Medicaid Reforms to Expand Coverage, Control Costs and Improve Care: Results from a 50-State Medicaid Budget Survey for State Fiscal Years 2015 and 2016

Vernon K. Smith, Kathleen Gifford and Eileen Ellis, Health Management Associates, Robin Rudowitz, Laura Snyder, and Elizabeth Hinton

Published:

Executive Summary

Medicaid plays a significant role in the U.S. health care system, now providing health insurance coverage to more than one in five Americans. The Medicaid program continues to evolve, responding to changes in the economy, the broader health system, state budgets and policy priorities, and in recent years, to requirements and opportunities in the Affordable Care Act (ACA).

This report provides an in-depth examination of the changes taking place in Medicaid programs across the country. The findings in this report are drawn from the 15th annual budget survey of Medicaid officials in all 50 states and the District of Columbia conducted by the Kaiser Commission on Medicaid and the Uninsured and Health Management Associates (HMA), in collaboration with the National Association of Medicaid Directors. This report highlights policy changes implemented in state Medicaid programs in FY 2015 and those planned for implementation in FY 2016 based on information provided by the nation’s state Medicaid directors.

Policy changes and initiatives described in this report include those in eligibility and enrollment, managed care, delivery and payment system reforms, provider payment rates, and covered benefits (including prescription drug policies). The report also looks at the key issues and challenges now facing Medicaid programs.

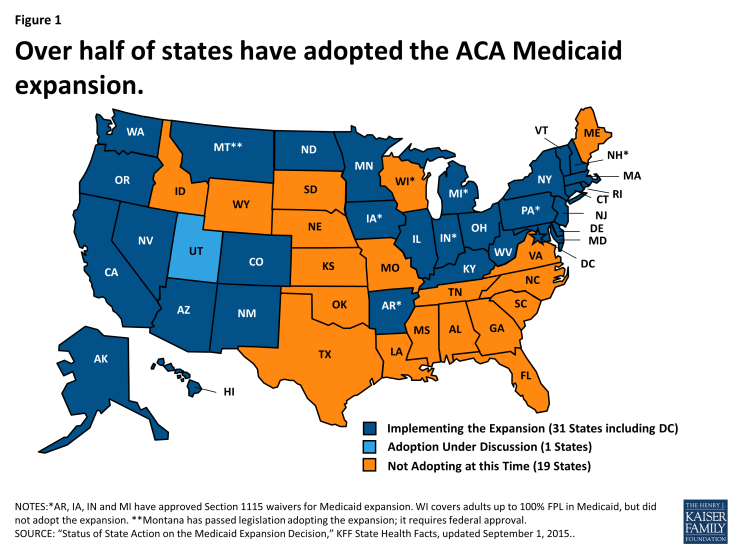

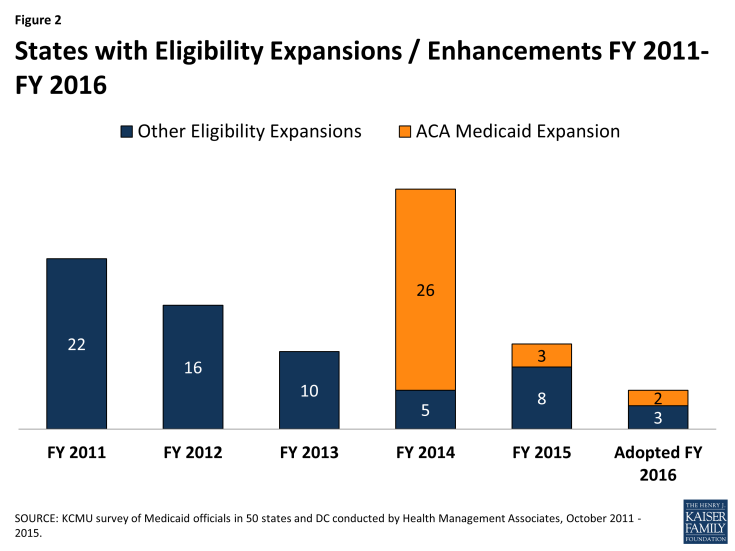

Eligibility and enrollment changes in the ACA are continuing to have major policy implications for states in FY 2015 and FY 2016. As of October 2015, 31 states (including DC) had adopted the ACA Medicaid expansion. This includes 26 states that implemented the expansion in FY 2014, three additional states in FY 2015 (New Hampshire, Pennsylvania and Indiana) and two additional states in FY 2016 (Alaska and Montana). Other eligibility changes adopted or planned for states in FY 2015 and FY 2016 were small and targeted to a limited number of beneficiaries. As a result of new coverage pathways, a number of states are eliminating coverage for beneficiaries with incomes above 138 percent of poverty, many of whom qualify for Marketplace subsidies, as well as eligibility pathways to more limited Medicaid coverage. A few states had received or were seeking waivers to implement changes to premiums that were primarily related to the ACA coverage expansions (Arkansas, Indiana, Iowa, Michigan and Montana).

Under the ACA, all states were required to implement enrollment changes including new streamlined application, enrollment, and renewal processes for individuals. Many states adopted new eligibility and enrollment systems. A number of states were still working through challenges in processing renewals at the start of FY 2016.

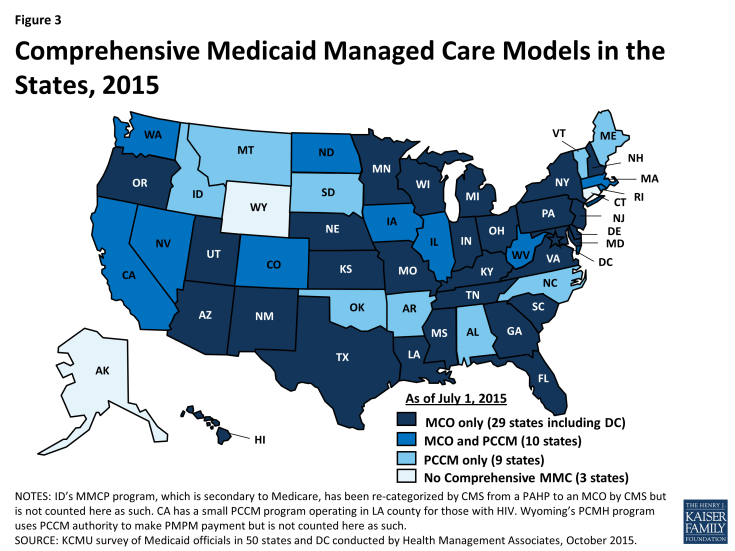

States remain focused on strategies and initiatives to improve the effectiveness and outcomes of care, and to slow the growth in the cost of care. As of July 2015, a total of 48 states used some form of managed care to serve the Medicaid population, including 39 states (including DC) that contracted with risk-based managed care organizations (MCOs) to serve their Medicaid enrollees. In 21 of these states, at least 75 percent of all Medicaid beneficiaries were enrolled in MCOs. In FYs 2015 and 2016, the trend toward increased use of MCOs continues, as five states (Florida, Indiana, Iowa, Louisiana and Rhode Island) end their primary care case management (PCCM) programs and transition populations to MCOs. Other states are moving more eligibility groups, geographic areas and benefits into MCOs. As more states rely on MCOs for acute physical health care, a growing number of states are focusing on integration of physical health, behavioral health and long-term services and supports (LTSS) under the umbrella of managed care as a priority policy direction.

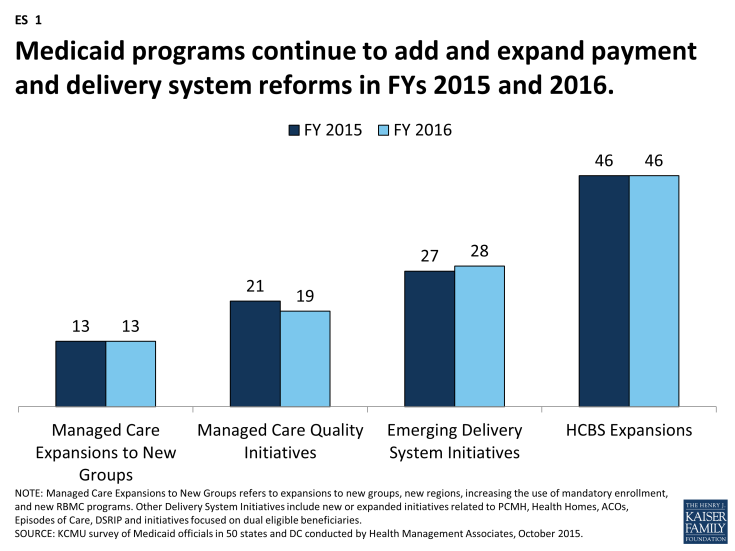

With greater utilization of MCOs has come greater focus on quality performance. For FY 2015, a total of 21 states implemented new or expanded quality initiatives and 19 states planned to do so in FY 2016. (ES 1) These include MCO report cards and greater reporting of quality metrics, pay for performance, capitation withholds, performance bonuses or penalties, and special quality initiatives and performance improvement projects.

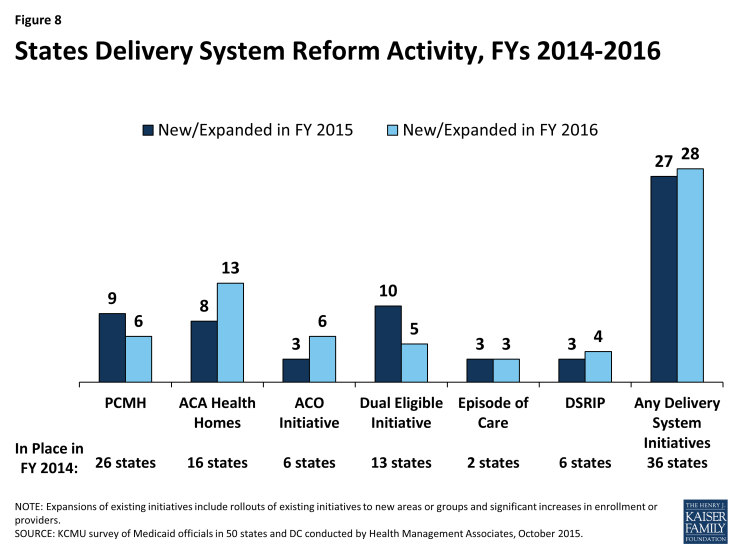

States are implementing and expanding alternative delivery system and payment models. Thirty-seven (37) states in either FY 2015 or FY 2016, including 27 states in FY 2015 and 28 states in FY 2016, reported adopting or expanding one or more initiatives that seek to control costs, reward quality and encourage integrated care. (ES 1) Initiatives include patient-centered medical homes (PCMHs), Health Homes, Accountable Care Organizations (ACOs) as well as other initiatives to coordinate physical and behavioral health care and better manage the care of persons with multiple chronic conditions. Nearly a quarter of states are implementing initiatives in FY 2015 or FY 2016 to coordinate care and financing for dually-eligible Medicare-Medicaid beneficiaries. A limited number of states are implementing episode of care and DSRIP initiatives.

