Overview of Medicaid Per Capita Cap Proposals

Introduction

Medicaid is administered by states within the parameters of federal rules, but financing is shared by states and the federal government. Federal Medicaid financing for states is open-ended, with the federal government matching state spending according to a pre-determined formula. This structure has resulted in significant variation across state Medicaid programs and has been the source of tensions over the balance between federal standards and state flexibility and over Medicaid costs and financing. Over time, some have proposed Medicaid reforms, often tied to broader deficit reduction efforts, that would alter this structure, For example, Congress has debated proposals to eliminate the Medicaid matching structure and limit federal spending through a block grant or through per capita or beneficiary caps. Such changes represent a fundamental change in the financing structure of the program that would have major implications for beneficiaries, providers, states and localities.

Congress is again focused on options to reform Medicaid financing to achieve federal savings. In response to a request by congressional committee chairs with interest in Medicaid, the Medicaid and CHIP Payment and Access Commission (MACPAC) released a report to analyze and evaluate Medicaid financing reforms that would reduce federal and state outlays. In response to a request by the ranking members of these committees, the report also assess the effects of financing reforms on states, enrollees, providers, and plans.1

In addition, in June 2016, the House Republicans put forth a proposal to convert Medicaid to a per capita cap or a block grant. The House Budget Resolution released in spring 2016 as well as legislation (the Health Accessibility, Empowerment and Liberty Act of 2016 or HAELA) put forth by Congressman Pete Sessions (R-Texas) and Senator Bill Cassidy (R-Louisiana) also include variations of a Medicaid per capita cap.

This fact sheet examines five key questions:

- What are the Medicaid financing and eligibility rules under current law?

- What is a per capita cap?

- What are key challenges in designing a per capita cap?

- What are the key provisions in the current proposals?

- What are the implications of a per capita cap?

What are the Medicaid financing rules under current law?

Under current law, Medicaid provides a guarantee to states for federal matching payments with no pre-set limit. The federal share of Medicaid is determined by a formula set in statute that is based on a state’s per capita income. The formula is designed so that the federal government pays a larger share of program costs in poorer states. The federal share (FMAP) varies by state from a floor of 50% to a high of 74% in 2016, and states may receive higher FMAPs for certain services or populations. In 2014, the federal government paid about 60% of total Medicaid costs with the states paying 40%.2 Each quarter, states report their Medicaid costs (for qualified beneficiaries and services) to the federal government, and the federal government matches those costs at the state’s matching rate.

To participate in Medicaid and receive federal matching dollars, states meet core federal requirements. States must provide certain core benefits (e.g. hospital and physician and nursing home services) to core populations (e.g. poor pregnant women and children) without imposing waiting list or caps. States may also receive federal matching funds to cover “optional” services (e.g., adult dental care) or “optional” groups (e.g., elderly with high medical expenses). States also have discretion as to how to purchase covered services (e.g., fee-for-service or managed care) and the amounts they pay providers. Based on program flexibility, spending per Medicaid enrollee varies significantly across eligibility groups and states.3

What is a Medicaid per capita cap?

Under a Medicaid per capita cap, the federal government would set a limit on how much to reimburse states per enrollee. Under this model, a per-beneficiary federal cap (either total or by population group) would be determined for a base year. Each year, the per enrollee cap would be adjusted annually based on a federally-determined growth limit. A state’s total federal Medicaid funding limit for each subsequent year would be determined by multiplying the base year per capita amount, the growth limit percentage, and enrollment. To achieve federal savings, the per capita growth amounts would be set below the projected rates of growth under current law.

Payments to states would reflect changes in enrollment but not changes in the costs per enrollee beyond the growth limit. For example, should Medicaid enrollment increase due to tough economic times, as was seen in the Great Recession, the payments to states would be higher; however if enrollment declines, the federal payments to states would be lower. Details about state matching requirements are not clear in current proposals. State matching dollars could be required to draw down federal dollars up to the per capita cap, but after reaching the cap, states could be responsible for additional costs. Health care costs of the population, including changes due to an increase in the prevalence of chronic disease or new technology would not be factored into the payments for states.

