Medicare Beneficiaries’ Out-of-Pocket Health Care Spending as a Share of Income Now and Projections for the Future

Overview

Our analysis of Medicare beneficiaries’ out-of-pocket spending burden—that is, out-of-pocket health care spending as a share of income—is based on estimates from both the MCBS and DYNASIM3. The MCBS is a nationally representative survey of Medicare beneficiaries and an ideal source of data on beneficiaries’ out-of-pocket spending on premiums and health and long-term care services because these amounts are based on both actual survey-reported data and actual administrative data, where available. As such, the survey is well suited for estimating per capita out-of-pocket spending at the individual and subgroup level.

The analysis was conducted separately for Social Security income and total income, using different approaches to account for differences in the available data. To analyze the spending burden based on Social Security income, we calculate average total out-of-pocket spending (from the MCBS) as a share of average per capita Social Security income (from DYNASIM3) for all beneficiaries and by subgroup, which enables us to compare our results to the Medicare Trustees’ estimates. To analyze the spending burden based on total income, we use the MCBS to calculate a ratio of out-of-pocket spending to per capita total income for each respondent, and then estimate the median—an approach that addresses the distortion of averages by outlier values for both spending and income. We measure the out-of-pocket health care spending burden for Medicare beneficiaries overall and by demographic, socioeconomic, and health status indicators, in 2013 and projections for 2030, in constant 2016 dollars.

Data

Out-of-pocket health care spending

The analysis of out-of-pocket spending is based on data from the Centers for Medicare & Medicaid Services (CMS) Medicare Current Beneficiary Survey (MCBS) Cost and Use file, 2013 (the most recent year of data available). The MCBS is a survey of a nationally-representative sample of the Medicare population, including both aged and disabled enrollees who are living in the community as well as long-term facility residents. The Cost and Use file integrates survey information reported directly by beneficiaries with Medicare administrative data. Survey-reported data includes the demographics of respondents (e.g., sex, age, race, living arrangements, income), health indicators (e.g., self-reported health status, chronic conditions, and physical functioning), the use and costs of health care services, and supplementary health insurance arrangements. The dataset includes detailed information on Medicare-covered and non-covered services, utilization, and spending, including spending by Medicare, Medicaid, third-party payers, and out-of-pocket payments by beneficiaries. The survey collects information on inpatient and outpatient hospital care, physician and other medical provider services, home health services, durable medical equipment, long-term and skilled nursing facility services, hospice services, dental services, and prescription drugs.

Survey-reported out-of-pocket payments are those payments made by the beneficiary or their family, including direct cash payments and Social Security or Supplemental Security Income (SSI) checks paid directly to nursing homes. Out-of-pocket spending on premiums is derived from administrative data on Medicare Part A, Part B, Part C (Medicare Advantage), and Part D premiums paid by each sample person along with survey-reported estimates of premium spending for other types of health insurance beneficiaries may have (including Medigap, employer-sponsored insurance, and other public and private sources). Survey-reported information is matched to and supplemented by administrative records and billing and claims-level data when possible. Extensive efforts are made to verify the accuracy of survey reports and to reconcile discrepancies using administrative bill data (primarily for traditional Medicare beneficiaries) to produce a more complete and reliable dataset. Out-of-pocket spending amounts are net of payments by any third-party payers, such as payments by Medicaid, Medigap, or employer-sponsored insurance.

Out-of-pocket spending amounts used in this analysis based on the 2013 MCBS are inflation adjusted to 2016, (based on the Consumer Price Index for All Urban Consumers, or CPI-U), projected to 2030, and presented in constant 2016 dollars.

Beneficiary population

We analyze out-of-pocket spending among all Medicare beneficiaries and by specific beneficiary subgroups, including age (under 65, 65-74, 75-84, 85 and over), gender (female, male), age by gender, race (white, black, Hispanic, other), marital status (married, divorced/separated, widowed, single (never married)), education level (less than high school, high school graduate, some college, college graduate), per capita income categories (increments of $10,000), self-reported health status (excellent, very good, good, fair, poor), number of chronic conditions (none, 1-2, 3-4, 5 or more), and functional limitations (having no or any limitations in activities of daily living, or ADLs).