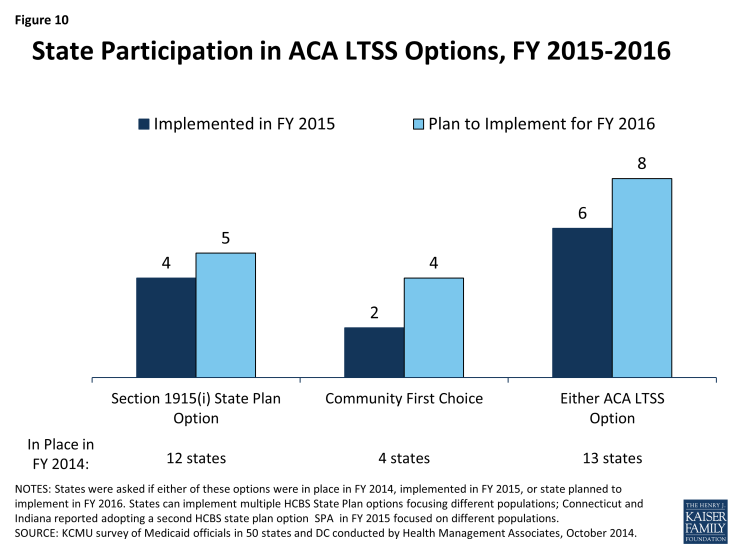

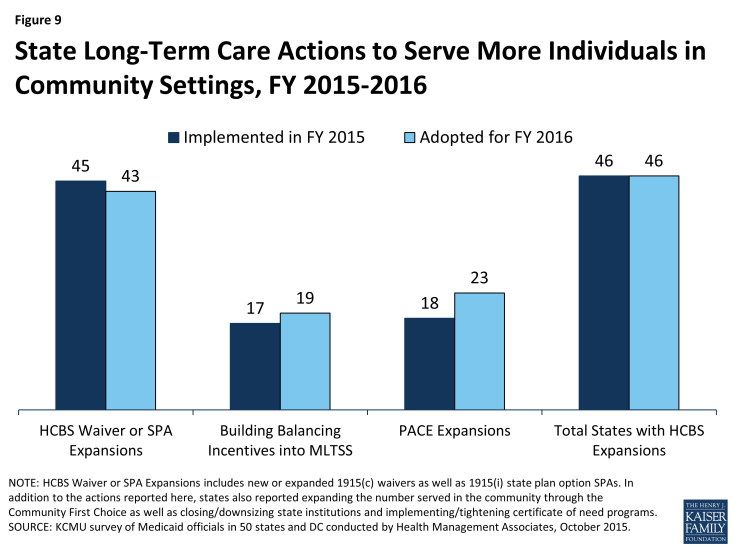

States are implementing policies designed to “re-balance” care to allow more individuals to live in their homes and in the community. Nearly every state (46 states in both FY 2015 and FY 2016) took steps to expand care in the home and community. The ACA included some LTSS-related options intended to promote LTSS rebalancing including the Community First Choice Option and the 1915(i) HCBS State Plan Option. Thirteen (13) states reported having one or both of these options in place in FY 2014; an additional six states implemented at least one of these options in FY 2015 and eight states planned to do so in FY 2016.

Figure ES-1: Medicaid programs continue to add and expand payment and delivery system reforms in FYs 2015 and 2016.

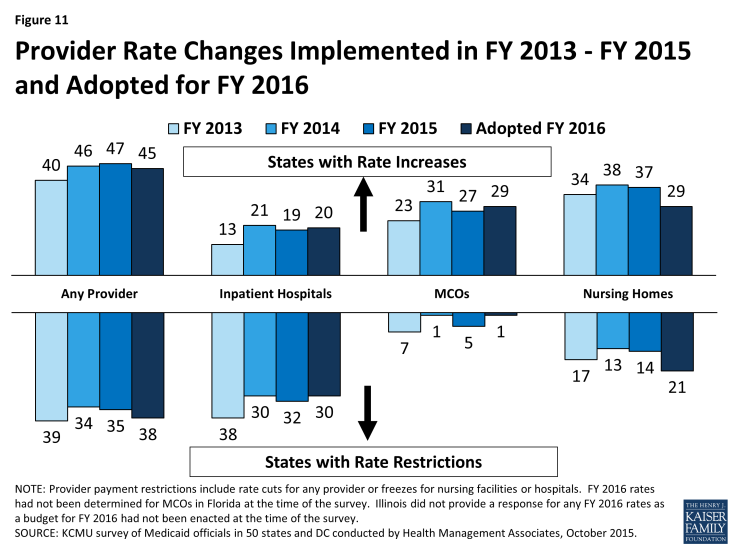

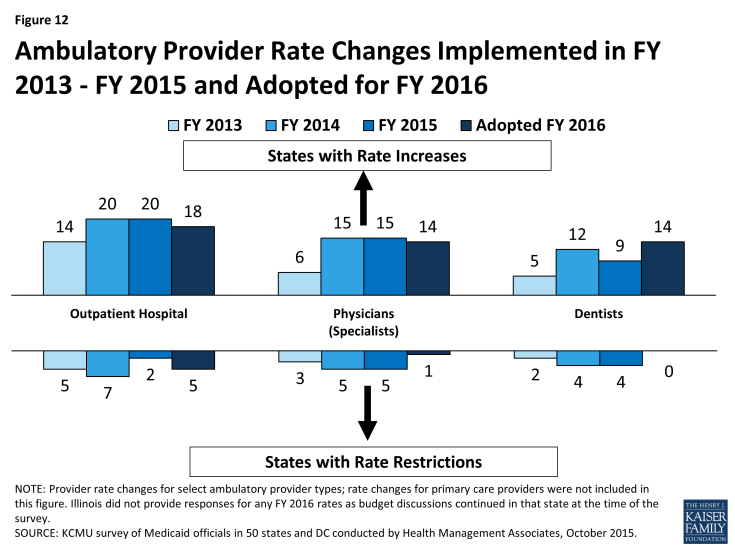

Given the size of Medicaid in state budgets, there is always pressure to control costs; however, improvements in the economy have allowed states to adopt more increases in reimbursement rates and benefits compared to restrictions. Medicaid provider payment rates and benefits are often adjusted in response to changes in the economy, with restrictions in times of economic downturns and state budget shortfalls, and restorations or enhancements when the economy and state revenues improve. In FY 2015 and FY 2016, more states implemented or planned for rate increases compared to restrictions (47 and 45 states increasing compared to 35 and 38 states restricting rates in those years). In this survey, a number of states reported that they have or are adopting reimbursement policies to reduce potentially preventable hospital readmissions and early elective deliveries.

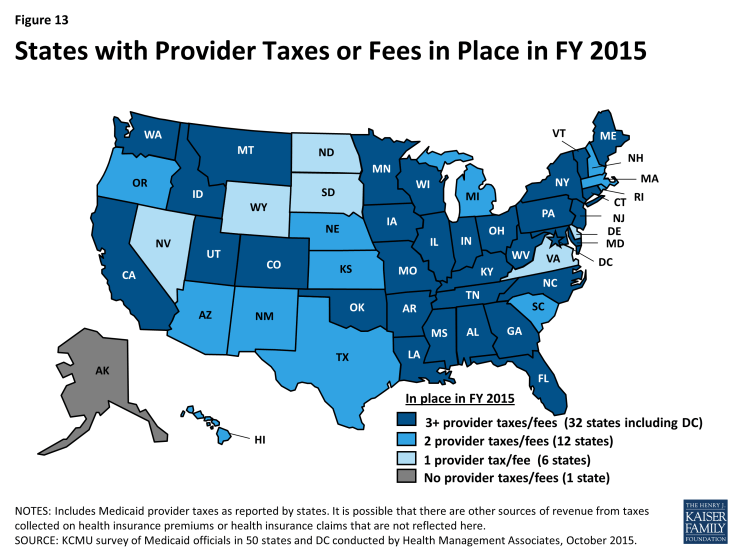

All states (except Alaska) use at least one provider tax or fee to help finance Medicaid. Eighteen (18) states increased or planned to increase one or more provider taxes or fees in FYs 2015 and 2016. Seven (7) of the Medicaid expansion states (Arizona, California, Colorado, Indiana, Kentucky, Nevada and Ohio) reported plans to use increased provider taxes or fees to fund all or part of the costs of the ACA Medicaid expansion beginning in January 2017, when states must pay a small share of the costs of the expansion.

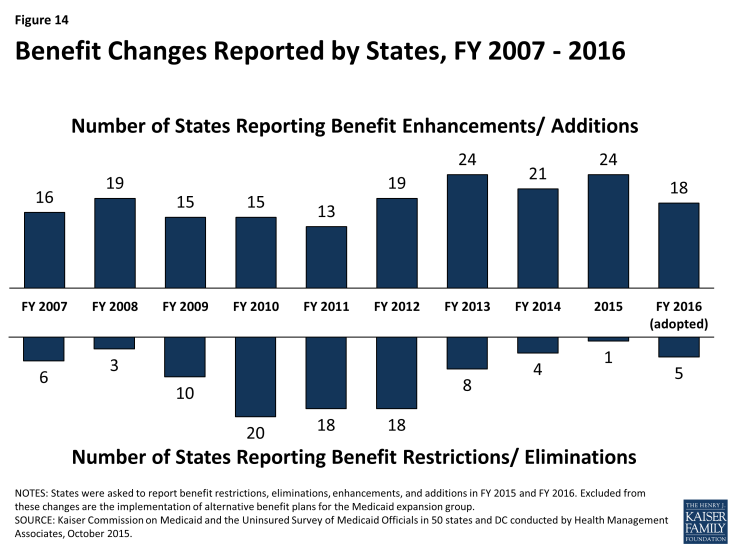

A total of 24 states expanded or enhanced covered benefits in FY 2015, and 18 states planned expansions in FY 2016. The most common benefit enhancements reported were for behavioral health and substance abuse services, HCBS and dental services for adults. Far fewer states reported benefit restrictions.

States have a renewed focus on controlling rising prescription drug costs. Since 2014, rising drug prices and increasing program costs have refocused state attention on pharmacy reimbursement and coverage policies. The majority of states identified high-cost and specialty drugs (e.g., hepatitis C antivirals among others) as a significant cost driver for state Medicaid programs as well as increased costs for generics among other factors. Over two-thirds of the states in FY 2015 and half in FY 2016 reported actions to refine and enhance their pharmacy programs in response to new and emerging specialty and high-cost drug therapies.

