ranged from $10.36 to $15.91 in that study. Subsequent state-funded studies estimated an average cost of dispensing of $12.97 per pharmacy in Alabama in 200916 and an unweighted average cost of dispensing of $11.15 per pharmacy in Oregon that same year.17 These states use AAC-based reimbursement with dispensing fees of $10.64 (Alabama) and $9.68 to $14.01, varying by volume (Oregon).18 Alabama pays additional fees to pharmacists for special services such as pill-splitting or long-term drug maintenance.19

Beneficiary Cost Sharing

A final component of Medicaid reimbursement for prescription drugs is cost sharing paid by the beneficiary. Medicaid has traditionally imposed limits on cost sharing. Until the enactment of the Deficit Reduction Act (DRA) of 2005, prescription drug copayments were limited to “nominal” levels, usually $3 per prescription except under Medicaid waiver, although some groups of enrollees, including children and pregnant women, could not be charged. In addition, under Medicaid policy, even if copayments were imposed and beneficiaries could not pay, pharmacies were supposed to dispense the drug anyway. The DRA modified these policies, allowing states to increase nominal cost-sharing levels based on the Consumer Price Index for Medical Care and permitting higher cost-sharing levels for beneficiaries with incomes over 100 percent of poverty as well as alternative cost-sharing policies. Today, almost all state Medicaid programs and Medicaid managed care plans charge nominal copayments for prescription drugs for adults, although they sometimes have variations in the copayment level based on whether a medication is generic or branded, or whether it is designated a “preferred” drug in the state’s Medicaid program.

Final rules issued by CMS in July 2013 allow states to require cost-sharing of up to $4 for preferred drugs and $8 for non-preferred drugs for all Medicaid-covered individuals, including individuals with incomes at or below 150% of the federal poverty level (FPL). For individuals with incomes above 150% of the FPL, the new rules allow states to establish higher cost sharing, including coinsurance of up to 20% of the cost of the drug, for non-preferred drugs.20,21

In making decisions about imposing cost-sharing, states will need to weigh a large body of evidence about the effects of beneficiary cost sharing. A systematic review of cost sharing literature by Goldman et al. found that increases in cost sharing are associated with decreased use, poorer adherence, and more frequent discontinuation of prescription medicines.22 The literature also suggests that when higher cost sharing for prescription medications leads to reduced utilization and adherence, it can engender increases in other medical costs if patients become sicker as a result.23,24,25, 26,27

Changes in Reimbursement Policy

Calls to Revise Drug Ingredient Cost Methodology

In the early 1990s, the Health Care Financing Administration1 pressured states to improve their estimates of acquisition costs based on evidence that AWP was higher than pharmacies’ actual costs of acquiring drugs from a wholesaler or manufacturer.2 Over the next two decades, federal investigations continued to show that AWP-based payments exceeded pharmacies’ acquisition costs, despite states’ efforts to bring reimbursement in line with costs.3,4,5,6Regardless, until recently, the majority of states used AWP to determine reimbursement amounts; for example, at the end of 2010, 34 states still based their EAC on AWP.7

In 2009, First DataBank and Medi-Span, publishers of the most widely used drug price compendia, settled lawsuits that alleged they had inflated AWPs to benefit pharmacies and wholesalers with higher payments, at the expense of purchasers (including state and federal governments). These lawsuits supported claims that AWP does not reflect actual transaction cost and confirmed suspicions that it may be subject to manipulation. In 2009, First DataBank announced they would cease publishing AWPs within two years. Medi-Span made a similar announcement at that time, but later reversed the decision, and as a result, they continue to publish AWPs today. However, the announcements that widely used sources would no longer list AWP, combined with the attention to the subject resulting from and abundance of studies and litigation on the topic caused many states and industry groups to discuss alternatives to the AWP. WAC seems to suffer much criticism because of its close relationship to AWP. However, there is evidence that WAC is actually a relatively accurate pricing measure for many single-source drugs (brand-name medications with market exclusivity) but it is less accurate, if even reported, for many multiple-source drugs (generic versions of brand-name drugs).8

The Move to AAC

In this atmosphere, and in direct response to the OIG’s extensive research on the actual acquisition cost and AWP, in February 2012, CMS issued proposed rules that would require states to pay pharmacies based on actual acquisition cost (AAC) plus a “professional” dispensing fee, instead of the current EAC plus a reasonable dispensing fee.9 In the proposed rule,CMS defines AAC as the state Medicaid agency’s determination of pharmacy providers’ actual prices paid to acquire drug products marketed or sold by a specific manufacturer. To determine AAC, CMS suggests in the proposed rule that states may survey pharmacies, as is currently done by every state using AAC-based reimbursement, or use the AMP data that manufacturers already are required to report to enable calculations of federal rebates and FUL pricing. The Office of Management and Budget has indicated the final rule is scheduled to come out in mid-2014.10

A 2011 survey by the Department of Health and Human Services’ Office of the Inspector General (OIG) found that most states want CMS to create a national benchmark for Medicaid reimbursement of prescription drugs.11 The proposed rule from February 2012 also mentioned that a national survey could be used to develop an AAC metric. To this end, CMS contracts with a public accounting firm to perform a survey of invoices from independent and chain retail pharmacies, which it uses to calculate National Average Drug Acquisition Costs (NADAC) values.12 CMS began to post draft NADAC data to a public website in October 2012. Effective November 27, 2013, CMS is posting final NADAC data, updated on a weekly and monthly basis.13 CMS views these data as a way of providing Medicaid agencies with information concerning acquisition costs, which state agencies can use to compare pricing methodologies and payments. If a state agency chooses to use NADAC as its metric to determine reimbursement, it would have to submit a state plan amendment to CMS for approval.

