Health Affairs Blog: Medicare Premium Support Proposals Could Increase Costs for Today’s Seniors, Despite Assurances

Perspective

Health Affairs Blog: Medicare Premium Support Proposals Could Increase Costs for Today’s Seniors, Despite Assurances

Perspective

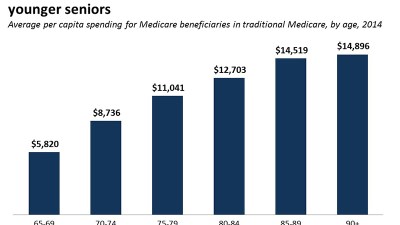

In a Health Affairs blog post, Tricia Neuman and Gretchen Jacobson of the Kaiser Family Foundation examine how proposals to convert Medicare to a premium support system could lead to higher Medicare premiums and cost-sharing for seniors currently enrolled in the program, even if today’s seniors are “grandfathered” and the new system is phased-in for people ages 55 and younger. The blog post explains how today’s seniors could face higher health care costs, if older beneficiaries are separated, at least actuarially, from younger ones. Lawmakers could implement policies to prevent cost increases for seniors, but doing so would reduce Medicare savings, a key objective of many premium support proposals.