Medicaid directors reported a number of key priorities in FY 2016 and beyond. Medicaid is a large and complex program that provides health coverage for an increasing share of the population in each state. As the program continues to evolve, the key priorities for most directors are around implementing the ACA coverage provisions, controlling costs, implementing an array of complex delivery system reforms, and standing up new systems to support program operations related to enrollment, claims processing and delivery system reforms. Tackling this magnitude of change is a significant challenge, particularly given that most state Medicaid programs are operating within constrained resources, both in terms of staff and funding. Emerging priorities mentioned by Medicaid directors include population health and social determinants of health. (ES 2) State Medicaid programs are looking for opportunities to leverage other resources and stakeholders (such as state public health agencies and other payers) to improve the quality of care provided and ultimately affect health outcomes for the populations they serve. Pursuing these significant goals has caused Medicaid to evolve into a major player in transforming the overall health care system.

Report

Introduction

This report provides an in-depth examination of the reforms, policy changes and initiatives taking place in state Medicaid programs across the country. The findings in this report are drawn from the 15th annual budget survey of Medicaid officials in all 50 states and the District of Columbia conducted by the Kaiser Commission on Medicaid and the Uninsured (KCMU) and Health Management Associates (HMA), in collaboration with the National Association of Medicaid Directors. This was the fifteenth annual survey, which has been conducted at the beginning of each state fiscal year from FY 2002 through FY 2016.1 (Copies of previous reports are archived here.)

The KCMU/HMA Medicaid survey on which this report is based was conducted from June through August 2015. Medicaid directors and staff provided data for this report in response to a written survey and a follow-up telephone interview. All 50 states and DC completed surveys and participated in telephone interview discussions between June and August 2015. The survey asked state officials to describe policy initiatives and changes that occurred in FY 2015 and those adopted for implementation for FY 2016 (which began for most states on July 1, 20152). The survey does not attempt to catalog all Medicaid policies. Experience has shown that adopted policies are sometimes delayed or not implemented for reasons related to legal, fiscal, administrative, systems or political considerations, or due to delays in approval from CMS. Not included in the survey are policy changes under consideration where a definite decision on implementation has not yet been made. A copy of the survey instrument is located in the appendix of this report.

Key findings of this survey, along with 50-state tables providing more detailed information, are described in the following sections of this report:

- Eligibility, Enrollment, Premiums and Cost-Sharing

- Managed Care Reforms

- Emerging Delivery System and Payment Reforms

- Long-Term Services and Supports

- Provider Rates, Taxes and Benefits

- Priorities for FY 2016 and Beyond Reported by Medicaid Directors

Eligibility, Enrollment, Premiums and Cost-Sharing

| Key Section Findings |

Tables 2, 3 and 4 at the end of this section include additional details on eligibility, premiums and cost-sharing policy changes in FYs 2015 and 2016. These tables are also available in a downloadable PDF. |

Changes to Eligibility Standards

The ACA included a number of significant changes to Medicaid eligibility and enrollment policies. One of the most significant changes was to extend Medicaid coverage to nearly all non-elderly adults with incomes up to 138 percent of the federal poverty level (FPL) ($16,242 per year for an individual in 2015), ending the historic exclusion of adults without dependent children, or childless adults, from the program. However, the June 2012 Supreme Court ruling on the constitutionality of the ACA effectively made the Medicaid expansion optional for states. Regardless of whether states implement the Medicaid expansion, all states were required to implement a range of other changes to eligibility and enrollment under the ACA. These changes included transitioning to use of Modified Adjusted Gross Income (MAGI) to determine financial eligibility for children, pregnant women, parents and low-income adults; eliminating asset limits for these same groups; establishing a new minimum eligibility limit of 138 percent FPL for children in Medicaid, which resulted in the transition of older children from the Children’s Health Insurance Program (CHIP) to Medicaid in some states; and providing new streamlined application, enrollment, and renewal processes for individuals. In addition, Medicaid agencies must coordinate eligibility determination and enrollment processes with the new Marketplaces. Altogether, the eligibility changes in 2014 represent historic program changes. Most of these changes occurred in FY 2014. As a result, very few changes in eligibility standards occurred for FY 2015 and FY 2016.

As of October 2015, 31 states (including DC) had adopted the Medicaid expansion. (Figure 1) In Utah, discussions continue about implementing the Medicaid expansion, and other states may re-visit the decision in the next legislative session. Most states that have adopted the ACA Medicaid expansion did so in FY 2014 (26 states). In FY 2015, three additional states adopted the ACA Medicaid expansion (Indiana, New Hampshire and Pennsylvania.) In FY 2016, two states to date have adopted the ACA Medicaid expansion; Alaska implemented in September 2015, and Montana plans to implement in January 2016 pending federal waiver approval.

Other eligibility changes in FY 2015 and FY 2016 were limited and targeted to small numbers of beneficiaries. For FY 2015, a total of eleven states made changes that expanded Medicaid eligibility and for FY 2016, five states plan to implement Medicaid eligibility expansions. (Figure 2) Only one state in FY 2015 and three states in FY 2016 made or are planning eligibility restrictions that were likely to leave individuals without other coverage options. A number of states are making changes to existing Medicaid eligibility pathways due to the availability of new coverage options; these changes are not counted as restrictions or expansions in this report.

Coverage Transitions

As reported last year, with more coverage options available across the income spectrum, some states made changes to existing Medicaid pathways. These changes are discussed below and are noted in Tables 2 and 3 as “(#)” meaning they are not counted as a positive or negative eligibility change.

Medicaid expansion states reducing eligibility for adults over 138 percent FPL. Both Minnesota and New York previously covered adults with incomes above traditional Medicaid eligibility levels through Medicaid waiver programs but have transferred those groups to their Basic Health Plans, discussed below. In addition, Connecticut reported plans to reduce Medicaid parent eligibility levels to 150 percent FPL in FY 2016; many parents previously eligible at the higher levels should be eligible for Marketplace subsidies.

| Basic Health Plan |

New York and Minnesota both implemented a Basic Health Plan (BHP) in FY 2015. Under the BHP provisions of the ACA, a state receives 95 percent of what the federal government would have spent on premium and cost-sharing subsidies in the Marketplace for the eligible population. The state then provides coverage through a state-managed BHP. While the BHP is not part of Medicaid, it affected Medicaid in these states.

|

States reducing or eliminating optional and limited Medicaid eligibility pathways. With new coverage options available either through the Medicaid expansion or the Marketplace, states have new options about how they treat some existing eligibility pathways for more limited Medicaid coverage, such as pregnancy related coverage, family planning-only programs, some spend-down programs, and the Breast and Cervical Cancer Treatment (BCCT) program.2 Prior to the implementation of the major ACA coverage changes, it was not clear if states would eliminate or scale back some of these programs in response to the new coverage options. While most states reported no current plans to change such pathways, many states indicated that enrollment in these groups has declined as more individuals are eligible under the adult Medicaid expansion group. However, a few states did note eligibility changes. (Table 1) In these cases, states generally plan to not allow new enrollment through these pathways but will continue coverage for those already enrolled.

| Table 1: States Eliminating Coverage for Optional and Limited Medicaid Eligibility Pathways | ||

| Program | In Place in 2013 (Prior to the ACA) | Eliminated or Plans to Eliminate |

| Breast and Cervical Cancer Treatment | 51 | Arkansas and Maryland (FY 2014), Illinois (FY 2016) |

| Medically Needy / Spend Down Adults | 36 | Hawaii and Illinois (FY 2014); Pennsylvania1 (FY 2015) |

| Pregnant Women Coverage > 138% FPL | 43 | Louisiana2 (FY 2014) |

| Family Planning Waivers or State Plan | 33 | Arizona, Arkansas, Delaware, Louisiana3 and Michigan4 (FY 2014); Illinois (FY 2015); Ohio and Pennsylvania5 (FY 2016) |

|

NOTES:

1 Pennsylvania eliminated spend-down for the disabled only; it is reinstating this coverage in FY 2016.

2 Louisiana reported that pregnant women with income above 133% FPL were eligible for coverage under CHIP. 3 Louisiana converted its family planning waiver to a SPA, but eligibility declined to 133% FPL. 4 Michigan closed its family planning waiver to new enrollment in April 2014. 5 Pennsylvania is converting its family planning wavier to a SPA but is no longer accepting new enrollment. |

||

Other Eligibility Changes

Other eligibility changes were more targeted or limited. These changes are noted in Table 2, but a few include:

- In FY 2016, Colorado is implementing the option to eliminate the five-year bar on Medicaid eligibility for lawfully-residing immigrant children.

- In FY 2015, Montana increased the cap on enrollment in its Mental Health Services Plan (MHSP) waiver from 2,000 to 6,000 adults with serious mental illness (before the state adopted the Medicaid expansion).

- Virginia implemented a Section 1115 waiver to provide limited benefits to some uninsured adults with serious mental illness as part of the Governor’s Action Plan in FY 2015. (State legislation later reduced eligibility for this waiver from 100 percent FPL to 60 percent FPL, effective July 1, 2015.)

- A number of states made changes to increase eligibility for the aged, blind and individuals with disabilities including eliminating the asset test (Vermont in FY 2015)and increasing income and asset limits for working individuals with disabilities (Virginia, New Jersey, Florida and Michigan).

Only one state in FY 2015 (Wisconsin) and three states in FY 2016 (Ohio, Tennessee and Virginia) made or plan to make eligibility restrictions that are likely to leave individuals without other coverage options. These are targeted restrictions that would affect small groups of beneficiaries.

In addition, California mentioned plans in FY 2016 to extend coverage to all undocumented children. This is a state-funded initiative and not funded through Medicaid; therefore, it is not counted as a Medicaid policy change in this report.

Enrollment Policies and Changes

Renewals

As of January 1, 2014, new streamlined renewal policies for Medicaid also went into effect under the ACA. However, many states were delayed in implementing new renewal procedures. Recognizing this delay, during 2014, CMS allowed states to suspend renewals for existing enrollees for specified periods of time in order to free up staff resources to process new applicants and continue to update eligibility systems to implement new streamlined renewal procedures based on MAGI rules. States were asked if, at the time of the survey, they were experiencing challenges processing MAGI-based renewals and to describe those challenges.

A number of states reported that they were experiencing challenges processing MAGI-based renewals at the time of the survey. Most of the issues reported were related to new eligibility systems, high volume of renewals, challenges matching data, and issues with pre-populated renewal forms. Most of these challenges were seen as temporary issues, but were not yet fully resolved in some states at the start of FY 2016.

Hospital Presumptive Eligibility (HPE)

Starting in January 2014, the ACA allowed qualified hospitals to make Medicaid presumptive eligibility determinations. States were asked to describe the level of participation among hospitals in their states. Thirty-three (33) states reported that they have implemented HPE and have at least one hospital participating in the initiative; the remaining states noted that either they were still working to implement HPE or that no hospitals had signed up to participate at the time of the survey.