Commercial entities have also developed alternative measures to estimate actual acquisition costs. For example, Elsevier/Gold Standard, a drug database and drug reference provider, promotes use of a new pricing metric it calls Predictive Acquisition Cost (PAC). This metric comes from a predictive analytic model that estimates drug acquisition cost based on factors such as industry maximum allowable cost benchmarks, published prices, existing price benchmarks, drug dispensation metrics, supply-demand measures, and survey-based acquisition costs.14

Comparing Pricing Under Different Measures

Existing Evidence

The U.S. Department of Health and Human Services’ Office of Inspector General (OIG) and the U.S. Government Accountability Office (GAO) have issued several studies that indicate how drug pricing benchmarks relate to each other and to measures of acquisition costs, FULs, and state MACs. These studies emphasize that relationships between list prices (AWPs and WACs) and average prices (AMPs) differ based on whether a drug is a single-source brand, multiple-source brand, or generic. They show AMPs were consistently less than AWPs and generic WACs, but AMPs were relatively close to brand WACs. They also show AMPs were close to single-source brand invoice prices, but the relationship was much more variable for multiple-source brands and generics without FULs. Additionally, they showed that AMP values vary considerably from month to month. See Appendix Table 1 for a more complete review of OIG, GAO, and other existing research on the comparison of drug pricing metrics.

Comparing EACs and NADACs

Because the NADAC is a new measure, there is little current research on its relationship to other pricing metrics. Our goal was to understand how the NADAC, an AAC measure, compares with the EAC measures and ultimately how they compare with the current amounts that Medicaid pays. To do this, we compared AWPs, WACs, NADACs, and amounts paid for different drugs. We merged several sources of data at the National Drug Code (NDC)1 level. We grouped the NDCs by brand, generic, therapeutic class, and therapeutic subclass. Finally, we calculated the weighted averages of AWPs, WACs, NADACs, and amounts paid for the top 25 brand, top 25 generic, top 100 generic, and therapeutic class. The calculation of current payment levels takes into account each state’s EAC computations and the effects of FULs, state MACs and usual and customary charges. Further details on our methodology are provided in the Methods section at the end of this report.

Brand-Name Drugs

Figure 2 shows that among the top 25 single source brands and top 25 multiple source brands, the average NADAC ($8.03) is about 18 percent less than the average AWP ($9.78), but just slightly less than the average WAC ($8.14). Average WACs and NADACs for brand drugs are less than the amount that Medicaid pays ($8.33). However, it is important to note that the actual paid amounts include dispensing fees, and are reduced by patient cost sharing and amounts paid by third parties, which are not accounted for in the AWP, WAC, or NADAC. To get a sense for this, if we assume that the average prescription for the top 25 single source brand drugs used to compute the values shown in Figure 2 contains 35 units (based on calculations using our source data), that the average dispensing fee is $5 per prescription ($0.14 per unit), and that there are negligible amounts of third party payment and cost sharing (reasonable assumptions at the national level), then the weighted average total amount paid per unit absent these amounts would be about $8.19. We then approximate that for the top 25 single-source brand drugs, NADACs are just slightly less than actual Medicaid payments for the drug ingredient cost.

Table 1 shows the prescription-weighted, per-unit average AWP, WAC, NADAC and total amount paid for single source brand drugs grouped into therapeutic drug classes. Across therapeutic classes, NADAC is usually very close to WAC— 1 % to 2% higher or lower— although there are larger differences in a few classes. Table 1 also reaffirms that the acquisition costs are well below AWPs.

The analysis by therapeutic drug class also highlights the significant challenges in developing reimbursement formulas caused by great variation in drug prices. Any formula using a fixed percentage increase or decrease from a benchmark, such as AWP minus 16% or WAC plus 4%, results in markups (or markdowns) that vary in actual dollar amounts based on the price of the drug. The data in Table 1 illustrate this result: for example, the difference between the weighted average actual amount paid and the weighted average NADAC, per unit, is $0.20 for drugs the Cardiovascular Drugs class but $1.40 for the generally more expensive Anti-infective Agents class.

| Table 1: Pricing Metric Per Unit Comparison by Therapeutic Class of Single-Source Brand Drugs | |||||

| Therapeutic Class | Weighted Average Unit AWP |

Weighted Average Unit WAC |

Weighted Average Unit NADAC |

Weighted Average Total Amount Paid Per Unit |

Total Rx for 1 Quarter |

| Central Nervous System Agents | $10.36 | $8.63 | $8.52 | $8.80 | 4,840,803 |

| Hormones and Synthetic Substitutes | $4.85 | $4.03 | $3.95 | $4.20 | 927,027 |

| Cardiovascular Drugs | $4.57 | $3.80 | $3.75 | $3.95 | 924,381 |

| Anti-infective Agents | $30.68 | $25.56 | $25.00 | $26.40 | 822,343 |

| Gastrointestinal Drugs | $5.86 | $4.84 | $4.75 | $4.93 | 818,167 |

| Vitamins | $1.01 | $0.74 | $0.68 | $0.77 | 452,696 |

| Autonomic Drugs | $8.26 | $6.89 | $6.76 | $7.17 | 344,827 |

| Miscellaneous Therapeutic Agents | $19.66 | $16.37 | $16.02 | $16.44 | 123,565 |

| Smooth Muscle Relaxants | $6.84 | $5.70 | $5.60 | $5.80 | 115,256 |

| Blood Formation, Coagulation & Thrombosis | $5.00 | $4.16 | $4.22 | $4.31 | 62,356 |

| Electrolytic, Caloric, and Water Balance | $2.85 | $2.28 | $2.22 | $2.37 | 47,612 |

| Antineoplastic Agents | $100.18 | $83.44 | $81.24 | $82.38 | 17,855 |

| Respiratory Tract Agents | $4.55 | $3.78 | $3.72 | $3.87 | 17,617 |

| Antihistamine Drugs | $2.09 | $1.70 | $1.72 | $1.93 | 15,957 |

| Skin and Mucous Membrane Preparations | $24.90 | $19.94 | $19.41 | $21.49 | 4,715 |

| Eye, Ear, Nose & Throat Preparations | $0.56 | $0.45 | $0.42 | $0.43 | 1,224 |

| Source: CMS Drug Utilization Data, 2011Q4-2012Q3; Wolters Kluwer Master Drug Database, Version 2.5, March 1, 2013; CMS NADACs, October 4, 2012. | |||||

Generic Drugs

For generic drugs, the differences between the benchmarks and actual amounts paid become more exaggerated. Although there are AWPs for generic drugs, the values are high and generally not reflective of actual transaction prices. Due to substantial discounts from AWP, aggressive state MAC rates established by states to pay for generic drugs, and usual and customary amounts, generics are more likely to be reimbursed at rates far below AWP values. As with brand-name drugs, WAC values tend to be much closer to actual paid amounts and relatively close to NADAC values.

Because generic drugs have much lower per-unit prices, the dispensing fee is a more important factor in the difference between paid amounts and benchmarks. The average prescription for the top 25 generic drugs used to compute the values shown in Figure 3 contains 46 units. If one assumes an average dispensing fee of $5 per prescription ($0.11 per unit) and negligible amounts of third party payment and cost sharing, which again are reasonable assumptions at a national level, the weighted average total amount paid per unit absent these amounts would be about $0.24 per unit, which falls between the weighted average WAC ($0.39) and NADAC amounts ($0.14).

As with brand-name drugs, generic drug prices differ considerably. Table 2 illustrates the variation in average benchmarks and actual amounts paid for generic drugs, across drug classes. The lowest prices tend to be in classes with multiple older, established products that compete with each other for market share, while the higher prices tend to be in classes with greater concentrations of newer products or fewer competing therapies. Unlike with the brand drugs, NADACs vary in their relation to WACs by therapeutic class, ranging from 11% less than WAC for the eye, ear, nose, and throat preparations class to 73% less than WAC for the gastrointestinal drugs class.

| Table 2: Pricing Metric Per Unit Comparison by Therapeutic Class of Generic Drugs | |||||

| Therapeutic Class | Weighted Average Unit AWP |

Weighted Average Unit WAC |

Weighted Average Unit NADAC |

Weighted Average Total Amount Paid Per Unit |

Total Rx for 1 Quarter |

| Central Nervous System Agents | $2.33 | $0.51 | $0.27 | $0.53 | 29,748,635 |

| Cardiovascular Drugs | $1.95 | $0.32 | $0.13 | $0.35 | 11,240,268 |

| Anti-infective Agents | $4.50 | $1.28 | $0.49 | $1.26 | 6,764,413 |

| Hormones and Synthetic Substitutes | $1.11 | $0.62 | $0.45 | $0.70 | 6,185,648 |

| Gastrointestinal Drugs | $5.31 | $0.60 | $0.16 | $0.47 | 5,069,551 |

| Antihistamine Drugs | $0.98 | $0.24 | $0.13 | $0.28 | 2,948,786 |

| Electrolytic, Caloric, and Water Balance | $0.37 | $0.23 | $0.14 | $0.26 | 2,102,647 |

| Autonomic Drugs | $1.47 | $0.23 | $0.10 | $0.27 | 2,096,000 |

| Vitamins | $0.80 | $0.55 | $0.17 | $0.69 | 1,593,165 |

| Blood Formation, Coagulation & Thrombosis | $2.36 | $0.22 | $0.08 | $0.47 | 1,067,081 |

| Miscellaneous Therapeutic Agents | $11.24 | $2.55 | $1.57 | $2.70 | 531,679 |

| Antineoplastic Agents | $6.49 | $1.22 | $0.47 | $1.24 | 185,885 |

| Smooth Muscle Relaxants | $1.76 | $1.26 | $0.54 | $0.97 | 141,244 |

| Skin and Mucous Membrane Preparations | $2.70 | $1.28 | $0.64 | $1.16 | 127,572 |

| Respiratory Tract Agents | $1.35 | $0.51 | $0.25 | $0.45 | 69,503 |

| Eye, Ear, Nose & Throat Preparations | $1.94 | $1.45 | $1.29 | $1.29 | 19,261 |

| Source: CMS Drug Utilization Data, 2011Q4-2012Q3; Wolters Kluwer Master Drug Database, Version 2.5, March 1, 2013; CMS NADACs, October 4, 2012. | |||||

