Data Note: Variation in Per Enrollee Medicaid Spending

Congress is currently debating the American Health Care Act (AHCA), passed by the House on May 4th 2017. This bill would end the enhanced federal matching funds for the Affordable Care Act (ACA) Medicaid expansion and fundamentally restructure federal Medicaid financing for other eligibility groups. Currently, the federal government matches state Medicaid spending with no limit. The AHCA would cap and significantly reduce federal Medicaid financing provided to states through a per capita cap or, at state option, a block grant for certain populations. Specifically, the AHCA would cap federal Medicaid funding per enrollee starting in FY2020. Each state would have its own federal per enrollee cap based on its Medicaid per enrollee expenditures in 2016 trended forward to 2019. Per enrollee caps would be set for each state by eligibility group. Beginning in 2020, these per enrollee amounts would increase by a set index per eligibility group. These same growth rates would apply to all states. The Congressional Budget Office estimates that the AHCA would reduce federal Medicaid spending by $834 billion from 2017 through 2026.

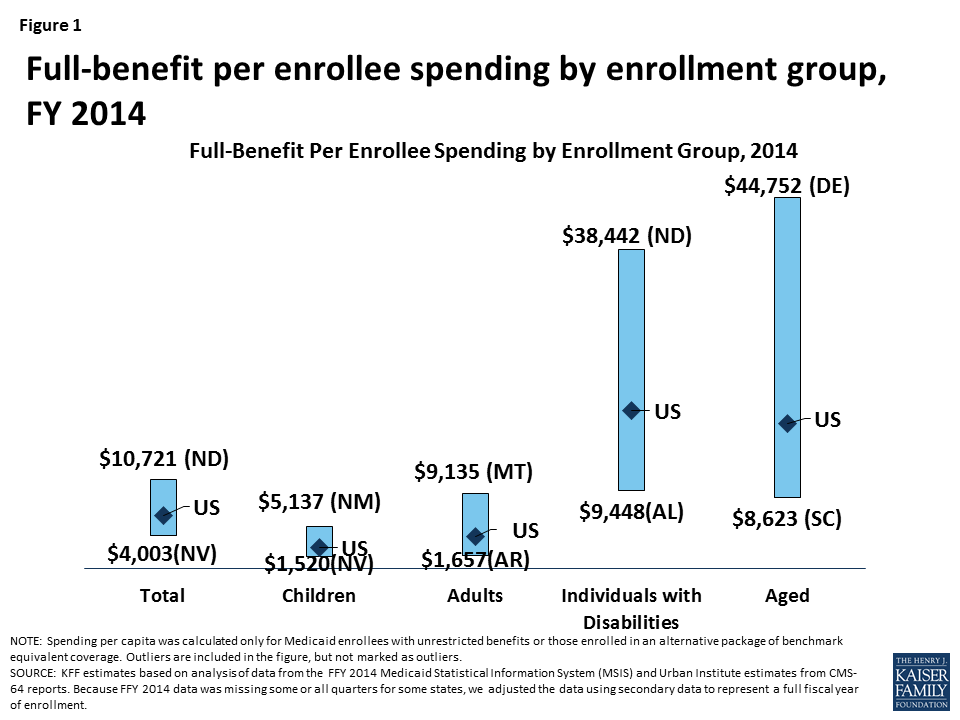

Current variation in state Medicaid spending per enrollee reflects the flexibility built into the program for states to make policy choices to administer their programs within broad federal rules as well as other factors such as the availability of revenues, demand for service, health care markets, and state budget and policy processes. Using a base year and a uniform index to establish the federal caps, as proposed in the AHCA, would lock in variation in states’ Medicaid spending levels per enrollee and reduce the federal contribution to Medicaid over time. As a result, the proposal would have differential impacts on states’ ability to address changing needs and new health challenges. To understand the potential implications of per capita cap proposals, this data note shows variation in per full-benefit enrollee spending by state and eligibility group.

Medicaid Spending Per Full-Benefit Enrollee

Some Medicaid enrollees are only eligible for “partial benefits.” For example, “partial-benefit enrollees” include those eligible for family planning services only, people who receive only emergency services, those in premium assistance programs, and dual eligibles for whom Medicaid covers only Medicare premiums and cost sharing. Under the AHCA, spending for “partial benefit” enrollees is not subject the cap.1 Among full-benefit enrollees who would be subject to a cap, average Medicaid spending per enrollee was $6,396 in 2014. Per enrollee spending is higher among the aged and individuals with disabilities due to the higher use of complex acute services and long-term care among these populations ($17,476 and $19,033, respectively, for FY 2014). Average spending per Medicaid enrollee was lower for adults and children ($3,955 and $2,602, respectively). For each eligibility group, there is considerable variation across states in per enrollee spending (Figure 1 and Map 1). An additional table provides an index value to show how per enrollee amounts for each state compare to the average per enrollee spending for the US as a whole. For example, spending for full-benefit enrollee ranges from $4,003 to $10,721, or 0.63 (63%) to 1.68 (168%) of the US per enrollee amount.

Interactive Map 1: Spending Per Full-Benefit Enrollee, FY 2014 (back to top)

Health care spending across payers consistently shows that a small group of high-spenders account for a large majority of the spending. Even within a specific eligibility group within a state, spending varies considerably. We examined states with average per enrollee spending close to the national median and found that wide variation in spending within the eligibility group within states. For example, average spending per disabled enrollee in Pennsylvania is $18,310, but spending ranges from $1,051 for those in the first quartile to $116,515 for those in the top 5th percentile of spending. In Louisiana, spending per aged enrollee ranges from an average of $143 for those in the first quartile to $70,173 for those in the top 5th percentile of spending. Despite the general lower cost for child enrollees, the variation in spending per child was wide in Oklahoma. Similarly, the variation in adult spending per enrollee was wide in Ohio, an expansion state, as well as Mississippi, a non-expansion state. Under a per enrollee cap in federal Medicaid funds, states may face incentives to enroll individuals with lower per enrollee costs or may be challenged to finance their programs if a larger share of high cost individuals enroll.

| Table 1: Average Spending Per Full-Benefit Enrollee by Percentile in Select States, FY 2014 | |||||

| Percentile | Aged in Louisiana | Individuals with Disabilities in Pennsylvania | Adults in Ohio | Adults in Mississippi | Children in Oklahoma |

| 0-25% | $143 | $1,051 | $530 | $1,103 | $131 |

| >25-50% | $1,436 | $10,846 | $2,898 | $3,625 | $735 |

| >50-75% | $16,685 | $17,977 | $4,981 | $4,341 | $1,849 |

| >75-90% | $39,931 | $23,432 | $6,845 | $6,293 | $4,269 |

| >90-95% | $50,036 | $34,642 | $10,492 | $10,147 | $8,186 |

| >95% | $70,173 | $116,515 | $20,143 | $22,205 | $24,571 |

| NOTE: We selected states with spending per enrollee for the given eligibility group that was at or close to the national median.SOURCE: KFF estimates based on analysis of data from the FFY 2014 Medicaid Statistical Information System (MSIS) and Urban Institute estimates from CMS-64 reports. | |||||

Methods

This analysis is based on KFF estimates from the 2014 Medicaid Statistical Information System (MSIS) and Urban Institute estimates from CMS-64 reports. We adjusted MSIS spending to CMS-64 spending to account for MSIS undercounts of spending. Due to differences in the way CMS-64 and MSIS handle spending for managed long-term services and supports (MLTSS) and increased use of MLTSS in Medicaid, we have revised our methodology of adjusting MSIS to CMS-64. As a result, spending per enrollee totals in this note are not comparable to previously published KFF analysis of Medicaid spending amounts from the MSIS.

Because FY 2014 MSIS data was missing some or all quarters for some states, we also adjusted the enrollment data using secondary data to represent a full fiscal year of enrollment. We accounted for a state’s expansion status, the number of quarters of missing data, and the state’s historical patterns of spending and enrollment in making state-by-state adjustments.

Specifically, for states missing any quarter of enrollment data, we adjusted total enrollment using fiscal year totals in the Medicaid Budget and Expenditure System (MBES), adjusted to account for underlying differences in data between MSIS and MBES. For non-expansion states, we adjusted the distribution of enrollment by eligibility group by using either the existing MSIS data (if any quarters were available) or the previous year’s distribution. For expansion states, we adjusted the distribution of enrollment by eligibility group using either the existing MSIS data (if any expansion quarters were available), the median for expansion states with a full year of data, or the state’s historical distribution (if historical data indicated a higher share of adult enrollment than medians). We estimated full-benefit enrollment among aged, child, and disabled enrollees based on each state’s historical full/partial beneficiary split. We estimated full-benefit enrollment among adult enrollees using either each state’s historical full/partial beneficiary split (for non-expansion states) or, for expansion states, the existing MSIS data (if any expansion quarters were available), the median for expansion states with at least one quarter of expansion data, or the state’s historical distribution (if historical data indicated a higher share of adult enrollment than medians).

We followed a similar approach for adjusting spending data, though fewer spending adjustments were necessary as the spending data had already been adjusted to the full-year CMS-64 data and did not need to account for missing quarters. For non-expansion states with no data, we adjusted the available FY 2013 MSIS data to the FY 2014 CMS-64 data. For expansion states with no data, we estimated total spending using data from the CMS-64 data and distributed the spending by eligibility group based on the median distribution for expansion states. For expansion states that did not have data covering the post-expansion period, we allocated spending across eligibility groups using either the median for other expansion states or the state’s historical distribution (if historical data indicated a higher share of adult spending than medians). We estimated the share of spending for full-benefit enrollees using the same approach used for enrollment.

Adjustments vary across states, and some adjustments were made for the following states: Alabama, Alaska, Colorado, Delaware, District of Columbia, Florida, Illinois, Kansas, Kentucky, Maine, Maryland, Montana, Nevada, New Hampshire, New Mexico, North Carolina, North Dakota, Rhode Island, South Carolina, Texas, and Wisconsin. Due to these adjustments, enrollment and spending estimates here may not match other analysis based on the MSIS data or state’s own reporting systems.

Table 2: Medicaid Spending per Full-Benefit Enrollee (back to top)

| NOTES: Due to a data quality issue, we are unable to report spending for the elderly in New Mexico. However, we do include this spending in state and national spending per enrollee calculations. SOURCE: KFF estimates based on analysis of data from the FFY 2014 Medicaid Statistical Information System (MSIS) and Urban Institute estimates from CMS-64 reports. Because FFY 2014 data was missing some or all quarters for some states, we adjusted the data using secondary data to represent a full fiscal year of enrollment. |

Table 3: Ratio of State Per Enrollee Spending to the Average US Per Enrollee Medicaid Spending by Eligibility Group (back to top)

| NOTES: Data represent the ratio of state per full-benefit enrollee spending to the average per full-benefit enrollee spending in the U.S. For example, spending for full-benefit enrollee ranges from $4,003 to $10,721 or 0.63 (63%) of the national average to 1.68 (168%) of the national average. Due to a data quality issue, we are unable to report spending for the elderly in New Mexico. However, we do include this spending in state and national spending per enrollee calculations. SOURCE: KFF estimates based on analysis of data from the FFY 2014 Medicaid Statistical Information System (MSIS) and Urban Institute estimates from CMS-64 reports. Because FFY 2014 data was missing some or all quarters for some states, we adjusted the data using secondary data to represent a full fiscal year of enrollment. |

- Eliminating partial-benefit enrollees (including those eligible for family planning services only or dual eligibles for whom Medicaid covers only Medicare premiums and cost sharing but not other Medicaid services) provides a better understanding of what Medicaid spends for people eligible for the full scope of benefits. Eliminating partial-benefit enrollees from the computation of per enrollee spending generally increases estimates of per enrollee spending (because partial-benefit enrollees tend to be less expensive than full-benefit enrollees). This is particularly true for aged beneficiaries, as a relatively large share of enrollees in this category are partial benefit enrollees for whom Medicaid only pays Medicare cost sharing and premiums. ↩︎