Premiums and Cost-Sharing

In July 2013, CMS released final rules designed to streamline and simplify regulations around Medicaid premiums and cost-sharing, consolidate existing law and provide for individual market premium assistance. Under the new rules, CMS clarified that total Medicaid premiums and cost-sharing incurred by all individuals in a Medicaid household may not exceed an aggregate limit of five percent of the family’s income, applied on either a quarterly or monthly basis. To enforce this, the new rules also extended the requirement that states track aggregate premiums and cost-sharing and suspend such payments if the household reached the five percent cap.3 In this year’s survey, several states commented on the difficulty of implementing a process to track these limits. In some cases, this has resulted in delays or reversals of plans to increase beneficiary cost-sharing.

Premiums

With certain exceptions, Medicaid generally is not allowed to charge premiums to Medicaid beneficiaries with incomes at or below 150 percent FPL, although in limited cases certain populations may be charged premiums (sometimes referred to as “buy-in” programs) including: working individuals with disabilities eligible under the Ticket to Work and Work Incentives Improvement Act (TWWIIA) and children with disabilities in families with incomes that otherwise exceed Medicaid limits eligible under the Family Opportunity Act (FOA). States are also permitted under certain circumstances to impose premiums on parents receiving Transitional Medical Assistance (TMA) coverage. Prior to the ACA Medicaid expansion, a number of states also received Section 1115 waiver authority to expand coverage to higher income groups who were not otherwise eligible for Medicaid and to subject them to a premium requirement. Under the ACA, a few states have received federal waivers to impose premiums on their Medicaid expansion populations.

In this year’s survey, states identified very few changes to premiums. Six states reported premium changes, including some with multiple changes. Five states made or proposed changes related to ACA coverage expansions (Arkansas, Indiana, Iowa, Michigan and Montana) and are described following the next section. Two states (Michigan and Minnesota) increased premiums for working individuals with disabilities.4

Copayment Requirements

Most state Medicaid programs require beneficiary copayments, but to varying degrees. Six states reported new copayment requirements in either FY 2015 or FY 2016; each of these states reported new copayment requirements for their Medicaid expansion populations. Indiana reported new copayments in FY 2015 and FY 2016 aside from the new Medicaid expansion group. Only three states reported any other actual or planned copayment increases for either FY 2015 (one state) or FY 2016 (two states). Two states reported elimination of copayments in FY 2015 and three states reported reductions in copayments in either FY 2015 (two states) or FY 2016 (one state).

Increases for the ACA Expansion Population. Two states in FY 2015 (Indiana and Iowa) and four states in FY 2016 (Arizona, Montana, New Hampshire and New Mexico) adopted new copayments for their expansion populations. Four of these states (Arizona, Indiana, Iowa and New Mexico) noted changes in copayments related to non-emergent use of the Emergency Department (ED) for the expansion group; all but one (Indiana) planned to increase such copayments under existing state plan authority (up to $8). Indiana received a waiver under Section 1916(f) to test the effects of higher copayments ($8 for the first use of the ED and then $25 for subsequent use) than otherwise allowed under federal law (Section 1115 waiver authority does not extend to Medicaid cost-sharing requirements).5 Additionally, two states (New Hampshire and Michigan) reported plans to increase copayments for some expansion adults in FY 2016.

Pharmacy. A few states reported changes to pharmacy copayments in either FY 2015 or FY 2016. The nature and direction of these changes varied based on policy goals. New Mexico added pharmacy copayments for its expansion population. New Hampshire increased pharmacy copayments for its Medicaid expansion population, but eliminated pharmacy copayments for adults with incomes below 100 percent FPL. Two states reported decreased pharmacy copayments – an across the board reduction for working individuals with disabilities in New Mexico and a reduction in copayments for high value drugs (such as those for diabetes or mental illness) in South Carolina.

| ACA Medicaid Expansion Premium Waivers |

| Five states (Arkansas, Indiana, Iowa, Michigan and Montana) used or plan to use Section 1115 demonstration waiver authority to implement premium requirements for their expansion populations. (Pennsylvania also received waiver authority to implement premiums for this population beginning January 1, 2016, but Governor Wolf chose to transition its Medicaid expansion from a waiver to a state plan amendment by September 2015, without premiums.) Arkansas, Indiana, Iowa, Michigan and Montana all implemented or plan to implement changes to premiums for their expansion populations in FY 2015 or FY 2016.

Arkansas, in February 2015, added monthly contributions of $10 to $15 depending on income as part of Health Care Independence Accounts (HIA) available to newly eligible adults with incomes between 100 and 138 percent FPL in lieu of paying cost-sharing obligations. If individuals do not pay the HIA amounts, they would be assessed copayments at the point of service. Indiana’s Medicaid expansion waiver, Healthy Indiana Plan 2.0, requires most newly eligible adults with incomes from 0 to 138 percent FPL to contribute to a Personal Wellness and Responsibility (POWER) Account. Contributions range from $1 per month for individuals with incomes from zero to five percent FPL to $27 per month for individuals with incomes between 100 and 138 percent FPL. Payment is required before Medicaid enrollment is effective. Individuals have 90 days from the date of their invoice to make the required contributions without penalty. Failure to make contributions to the POWER accounts would result in a more limited benefits package and point of service copayments for those with incomes below 100 percent FPL and would result in a six month “lockout” from Medicaid eligibility for those with incomes above 100 percent FPL. Under Iowa’s Medicaid expansion waiver, enrollees with incomes over 50 percent FPL are required to make a monthly premium contribution, beginning in the second year of coverage (January 2015 at the earliest), which could be waived if the beneficiary completes specified wellness activities. Beneficiaries can also receive a hardship exemption if they cannot pay the premiums. In Iowa, there are no copayment requirements except for non-emergency use of the emergency department, which were waived during the first year of enrollment. This copayment was adopted under a SPA, not a waiver. The Healthy Michigan Plan requires contributions equal to two percent of annual income for persons between 100 and 138 percent FPL after they have been in the health plan for six months. (This is equivalent to the premiums that this population would face if they were enrolled in the Marketplace if the state had not expanded Medicaid). Total cost-sharing, including copayments (determined based on the past six months of services use) cannot exceed five percent of annual household income and is paid through the use of a dedicated health account called the “MI Health Account.” Enrollees can reduce their annual cost-sharing by participating in healthy behavior activities which include completing an annual health risk assessment. The imposition of these contributions began in FY 2015.6 Failure to pay premiums would not result in a loss of eligibility. Montana’s Medicaid expansion waiver request would impose a premium of two percent of income for the entire ACA expansion group (from 0 to 138 percent FPL) as of January 1, 2016. Montana proposes dis-enrolling beneficiaries from 100-138 percent FPL for failing to pay premiums and seeks waiver authority to lock-out these individuals until overdue premiums are paid, or there is an assessment from the Department of Revenue against income taxes. Additionally, the waiver mentions that participation in a wellness program could exempt a beneficiary from disenrollment, but details were not provided. While the state is not requesting waiver authority, the proposal would require copayments according to maximum state plan amounts and consistent with federal law for all newly eligible beneficiaries.7 |

Table 2: Changes to Eligibility Standards in all 50 States and DC, FY 2015 and 2016

|

Eligibility Standard Changes |

||||||

|

STATES |

FY 2015 |

FY 2016 |

||||

|

(+) |

(-) |

(#) |

(+) |

(-) |

(#) |

|

|

Alabama |

||||||

|

Alaska |

X – Medicaid Expansion |

|||||

|

Arizona |

||||||

|

Arkansas |

||||||

|

California |

||||||

|

Colorado |

X |

|||||

|

Connecticut |

X |

|||||

|

Delaware |

||||||

|

DC |

||||||

|

Florida |

X |

|||||

|

Georgia |

||||||

|

Hawaii |

||||||

|

Idaho |

||||||

|

Illinois |

X |

X |

||||

|

Indiana |

X – Medicaid Expansion |

|||||

|

Iowa |

||||||

|

Kansas |

X |

|||||

|

Kentucky |

||||||

|

Louisiana |

X |

X |

||||

|

Maine |

||||||

|

Maryland |

||||||

|

Massachusetts |

||||||

|

Michigan |

X |

|||||

|

Minnesota |

X |

|||||

|

Mississippi |

||||||

|

Missouri |

||||||

|

Montana |

X |

X – Medicaid Expansion |

||||

|

Nebraska |

X |

|||||

|

Nevada |

||||||

|

New Hampshire |

X – Medicaid Expansion |

|||||

|

New Jersey |

X |

|||||

|

New Mexico |

||||||

|

New York |

X |

|||||

|

North Carolina |

X |

|||||

|

North Dakota |

||||||

|

Ohio |

X |

X |

||||

|

Oklahoma |

||||||

|

Oregon |

||||||

|

Pennsylvania |

X – Medicaid Expansion |

X |

X |

|||

|

Rhode Island |

||||||

|

South Carolina |

||||||

|

South Dakota |

||||||

|

Tennessee |

X |

|||||

|

Texas |

||||||

|

Utah |

||||||

|

Vermont |

X |

|||||

|

Virginia |

X |

X |

X |

|||

|

Washington |

||||||

|

West Virginia |

||||||

|

Wisconsin |

X |

|||||

|

Wyoming |

||||||

|

Totals |

11 |

1 |

6 |

5 |

3 |

4 |

| NOTES: Positive changes from the beneficiary’s perspective that were counted in this report are denoted with (+). Negative changes from the beneficiary’s perspective that were counted in this report are denoted with (-). Several states made reductions to Medicaid eligibility pathways in response to either the availability of coverage through the Marketplaces and/or through the Medicaid expansion; these changes were denoted as (#) since most affected beneficiaries will have access to coverage through an alternative pathway.

SOURCE: Kaiser Commission on Medicaid and the Uninsured Survey of Medicaid Officials in 50 states and DC conducted by Health Management Associates, October 2015. |

||||||

Table 3: Eligibility Changes in all 50 States and DC, FY 2015 and FY 2016*

| State | Fiscal Year | Eligibility Changes |

| Alabama | 2015 | |

| 2016 | ||

| Alaska | 2015 | |

| 2016 | Adults (+): Medicaid expansion on September 1, 2015. (Estimated first year enrollment of 20,000) | |

| Arizona | 2015 | |

| 2016 | ||

| Arkansas | 2015 | |

| 2016 | ||

| California | 2015 | |

| 2016 | ||

| Colorado | 2015 | |

| 2016 | Other (+): Implement the option to eliminate the 5-year bar on eligibility for lawfully residing immigrant children. (Estimated to affect 1,699 individuals) | |

| Connecticut | 2015 | |

| 2016 | Adults (#): Reduction in income limits for parent/caretakers to 150% of FPL (with disregard, effectively 155%) (Estimated to affect 23,700 individuals, of whom 1,350 are not eligible for Transitional Medical Assistance and will lose Medicaid eligibility effective 9/1/2015) | |

| Delaware | 2015 | |

| 2016 | ||

| District of Columbia | 2015 | |

| 2016 | Adults (nc): Section 1115 waiver expires 12/31/2015. Plan to transition adults with incomes above 138% FPL from a Medicaid waiver to Medicaid state plan. (Estimated to affect 7,000 or more individuals) | |

| Florida | 2015 | Elderly and Disabled (+): Increased the minimum monthly maintenance income allowance and excess standard for community spouses of institutionalized people. (The number of nursing home residents eligible for Medicaid is also affected by 2015 cost of living adjustments and increases in the average private pay nursing home used to set LTSS policy.) |

| 2016 |

|

|

| Georgia | 2015 | |

| 2016 | ||

| Hawaii | 2015 | |

| 2016 | ||

| Idaho | 2015 | |

| 2016 |

|

|

| Illinois | 2015 | Adults (#): Family planning waiver expired December 31, 2014.

