Coverage Implications of Policies to Lower the Age of Medicare Eligibility

President Biden proposed lowering the age of Medicare eligibility to 60 during the presidential campaign and reiterated his support recently, with the goal of broadening coverage and making health coverage affordable for older adults. Proposals to lower the age of Medicare, either to 60 or a younger age, may be considered by Congress. One KFF analysis shows that lowering the age of Medicare eligibility to 60 could reduce costs for employer health plans by as much as 15 percent if all eligible employees shifted from employer plans to Medicare. In addition, another KFF analysis shows that 60- to 64-year-olds who move from employer plans to Medicare could be covered more cheaply because Medicare payments to hospitals, physicians and other health care providers are generally lower than what private insurance pays.

This data note looks at who might be affected by such policies and the implications for health coverage. Most people affected by a policy change to lower the age of Medicare already have private coverage, making the cost and affordability implications paramount. A relatively small share of people in this age range are currently uninsured, so the policy is likely to have a modest effect on increasing the number of people with health coverage.

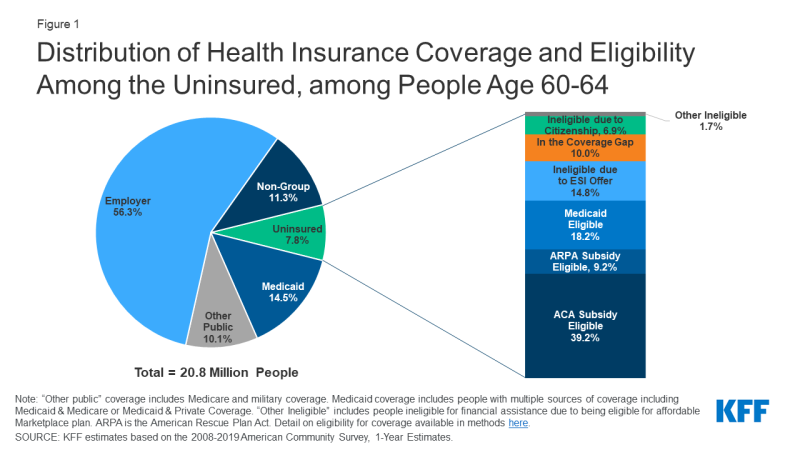

Two-thirds of adults age 60-64 have private coverage, either through an employer (56%) or though the non-group market, including those in the Affordable Care Act (ACA) marketplace (11%) (Figure 1). The policy to lower the age of Medicare eligibility could potentially shift 11.7 million people with employer coverage and 2.4 million with non-group coverage into Medicare. It is not clear how the policy would affect the 14.5% (3 million) who have Medicaid coverage, including the 4% within this group (just under 1 million) that are dually eligible for Medicare and Medicaid coverage (those who qualify on the basis of disability for both programs). About 8% of people age 60-64, or 1.6 million people, are uninsured and could newly gain Medicare coverage under this policy.

Among uninsured adults age 60-64, most (66%) are eligible for financial assistance for coverage through the ACA marketplace or Medicaid (Figure 1). Nearly half (48%) are eligible for marketplace premium help, including those eligible under temporary ARPA subsidies, and 18% are Medicaid-eligible. About 15% are estimated to have access to private coverage offered by an employer, which they may view as unaffordable. The remainder are in the coverage gap because they live in a state that has not expanded Medicaid (10%), are unauthorized immigrants (7%), or otherwise ineligible (2%).

Figure 1: Distribution of Health Insurance Coverage and Eligibility Among the Uninsured, among People Age 60-64

While a policy to lower the age of Medicare may have a small effect on covering the nearly 30 million uninsured people in the United States, it could improve access or affordability for millions. Policies to lower the age beyond 60—for example, to age 55 or even 50— could extend coverage to a larger number of uninsured adults (Table 1). Further, as other analysis shows, lowering the age of Medicare eligibility could shift the cost of coverage largely from employers to the federal government and lower the cost of coverage for this population while increasing federal spending. The ultimate effect on coverage, access, and affordability will depend on what type of premium and cost sharing assistance it provides to newly-eligible adults, as well as other structural factors.

| Table 1: Health Insurance Coverage among Nonelderly Adults by Age, 2019 | ||||||

| Coverage Distribution (%) | ||||||

| Number of People in Age Group (millions) | Employer | Non-Group | Medicaid | Other Public | Uninsured | |

| 18-49 Years | 132.6 | 61.0% | 7% | 15.3% | 2.1% | 14.6% |

| 50-54 Years | 20.2 | 64.8% | 7.8% | 12.8% | 4.0% | 10.6% |

| 55-59 Years | 21.3 | 62.3% | 8.7% | 13.9% | 6.0% | 9.2% |

| 60-64 Years | 20.8 | 56.3% | 11.3% | 14.5% | 10.1% | 7.8% |

| NOTE: Other public includes Medicare and military coverage. Medicaid includes people with multiple sources of coverage including Medicaid. For additional detail on coverage definitions, see sources and data notes here. SOURCE: KFF estimates based on the 2008-2019 American Community Survey, 1-Year Estimates. |

||||||