Table 1 compares key Medicaid program elements under current law and a per capita cap.

| Table 1: Current Medicaid Program Financing Compared to Per Capita Cap Financing | ||

| Current Program | Per Capita Cap | |

| Entitlement to Coverage |

|

|

| State / Federal Funding |

|

|

What are key challenges in designing a per capita cap?

The key design questions and challenges in developing a per capita cap proposal are tied to decisions about methodology used to calculate the base spending per enrollee, the allowable growth rate for spending per enrollee, and what federal core requirements could be changed.

Setting the Base Spending Per Enrollee. Determining the base spending per enrollee in a per capita model would involve a number of decisions. Policy makers may include or exclude certain Medicaid payments (such as disproportionate share hospital payments (DSH) or Medicare premium amounts) and may include or exclude “partial benefit” enrollees (those who may be eligible for limited benefits such as family planning or home and community-based services only).

Per capita caps could be based on per enrollee spending for each state or nationally; similarly, there could be one per enrollee spending base or separate base amounts for each eligibility group. If the cap were to use a historical spending per enrollee by state as the base, states effectively would be locked into their policy choices, and inequalities between the different Medicaid programs would become permanent. On the other hand, implementing a uniform per capita cap across states would likely result in large changes in the distribution of funds across states. Some proposals may include provisions to attempt to address these issues.

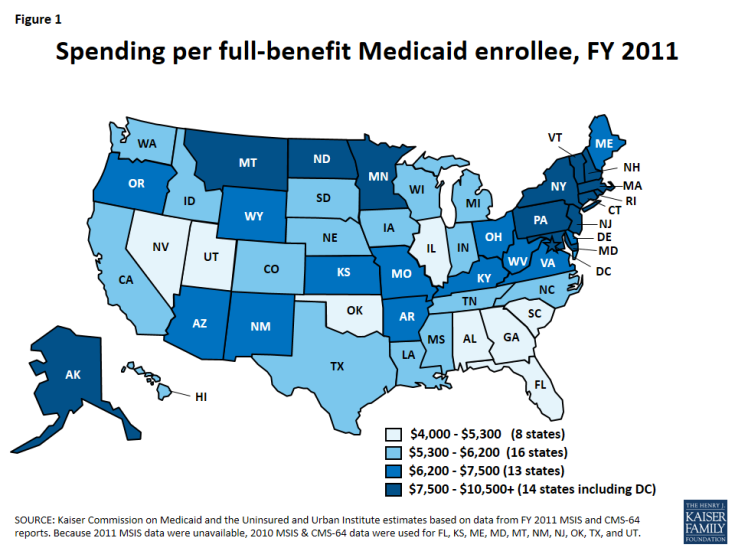

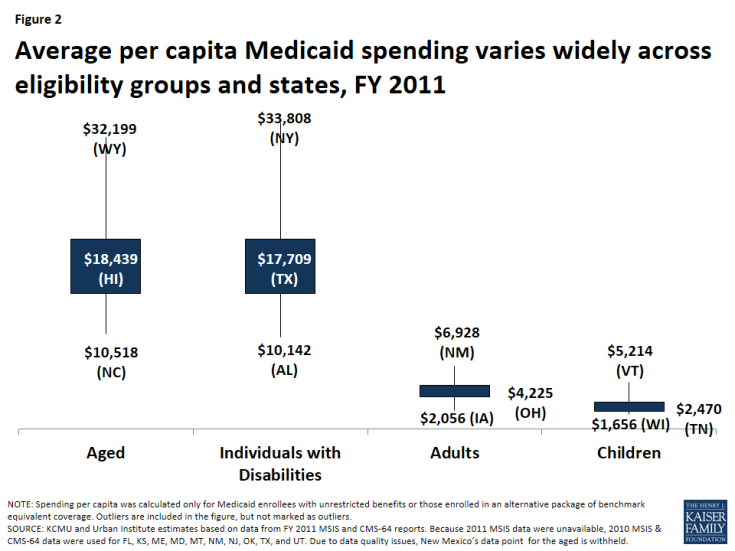

Based on current flexibility in the Medicaid program, there is considerable variation in per enrollee costs across eligibility groups and across states. Total spending per full benefit enrollee ranged from a low of $4,010 in Nevada to $11,091 in Massachusetts in FY 2011.4 (Figure 1) Spending for the elderly and individuals with disabilities may be more than four times the spending for an adult and more than seven times spending for an average child covered by the program.5 (Figure 2) In addition, even within a given state and eligibility group, per enrollee costs may vary significantly, particularly for individuals with disabilities.

Figure 2: Average per capita Medicaid spending varies widely across eligibility groups and states, FY 2011

Currently, the latest administrative data to examine per enrollee spending in Medicaid is from FY 2011. Reliable data to determine the base per enrollee spending may be significantly lagged.

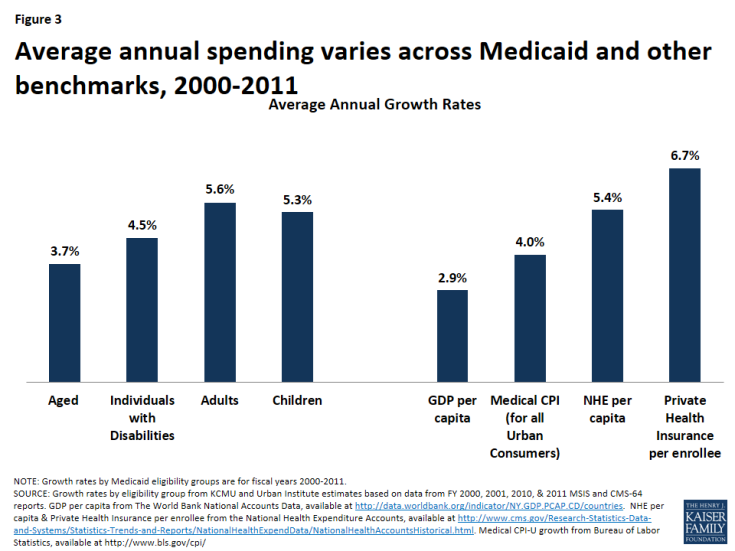

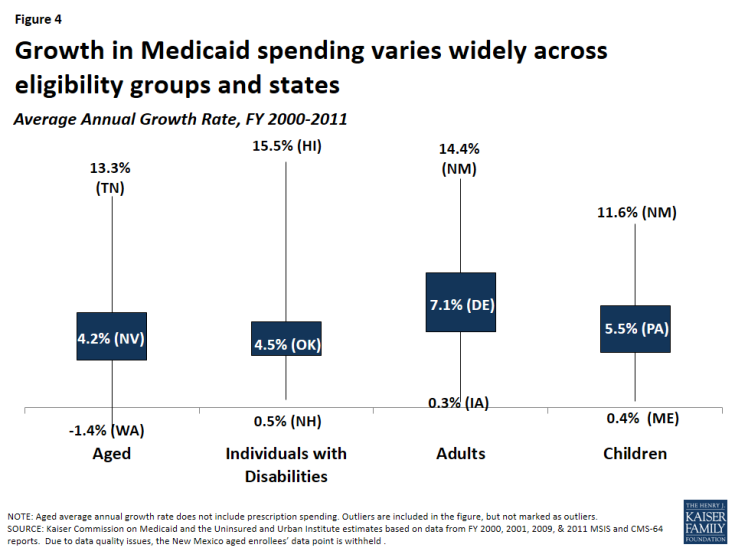

Growth Rates. To achieve federal savings, most proposals for a per capita cap set the amount of growth in per enrollee spending below current projections. Research shows Medicaid spending growth primarily has been driven by rising Medicaid enrollment. Spending growth per enrollee in Medicaid has been low compared to other payers: in particular, Medicaid per enrollee costs have been lower than private insurance.6 (Figure 3) Applying uniform growth rates across states in per enrollee spending could have different implications across states since per enrollee growth varies widely by state. Some proposals may tie per enrollee caps to gross domestic product (GDP) or inflation. GDP is a broad measure of national economic activity; therefore, during economic downturns, GDP may grow slowly or not at all. Looking back over the 2000-2011 period shows a wide range in growth rates across states and eligibility groups. (Figure 4)