Policy Implications

FY 2015 HHS Budget

The federal government is making efforts to provide more transparent Medicaid drug pricing data, with Health and Human Services proposing to “increase access to and transparency of Medicaid drug pricing data” in its 2015 budget.1 HHS specifically proposes funding a nationwide survey of pharmacy drug prices to consumers, and collecting wholesale acquisition costs for all Medicaid-covered drugs. These proposals come amongst many to reform Medicaid outpatient drug reimbursement in the 2015 HHS budget.

State AAC Initiatives

State Medicaid programs use a variety of benchmarks to determine their reimbursements to pharmacies for prescribed drugs. Due to concerns about the accuracy and availability of commercially available benchmarks such as AWP, many states have changed the methods they use to determine reimbursement in recent years and more continue to explore new options. As of December 2013, Alabama, Colorado, Idaho, Iowa, Louisiana, and Oregon all use surveys of pharmacy invoices in an effort to bring more transparency to drug acquisition costs, as does CMS’s NADAC measure. Five of these states use the same firm, Myers and Stauffer, LC, to conduct the state-wide pharmacy surveys as the federal government does. Alabama was the leader in implementing these survey-based AACs, having used the AAC model since September 2010. Oregon implemented the model in January 2011.2

The state AAC and NADAC survey approaches rely on invoices to evaluate the costs that retail pharmacies pay to acquire prescription drugs from manufacturers or wholesalers; these costs do not account for rebates or discounts if they are not included on the invoice. Other states have switched from AWP-based formulas to WAC-based formulas, in part due to studies indicating WAC has a reasonably consistent relationship to invoice prices. State MACs typically determine reimbursements for the most common multiple-source brand-name drugs and generics.

The Relationship Between NADACs, EACs, and Actual Paid Amounts

The OIG’s analyses indicate that AWP, WAC, and AMP all have relatively consistent relationships with invoice prices for brands (including single- and multiple-source brands), but larger and more variable relationships with invoice prices for generic drugs. Our own analysis indicates that actual Medicaid payment amounts to retail pharmacies for prescribed drugs are much closer to WAC and NADAC prices than to AWP, primarily because of complex “lesser of” payment formulae and large percentage reductions from AWP used in EAC calculations. Differences between WAC or NADAC and the actual paid amounts are relatively modest because states have refined their reimbursement schemes over the past several years in response to concerns about excessive payment rates and as a way of controlling cost growth. For generic drugs, differences remain relatively large in percentage terms but are generally modest in terms of actual dollar amounts. Benchmarks and paid amounts vary considerably by drug class, in part due to the mix of brand name and generic medications in each class. It is important to note, however, that our analysis only looks at one point in time. Further, we were examining NADACs from the first month they were issued. It would be worthwhile to continue looking at these trends using NADACs from other time periods, as well as studying the volatility of NADACs over time.

How Switching to AAC Affects Dispensing Fees

Regardless of whether one believes that any benchmark accurately captures final transaction prices at which retail pharmacies purchase the drugs that they dispense to Medicaid beneficiaries, the right benchmark for acquisition costs still does not resolve the issue of what constitutes “appropriate” reimbursement under Medicaid. Retail pharmacies incur costs to build and maintain infrastructure that is convenient for patients and to employ the staff and technology necessary to safely and accurately dispense medications to patients. To stay in business, the total compensation they receive, including reimbursement for the cost of the drug and the dispensing fee, needs to be sufficient to support ongoing operations profitability. Many states have increased their dispensing fees as they have ratcheted down the acquisition cost component of reimbursement. In a 2011 Kaiser Family Foundation study of Medicaid pharmacy directors, some stated they would spend more money if they were to base their reimbursements on Alabama AACs, due to the accompanying increased dispensing fee.3 It should be noted that the pharmacy directors made these comments with regard to Alabama AACs, not NADACs. The potential savings from using NADACs or any other AAC measure are dependent on the current and future dispensing fees in each state and the state’s mix of brand and generic prescriptions. Policy-makers should not assume that the prescription trends of the past will remain the same in the future. Further, CMS and numerous experts have expressed the value of basing reimbursement on actual pricing data.4

Specialty Drugs

Concerns over drug costs are increasingly falling outside the purview of traditional pharmacy reimbursement amounts and related benchmarks. Many new drugs and biologics are “specialty” medications, which may be dispensed through specialty pharmacies because of unusual distribution or handling requirements. These products may also require consultation with or monitoring of patients prior to or after administration of the medication, entailing administration by physicians or other health care providers, and coverage through medical benefits. Provider involvement adds a layer of complexity because of the necessary coordination of benefits, payments and rebate collections. Specialty products also tend to be much more expensive than traditional drugs, so accurate reimbursement is important, regardless of whether the state pays for them through pharmacies or through medical providers or health care facilities. With their high costs and rapid growth of utilization, managing specialty drugs will be crucial to limiting state and federal Medicaid expenditures for prescribed drugs in the near future.

This brief was prepared by Brian Bruen from George Washington University and Katherine Young from the Kaiser Family Foundation.

Methodology

Methods

To compare actual drug payments to AWPs, WACs, and NADACs, we combined at the National Drug Code (NDC) level the CMS drug utilization data, the CMS list of NADACs for October 4, 2012, and the March 1, 2013 version of Wolters Kluwer Master Drug Database (MDDB) Version 2.5. We set the state drug utilization data to the most recent quarter available. At the time of this analysis, 2012 quarter three drug utilization was available for 40 states and the District of Columbia, 2012 quarter two for six states, 2012 quarter one for one state, and 2011 quarter 4 for two states. We restricted the sample of interest to all NDCs with NADACs, AWPs, WACs, and utilization data. NADACs reported on October 2012 are reflective of data from at least a few weeks earlier. In this analysis we compared the NADACs to AWPs and WACs as of August 1, 2012.

NADAC data are available for drug products grouped by active ingredient(s), strength, dosage form, and route of administration. Drugs are further classified according to drug category as single-source, innovator multiple-source, or non-innovator multiple-source. Many people refer to drugs in the first two categories using the colloquial terms “brand-name” or “branded” drugs, and drugs in the latter category as “generic” drugs. Using the MDDB, we similarly classified single-source, single-source co-licensed, and multi-source originator products as brand drugs, and all others as generics. We identified the top 25 brand, top 25 generic, and top 100 generic drugs by the total number of paid prescriptions for each drug. We used the MDDB to identify the drug name, American Hospital Formulary System (AHFS) therapeutic class, and AHFS therapeutic subclass for each product. We then calculated the weighted average AWP, WAC, NADAC, and actual amount paid by state Medicaid agencies, for the top 25 brand, top 25 generic, top 100 generic, therapeutic class, and therapeutic subclass. We weighted each drug at the NDC level using the total number of prescriptions dispensed to Medicaid beneficiaries.

Appendix

| Appendix Table 1: Existing Research on Pricing Benchmark Comparisons | ||

| Topic | Author & Publication Year | Findings |

| EAC/AAC Benchmarks | OIG, 2005 | The OIG found that AMP was 23 percent lower than AWP for single-source brands, 28 percent lower for multiple-source brands, and 70 percent lower than AWP for generics (all differences measured at the midpoint of the distribution in the sample). AMP was 4 percent lower than WAC for single-source brands, 8 percent lower for multiple-source brands, and 25 percent lower for generics. There was much more variation in the percentage differences between AMP and published prices for generics than for brands.1 |

| OIG,2011 | The OIG compared AMPs, AWPs, and WACs to November 2010 invoice prices from a sample of pharmacies (as a proxy for acquisition costs). Invoice prices were generally about 15-20 percent lower than AWPs for single-source brands, with some larger differences among multiple-source brands. Invoice prices for generics without FULs ranged from 5 percent to 95 percent less than AWP, with no consistent relationship. WAC and AMP values were about the same as invoice prices for single-source brands but, as with AWP, the relationships were much more variable for multiple-source brands and generics without FULs. AMP was the least consistent benchmark.2 | |

| AMP-Based FULs | GAO,2013 | Using 2013 data, the GAO compared draft AMP-based FULs to NADACs, and found that in the aggregate, the two were within a few percentage points. However, breaking the drugs out into brand and generic, but keeping the comparison in the aggregate, the GAO found that the generic draft AMP-based FULs were 19 percent higher than generic NADACs, and the brand draft AMP-based FULs were 26 percent lower than brand NADACs.3 |

| GAO,2010 | Using 2008 data, the GAO compared estimated AMP-based FULs with average retail pharmacy acquisition costs computed by IMS Health and found that acquisition costs were higher than AMP-based FULs for most of the studied drugs, and in the aggregate.4After revising their estimates in 2010 to reflect changes to AMP-based FUL calculations included in the Affordable Care Act, the GAO concluded that AMP-based FULs were at least 35 percent higher than pharmacies’ acquisition costs, in aggregate.5 | |

| OIG,2012 | The OIG compared pharmacy invoice data with FULs using the current method based on published prices and the revised, AMP-based FULs yet to be implemented by CMS. Invoice prices were four times lower than FULs based on published prices, and about 43 percent lower than AMP-based FULs, in aggregate.6 | |

| A Fein,2011 | Analysis of the draft AMP-based FULs published by CMS in 2011 indicated that AMP-based payments for generic drugs could be about 40 percent lower than current federal and state payment levels, but because generics are comparatively inexpensive, the impact is smaller when including dispensing fees.7 Another analysis by the same author indicated that AMP values vary considerably from month-to-month.8 | |