Adults (nc): The state’s previous 1115 waiver (Cook County Care) ended June 30, 2014; adults transitioned to the new Medicaid expansion adult group July 2014. |

| 2016 | Adults (#): Plan to eliminate Breast and Cervical Cancer Treatment Program, with the expectation that these individuals qualify under the ACA expansion. (current enrollment is about 1,200) | |

| Indiana | 2015 | Adults (+): Adult expansion under HIP 2.0. (Affects an estimated 357,000 individuals) |

| 2016 | ||

| Iowa | 2015 | |

| 2016 | ||

| Kansas | 2015 | Adults (+): Presumptive Eligibility for Pregnant Women. (Estimated fewer than 500) |

| 2016 | ||

| Kentucky | 2015 | |

| 2016 | ||

| Louisiana | 2015 | Adults (#): Eliminated Family Planning waiver for those over 138% FPL. Those with income below 133% FPL will move from waiver to state plan. (8,700 individuals)

Adults (+): Family Planning SPA includes more services and adds coverage for men. |

| 2016 | ||

| Maine | 2015 | |

| 2016 | ||

| Maryland | 2015 | |

| 2016 | ||

| Massachusetts | 2015 | |

| 2016 | ||

| Michigan | 2015 | |

| 2016 | Adults (+): Income and asset expansion for working disabled adults. | |

| Minnesota | 2015 | Adults (#): Eliminated MinnesotaCare coverage for those with incomes between 133% and 200% FPL. Change is neutral for enrollees because Minnesota implemented a Basic Health Plan for those with incomes between 133% and 200% FPL. |

| 2016 | ||

| Mississippi | 2015 | |

| 2016 | ||

| Missouri | 2015 | |

| 2016 | ||

| Montana | 2015 | Adults (+): Raised cap on 1115 Mental Health Services Plan (MHSP) waiver from 2,000 to 6,000 adults with SMI. |

| 2016 | Adults (+): Waiver request in process to implement ACA expansion, including request for 12 month continuous coverage. | |

| Nebraska | 2015 | |

| 2016 | Other (+): Individuals age 19-21 who entered into a subsidized guardianship or adoption at age 16 or older. (13 individuals) | |

| Nevada | 2015 | |

| 2016 | ||

| New Hampshire | 2015 | Adults (+): Implemented the Medicaid expansion as of July 1, 2014. Coverage became effective August 15, 2014. The expansion was originally implemented through existing managed care programs and transitioned to a waiver January 2016. (estimated 50,000 individuals) |

| 2016 | ||

| New Jersey | 2015 | Elderly and Disabled (+): New Jersey implemented the “Miller Trust” option. New applicants formerly eligible for the Medically Needy program will establish qualified income trust, resulting in an expanded benefit package (beyond just long-term care services). Individuals in the “Medically Needy Spend-Down Adults” group on November 30, 2014, were grandfathered into this program.8 (209 additional enrollees) |

| 2016 | ||

| New Mexico | 2015 | |

| 2016 | ||

| New York | 2015 | Adults (#): Transfer some Medicaid waiver coverage (parents with incomes from 138% FPL to 150% FPL that receive an additional premium wrap to purchase coverage in the Marketplace) to Essential Plan (New York’s BHP). |

| 2016 | ||

| North Carolina | 2015 | Adults (+): Income and resource disregard of payments from the Eugenics Compensation Program. |

| 2016 | ||

| North Dakota | 2015 | |

| 2016 | ||

| Ohio | 2015 | |

| 2016 | Adults (#): Ending Family Planning coverage group as of 1/1/16.

Other (-): Change in transitional Medicaid for families from 12 months of eligibility to six months of eligibility with possible coverage for two consecutive six-month reporting periods. (Affects estimated 50,000 individuals) |

|

| Oklahoma | 2015 | |

| 2016 | ||

| Oregon | 2015 | |

| 2016 | ||

| Pennsylvania | 2015 | Adults (+): Implemented the Healthy PA Section 1115 waiver January 1, 2015, which increased Medicaid eligibility for adults up to 138% FPL. (605,180 individuals) State converted this to a SPA starting in FY 2015 with completion in FY 2016.

Adults (#); Medically-Needy Spend-down disabled adult coverage was discontinued with the implementation of Healthy PA; however, it is scheduled for reinstatement in FY 2016. (Affects 3,346 individuals) |

| 2016 | Adults (nc): Family Planning waiver converted to a SPA. Review of family planning enrollees for possible eligibility for full health care. (90,000 individuals)

Adults (#): Reinstatement of medically needy spend-down for disabled adults. (3,346 individuals) Adults (nc): Converted all individuals enrolled in Medicaid expansion under the Healthy PA 1115 waiver to the Health Choices Medicaid expansion state plan as of September 1st. |

|

| Rhode Island | 2015 | |

| 2016 | ||

| South Carolina | 2015 | |

| 2016 | ||

| South Dakota | 2015 | |

| 2016 | ||

| Tennessee | 2015 | |

| 2016 | Elderly and Disabled (-): In FY 2016 (7/1/2015), will begin limiting new LTSS enrollment into a 1915(i)-like group (offered under 1115 authority) to those eligible for SSI only. People already enrolled in the group under institutional income standards will be grandfathered. (Affects estimated 915 individuals) | |

| Texas | 2015 | |

| 2016 | ||

| Utah | 2015 | |

| 2016 | ||

| Vermont | 2015 | Other (+): Submitted SPA to disregard asset tests for non-ABD medically needy. |

| 2016 | ||

| Virginia | 2015 | Adults (#): Restored income eligibility for Family Planning coverage to 200% FPL. (Limit had been cut to 100% FPL on 1/1/2014.)

Elderly and Disabled (+): For Ticket to Work disabled population, three changes: Adults (+): Implemented a Section 1115 waiver program to expand limited benefit coverage to uninsured adults with incomes up to 100% FPL with serious mental illness. |

| 2016 | Adults (-): Per state legislation, income eligibility for the Section 1115 waiver program that expanded limited benefit coverage to uninsured adults with serious mental illness was reduced from 100% FPL to 60% FPL. | |

| Washington | 2015 | |

| 2016 | ||

| West Virginia | 2015 | |

| 2016 | ||

| Wisconsin | 2015 | Elderly and Disabled (-): Treating promissory notes as an asset. (Estimate of 40 individuals) |

| 2016 | ||

| Wyoming | 2015 | |

| 2016 | ||

| * Positive changes from the beneficiary’s perspective that were counted in this report are denoted with (+). Negative changes from the beneficiary’s perspective that were counted in this report are denoted with (-). Several states made reductions to Medicaid eligibility pathways in response to either the availability of coverage through the Marketplaces and/or through the Medicaid expansion; these changes were denoted as (#) since most affected beneficiaries will have access to coverage through an alternative pathway. Other changes to Medicaid eligibility that are not likely to affect beneficiaries but were reported by states are denoted with (nc). | ||

Table 4: Premium and Copayment Actions Taken in all 50 States and DC, FY 2015 and 2016*

| State | Fiscal Year | Premium and Copayment Changes |

| Alabama | 2015 | |

| 2016 | ||

| Alaska | 2015 | |

| 2016 | ||

| Arizona | 2015 | |

| 2016 | Copays (New only for expansion group): Impose mandatory copays to federal statutory limits and an $8 copay for non-emergent use of the ER on expansion adults. (Upon CMS approval) | |

| Arkansas | 2015 | Premiums (New only for expansion group): Added monthly contributions as part of Health Independence Accounts available to newly eligible adults with incomes between 100-138% FPL. Contributions to the HIAs are in lieu of point of service copayments. (February 2015) |

| 2016 | ||

| California | 2015 | |

| 2016 | ||

| Colorado | 2015 | |

| 2016 | ||

| Connecticut | 2015 | |

| 2016 | ||

| Delaware | 2015 | |

| 2016 | ||

| District of Columbia | 2015 | |

| 2016 | ||

| Florida | 2015 | |

| 2016 | ||

| Georgia | 2015 | |

| 2016 | ||

| Hawaii | 2015 | |

| 2016 | ||

| Idaho | 2015 | |

| 2016 | ||

| Illinois | 2015 | |

| 2016 | ||

| Indiana | 2015 | Premiums (New only for expansion group): POWER Account Contributions under HIP 2.0 for all low-income parents/caretakers and the new adult group (0-138% FPL) on a sliding scale. Those that fail to pay premiums within a 60-day grace period with income at or below 100% FPL are moved to a more limited benefit package and those with income over 100% FPL will be dis-enrolled from coverage and barred from re-enrolling for 6 months. (Feb 2015)

Premiums (New): Non-expansion parent/caretaker relatives and those receiving TMA have the option of paying premiums to get additional benefits and in lieu of copays for services. Copays (New): Testing graduated copays ($8 then $25) for non-emergency use of the ER for non-expansion parent/caretakers and newly eligible adults under § 1916(f) authority. Copays (New for expansion group): Beneficiaries with income at or below 100% FPL who fail to pay premiums will be required to make copays in state plan amounts. Copays (Elimination): Remove copays for ABD enrollees in managed care. (April 2015) |

| 2016 | Copays (New): Restore copays for ABD enrollees in managed care (Jan 2016) | |

| Iowa | 2015 | Premiums (New only for expansion group): Under the Iowa Health and Wellness Plan (IHWP), enrollees with incomes over 50 percent FPL are required to make a monthly premium contribution, beginning in the second year of coverage, which could be waived if they complete specified wellness activities. Premium amounts are $5 per month for those with incomes between 50% to 100% FPL and $10 per month for those with incomes over 100% FPL. Individuals can file a hardship exemption if they are not able to pay. (Jan 2015)

Copays (New only for expansion group): All enrollees in the expansion group are be subject to $8 copay for non-emergent use of the ED. (Jan 2015) |

| 2016 | ||

| Kansas | 2015 | |

| 2016 | ||

| Kentucky | 2015 | |

| 2016 | ||

| Louisiana | 2015 | |

| 2016 | ||

| Maine | 2015 | |

| 2016 | ||

| Maryland | 2015 | |

| 2016 | ||

| Massachusetts | 2015 | |

| 2016 | ||

| Michigan | 2015 | Premiums (New only for expansion group): Healthy Michigan Plan requires MI Health Account contributions equal to 2% of annual income for persons between 100% and 133% FPL after they have been in the health plan for 6 months. (Oct 2014) |

| 2016 | Premiums (Increase): Legislation expanding the income and asset levels for Freedom to Work Medicaid (TWIIAA) included a revised premium schedule. (Oct 2015)

Copays (Increase): Increase in prescription, hospital, and office visit copays for Healthy Michigan Plan enrollees with incomes above 100% FPL. (Unknown date due to systems issues and CMS approval requirements.) |

|

| Minnesota | 2015 | Cost-Sharing (Neutral Effect): The family deductible for adults in Medicaid was decreased to $2.75 per month, retroactive to 1/1/2014. (MCOs can waive the deductible.) |

| 2016 | Premiums (Decreased): Minimum premium for Medical Assistance for Employed Persons with Disabilities (MA-EPD) reduced. (Sep 2015)

Copays (Decreased): Decreased copayment amounts for MA-EPD group. (Sep 2015) |

|

| Mississippi | 2015 | |

| 2016 | ||

| Missouri | 2015 | |

| 2016 | ||

| Montana | 2015 | |

| 2016 | Premiums (New only for expansion group): Waiver request to impose premiums (2% of income) for the entire ACA expansion group.

Copays (New only for expansion group): Individuals with incomes up to 138% FPL will be required to pay copayments up to the maximum allowable amount under federal law. |

|

| Nebraska | 2015 | |

| 2016 | ||

| Nevada | 2015 | |

| 2016 | ||

| New Hampshire | 2015 | Copays (Eliminated): Eliminating pharmacy copays for adults under 100% FPL. (July 2014) |

| 2016 | Copays (Increased): Pharmacy copays for the expansion group (those above 100% FPL) are being increased from $1/$4 (generic/brand) to $2/$8. (Jan 2016)

Copays (New only for expansion group): Expansion group will be subject to copays on some medical services. (Jan 2016) |

|

| New Jersey | 2015 | |

| 2016 | ||

| New Mexico | 2015 | Copays (Decreased): Pharmacy copayment decreased from $5.00 to $4.00 for working disabled Individuals. (FY 2015) |

| 2016 | Copays (New only for expansion group): Copays for non-emergency use of the emergency department and for brand-name prescriptions when there is a less expensive generic equivalent medicine available. (FY 2016) | |

| New York | 2015 | |

| 2016 | ||

| North Carolina | 2015 | |

| 2016 | ||

| North Dakota | 2015 | |

| 2016 | ||

| Ohio | 2015 | |

| 2016 | ||

| Oklahoma | 2015 | Copays (Increased): Most SoonerCare copays increased. (July 2014) |

| 2016 | ||

| Oregon | 2015 | |

| 2016 | ||

| Pennsylvania | 2015 | |

| 2016 | ||

| Rhode Island | 2015 | |

| 2016 | ||

| South Carolina | 2015 | |

| 2016 | Copays (Decrease): Exempting certain high value drugs (including maintenance and certain psychiatric drugs) from copay requirements for all full benefit Medicaid beneficiaries. (July 2015) | |

| South Dakota | 2015 | |

| 2016 | ||

| Tennessee | 2015 | |

| 2016 | ||

| Texas | 2015 | |

| 2016 | ||

| Utah | 2015 | |

| 2016 | ||

| Vermont | 2015 | |

| 2016 | ||

| Virginia | 2015 | |

| 2016 | ||

| Washington | 2015 | |

| 2016 | ||

| West Virginia | 2015 | |

| 2016 | ||

| Wisconsin | 2015 | |

| 2016 | ||

| Wyoming | 2015 | |

| 2016 | ||

| * New premiums or copays as well as new requirements (i.e. making copays enforceable) are noted as (NEW). Increases in existing premiums or copays are noted as (Increased), while decreases are noted as (Decreased) and eliminations are noted as (Eliminated). | ||

Managed Care Reforms

| Key Section Findings |

Tables 5 through 10 include more detail on the populations covered under managed care (Table 5), expansions to new groups (Table 6), selected benefits included in managed care contracts (Table 7), managed care quality initiatives (Table 8), and MLR (Table 9) and auto-enrollment policies (Table 10). These tables are also available in a downloadable PDF. |

Managed care is now the predominant delivery system for Medicaid in most states, as Medicaid programs increasingly have turned to managed care as a means to help ensure access, improve quality and achieve budget certainty. As of July 2015, all states (including DC) except three – Alaska, Connecticut and Wyoming– had in place some form of managed care. Across the 48 states with some form of managed care, a total of 39 states (including DC) had contracts with comprehensive risk-based managed care organizations (MCOs); 19 states administered a Primary Care Case Management (PCCM) program, a managed fee-for-service based system in which beneficiaries are enrolled with a primary care provider who are paid a small fee to provide case management services in addition to primary care. Of the 48 states that operate some form of managed care, a total of 10 states operate both MCOs and a PCCM program while 29 states (including DC) operate MCOs only and nine states operate PCCM programs only.1 (Figure 3) Wyoming, one of the three states without managed care (i.e., without an MCO or PCCM model), does operate a limited-benefit risk-based prepaid health plan (PHP). In total, 18 states (including Wyoming) contracted with one or more PHPs to provide behavioral health, dental care, maternity care, non-emergency medical transportation, or other benefits.

Populations Covered by Managed Care

The share of Medicaid beneficiaries enrolled in MCOs, PCCM programs or remaining in fee-for-service varies widely by state. However, the share of Medicaid beneficiaries enrolled in MCOs has steadily increased as states have expanded their managed care programs to new regions and new populations and made MCO enrollment mandatory for additional eligibility groups. In this year’s survey, states were asked to indicate the approximate share of specific Medicaid populations that were served by MCOs, PCCM programs and fee-for-service (FFS) for their acute care services. As shown in Table 5, among the 39 states (including DC) with MCOs, 21 states reported that 75 percent or more of their Medicaid beneficiaries were enrolled in MCOs as of July 1, 2015, including four of the five states with the largest total Medicaid enrollment, accounting for 4 out of every 10 Medicaid beneficiaries across the country (California, New York, Texas and Florida). (Figure 4 and Table 5)

Figure 4: MCO Managed Care Penetration Rates for Select Groups of Medicaid Beneficiaries as of July 1, 2015

Children and adults (particularly those enrolled through the ACA Medicaid expansion) are much more likely to be enrolled in an MCO than elderly Medicaid beneficiaries or those with disabilities. Thirty-two (32) of the 39 MCO states covered 75 percent or more of children through MCOs. Twenty-one (21) of the 39 MCO states covered 75 percent or more of low-income adults (e.g., parents, pregnant women) through MCOs. The elderly and people with disabilities were the group least likely to be covered through managed care contracts, with only 15 of the 39 MCO states covering 75 percent or more such enrollees through MCOs. (Figure 4) With the exception of some states participating in the CMS Financial Alignment Demonstrations, most states were even less likely to include those dually eligible for Medicare and Medicaid through managed care contracts.

Of the 29 states that were implementing the ACA Medicaid expansion on July 1, 2015, 26 were using MCOs to cover newly eligible adults. (The three expansion states without risk-based managed care were Arkansas, Connecticut and Vermont.) The large majority (23) of these 26 states covered more the 75 percent of beneficiaries in this group through managed care. The three states with less than 75 percent MCO penetration for this group were Colorado, Illinois and Iowa (which each operate PCCM programs as well as MCOs.)

Ten (10) of the 19 states with PCCM programs also contract with MCOs. In most of these states, MCOs cover a larger share of beneficiaries than PCCM programs. However, Colorado, Iowa and North Dakota are exceptions: a majority of Colorado’s enrollees were in the PCCM program, which is the foundation of the state’s Accountable Care Collaboratives, and approximately four in ten enrollees in both Iowa and North Dakota were enrolled in those states’ PCCM programs as of July 1, 2015.

Managed Care Population Changes

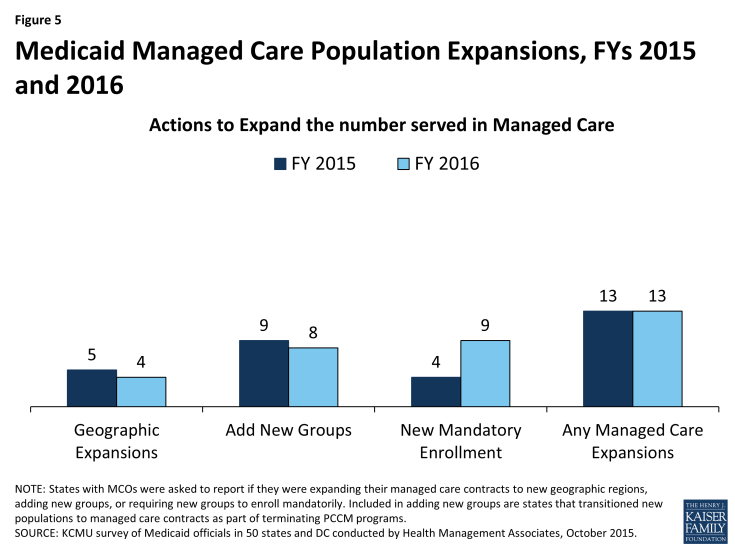

In both FY 2015 and in FY 2016, states continued to take actions to increase enrollment in managed care, although fewer states reported doing so than in last year’s survey – likely reflecting full or nearly full MCO saturation in a growing number of states. Of the 39 states (including DC) with MCOs, a total of 20 states indicated that they made specific policy changes in either FY 2015 (13 states) or FY 2016 (13 states) to increase the number of enrollees in MCOs, compared to 34 in last year’s survey; no states with MCOs took any action to restrict MCO enrollment.

The most common strategy was to expand voluntary or mandatory enrollment to additional eligibility groups (9 states in FY 2015 and 8 states in FY 2016). The eligibility group most commonly added to MCOs was persons eligible for LTSS (New Jersey, New Mexico, New York, Texas, Virginia and Washington), followed by the newly eligible adult group in states adopting the ACA Medicaid expansion (Illinois, Indiana, Pennsylvania and West Virginia). In addition, five states (Florida, Indiana, Iowa, Louisiana and Rhode Island) are terminating their PCCM programs in either FY 2015 or FY 2016 and shifting those populations into risk-based managed care (discussed below). Four states (Florida, Illinois, Louisiana and New York) made enrollment mandatory for specific eligibility groups in FY 2015, and nine states (Illinois, Iowa, Louisiana, New Hampshire, New York, Rhode Island, Utah, Virginia and Washington) are doing so in FY 2016. Expansions of MCO geographic service areas were reported in five states in FY 2015, and in four states for FY 2016. (Figure 5) In addition, California reported plans to enroll undocumented children into MCOs in FY 2015. This is predominantly a state-funded program and is therefore not counted as a Medicaid policy change in this report.

| Notable MCO Expansions Implemented or Planned |

| Florida transitioned nearly all Medicaid enrollees into MCOs on a phased-in schedule that was completed in August 2014. At that time, Florida’s PCCM, dental PHP and behavioral health PHP programs ended.

Indiana began enrolling aged, blind and disabled enrollees into the Hoosier Care Connect MCO program in April 2015 and ended the Care Select PCCM program on June 30, 2015. Iowa plans to implement statewide MCO coverage for almost all Medicaid enrollees on January 1, 2016 (pending federal waiver approval) and end its PCCM and behavioral health PHP programs. Louisiana discontinued its Bayou Health Shared Savings (enhanced PCCM) model on January 31, 2015 and transitioned enrollees to MCOs. Rhode Island reported plans to eliminate its PCCM program for adults with disabilities (Connect Care Choice) in FY 2016 and transition enrollees to MCOs. |

Primary Care Case Management (PCCM) Programs Changes

Of the 19 states with PCCM programs, six indicated they enacted policies to increase PCCM enrollment in FY 2015 or FY 2016. Four (Iowa, Massachusetts, Montana and Nevada) indicated that they would enroll new Medicaid expansion adults in their PCCM programs; Alabama expanded its Health Home program statewide in FY 2015; and Colorado reported increased PCCM enrollment of persons dually eligible for Medicare and Medicaid as part of its Financial Alignment Demonstration.

In contrast, seven states (Florida, Illinois, Indiana, Iowa, Louisiana, Oklahoma, and Rhode Island) have taken actions to decrease enrollment in their PCCM programs. Five of these states (Florida, Indiana, Iowa, Louisiana and Rhode Island) have ended or plan to end their PCCM programs and will transition PCCM enrollees to risk-based managed care. In June 2014, Illinois began transitioning 1.5 million PCCM enrollees to new care coordination models (including both risk-based managed care and PCCM models) in five mandatory enrollment regions. In Oklahoma, effective July 2014, individuals with creditable primary coverage are no longer eligible for the SoonerCare Choice PCCM program.

Limited-Benefit Prepaid Health Plans (PHP) Changes

Of the 18 states with one or more limited-benefit prepaid health plans (PHPs), six indicated they enacted policies to increase PHP enrollment in FY 2015 or FY 2016. California is planning to move coverage of substance abuse services from FFS to a PHP arrangement in FY 2016.2 Iowa reported that the benefit for its Medicaid expansion population includes a dental PHP program, and Pennsylvania reported that the Medicaid expansion would increase enrollment in its behavioral health PHP program. Michigan indicated that its dental PHP program was expanding to additional counties; Wisconsin noted that its LTSS PHP was expanding to additional counties; and Wyoming expanded a behavioral health PHP program for children statewide.

Four states reported actions that decreased enrollment in their PHP programs. Iowa and Florida folded, or will fold, PHP arrangements into their MCO programs (dental and behavioral health PHPs in Florida and a behavioral health PHP program in Iowa). Colorado ended a physical health PHP and replaced it with an MCO arrangement, and Washington is allowing “Early Adopter” counties to convert behavioral health PHPs to fully integrated MCO contracts.

Benefits Covered Under Managed Care Contracts

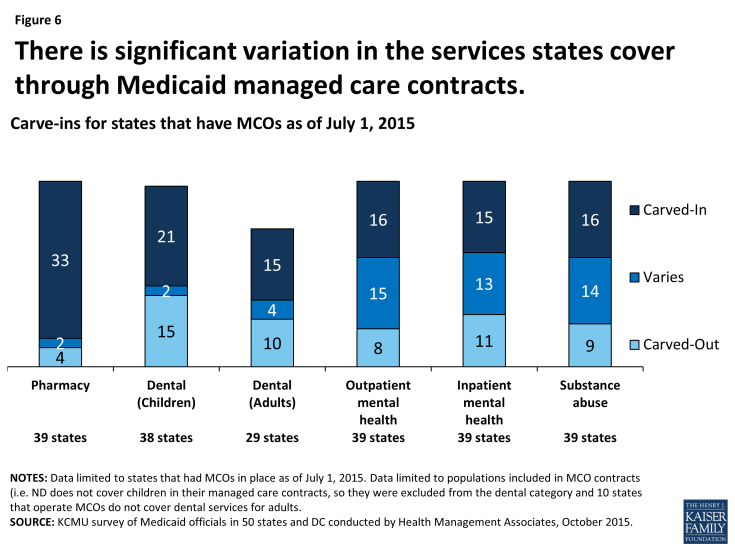

Although MCOs are at-risk financially for providing a comprehensive set of acute-care services, nearly all states elect to exclude or “carve-out” certain services from MCO contracts. These services may be delivered and financed through another contractual arrangement (e.g., through a limited benefit risk-based PHP) or in the FFS delivery system. In this year’s survey, states were asked to indicate the delivery system(s) used to provide the following benefits: prescription drugs, children’s dental services, adult dental services, outpatient and inpatient mental health services and substance abuse services.

The data presented shows this information only for populations enrolled under an MCO contract. Nearly all states exclude some populations from MCOs. For example, North Dakota does not cover children through its managed care contracts so North Dakota is not included in the “Dental (Children)” data. Ten states that operate MCOs do not cover dental services for adults (or only cover emergency dental), so these states are excluded from the “Dental (Adults)” counts.

“Carved-in” refers to the inclusion in MCO contracts of virtually all services in a given category (exceptions may exist, such as limited carve-outs for selected drugs). “Varies” refers to cases where the inclusion of benefits in MCO contracts may vary by population or region or the contract may cover some but not all services (e.g., states that carve-in some behavioral health services but carve-out specialized services for persons with serious mental illness). “Carved-out” means that the services are largely excluded from MCO contracts and are instead covered under either a FFS or PHP model. (Figure 6) States were also asked to describe any carve-in or carve-out changes for specific benefits in FY 2015 or planned for FY 2016. The most commonly reported benefit change was to carve-in behavioral health services and LTSS.

Figure 6: There is significant variation in the services states cover through Medicaid managed care contracts.

Pharmacy

Most MCO states (33 of 39 states) carve-in their pharmacy services for the populations covered by their MCO contracts. Some of these states have small carve-outs for certain drugs or drug classes (e.g., HIV/AIDS drugs, medications for hepatitis C, mental health drugs, etc.). Three states (Iowa, Missouri and Nebraska) carve-out pharmacy benefits entirely, delivering these benefits on a FFS basis. Additionally, Tennessee reported that all drugs – except for certain physician-administered drugs – are carved-out and delivered FFS through a contracted pharmacy benefit manager. Two states (Indiana and Wisconsin) reported that pharmacy benefits are carved-in under certain MCO programs but carved-out of others.

A number of states have carved pharmacy benefits into their managed care contracts in recent years. In this year’s survey, four states added or reported plans to add pharmacy benefits to their managed care contracts (Delaware, Iowa, Indiana and New York). Delaware reported carving pharmacy benefits into their MCO contracts in FY 2015. Iowa plans to carve the pharmacy benefit into its MCO contracts as it terminates its PCCM program and shifts this population to MCOs in FY 2016. Indiana implemented a new MCO program for the aged, blind and disabled population in FY 2015 that included pharmacy benefits; it also carved-in pharmacy benefits for the Healthy Indiana Plan (the state’s expansion group). New York, which had already carved most pharmacy benefits into managed care contracts, plans to carve-in hemophilia factor products and injectable antipsychotic drugs in FY 2016. In contrast, only one state (Maryland) reported carving some pharmacy benefits out of managed care contracts in FY 2016 (substance use disorder drugs).

Dental

Children’s Dental. More than half of MCO states that cover children under their managed care contracts3 generally carve-in children’s dental services (21 of 38 states). Fifteen (15) MCO states carve-out children’s dental services. The majority of these states cover children’s dental on a FFS basis, but two states (Louisiana and Rhode Island) carve-out these services to a PHP and two states (Michigan and Utah) use both PHP and FFS models, depending on geographic area. Two states (Indiana and Wisconsin) reported that children’s dental services are sometimes carved-in: Indiana’s coverage varies by MCO program and Wisconsin’s coverage varies by geographic region.

Adult Dental. Twenty-nine (29) of the 39 MCO states reported that they cover adult dental benefits; the other ten do not cover adult dental or only provide coverage for emergency dental services.4 Just over half of the MCO states that cover adult dental generally carve-in this benefit (15 of 29 states). Another four (Indiana, Massachusetts, Michigan and Wisconsin) sometimes carve-in adult dental services; in Indiana, Massachusetts and Michigan, the dental carve-in varies by MCO program while the dental carve-in in Wisconsin varies by geographic region. Eight of the remaining ten MCO states with adult dental benefits carve these services out5 to FFS, while two states (Iowa for expansion adults and Louisiana) carve-out adult dental services to PHPs.

Indiana reported carving dental services into managed care contracts for selected populations (children and adults) in FY 2015.

Behavioral Health

States cover behavioral health services (mental health and substance abuse services) through a wide array of delivery arrangements. Sixteen (16) MCO states generally cover outpatient mental health services through their MCO contracts; a similar number cover inpatient mental health services (15 states) and substance abuse services (16 states) through their MCO contracts. Of the remaining states, a number contract with PHPs to provide carved-out specialty behavioral health services.

Eight states reported planned changes for FY 2016: six states (Arizona, Iowa, Louisiana, New York, Washington and West Virginia) plan to carve inpatient and outpatient mental health services as well as substance abuse services into at least some of their MCO contracts. Arizona plans to carve-in these services for their dual-eligible beneficiaries under their acute care contracts; New York continues to phase in coverage of these services under managed care plans. Iowa and Louisiana plan to transition coverage from PHPs to their managed care contracts. Washington also reported plans to carve these services into managed care contracts in regions that elect to be “Early Adopters” as part of their effort to establish common purchasing regions for managed behavioral health and physical health. (Those that do not will contract separately for physical and behavioral health.) In addition, Mississippi plans to carve inpatient mental health services into its managed care contracts as part of its larger effort to carve-in inpatient services generally. Maryland reported carving substance abuse services out of managed care contracts in FY 2015.