Core Requirements. Medicaid financing reform proposals are often tied to changes in core requirements for Medicaid, which could give states additional flexibility. Proposals may include changes to minimum standards for eligibility or benefits. In addition, proposals could set maximum eligibility or benefits wherein the federal government would not reimburse for coverage or benefits beyond those specified in the law (compared to current law where states have the option to provide coverage and benefits beyond core requirements and still receive federal match). Key questions arise over the requirements for state spending and how states would be held accountable for use of federal Medicaid funds.

What are key provisions in the current proposals?

As noted above, current proposals that include a Medicaid per capita cap are the House Republican Plan, the House Budget Resolution7 and HEALA.8

House Republican Plan. The House Republican Plan would transition current Medicaid financing to a per capita allotment (or states could choose a block grant option). Beginning in 2019, states would receive a federal allotment that would be based on the product of the state’s per capita allotment for the four major beneficiary categories—aged, blind and disabled, children, and adults—and the number of enrollees in each of those four categories. The allotments would be determined based on each states’ total Medicaid spending for each group for full-year enrollees in 2016, adjusted for inflation. Similar to CHIP, states would draw down federal dollars up to the allotment based on the traditional FMAP rules. Payments including DSH and graduate medical education would be excluded from the allotments. State decisions to expand Medicaid under the ACA would be locked-in as of January 1, 2016.

States that have already expanded Medicaid under the ACA would be able to retain those dollars, but would be given flexibility to shift dollars to other populations. The enhanced FMAP for the expansion population would be phased down to match the states’ traditional match rate. States could transition “able-bodied” adults from Medicaid into commercial coverage with a tax credit or employment-based coverage. The plan would maintain the CHIP program but revert back to the original enhanced match rates in place prior to the ACA. The plan specifies new options for states to impose premiums and work requirements. The plan would also allow states to impose waiting lists and limited benefit plans for eligibility groups that are not mandatory coverage groups. The plan would also allow states to limit participation of entities or persons who perform elective abortions.

States that opt for a block grant would receive a set amount of funds to finance their programs determined by a base year (assuming those enrolled in the new expansion group are enrolled in other coverage types). States would be required to provide coverage to elderly and disabled individuals who are described as mandatory populations under current law.

While designed to reduce federal spending, the House Republican plan does not specify any set budget targets.

House Budget Resolution. The House Budget Resolution would allow states to choose between a block grant and a per capita cap option in place of the current Medicaid financing. Under the per capita cap option, per enrollee spending amounts would be set for the four eligibility groups (elderly, the blind and individuals with disabilities, nondisabled adults, and children). A per-person payment amount would be established to account for the average cost of care, per enrollee, in each of these four principal categories, and would be indexed to a predetermined growth rate. The Federal government would then provide Medicaid funds to the States based on the total number of enrollees in each category. It is not specified if the per enrollee amounts would vary across states and what the growth rate would be. Overall, the House proposal seeks to achieve $3 trillion in savings from the repeal of the Affordable Care Act (ACA) and the Medicaid financing reforms.

HAELA Bill. The HAELA bill is proposed legislation and therefore has more details than the budget resolution about how the per capita proposal would be implemented. The legislation specifies four enrollee categories (elderly, blind or disabled, children (to age 21) and adults. Per beneficiary amounts would be set for each category for each state and increased by inflation in the first year, then by projected changes in gross domestic product plus one percentage point. In years 4 through 10, the proposal would transition states to a corridor around a national average per enrollee amount by allowing for higher growth for low spending states and lower growth for high spending states for each category. Federal payments would be limited to cover only expenditures for individuals up to 100% FPL. The federal government would pay the higher of 75% or the traditional FMAP. Certain Medicaid payments including Medicare premium payments and vaccines for children would not be part of the per beneficiary amount but would be reimbursed separately according to existing law. The legislation also includes an option to have states receive federal funds to cover all Medicare services for duals. The proposal creates early chronic care bonus payments for states of up to $1 billion per year).