For the analysis of out-of-pocket spending as a share of total income, we exclude beneficiaries enrolled in Part A or Part B only and beneficiaries enrolled in Medicare Advantage plans from the MCBS analysis of out-of-pocket spending. For Medicare Advantage enrollees, it is not possible to verify survey-reported events in the MCBS with administrative claims data, as is done for beneficiaries in traditional Medicare. This has the effect of biasing downward survey-reported out-of-pocket spending amounts for Medicare Advantage enrollees compared to beneficiaries with traditional Medicare. According to our 2013 MCBS estimates, nominal average per capita out-of-pocket health care spending on premiums and services by Medicare Advantage enrollees was 26 percent less than out-of-pocket spending by beneficiaries in traditional Medicare in 2013 ($4,316 versus $5,817); the overall average per capita amount for all Medicare beneficiaries (including both groups) was $5,341. It is not possible to determine whether the observed differences are real or due to underlying differences in the data collection, verification, and imputation process for out-of-pocket spending by beneficiaries in traditional Medicare and Medicare Advantage.

To evaluate the effect of including or excluding Medicare Advantage enrollees, we estimated average out-of-pocket spending as a share of average income for all beneficiaries, including both traditional Medicare and Medicare Advantage, and for traditional Medicare beneficiaries only. Not surprisingly, including the Medicare Advantage population produces somewhat lower estimates of out-of-pocket spending as a share of income relative to estimates based on the traditional Medicare population alone (results not shown). This is because the numerator in the spending burden calculation (average per capita out-of-pocket spending) is lower as a result of the lower average out-of-pocket costs among Medicare Advantage enrollees.

To avoid introducing bias associated with under-reporting of utilization events and associated spending among Medicare Advantage enrollees, for whom claims data are not available, our analysis of spending as a share of total income excludes these beneficiaries. We excluded beneficiaries who were coded as being enrolled in a Medicare Advantage or Medicare Advantage drug plan in any given month in the 2013 calendar year, based on administrative variables in the data file; this equaled 3,450 unweighted survey respondents (17.1 million weighted) of the 11,049 Medicare beneficiaries (53.9 million weighted) represented in the 2013 MCBS Cost and Use file.

For the analysis of spending as a share of total income, we also excluded beneficiaries who were enrolled in only Part A or Part B for the duration of their Medicare enrollment in 2013 (unweighted n=561). Because Medicare is typically not the primary payer for those who are enrolled in only Part A or Part B but not both programs, beneficiaries with Part A or Part B only also have significantly lower average total out-of-pocket spending relative to those enrolled in both Part A and B, which is the rationale for excluding them from the analysis of out-of-pocket spending as a share of total income. After excluding these enrollees, our sample for the analysis of spending as a share of total income included 7,038 respondents in traditional Medicare (32.4 million weighted) for the duration of their Medicare enrollment in 2013.

We can identify and exclude Medicare Advantage enrollees and beneficiaries enrolled in Part A or Part B only from our analysis of the MCBS for out-of-pocket spending as a share of total income, because that part of the analysis relies exclusively on individual-level data in the MCBS. However, it is not possible to exclude these subgroups from DYNASIM3 because the model does not specifically identify Medicare Advantage coverage or type of Medicare enrollment. Therefore, for the analysis of out-of-pocket spending as a share of Social Security income, which uses data from both the MCBS and DYNASIM3, we included both Medicare Advantage enrollees and those in Part A or Part B only in the analysis of out-of-pocket spending from the MCBS, because we wanted a uniform definition of the underlying population in the populations included in both datasets for analysis of out-of-pocket spending as a share of Social Security income. This decision means we erred on the side of producing more conservative results by including these enrollees (since they have lower out-of-pocket spending then their counterparts), rather than exclude them and potentially overstate the spending burden.

Social Security income

Although the MCBS is an ideal source of out-of-pocket spending data for this analysis, income in the MCBS is reported at the aggregate level for each respondent and does not allow for analysis of specific components of income, such as Social Security income. Therefore, for our analysis of out-of-pocket spending as a share of average per capita Social Security income, we used income estimates and projections from DYNASIM3, a predictive microsimulation model designed by The Urban Institute that draws upon multiple sources of data.

DYNASIM3 projects the population and analyzes the long-run distributional consequences of retirement and aging issues. The model starts with a representative sample of individuals and families and ages the data year by year, simulating demographic and economic events and including all key components of retirement income. The model uses parameters estimated from macroeconomic and demographic assumptions about the future from the Social Security Trustees, and from longitudinal data sources including the U.S. Census Bureau Survey of Income and Program Participation (SIPP), Pension Benefit Guaranty Corporation’s (PBGC) Pension Insurance Modeling System (PIMS), Health and Retirement Study (HRS), and the Panel Study of Income Dynamics (PSID). The model also incorporates administrative data from the Social Security Administration (SSA) and elements from the SSA’s Modeling Income in the Near Term (MINT) microsimulation model, and aligns projections of assets to the Survey of Consumer Finance (SCF).

DYNASIM3 projects the major sources of income and wealth annually from age 15 until death, including earnings, Social Security benefits, benefits from employer-sponsored defined benefit (DB) pensions, Supplemental Security Income (SSI), interest, dividends, rental income, home equity, retirement accounts (defined contribution (DC) plans, individual retirement accounts (IRAs), and Keoghs), and other assets (saving, checking, money market, certificate of deposit (CD), stocks, bonds, equity in businesses, vehicles, and non-home real estate, less unsecured debt). Reported total income includes withdrawals from retirement accounts but excludes capital gains.

DYNASIM3 generates average and percentiles of per capita Social Security and total income, both historical (in this analysis, back to 2013) and projected (in this analysis, through 2030), for specific demographic groups and health status indicators. DYNASIM3 calculates average per capita Social Security and total income for married couples by dividing income for the couple by two. All income amounts for 2013 and 2030 are presented in constant 2016 dollars.

Total income

The MCBS includes a measure of total income for individual respondents and their spouses, if applicable. However, the MCBS does not report all sources of income that some beneficiaries may have. As in many other surveys, income is self-reported, with beneficiaries asked to report total annual income for themselves and their spouses (where applicable) from all sources, including earnings, Social Security, pensions, and asset income. However, beneficiaries are not asked to report specific income amounts by source, and some types of income may go unreported or may be underestimated. Therefore, this measure results in an overall underreporting of income, particularly for those with relatively high incomes. This conclusion is based on a comparison of MCBS income estimates to income estimates from DYNASIM3, in which we measured the divergence of MCBS and DYNASIM income estimates at each percentile of per capita income.

We used the results of this comparison to derive adjustment factors for each percentile with which to rescale each MCBS respondent’s per capita total income. In general, this produced estimates of MCBS respondents’ income that are higher than self-reported values and that we believe are a more accurate representation of income among people on Medicare. We then combined this adjusted income estimate with per capita out-of-pocket spending estimates in the MCBS to derive a more reliable estimate of Medicare beneficiaries’ per capita out-of-pocket health care spending as a share of total income (described below) than one based on MCBS self-reported income data alone.

Methods

Our analysis was conducted in two parts using two separate methods, as described below: one for the analysis of out-of-pocket spending as a share of Social Security income and another for the analysis of spending as a share of total income.

Analysis of per capita out-of-pocket spending as a share of per capita Social Security income

To estimate Medicare beneficiaries’ out-of-pocket spending as a share of Social Security income, we combined estimates from both the MCBS and DYNASIM3. The basic calculation of spending burden for this part of the analysis is average per capita total out-of-pocket spending for premiums and services from the MCBS divided by average per capita Social Security income from DYNASIM3. We calculated this estimate for the total beneficiary population, including beneficiaries in traditional Medicare and Medicare Advantage enrollees, and beneficiaries enrolled in Part A or Part B only, and separately for subgroups by gender, age, gender by age, race/ethnicity, marital status, education level, income categories, and health status indicators. Using this approach, we calculated estimates of average out-of-pocket spending as a share of average Social Security income, overall and by subgroup, for 2013 and projected into the future (through 2030).

Analysis of per capita out-of-pocket spending as a share of per capita total income

For analysis of out-of-pocket spending as a share of total income, we revised our methodology in several ways: (1) we excluded from the analysis beneficiaries enrolled in only Part A or Part B, who do not have coverage of all Medicare-covered benefits and therefore incur lower out-of-pocket costs (as reported in the MCBS) than beneficiaries who are enrolled in both parts of the program; (2) we excluded from the analysis beneficiaries enrolled in Medicare Advantage plans, because utilization and spending data for these enrollees in the MCBS are based on survey responses only and are not reconciled with administrative claims data, which leads to underestimates of out-of-pocket spending; and (3) we used individual-level data on out-of-pocket spending and total income from the MCBS to create a ratio of spending to income for each individual. Because the MCBS does not ask about all sources of income that some beneficiaries may have, leading to underreporting of total income, we used DYNASIM3 to adjust the self-reported estimate of total income for each respondent in the MCBS (as described above), divided this estimate by two for married couples to derive a per capita income estimate, and used this estimate for total income in the analysis of out-of-pocket spending as a share of total income.

To measure per capita out-of-pocket health care spending as a share of per capita total income, we arrayed the individual ratios of annual out-of-pocket spending to annual income from low to high and computed the median (and other percentiles, e.g., 75th and 95th) for the entire group of traditional Medicare beneficiaries, and by demographic subgroups.1 We also calculated what percent of Medicare beneficiaries (overall and by subgroup) spent at least 10 percent or 20 percent of their per capita total incomes on out-of-pocket health care costs in 2013 and projected for 2030, measures that are commonly used to convey health care spending burdens.2

Spending burden projections for 2030

The 2030 projections are based on the assumption that nominal health care costs grow at an average annual rate of 4.3 percent, which equals the average annual rate of growth in nominal per capita out-of-pocket spending on premiums and services for all Medicare beneficiaries between 2000 and 2013 (2.1 percent in constant 2016 dollars).3 We applied this growth rate to the 2013 out-of-pocket spending estimates for each respondent in the MCBS to project their out-of-pocket spending in 2030.

Social Security income projections for 2030 are generated by DYNASIM3. The income projections from the DYNASIM3 microsimulation model are based on information from many different longitudinal data sources and are aligned to macroeconomic and demographic assumptions about the future from the Social Security Trustees. DYNASIM captures historic changes in labor force participation, earnings, marriage, disability, education, pension type, stock and bond market fluctuations, and benefit claiming. It includes important differentials by sex, age, education, marital status, race, nativity, and earnings level. DYNASIM3 projects an average annual growth rate of 3.6 percent in average nominal per capita Social Security income between 2013 and 2030 (1.0 percent in constant 2016 dollars). For total income projections in 2030, we measured the rate of total income growth between 2013 and 2030 at each percentile from DYNASIM3, and applied those growth rates to the corresponding percentiles of the DYNASIM-adjusted total income estimates for respondents in the MCBS.

Alternative out-of-pocket health care spending growth projections

To project growth in out-of-pocket spending, we considered three growth rates to approximate different scenarios for the path of future spending:

- 3.6 percent average annual growth (low spending growth rate): this rate equals the National Health Expenditure Accounts projections of the average annual growth rate in average nominal per capita out-of-pocket spending between 2013 and 2025; this translates to a 1.4 percent growth rate in constant 2016 dollars.

- 4.3 percent average annual growth (mid-range spending growth rate): this rate equals the average annual growth rate in average nominal per capita out-of-pocket spending on premiums and services for all beneficiaries between 2000 and 2013, based on historical spending data from the MCBS; this translates to a 2.1 percent growth rate in constant 2016 dollars.

- 5.8 percent average annual growth (high spending growth rate): this rate equals the average annual growth rate in total average nominal costs per Medicare beneficiary between 2000 and 2013, based on historical data published in the 2016 Medicare Trustees report; this translates to a 3.6 percent growth rate in constant 2016 dollars.

The out-of-pocket spending burden projections in this analysis are based on the mid-range spending growth rate. Because the actual trajectory of future spending is unknown, we measured the sensitivity of our spending burden results to the assumed 4.3 percent health care spending growth rate by calculating results for the projection of average out-of-pocket spending as a share of average Social Security and median out-of-pocket spending as a share of total income between 2013 and 2030 applying the low-spending (3.6 percent) and high-spending (5.8 percent) growth rates to the 2013 out-of-pocket spending estimates from the MCBS to depict a range of alternative outcomes.

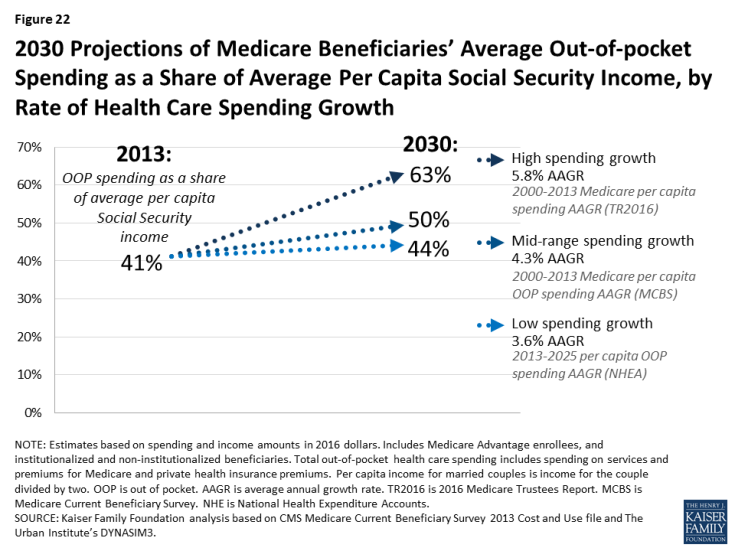

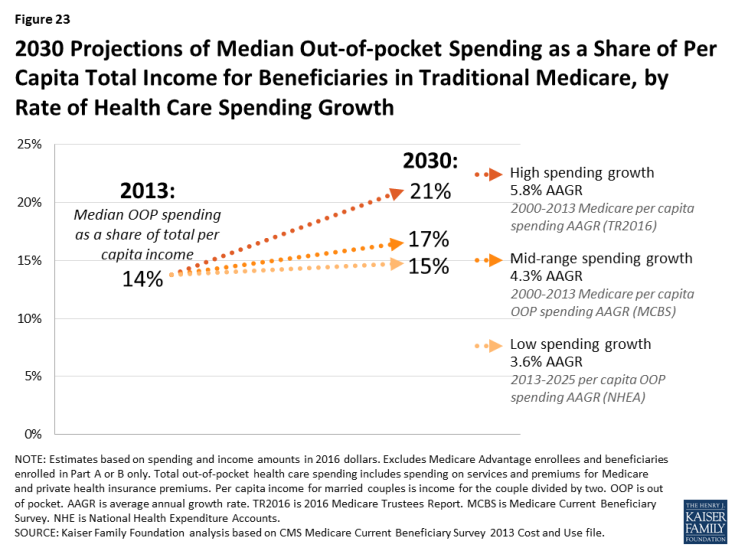

Under the mid-range health care spending growth rate assumption of 4.3 percent, average out-of-pocket spending as a share of average income is projected to increase by 9 percentage points between 2013 and 2030, from 41 percent to 50 percent. The corresponding increase for total income is 3 percentage points, from 14 percent to 17 percent, at the median. As expected, the magnitude of this increase would be larger or smaller if out-of-pocket health care spending grows faster or slower than the mid-range projection used for this analysis:

- If out-of-pocket spending grows at a slower rate of 3.6 percent (based on per capita out-of-pocket spending growth between 2013 and 2025 from NHEA), average out-of-pocket spending as a share of average per capita Social Security income would increase by 3 percentage points between 2013 and 2030, from 41 percent to 44 percent (Figure 22). For median spending as a share of per capita total income, the share would be relatively flat under a low-spending growth scenario: 14 percent in 2013 and 15 percent in 2030 (Figure 23).

- Conversely, if average out-of-pocket spending grows at a relatively high rate of 5.8 percent (based on Medicare per capita spending growth between 2000 and 2013 from Medicare Trustees), spending as a share of per capita Social Security income would increase by 22 percentage points, from 41 percent to 63 percent. Looking at out-of-pocket spending as a share of per capita total income at the median, the share would increase by 7 percentage points under a high-spending growth scenario, from 14 percent in 2013 to 21 percent in 2030.

Limitations

Data limitations

The ideal dataset for this analysis would have, at the level of an individual Medicare beneficiary, out-of-pocket spending on premiums and services reconciled with claims data, such as is available in the MCBS, and total income for the individual reported separately for all sources, including Social Security, earnings, pensions, asset income, and IRA distributions. With this ideal dataset, we would be able to calculate for each individual two ratios: 1) their out-of-pocket health care spending as a share of Social Security income and 2) out-of-pocket spending as a share of total income. We could then array the individual-level results from low to high and calculate the median ratio to present an undistorted measure of the individual health care spending burden, and by subgroup.

Unfortunately, this ideal dataset does not exist. MCBS does not report Social Security income for each respondent, while DYNASIM3 is a microsimulation model that reports income for all beneficiaries, but does not include out-of-pocket spending reconciled with claims data. Although the DYNASIM3 microsimulation model has recently been updated to project out-of-pocket medical spending and premiums, these projections are predicted based on certain demographic parameters in the model (e.g., age, sex, education, health status, insurance type), some of which are themselves predicted in the model (e.g., health status, insurance type). The MCBS is a more valid and reliable source of data on Medicare beneficiaries’ out-of-pocket spending on premiums and other health spending including and long-term care services because MCBS amounts are based on both survey-reported data and actual administrative data, where available. MCBS is better suited for deriving per capita estimates of out-of-pocket spending at the individual and subgroup level. While the MCBS provides the best estimate of out-of-pocket medical spending for Medicare beneficiaries, DYNASIM’s projected distributions of out-of-pocket medical spending as a share of Social Security and total income closely match values included in this report in all subgroups.

The Health and Retirement Study (HRS) includes out-of-pocket spending, Social Security income, and total income at the individual level, but health insurance premiums are missing for many respondents. Since premiums account for nearly half of Medicare beneficiaries’ total out-of-pocket spending, the HRS significantly underreports total out-of-pocket spending as compared to estimates from the MCBS.

Method for calculating out-of-pocket spending as a share of income

Faced with these data limitations, we used two methods for computing the ratio of out-of-pocket spending to income in this analysis (as described in detail above). For the spending burden analysis based on total income, we used per capita out-of-pocket spending and the DYNASIM3-adjusted per capita income measure in the MCBS to calculate a ratio of out-of-pocket spending to total income for each individual, and then presented the median ratio. As stated above, we were unable to follow this same approach in the spending burden analysis based on Social Security income, because MCBS does not report separate components of total income for each respondent. Because we could not use individual-level data on spending and Social Security income from one dataset, we could not array estimates in such a way as to calculate the median ratio of out-of-pocket spending as a share of income. Therefore we calculated average out-of-pocket spending as a share of average per capita Social Security income, in the aggregate and by subgroup.

We recognize that using average out-of-pocket spending and average Social Security income is prone to bias since averages are affected by outlier values and the resulting spending burden calculations may be distorted. Although averages for both spending and income are more affected by outlier values than medians, there was no rationale to support dividing median out-of-pocket spending from the MCBS with median estimates of income in DYNASIM3. Moreover, we note that Social Security income is not as affected by outlier values as total income since there is a maximum Social Security retirement benefit payable in any given year; for 2017, the amount was $3,538 per month for a person retiring at age 70, or $42,456 per year.

Despite the data limitations inherent in both the MCBS and DYNASIM3 precluding us from using the same methodology for both parts of this analysis, we believe that the approach we have adopted here is a reasonable and straightforward alternative to calculating the out-of-pocket spending burden for Social Security income, while enabling us to use our preferred approach (calculating the individual-level ratio of spending to income and then calculating the median value) for spending as a share of total income. Both parts of the analysis use the best-available sources of data for Medicare beneficiaries’ total out-of-pocket health care spending and per capita Social Security and total income. Moreover, the approach we use for the Social Security analysis is consistent with the approach used by the Medicare actuaries in their calculation of average per capita costs for Medicare Part B and Part D as a share of the average Social Security benefit. This facilitates a comparison of our results with the actuaries’ analysis as shown in the Medicare Trustees report each year, but also highlights the importance of other out-of-pocket health care spending that is not included in the Trustees’ calculations. Dividing couple incomes in half recognizes that couples share resources and facilitates comparisons of the spending burden for married and unmarried individuals on a per capita basis.

Projecting income growth

For this analysis, we relied on income projections generated by the DYNASIM3 model. We did not model variation in the rate of Social Security or income growth between 2013 and 2030. According to the predictive DYNASIM3 microsimulation model, the rate of average annual growth in average nominal per capita Social Security income for Medicare beneficiaries is projected to be 3.6 percent (1.0 percent in constant 2016 dollars); the corresponding amounts for average per capita total income are 3.7 percent and 1.2 percent. The model allows for variation in the rate of income growth by demographic group, taking into account such factors as changing patterns in employment, earnings, marriage histories, Social Security full retirement age, pension type, and asset returns.

Modifying these income projections would affect our spending burden projections. For example, if the rate of average per capita income growth is higher than the DYNASIM3 model projects, out-of-pocket spending would consume a smaller share of income. Conversely, if the rate of per capita income growth is slower than the model projects, the out-of-pocket spending burden would be larger than the projections in this analysis.