The independent source for health policy research, polling, and news.

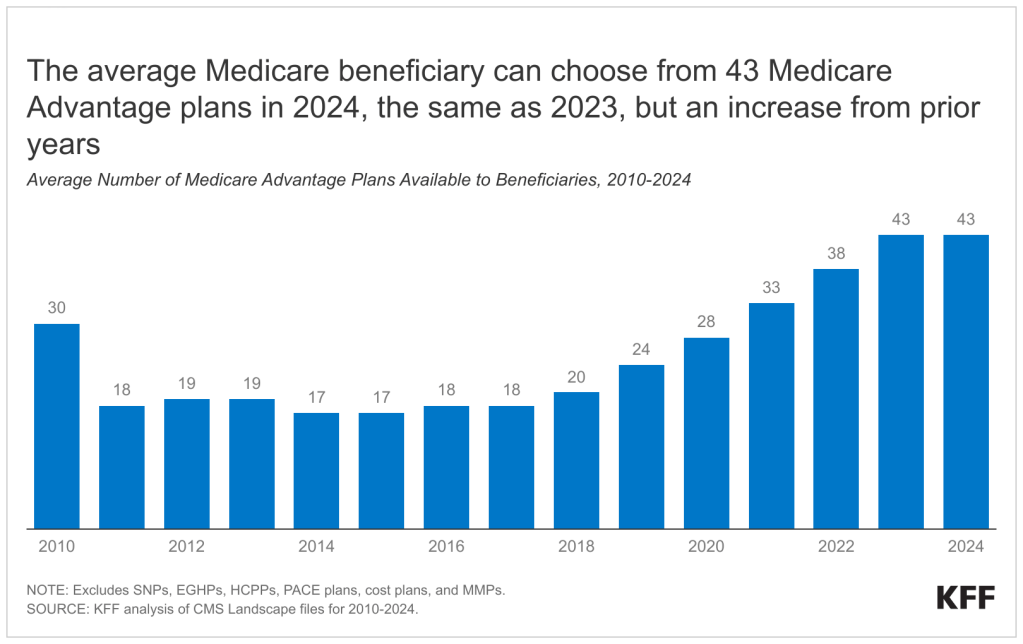

With Medicare Open Enrollment Underway, Beneficiaries Typically Will Have a Choice of 43 Medicare Advantage Plans for 2024, Consistent with 2023 But More than Double The Number From 2018

As More Beneficiaries Flock to Medicare Advantage Plans With Prescription Drug Coverage, Fewer Stand-Alone Part D

With open enrollment underway, Medicare beneficiaries have until December 7th to review and select their coverage for 2024. They also have a lot of options to choose from, as two new KFF analyses show.

For many beneficiaries, the first decision is whether to enroll in traditional Medicare (often with supplemental coverage and a stand-alone prescription drug plan) or Medicare Advantage, the private plans sponsored by insurance companies that now cover more than half of all eligible Medicare beneficiaries.

One new analysis shows that the typical beneficiary has a choice of 43 Medicare Advantage plans as an alternative to traditional Medicare for 2024. That is the same number available as in 2023, but more than double the number of plans offered in 2018, which shows how this market is attractive to both enrollees and insurers.

In addition, the typical person covered under traditional Medicare can choose among 21 Medicare stand-alone prescription drug plans (PDPs), the second analysis shows. The number of PDP options for 2024 is lower and the number of Medicare Advantage prescription drug plan (MA-PD) options is higher than in any other year since Part D started, reflecting the broader trend toward Medicare Advantage.

New for 2024 in all Medicare Part D plans, both stand-alone PDPs and MA-PDs, is the elimination of the 5% coinsurance requirement for catastrophic coverage, a provision in the Inflation Reduction Act that essentially functions as a new out-of-pocket limit on Part D drug expenses. That can translate into savings of thousands of dollars for enrollees who take expensive drugs.

The two new analyses provide an overview of the Medicare Advantage and Medicare Part D marketplace for 2024, including the latest data and key trends. Medicare’s open enrollment period began Oct. 15 and runs through Dec. 7.

Medicare Advantage

Nearly 31 million Medicare beneficiaries—51% of all eligible beneficiaries—are enrolled in Medicare Advantage plans, which are mostly HMOs and PPOs offered by private insurers.

Of the 43 Medicare Advantage plans that the typical beneficiary can choose from in their local market, 36 plans offer Part D drug coverage, on average.

The average Medicare beneficiary can choose from plans offered by eight firms in 2024, one fewer than in 2023.

Two-thirds (66%) of Medicare Advantage plans will not charge an additional premium beyond Medicare’s standard Part B premium in 2024, the same as in 2023. In addition, 19% of Medicare Advantage plans will offer some reduction in the Part B premium (also known as “money back”) in 2024, similar to 2023.

In 2024, nearly all plans (97% or more) offer some vision, fitness, hearing, or dental benefits as they have in previous years, though the scope of coverage for these services varies.

Part D

In 2023, more than half of all people with Medicare Part D coverage (56%) are enrolled in Medicare Advantage plans and 44% in stand-alone drug plans.

While the market for Part D coverage overall remains robust, for the average beneficiary the number of stand-alone drug plan options for 2024 is lower and the number of Medicare Advantage plans with drug coverage options is higher than in any other year since Part D started. The total number of stand-alone drug plans (709) and firms offering these plans (11) have declined from 2023.

The analysis also shows that, on average, monthly premiums for drug coverage are substantially higher for stand-alone plans compared to Medicare Advantage plans with drug coverage. While the average premium for stand-alone drug plans is projected to increase for 2024 for PDPs, it is expected to remain stable for Medicare Advantage plans with drug coverage.

Two-thirds of Part D stand-alone drug plan enrollees (excluding Low-Income Subsidy recipients)– close to 9 million enrollees–will see their monthly premium increase in 2024 if they stay in their current plan, while 4.4 million (34%) will see a premium reduction if they stay in their current plan.

Beneficiaries who receive Part D Low-Income Subsidies will have access to fewer premium-free (benchmark) plans in 2024 than in any year since Part D started. Due to changes in benchmark plan availability, an estimated 2.4 million LIS enrollees – half of all LIS enrollees in PDPs – need to switch plans during the 2023 open enrollment period if they want to be enrolled in a premium-free benchmark plan in 2024.

Related Resources: