Summary of Medicare Provisions in the President’s Budget for Fiscal Year 2016

On February 2, 2015, the Office of Management and Budget released President Obama’s budget for fiscal year (FY) 2016, which includes provisions related to Medicare. The President’s budget proposal would use federal savings and revenues to reduce the deficit, replace sequestration of Medicare and other federal programs for 2016 through 2025, and pay for new spending priorities.

The President’s FY2016 budget proposal would reduce net Medicare spending by $423 billion between 2016 and 2025, and is estimated to extend the solvency of the Medicare Hospital Insurance Trust Fund by approximately five years. This brief summarizes the Medicare provisions included in the President’s FY2016 Budget, with highlights noted below:

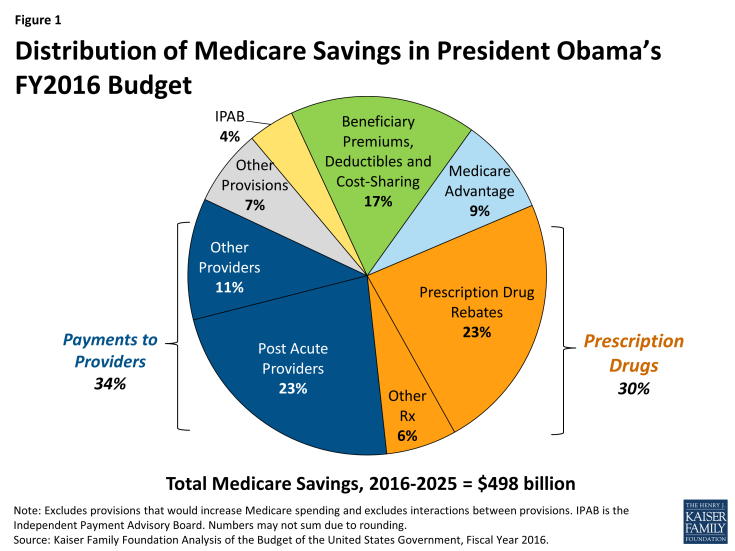

- More than one-third (34%) of the proposed Medicare savings are due to reductions in Medicare payments to providers, most of which affect providers of post-acute care (Figure 1).

- Nearly one-third (30%) of the proposed savings are related to Medicare prescription drug spending. The largest single-source of Medicare savings (23% of Medicare savings) is a provision that would require drug manufacturers to provide Medicaid rebates on prescriptions for Part D Low Income Subsidy enrollees, a proposal which was also included in the President’s FY2014 and FY2015 proposed budgets.

- About one-sixth (17%) of the proposed Medicare savings is due to increases in income-related premiums, increases in prescription drug copayments for low-income enrollees to encourage the use of generic drugs, an increase in the Part B deductible for new enrollees, and a new home health copayment for new enrollees.

- The President’s FY2016 budget would also repeal the Sustainable Growth Rate (SGR) formula and proposes about $54 billion in new Medicare spending, including, for example, provisions to reform physician payments and eliminate the 190-day lifetime limit on inpatient psychiatric care.

Many of the proposals in the President’s FY2016 budget were included in the FY2015 budget; new provisions are denoted with asterisks. Total budget estimates reflect the net 10-year budget effects of these proposals, FY2016-2025; for proposals implemented after 2016, the effects are for fewer than 10 years.

Summary of Medicare Provisions in the President’s Budget

General Provisions Pertaining to Medicare Expenditures

- The Independent Payment Advisory Board (IPAB): Would lower the IPAB target growth rate for Medicare spending from GDP+1 percent to GDP+0.5 percent for 2018 and future years. The FY2015 budget included a similar provision, although the budgetary impact was smaller because it included one less year of Medicare spending, which is projected to grow at a faster rate in future years. Estimated budget impact, FY2021-2025: -$20.88 billion

- Sequestration of Medicare Spending: Would replace sequestration with other savings and revenue provisions.

Physician Payments and the Sustainable Growth Rate (SGR) Formula

- Physician Payment Reform: Would repeal the Medicare Sustainable Growth Rate (SGR) formula; the Administration’s adjusted baseline assumes the cost associated with preventing a reduction in Medicare physician payments, FY2016-2025: +$108 billion. The FY2016 budget also proposes to reform Medicare physician payments in line with provisions included in H.R. 4015 and S. 2000 developed in the 113th Congress. In these bills, physicians are given the choice to receive performance-based payments from Medicare or receive added payments if they participate in delivery models that account for both spending and quality. Estimated budget impact (details of proposed reforms unspecified), FY2016-2025: +$43.99 billion

- Primary Care Incentive Payments*: Would convert the current, temporary 10-percent Medicare primary care bonus payment program (set to expire at the end of 2015) into a permanent program that is budget neutral within the Medicare physician fee schedule. Estimated budget impact, FY2016-2025: no budget impact1

Medicare Payments to Other Providers

Total Budget Impact: -$167.84 billion

- Post-Acute Care Providers: Would restructure payments for post-acute care services using a bundled payment approach, beginning in 2020. Would reduce payment updates for certain post-acute care providers, equalize payments for certain conditions commonly treated in inpatient rehabilitation facilities (IRFs) and skilled nursing facilities (SNFs), and require that 75 percent of IRF patients require intensive rehabilitative services, beginning in 2016. Estimated budget impact, FY2020-2025: -$113.56 billion

- Hospital Outpatient Payments*: Would lower payments to services provided in off-campus hospital outpatient departments to either the applicable physician fee schedule rate or the ambulatory surgical center (ASC) rate. Changes would be phased in beginning in 2017. Estimated budget impact, FY2017-2025: -$29.5 billion

- Indirect Medical Education (IME): Would reduce provider payments for IME to align with patient care costs, beginning in 2016. Estimated budget impact, FY2016-2025: -$16.26 billion

- Critical Access Hospitals: Would reduce critical access hospital payments to 100 percent of reasonable costs, and eliminate the designation for those critical access hospitals within 10 miles of the nearest hospital, beginning in 2016. Estimated budget impact, FY2016-2025: -$2.50 billion

- Hospital Readmissions and Hospital-Acquired Conditions*: Would establish a comprehensive hospital-wide readmissions measure and change the documentation requirements for the hospital-acquired conditions program. Estimated budget impact, FY2016-2025: no budget impact

- Additional Providers: Would exclude certain services from the in-office ancillary services exception; modify the documentation requirements for face-to-face encounters for durable medical equipment, prosthetics, orthotics and supplies claims; clarify the Medicare Fraction in the Medicare DSH statute; implement value-based purchasing for SNFs, home health agencies (HHAs), ambulatory surgical centers (ASCs), hospital outpatient departments (HOPDs), and community mental health centers; and expand the availability of Medicare data released to qualified entities. Estimated budget impact, FY2017-2025: -$6.02 billion

Prescription Drugs

Total Budget Impact: -$147.88 billion

- Part D Prescription Drug Rebate: Would require drug manufacturers to provide rebates on behalf of Part D low-income subsidy (LIS) enrollees that are no less than Medicaid rebate levels, and to provide an additional rebate for brand-name and generic drugs whose prices grow faster than inflation, beginning in 2017. Estimated budget impact, FY2017-2025: -$116.13 billion

- Pay for Delay: Would prohibit “pay for delay” arrangements between brand and generic drug manufacturers. Estimated budget impact for Medicare, FY2016-2025: -$10.06 billion; for Medicare and other federal health care programs combined, FY2016-2025: -$11.51 billion

- Part D Prescription Drug Discounts: Would increase the manufacturer discounts for brand-name drugs in the Part D coverage gap from 50 percent to 75 percent, closing the gap for brand-name drugs by 2017, three years earlier than under current law. Estimated budget impact, FY2017-2025: -$9.43 billion

- Part B Drugs: Would modify the reimbursement of Part B drugs by reducing payments from 106 percent to 103 percent of the average sales price. Estimated budget impact, FY2016-2025: -$7.38 billion

- Biologics: Would shorten the length of exclusivity for biologics from 12 years to 7 years, and prohibit additional periods of exclusivity for brand-name biologics due to minor changes in product formulations. Estimated budget impact for Medicare, FY2016-2025: -$4.40 billion; for Medicare and other federal health care programs combined, FY2016-2025: -$4.53 billion

- Mandatory Reporting of Drug Coverage*: Would require group health plans that offer a prescription drug benefit to report their plan enrollees with drug coverage to HHS or Part D plan sponsors. Estimated budget impact, FY2016-2025: -$0.48 billion

- Drug Price Negotiation*: Would allow the Secretary of HHS to negotiate prices for biologics and high-cost prescription drugs eligible for placement on the Part D specialty tier. Manufacturers would be required to supply HHS with all data and information necessary to come to an agreement on price. The final price would be indexed to the Consumer Price Index and plan sponsors would be permitted to negotiate additional discounts off this price. Estimated budget impact, FY2016-2025: no budget impact

- Part D Bonus Payments: Would provide new bonus payments to Part D plans with high quality star ratings (4 stars or more). Plans with high ratings would have a larger portion of their bid subsidized by Medicare, while plans with lower ratings would receive a smaller subsidy. Would be implemented in a budget neutral manner. Estimated budget impact, FY2016-2025: no budget impact

- Preventing Prescription Drug Abuse in Part D*: Would give the Secretary of HHS the authority to establish a program requiring certain Medicare beneficiaries to utilize only certain prescribers/pharmacies to obtain prescriptions for controlled substances. Estimated budget impact, FY2016-2025: no budget impact

- Retroactive Part D Coverage for LIS Beneficiaries: Would permanently authorize a demonstration (the LI NET program) allowing CMS to contract with a single plan to provide retroactive drug coverage for Part D LIS beneficiaries while their eligibility is being processed. Estimated budget impact, FY2016-2025: no budget impact

- Suspend Coverage and Payment for Some Part D Drugs: Would provide the Secretary of HHS with the authority to suspend coverage and payment for questionable Part D prescriptions and incomplete clinical information. Estimated budget impact, FY2016-2025: no budget impact

Beneficiary Premiums, Deductibles And Cost-Sharing

Total Budget Impact: -$83.81 billion

- Income-Related Part B and Part D Premiums: Would increase the current law income-related premiums paid under Medicare Parts A and B, and expand the share of beneficiaries who would be subject to income-related premiums. Under current law, premiums for most people on Medicare equal 25 percent of projected average per capita Part B expenditures and 25.5 percent of average per capita Part D expenditures. Beneficiaries with higher incomes (more than $85,000 for individuals and $170,000 for married couples), including 5 percent of beneficiaries in 2014, are required to pay higher premiums, ranging from 35 percent to 80 percent of per capita costs (up to $336 per month for the Part B premium), depending on their income; these thresholds are fixed though 2019, and will be indexed to rise with inflation beginning in 2020.

–

The proposal would increase the payment for the lowest income-related premium tier from 35 percent to 40 percent of projected per capita expenditures, and create new tiers of income-related premium payments every 12.5 percentage points, with a cap at 90 percent of projected per capita expenditures. It also would maintain a freeze on current-law income-related thresholds until 25 percent of Medicare beneficiaries pay income-related premiums. Estimated budget impact, FY2019-2025: -$66.41 billion

- Part D Copayments for Low-Income Subsidy (LIS) Beneficiaries: Would increase copayments to twice the level required under current law for specified brand-name drugs with appropriate generic substitutes for Part D LIS beneficiaries to encourage greater use of generic drugs; beneficiaries could receive drugs at current copayment levels with successful appeal of a coverage determination, and low-income beneficiaries qualifying for institutional care would be excluded from the policy. Estimated budget impact, FY2017-2025: -$8.86 billion

- Part B Premium Surcharge on “Near First-Dollar” Medigap Coverage: Would introduce a surcharge on Part B premiums that would be equivalent to about 15 percent of the average Medigap premium for new beneficiaries that purchase Medigap policies with “particularly low cost-sharing requirements,” starting in 2019. Estimated budget impact, FY2019-2025: -$3.97 billion

- Part B Deductible: Would increase the Part B deductible for new beneficiaries by $25 in 2019, 2021, and 2023. Current beneficiaries or those nearing Medicare eligibility would not be subject to the higher deductible. Under current law, the Part B deductible is uniform across all beneficiaries ($147 in 2015) and is indexed to rise in accordance with changes in Medicare Part B per capita spending. Estimated budget impact, FY2019-2025: -$3.74 billion

- Home Health Copayment: Would introduce a new copayment of $100 per home health episode, for episodes with five or more visits not preceded by a hospital or post-acute care stay, applicable only to new beneficiaries starting in 2019. Under current law, Medicare does not impose a copayment on home health services. Estimated budget impact, FY2019-2025: -$0.83 billion

- Medicare Part B Late Enrollment Penalty*: Would clarify that the Part B premium “hold-harmless” provision does not apply to the calculation of the Part B late enrollment penalty, but only to the annual increase to the basic Part B premium, consistent with current CMS practice. Current law prohibits an increase in the Part B premium that would otherwise result in a reduction in an individual’s monthly Social Security payments in a year where the Social Security cost-of-living adjustment (COLA) is insufficient to cover the amount of the Part B premium increase for an individual. Estimated budget impact, FY2016-2025: no budget impact

Medicare Advantage

Total Budget Impact: -$43.40 billion

- Coding Intensity Adjustment: Would increase the minimum coding intensity adjustment for payments to Medicare Advantage plans. Estimated budget impact, FY2017-2025: -$36.24 billion

- Employer-Group Plans: Would align payments for Medicare Advantage employer group waiver plans with the average individual Medicare Advantage bid in each Medicare Advantage payment area. Estimated budget impact, FY2017-2025: -$7.16 billion

Accountable Care Organizations (ACOs)

Total Budget Impact: -$0.14 billion

- Providers Eligible to be Assigned Beneficiaries in Shared Savings ACOs*: Would allow CMS to assign beneficiaries to Federally Qualified Health Centers and Rural Health Clinics participating in the Medicare Shared Savings ACO Program. Estimated budget impact, FY2019-2025: -$0.08 billion

- Beneficiary Assignment to ACOs*: Would expand the basis for beneficiary assignment to ACOs to include beneficiary use of nurse practitioners, physician assistants, and clinical nurse specialists. Estimated budget impact, FY2020-2026: -$0.06 billion

- Cost Sharing for Primary Care*: Would allow ACOs to pay beneficiaries for primary care visits up to the applicable Medicare cost-sharing amount. Participation would be voluntary and no additional payments would be made to ACOs to cover the costs of this proposal. Estimated budget impact, FY2016-2025: no budget impact

Medicare Coverage

Total Net Budget Impact: +$4.80 billion

- Psychiatric Care*: Would eliminate the 190-day lifetime limit on inpatient psychiatric facility services. Estimated budget impact, FY2016-2025: +$5.0 billion

- Dialysis Services*: Would expand Medicare coverage of short-term scheduled dialysis services for beneficiaries with acute kidney injury. Estimated budget impact, FY2016-2025: -$0.2 billion.

Dual-Eligible Beneficiaries

Total Net Budget Impact: +$0.975 billion

- Qualified Individuals: Would extend the program to pay Part B premiums for qualified individuals (QIs) through 2017. The QI program provides premium assistance to low income beneficiaries through a block grant which is currently authorized through March 31, 2015. Estimated budget impact, FY2015-2017: +$0.975 billion

- Program for All-Inclusive Care for the Elderly (PACE) Program: Would initiate a budget-neutral pilot in a limited number of states to expand eligibility requirements for the PACE program to include beneficiaries dually eligible for Medicare and Medicaid who are between the ages of 21 and 55 to test whether PACE programs can effectively serve a younger population without increasing costs. Current law limits the PACE program to dually eligible beneficiaries ages 55 and older. Estimated budget impact, FY2016-2025: no budget impact

- Appeals Process for Dual-Eligible Beneficiaries: Would implement a single beneficiary appeals process for managed care plans that integrate Medicare and Medicaid payment and services and serve dual-eligible beneficiaries. Estimated budget impact, FY2016-2025:no budget impact

- Special Needs Plans for Dual-Eligible Beneficiaries (D-SNPs)*: Would allow for joint Federal-State coordinated review of marketing materials for Medicare Advantage D-SNPs, which are managed care plans that integrate Medicare and Medicaid payment and services and serve Medicare-Medicaid enrollees. Estimated budget impact, FY2016-2025: no budget impact

Other Medicare Provisions

Total Net Budget Impact: -$32.145 billion

- Bad Debt: Would reduce bad debt payments from 65 percent to 25 percent over three years to more closely match private sector standards; details not specified. Estimated budget impact, FY2016-2025: -$31.08 billion

- Fraud, Waste, and Abuse: Would aim to reduce fraud, waste, and abuse in Medicare through several measures, including creating new initiatives to reduce improper payments in Medicare and requiring prior authorization for power mobility devices and advanced imaging, as well as other items and services at high risk of fraud and abuse. Estimated budget impact, FY2016-2025: -$1.821 billion

- Appeals*: Would provide the Office of Medicare Hearings and Appeals and Departmental Appeals Board authority to use Recovery Audit Contractor (RAC) collections; establish Medicare appeals refundable filing fee; remand appeals to the redetermination level with the introduction of new evidence; increase minimum amount in controversy for administrative law judge (ALJ) adjudication of claims to equal amount required for judicial review; establish magistrate adjudication for claims with amount in controversy below new ALJ amount in controversy threshold; and expedite procedures for claims with no material fact in dispute. Estimated budget impact, FY2016-2025: +$1.27 billion

- Delinquent Tax Debts: Would levy up to 100 percent of payments to Medicare providers with delinquent tax debts, beginning in 2015. Estimated budget impact, FY2016-2025: – $0.514 billion

Endnotes

Note that the U.S. Department of Health and Human Services Budget in Brief for Fiscal Year 2016 refers to provisions that the Office of Management and Budget determines will have a budget impact of “$500 million or less” as provisions with “no budget impact”.