What are the implications of a per capita cap?

A per capita cap could control federal outlays while giving states additional flexibility and budget predictability. The motivation of per capita cap proposals is often tied to deficit reduction and limiting federal Medicaid spending over time. The amount of federal savings as well as the implications for states, providers and beneficiaries would be largely affected by federal savings targets that may drive decisions about allowable growth rates. Proponents argue that these proposals could be combined with changes in the law to grant states additional flexibility. Unlike a block grant approach, a per capita cap does adjust for changes in enrollment.

Implementing a per capita cap could be administratively difficult and could maintain current inequities in per enrollee costs across states. A key issue in implementing a per capita cap would be determining the base per enrollee costs. As noted above, this is challenging because national Medicaid administrative data is currently severely lagged; the most current data available is for FY 2011. In addition, data show enormous variation across states in per enrollee spending. Per capita cap proposals could lock-in these inequities based on previous policy choices; alternatively, moving to a more uniform per enrollee amount could result in large shifts in federal financing across states.

Pre-set growth rates cannot account for changes in costs of medical services, patient acuity or epidemics. Unlike Medicaid’s current financing structure, the per capita cap does not easily account for changes in costs related to advances in medical technology, increases in costs of prescription drugs, the continued aging of the population, and the increased prevalence of chronic conditions. All of these changes could increase treatment costs beyond what might be accounted for in a per capita growth rate. Costs associated with natural disasters and epidemics, like HIV/AIDS, also could not be factored into pre-determined per capita cap amounts.

If federal Medicaid payments are limited, costs could be shifted to states, providers or beneficiaries. While some states may increase state spending or achieve some program efficiencies to offset reduced federal payments, states also may consider options to reduce spending.

- States may have incentives to reduce Medicaid payment rates and restrict benefits. Given state requirements to balance their budgets (and resulting difficulty in increasing state spending in a given year), states may seek to restrict Medicaid spending to operate their programs within federal caps. Lower payment levels in Medicaid have contributed to its relatively low costs.9 During economic downturns, states are likely to further restrict provider rates.10 Low reimbursement rates can contribute to issues around access to care and provider participation. In addition, states have a great deal of flexibility to design benefit packages. Similar to provider rates, states often restrict benefits during tight budget times. While a per capita cap may create additional incentives to increase efficiency, because states pay for a share of the program under current law there already are incentives to control costs. States have also focused on efforts to control pharmacy costs, implement delivery and payment reforms and rebalance the delivery of long-term services from institutional to more community-based care to control costs and better deliver care. Many payment and delivery system reforms often involve upfront investments to potential gain out year benefits. Limited federal financing could hinder these reforms.

- New flexibility could result in eligibility restrictions and cost shifts to beneficiaries. As noted above, a per capita cap proposal could also come with changes to federal core requirements or additional flexibility for states. If federal eligibility rules were changed, states could have incentives to restrict eligibility or make it more difficult for high-cost individuals with more complex needs to enroll. Without the ACA requirements to streamline enrollment, states could also impose barriers that would limit enrollment. Other changes in federal law could allow states to impose premiums or monthly fees on beneficiaries. Research shows that this has a negative effect on enrollment and access to care for low-income beneficiaries.11 The House Republican plan specifies that states would have options to impose premiums and work requirements and to provide limited benefits, waiting lists and premiums for non-mandatory populations.

Looking Ahead

Moving to a per capita cap would be a major transformation to how Medicaid financing works. Proponents of per capita cap proposals argue that this structure could reduce federal spending and promote flexibility for states. However, such policies may be difficult to implement and may result in cost shifts to states if pre-determined growth rates are lower than expected program spending. Pre-set growth rates cannot account for changes in medical costs or health care epidemics or emergencies. With limited federal financing states may turn to restrictions in provider rates and benefits, and with changes to federal requirements states could impose eligibility restrictions or policies to shift costs to beneficiaries. Per capita cap proposals are likely to be debated in Congress and as part of the elections in the context of broader health care changes as well as deficit reduction.