Long-Term Care Services and Supports (LTSS)

In this survey, about half of the MCO states reported that institutional LTSS (17 states) and home and community-based services (HCBS) (18 states) were provided only under the FFS delivery system. However, the survey did not capture whether LTSS was carved out of the states’ MCO arrangements or whether, instead, persons receiving LTSS were entirely excluded from MCO arrangements for all of their care (primary, acute, and behavioral health services). Only a small number of states reported that most LTSS is provided by MCOs – five states for institutional LTSS (Arizona, Hawaii, Kansas, New Mexico and Tennessee) and four states for HCBS (Arizona, Kansas, New Jersey and Tennessee). In some of these states, however, persons with intellectual and developmental disabilities (IDD) are excluded from enrollment or IDD waiver services are carved-out. In addition, 17 other MCO states reported providing some HCBS and institutional LTSS through MCOs, often based on specific population characteristics and/or geographic region (for example, under a Financial Alignment Demonstration for dual eligible beneficiaries). A number of states also mentioned PACE programs,6 but this site-based form of managed care was not counted for purposes of this analysis.

Ten states reported changes for FY 2015 or planned for FY 2016. In FY 2015, six states (California, Michigan, New Jersey, New York, South Carolina and Texas) implemented MCO arrangements for institutional LTSS and HCBS for at least some populations; many of these states noted this change was in reference to the launch of dual eligible demonstrations (Michigan, New York, South Carolina and Texas). California implemented MCO contracts including both HCBS and institutional care services in some counties in FY 2015. New Jersey carved HCBS (services and beneficiaries) into managed care contracts as well as institutional services for new nursing facility entrants (those already in nursing facilities will remain in FFS). Texas also carved institutional LTSS into its non-dual managed LTSS program. Additionally, Idaho added institutional as well as HCBS to its Medicare-Medicaid Coordinated Plan (MMCP) in FY 2015.7

In FY 2016, five states will implement new LTSS MCO arrangements. Rhode Island will implement its dual eligible demonstration; Iowa will include both HCBS and institutional LTSS into new MCO contracts (pending federal waiver approval), and New Hampshire will add HCBS to its MCO contracts. New York and New Mexico will add additional LTSS (services and beneficiaries) to their MCO contracts (assisted living services in New York, waiver services for the medically frail in New Mexico).

Managed Care Quality Initiatives

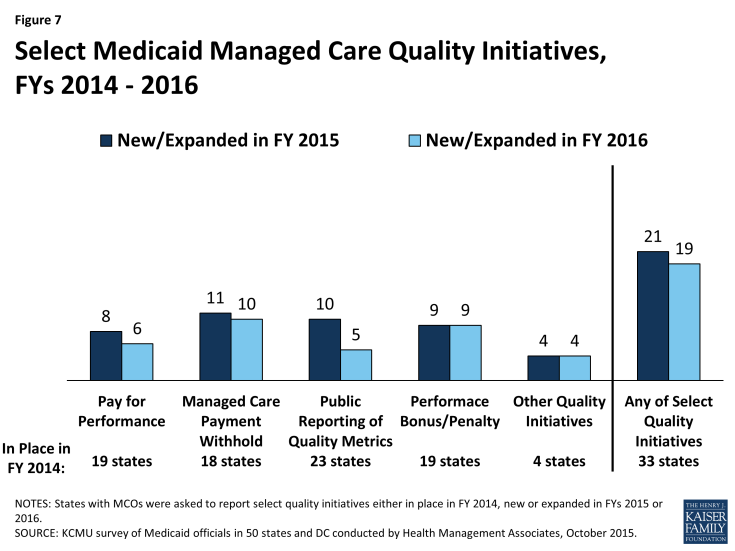

All states with MCO programs track one or more quality measures and require other health plan quality activities to improve health care outcomes and plan performance. In this year’s survey, states were asked whether certain quality strategies were in place in FY 2014, or newly added or expanded in FY 2015 or FY 2016. Thirty-three (33) of the 39 MCO states (including DC) had one or more of these quality strategies in place in FY 2014. A majority (23 states) publicly reported or required MCOs to publicly report quality metrics (e.g., a “report card”), and over one-third had pay-for-performance provisions, capitation withholds, and performance bonuses or penalties in place in FY 2014 as well. (Figure 7) Four states mentioned other types of quality initiatives in place in 2014 including a requirement for some or all plans to be NCQA-accredited (Massachusetts and Tennessee), a requirement for MCOs to implement provider and member incentive plans (Missouri) and other reviews of performance, quality and network adequacy (Nevada).

In FY 2015, a total of 21 states implemented new or expanded quality initiatives and 19 states planned to do so in FY 2016. The most common initiative that was new or expanded in FY 2015 and 2016 was managed care payment withholds tied to quality performance. (Figure 7) Three of these states in FY 2015 (California, Texas and West Virginia) and two of these states in FY 2016 (DC and Iowa) added new withhold requirements. Withhold amounts ranged from 0.15 percent (Virginia) to five percent (West Virginia and Minnesota). Several states also reported expanding or adding new pay-for- performance requirements as well as performance bonus or penalties and initiatives to publicly report quality metrics.

A few states mentioned additional types of quality initiatives. Minnesota will require MCOs to participate in its ACO and value-based contracting initiatives in FY 2016, and Pennsylvania will require MCOs to participate in community-based care management programs in FY 2015 and plans to require MCOs to participate in physical health/behavioral health integration efforts in FY 2016.

Medicaid Managed Care Administrative Policies

Minimum Medical Loss Ratios

For an MCO, the proportion of total per member per month capitation payments that is spent on clinical services and for quality improvement is known as the Medical Loss Ratio (MLR). Thus, the MLR represents the share of dollars that MCOs spend on providing and improving patient care, rather than on administrative costs, which include executive salaries, overhead, and marketing and profits. State insurance regulators commonly set a minimum MLR for commercial health plans, and the ACA mandates a minimum MLR for Medicare Advantage plans and for qualified health plans (QHPs) participating in the health insurance Marketplaces. There is currently no federal minimum MLR for Medicaid MCOs, nor are state Medicaid programs currently required to set minimum MLRs, but states are allowed to establish minimum MLR requirements for Medicaid health plans.

As of July 1, 2015, 19 of the 39 states that contracted with comprehensive risk-based MCOs specified a minimum MLR for all or some plans, and 20 states did not have an MLR requirement. Seventeen (17) of the 19 states with a MLR requirement always applied it and two states applied it on a limited basis (e.g., for the new ACA Medicaid expansion population). State Medicaid MLRs vary, but are most commonly set at 85 percent. A few states noted that their minimum MLRs varied by type of plan or population.

Other states that do not require a minimum MLR did note other mechanisms to monitor administrative costs and profits among Medicaid MCOs. Four states without minimum MLRs (Massachusetts, New York, Pennsylvania and Virginia) reported having a cap on profits and/or administrative costs. Two states (California and Utah) reported using a target MLR in their rate-setting process. One state (Texas) reported requiring “experience rebates” from plans with profits above a specified level, and one state (Kansas) reported not requiring a minimum MLR but does track MLRs of its plans.

Auto-enrollment

Beneficiaries who are required to enroll in MCOs must be offered a choice of at least two plans. Those who do not select a plan are auto-enrolled in a plan by the state. Of the 39 states with comprehensive risk-based MCOs, all except one required some or all beneficiaries to enroll in an MCO. (The exception is North Dakota, which has only one health plan.) The proportion of beneficiaries who are auto-enrolled varies widely across states. Two states had auto-enrollment rates of 10 percent or less, while six states auto-enrolled over 75 percent of new MCO enrollees.8 States’ auto-enrollment algorithms also vary, but are usually designed to take into consideration previous plan or provider relationships, geographic location of the beneficiary, and/or plan enrollments of other family members. In addition, over half (23) of MCO states reported that their auto-enrollment algorithms were designed to balance enrollments among plans; 15 states considered plan capacity, and eight states took plan quality rankings into consideration. Other states noted plans to move toward including quality rankings in their auto-assignment algorithms in the future.

| Selected State Auto-Enrollment Quality Criteria |

| Minnesota: Enrollees who do not select a plan are defaulted (i.e., auto-enrolled) into plans in their area with the highest overall quality score.

Missouri: Auto-enrollment algorithm includes various factors including plan capacity, balancing enrollment among plans, certain performance criteria and consideration of the number of FQHCs, RHCs, CMHCs, and safety net hospitals in the plan. Washington: The auto-enrollment algorithm is based on an average of plan performance on two HEDIS measures as well as initial health screening rates. In May 2015, Washington’s Health Benefit Exchange implemented health plan selection online, enabling Medicaid beneficiaries to select a health plan online at the time of eligibility and recertification or at any time (as state does not currently have a “lock-in” policy). The state anticipates this change will reduce the number of auto-enrolled individuals. |

Using HEDIS measures for Plan Selection. In this year’s survey, states were asked if they used, or planned to use, HEDIS scores as criteria for selecting MCOs to contract with. Of the 39 states with MCOs, 14 answered “yes,” 22 answered “no,” and three states did not respond.

| Proposed Managed Care Rule |

| On May 26, 2015, CMS released a long-awaited proposal to revise and modernize the Medicaid managed care regulations.9 The proposed rule addresses changes that have occurred in state Medicaid managed care and other programs since the regulations were last revised in 2002, including the emergence of managed long-term services and supports (MLTSS) and other innovative payment and delivery system models. Among other things, the sweeping changes proposed are intended to strengthen the quality of care provided to Medicaid beneficiaries, promote more effective use of data in overseeing managed care, strengthen actuarial soundness and other payment requirements, ensure beneficiary protections, promote beneficiary access to care and strengthen program integrity safeguards. The proposed rule is also intended to promote better alignment with other coverage including Marketplace Qualified Health Plans and Medicare Advantage plans.10 A variety of other stakeholders, including state Medicaid agencies, health plans, providers and beneficiary advocates, commented on the proposed rule, expressing support for select provisions and raising concerns over others.11

In its lengthy and detailed comment letter to CMS submitted on July 27, 2015, the National Association of Medicaid Directors (NAMD) identified both the specific concerns of its members as well as those provisions of the proposed rule viewed as positive policy approaches.12 Three overarching concerns were identified: the new administrative costs that states would incur to implement the new requirements; the ability of CMS to carry out the new proposed oversight activities without resulting in problematic delays for states (e.g., approvals of capitation rates and contracts); and the apparent shift in the balance of regulatory authority for Medicaid managed care from the states to the federal government. Of particular concern is a requirement for states to provide a minimum 14-day period of FFS coverage before enrolling beneficiaries into managed care arrangements and the proposed capitation rate review process. In this survey, states were asked to identify the key issues, concerns or opportunities related to the proposed rule. A number of states indicated that the proposed rule was still under review and other states touched on many of the issues raised in the NAMD comment letter. The most frequently cited concerns related to the capitation rate review process and the 14 day FFS enrollment requirement. |

Table 5: Share of the Medicaid Population Covered Under Different Delivery Systems, as of July 2015

| States | Type(s) of Managed Care In Place | Share of Medicaid Population in Different Managed Care Systems | ||

| MCO | PCCM | Other / FFS | ||

| Alabama | PCCM | — | 64.3% | 35.7% |