| OIG,2007 | These findings are consistent with another analysis by the OIG, which found that 24 percent of AMP values fluctuated by more than 10 percent from quarter to quarter; AMPs for high-expenditure drugs and single-source drugs had the most frequent changes.9 | |

| OIG,2009 & 2010 | These OIG analyses raised concerns about the accuracy and consistency of AMP values.10,11 | |

| State MAC Pricing | OIG,2013 | The OIG compared FULs to State Maximum Allowable Costs (state MACs) in a 2013 report, and found that FUL amounts using current methods based on published prices were almost twice the amount of state MAC prices, in aggregate. AMP-based FUL amounts were 22 percent lower than state MAC prices, in the aggregate. In addition, the OIG found that state MAC programs include 50-60 percent more drugs than FULs. Of 41 states that identified a pricing benchmark for their state MAC programs, 29 used pharmacy acquisition costs as part of the benchmark to set state MAC prices.12 |

Endnotes

Executive Summary

“Medicaid Program; Covered Outpatient Drugs; Proposed Rule.” 72 Federal Register 22 (2 February 2012). pp. 5317-5367.

Issue Brief

Background

This figure includes rebates. See Urban Institute estimates based on data from Medicaid Financial Management Reports (HCFA/CMS Form 64). Published in Young K, Garfield R, Clemans-Cope L, Lawton E, and Holahan J. Enrollment-Driven Expenditure Growth: Medicaid Spending during the Economic Downturn, FY 2007-2011. Washington DC: Kaiser Family Foundation. April 2013. Available at https://www.kff.org/medicaid/report/enrollment-driven-expenditure-growth-medicaid-spending-during/. Note that more recent data is available, but because managed care organizations now currently handle much of Medicaid prescription drug services, publicly available data on prescription drug spending (i.e. fee-for-service prescription drug spending) only reflects a fraction of actual prescription drug spending.

Smith V, Kramer S, and Rudowitz R. Managing Medicaid Pharmacy Benefits: Current Issues and Options. Washington DC: Kaiser Family Foundation. September 2011. Available at https://www.kff.org/medicaid/report/managing-medicaid-pharmacy-benefits-current-issues-and-options/.

Young, Garfield, Clemans-Cope, Lawton, and Holahan, 2013.

For each covered drug that Medicaid programs pay for today, manufacturers must pay a rebate that at a minimum is equal to roughly 23 percent of the AMP for single-source drugs and 13 percent of the AMP for multiple source non-originator (generic) drugs. Actual rebates paid for single-source drugs often exceed the minimum due to provisions in federal law that increase the rebates to account for price increases that exceed inflation, or to ensure that Medicaid gets the best price available to any private payer, including hospitals, nursing homes, and insurance plans. Most states also have supplemental rebate agreements with drug manufacturers.

For a thorough background on issues pertaining to Medicaid pharmacy benefits, see Smith, Kramer, and Rudowitz, 2011.

Current Reimbursement Policy

Multiple-source drugs are products available from two or more manufacturers; most are generic versions of older brand name drugs and the originator brand name drugs themselves. Most widely used multiple-source drugs have a federal upper limit (FUL) or a state maximum allowable cost (state MAC) that caps reimbursement below the estimated acquisition cost (EAC).

42 CFR 447.512(b); note that the EAC is applied as an aggregate limit on payments, and need not apply to each prescription. Separate EAC certifications are required for single source and multiple-source drugs.

Section 1847A(c)(6)(B) of the Social Security Act defines WAC as the “manufacturer’s list pricefor the drug or biological to wholesalers or direct purchasers in the United States, not including prompt pay or other discounts, rebates or reductions in price […] as reported in wholesale price guides or other publications of drug or biological pricing data.”

U.S. Department of Health and Human Services - Office of Inspector General. Analyzing Changes to Medicaid Federal Upper Limit Amounts. October 2012. Available at http://oig.hhs.gov/oei/reports/oei-03-11-00650.pdf.

Neither the total drug spending nor the spending on FUL drugs includes rebates.

U.S. Department of Health and Human Services - Office of Inspector General. Comparison of Medicaid Federal Upper Limit Amounts to Average Manufacturer Prices. June 2005. Available at https://oig.hhs.gov/oei/reports/oei-03-05-00110.pdf.

The “average” used to compute the FUL is a utilization-weighted average of the AMPs reported by each manufacturer of the drug. See Section 1927(k)(1) of the Social Security Act, as amended by §2503 of the Affordable Care Act, P.L. 111-148.

Draft Affordable Care Act Federal Upper Limit, March 2013. Available at http://www.medicaid.gov/ Medicaid-CHIP-Program-Information/By-Topics/Benefits/Prescription-Drugs/Federal-Upper-Limits.html.

U.S. Department of Health and Human Services – Office of Inspector General. Medicaid Drug Pricing in State Maximum Allowable Cost Programs. 2013. Available at http://oig.hhs.gov/oei/reports/oei-03-11-00640.pdf.

