Data Note: Review of CBO Medicaid Estimates of the American Health Care Act

This data note reviews the Medicaid estimates included in the American Health Care Act as passed by the House of Representatives on May 4, 2017 prepared by the Congressional Budget Office (CBO) and staff at the Joint Committee on Taxation (JCT).

American Health Care Act (AHCA)

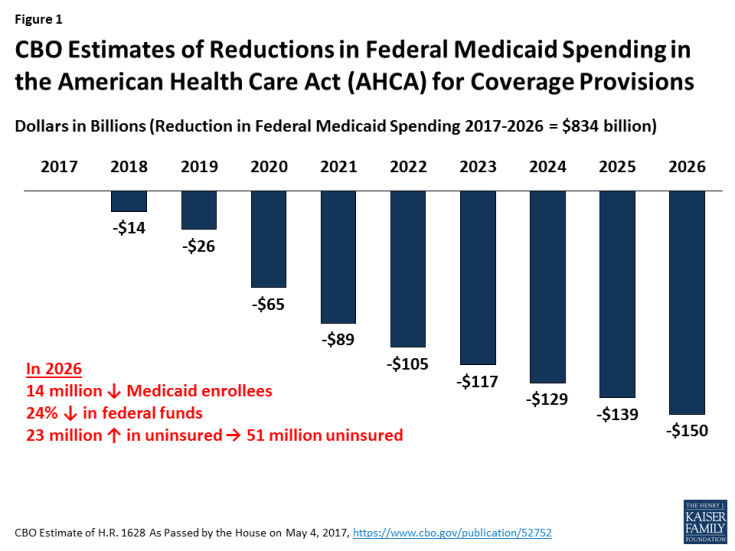

CBO estimates that the coverage provisions of the AHCA as passed by the House of Representatives would reduce direct spending for Medicaid by $834 billion over the 2017-2026 period (Figure 1). By 2026, Medicaid spending would be about 24 percent less than what CBO projects under current law. Most of the reduction in spending is tied to estimates of lower enrollment. By 2026, CBO estimates 14 million fewer people would be enrolled in Medicaid compared to current law. Overall, the AHCA would reduce federal deficits by $119 billion over the 2017-2026 period with a number of provisions that increase costs and decrease revenues offset by large reductions in federal spending coming primarily from Medicaid and the elimination of subsidies for non-group health insurance included in the Affordable Care Act (ACA). Overall, the total uninsured would reach 51 million in 2026, or 23 million more than what is projected under current law with the ACA. Key Medicaid provisions include the following:

Figure 1: CBO Estimates of Reductions in Federal Medicaid Spending in the American Health Care Act (AHCA) for Coverage Provisions

End of Enhanced Match for the ACA. Under current law, states that adopted the ACA Medicaid expansion receive an enhanced match rate for those newly eligible for coverage. Beginning in 2020, the AHCA would reduce the enhanced federal matching rate for newly eligible adults from 90 percent to the traditional match rate (which ranges from 50% to 75%) for those newly enrolled after December 31, 2019. CBO estimates the following effects from this provision:

- No additional states will adopt the expansion resulting in 5 million fewer enrollees by 2026 compared to projections under current law;

- Some states that have already expanded their Medicaid programs would not continue that coverage (some states might also begin to reduce coverage prior to 2020); and

- Reductions in spending for those covered at the enhanced match (those with coverage as of December 31, 2019 without a break in coverage) as they cycle off the program (fewer than one-third of those enrolled as of December 31, 2019 would have maintained continuous eligibility two years later and the higher federal matching rate would apply for fewer than 5 percent of newly eligible enrollees by the end of 2024). New enrollees are covered at the traditional match rate.

Impose a Per Capita-Based Cap or Block Grant for Medicaid. Under current law, the federal government matches state Medicaid spending with no pre-set limit. Under the AHCA, beginning in 2020, Medicaid would transition to per capita cap to limit federal financing. The per capita cap would be set for five enrollment groups (the elderly, individuals with disabilities, children, newly eligible adults, and all other adults), increased by the consumer price index for medical care services (CPI-M) for children and adults and CPI-M plus one percentage point for the elderly and people with disabilities multiplied by the number of enrollees in each category in that year. CBO assumes:

- Medicaid per enrollee growth constrained to CPI-M (3.7% over the 2017-2026 period) would be lower than the average annual rate of 4.4 percent projected under current law.

- With less federal funding for Medicaid, states would need to increase state funding to maintain the program at current-law levels or make cuts to Medicaid by reducing payments to providers and health plans, eliminating optional services, restricting eligibility for enrollment, or (to the extent feasible) arriving at more efficient methods for delivering services (or employ a combination of strategies).

Key Changes in the Managers Amendment and House Passed Bill: The bill as amended and then passed by the House of Representatives included additional provisions that on net reduced federal savings from $880 billion to $834 billion:

- Increases the per capita costs for aged, blind, and disabled enrollees by the CPI-M plus one percentage point;

- Reduces the per capita allotment in Medicaid for the state of New York in proportion to any financing the state receives from county governments;

- Provides states the option to make eligibility for Medicaid conditional on satisfying work requirements for enrollees who are not single parents of children under age 6 or who are not pregnant or disabled;

- Allows states to receive a block grant for Medicaid coverage of children and some adults instead of funding based on a per capita cap.

Impact of Other Medicaid Provisions. Other Medicaid provisions would result in reduced federal outlays, and two provisions would result in increased outlays.

- Repeal of Medicaid Provisions. Repeal increase in Medicaid eligibility to from 100% to 138% FPL for children ages 6-19 as of December 31, 2019; repeal hospital presumptive eligibility provisions and presumptive eligibility for expansion adults, effective January 1, 2020, and repeal enhanced FMAP for the Community First Choice (CFC) option to provide attendant care services effective January 1, 2020 ($19.2 billion in savings 2017-2026 with $12 billion from CFC repeal)

- Reduce Medicaid Costs. Require states to treat lottery winnings and certain other income as income for purposes of determining eligibility; decrease the period when Medicaid benefits may be covered retroactively, and eliminate states’ option to increase the amount of allowable home equity from $500,000 to $750,000 for individuals applying for Medicaid coverage of long-term services and supports ($6.2 billion in savings 2017-2026).

- Repeal Medicaid Disproportionate Share Hospital (DSH) cuts for FY2020 – FY2025; exempt non-expansion states from DSH cuts for FY2018 – FY 2019 ($31 billion increase 2017-2016).

- Safety-Net Funding. Provide $2 billion in funding in FY 2018 to FY 2021 to states that did not expand Medicaid eligibility under the ACA ($10 billion increase 2017-2026).

Interaction with Other Provisions.

- Planned Parenthood. Prohibit funding for Planned Parenthood from Medicaid, which would reduce direct spending by $234 million over the 2017-2026 period; but savings would be partially offset by increased Medicaid spending for additional births ($.1 billion over the 2017-2026 period) and some new Medicaid coverage costs.

- Marketplace Provisions. Eliminate penalties associated with the individual mandate results in fewer people enrolling in Medicaid.