Centers for Medicare and Medicaid Services. Medicaid Prescription Reimbursement Information by State - Quarter Ending December 2013. [revised 01/31/2014; cited 4/9/2014]; Available at http://www.medicaid.gov/Medicaid-CHIP-Program-Information/By-Topics/Benefits/Prescription-Drugs/Downloads/Revised-Reimbursement-chart-.pdf.

Claxton G, Rae M, Panchal N, Damico A, Bostick N, Kenward K, and Whitmore H. Employer Health Benefits: 2012 Annual Survey. Washington DC: Kaiser Family Foundation and Health Research & Educational Trust. September 2012. Available at https://www.kff.org/private-insurance/report/employer-health-benefits-2012-annual-survey/.

Pharmaceutical Benefit Management Institute. 2012-2013 Prescription Drug Benefit Cost and Plan Design Report. 2012.

CVS/Caremark. Insights. 2012.

Express Scripts. 2012 Drug Trend Report. March 2013. Available at http://www.drugtrendreport.com/.

Grant Thornton LLP. An Independent Comparative Analysis of U.S. Prescription Dispensing Costs. 2007.

Health Information Designs. Cost of Dispensing Prescription Drugs in Alabama. 2010. Available at http://medicaid.alabama.gov/documents/4.0_Programs/4.5_Pharmacy_Services/4.5.1_AAC/4.5.1_COD_FINAL_Report_1.06.10.pdf

Myers and Stauffer LC. Survey of Dispensing Costs of Pharmaceuticals in the State of Oregon. 2010.

Centers for Medicare and Medicaid Services. Medicaid Prescription Reimbursement Information by State - Quarter Ending December 2013. [revised 01/31/2014; cited 4/9/2014]; Available at http://www.medicaid.gov/Medicaid-CHIP-Program-Information/By-Topics/Benefits/Prescription-Drugs/Downloads/Revised-Reimbursement-chart-.pdf.

“Long-term drug maintenance” is dispensing 90-day supplies of preferred maintenance medications, as specified by the Alabama Medicaid Agency.

Medicaid and Children’s Health Insurance Programs: Essential Health Benefits in Alternative Benefit Plans, Eligibility Notices, Fair Hearing and Appeal Processes, and Premiums and Cost-sharing; Exchanges: Eligibility and Enrollment; Final Rule. 78 Federal Register 135 (15 July 2013) , pp. 42160-42322.

Rudowitz R and Snyder L. Premiums and Cost-Sharing in Medicaid. Washington DC: Kaiser Family Foundation. February 2013. Available at https://www.kff.org/medicaid/issue-brief/premiums-and-cost-sharing-in-medicaid/.

Goldman D, Joyce G, Zheng Y. Prescription Drug Cost-sharing – Associations with Medication and Medical Utilization and Spending and Health. JAMA 2007;298(1):61-9.

Dor A, Lage MJ, Tarrants M, Castelli-Halley J. Cost-sharing, Benefit Design and Adherence: the Case of Multiple Sclerosis. Adv Health Econ Health Serv Res 2010;22:175-93.

Davidoff A, Lopert R, Stuart B, Shaffer T et al. Simulated Value-Based Insurance Design Applied to Statin Use by Medicare Beneficiaries with Diabetes. Value in Health 2012;15(3):404-11.

Bae SJ, Paltiel AD, Fuhlbrigge AL, Weiss ST, Kuntz KM. Modeling the Potential Impact of a Prescription Drug Copayment Increase on the Adult Asthmatic Medicaid Population. Value in Health 2008;11(1):110-8.

Gaynor M, Li J, Vogt WB. Is Drug Coverage a Free Lunch? Cross-Price Elasticities and the Design of Prescription Drug Benefits. No. w12758. National Bureau of Economic Research. 2006.

Goldman, D P, Joyce GF, Karaca-Mandic P. Varying Pharmacy Benefits With Clinical Status: The Case of Cholesterol-Lowering Therapy-Page 2. Am J Man Care 2006;12:21-8.

Changes in Reimbursement Policy

The Health Care Financing Administration became CMS in 2001.

Pracht EE, Moore WJ. Interest Groups and State Medicaid Drug Programs. Journal of Health Politics, Policy and Law. 2003;28(1):9-39.

U.S. Department of Health and Human Services - Office of Inspector General. Medicaid Pharmacy: Actual Acquisition Cost of Prescription Drug Products for Brand Name Drugs. 1997. Available at https://oig.hhs.gov/oas/reports/region6/69600030.pdf.

U.S. Department of Health and Human Services - Office of Inspector General. Medicaid Pharmacy: Actual Acquisition Cost of Brand Name Prescription Drug Products. 2001. Available at http://oig.hhs.gov/oas/reports/region6/60000023.pdf.

U.S. Department of Health and Human Services - Office of Inspector General. Medicaid Pharmacy: Additional Analyses of the Actual Acquisition Cost of Prescription Drug Products. 2002. Available at http://oig.hhs.gov/oas/reports/region6/60200041.pdf.

U.S. Department of Health and Human Services - Office of Inspector General. Medicaid Pharmacy: Actual Acquisition Cost of Generic Prescription Drug Products. 2002. Available at https://oig.hhs.gov/oas/reports/region6/60100053.pdf.

Centers for Medicare and Medicaid Services. Medicaid Prescription Reimbursement Information by State - Quarter Ending December 2010. Available at http://www.medicaid.gov/Medicaid-CHIP-Program-Information/By-Topics/Benefits/Prescription-Drugs/State-Prescription-Drug-Resources.html.

U.S. Department of Health and Human Services - Office of Inspector General. Medicaid Drug Price Comparisons: Average Manufacturer Price to Published Prices. 2005. Available at http://oig.hhs.gov/oei/reports/oei-05-05-00240.pdf.

Medicaid Program; Covered Outpatient Drugs, CMS–2345–P (2012).

Office of Management and Budget, Office of Information and Regulatory Affairs. RIN 0938-AQ41. Available at http://www.reginfo.gov/public/do/eAgendaViewRule?pubId=201310&RIN=0938-AQ41

U.S. Department of Health and Human Services - Office of Inspector General, Replacing Average Wholesale Price: Medicaid Drug Payment Policy (OEI-03-11-00060). July 2011. Available at http://oig.hhs.gov/oei/reports/oei-03-11-00060.pdf.

Due to funding issues, as of July 2013, CMS suspended the portion of this survey focusing on consumer purchase prices, which provided estimated National Average Retail Prices (NARP) for selected outpatient drugs based on actual transaction prices.

CMS posts draft and final NADAC data, along with methods and answers to questions, on the agency’s website: http://www.medicaid.gov/Medicaid-CHIP-Program-Information/By-Topics/Benefits/Prescription-Drugs/Survey-of-Retail-Prices.html

Morgan K. NADAC or PAC; Examining Options for a Better Drug Price Standard. Elsevier. 2012. Available at http://www.goldstandard.com/2012/04/nadac-or-pac-examining-options-for-a-better-drug-price-standard.

Comparing Pricing Under Different Measures

The NDC is a unique code that identifies each drug according to its labeler, strength, dosage form, package form, and package size.

Policy Implications

Department of Health and Human Services. Fiscal Year 2015 Budget in Brief: Strengthening Health and Opportunity for All American. Available at http://www.hhs.gov/budget/fy2015/fy-2015-budget-in-brief.pdf.

Smith, Kramer, and Rudowitz, 2011.

Smith, Kramer, and Rudowitz, 2011.

“Medicaid Program; Covered Outpatient Drugs; Proposed Rule.” 72 Federal Register 22 (2 February 2012). pp. 5317-5367.

Appendix

U.S. Department of Health and Human Services – Office of Inspector General. Medicaid Drug Price Comparisons: Average Manufacturer Price to Published Prices. 2005. Available at http://oig.hhs.gov/oei/reports/oei-05-05-00240.pdf.

U.S. Department of Health and Human Services – Office of Inspector General. Review of Drug Costs to Pharmacies and Their Relation to Benchmark Prices. 2011. Available at http://oig.hhs.gov/oas/reports/region6/61100002.pdf.

U.S. Government Accountability Office. CMS Should Implement Revised Federal Upper Limits and Monitor Their Relationship to Retail Pharmacy Acquisition Costs. 2013. Available at http://www.gao.gov/assets/660/659833.pdf.

U.S. Government Accountability Office. Medicaid Outpatient Prescription Drugs: Second Quarter 2008 Federal Upper Limits for Reimbursement Compared with Average Retail Pharmacy Acquisition Costs. 2009. Available at http://www.gao.gov/assets/100/96490.pdf.

U.S. Government Accountability Office. Medicaid Outpatient Prescription Drugs: Estimated Changes to Federal Upper Limits Using the Formula under the Patient Protection and Affordable Care Act. 2010. Available at http://www.gao.gov/assets/100/97232.pdf.

U.S. Department of Health and Human Services – Office of Inspector General. Analyzing Changes to Medicaid Federal Upper Limit Amounts. 2012. Available at http://oig.hhs.gov/oei/reports/oei-03-11-00650.asp.

Fein AJ. The Pharmacy Reimbursement Hit from AMP-Based FULs. Drug Channels. September 27, 2011.

Fein AJ. Generic Drug Prices are Rising, According to Latest AMP Data. Drug Channels. December 13, 2011.

U.S. Department of Health and Human Services – Office of Inspector General. Examining Fluctuations in Average Manufacturer Prices. 2007. Available at http://oig.hhs.gov/oei/reports/oei-03-06-00350.pdf.

U.S. Department of Health and Human Services – Office of Inspector General. Outlier Average Manufacturer Prices in the Federal Upper Limit Program. 2009. Available at http://www.healthlawyers.org/News/Health%20Lawyers%20Weekly/Documents/01%2022%2010/oei-03-07-00740.pdf.

U.S. Department of Health and Human Services – Office of Inspector General. Drug Manufacturers' Noncompliance with Average Manufacturer Price Reporting Requirements. 2010. Available at http://oig.hhs.gov/oei/reports/oei-03-09-00060.pdf.

U.S. Department of Health and Human Services – Office of Inspector General. Medicaid Drug Pricing in State Maximum Allowable Cost Programs. 2013. Available at http://oig.hhs.gov/oei/reports/oei-03-11-00640.pdf.