Hospital Charity Care: How It Works and Why It Matters

About four in ten adults (41%) in the United States—and about six in ten (57%) of those with household incomes below $40,000—have some level of medical debt, owing an estimated $195 billion or more in total. Many adults who report medical debt cite costs associated with emergency care (50%) and hospitalizations (35%) as sources of unpaid bills. Affording this care may be especially challenging for the large number of adults who are uninsured or underinsured. The financial impact of unpaid bills from hospitals and other providers on patients and their families can be substantial and long lasting. Recent reporting indicates that hospitals are earning healthy margins in some regions where a large share of residents are burdened with medical debt. In response to concerns about medical debt and the affordability of care more generally, policymakers have explored options to strengthen the regulation of hospital charity care programs, which provide free or discounted services to eligible patients who are unable to afford their care.

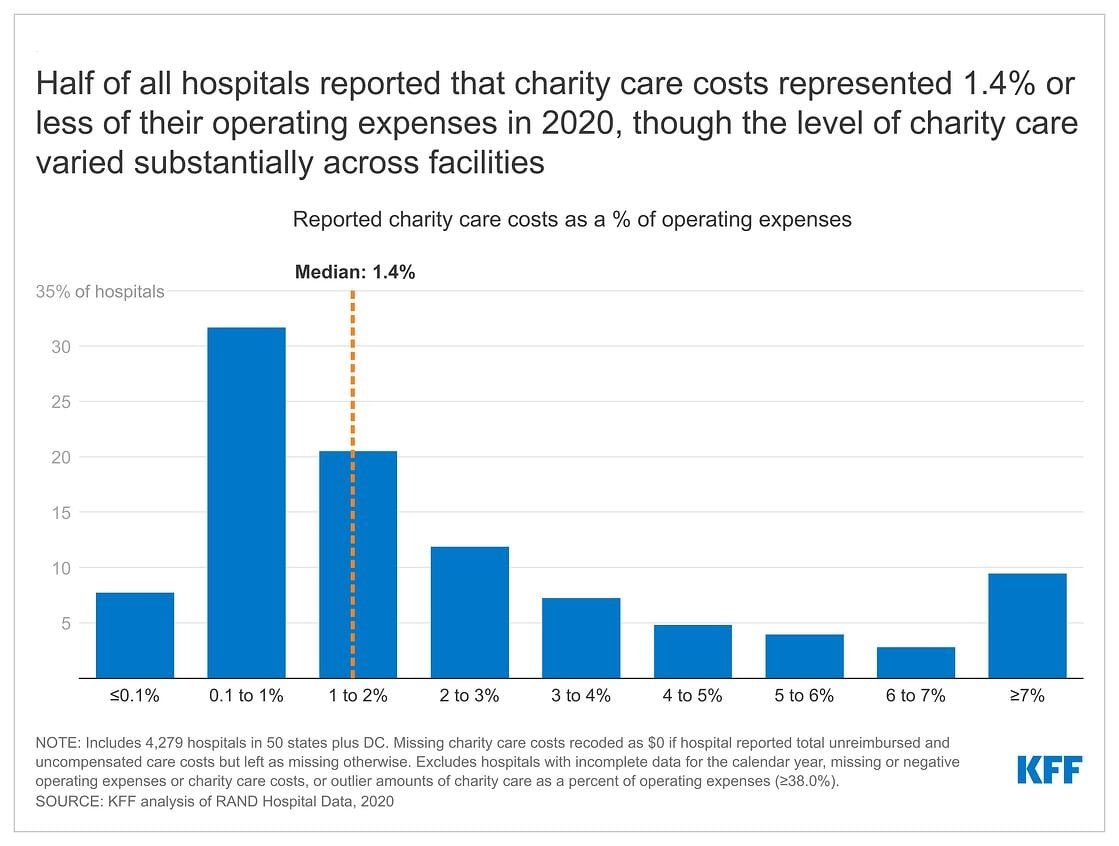

This issue brief addresses key questions about hospital charity care programs. According to our analysis of hospital cost reports, charity care costs represented 1.4 percent or less of operating expenses at half of all hospitals in 2020, though the level of charity care varied substantially across facilities (Figure 1) (see Methods for details about our calculations). For example, while charity care costs represented 0.1 percent of operating expenses or less on the lower end of the spectrum (for 8% of hospitals), they represented 7.0 percent of operating expenses or more among a similar share of hospitals (9%). The variation in charity care costs as a percent of operating expenses likely reflects differences in hospitals’ missions and business practices; the need for charity care among patients; and federal, state, and local policy and regulation. Federal, state, and local governments provide funding in a variety of ways—including through tax benefits for nonprofit hospitals—to support hospital charity care, which may in part motivate efforts to increase the regulation of these programs. Although charity care programs are an important source of relief for uninsured and underinsured patients, many Americans continue to have difficulty affording hospital care. In 2022, about one in seven adults (14%) reported delaying hospital services in the past year due to cost.

What is hospital charity care?

The Internal Revenue Service (IRS) defines “charity care”, also known as “financial assistance”, as “free or discounted health services provided to persons who meet the organization’s eligibility criteria for financial assistance and are unable to pay for all or a portion of the services.”1 Depending on their eligibility criteria, hospitals may provide charity care to both uninsured and insured patients. Among other government regulations, federal law requires that nonprofit hospitals—which account for nearly three-fifths (58%) of community hospitals—provide some level of charity care as a condition of receiving tax-exempt status, and many state governments require all or a subset of hospitals to extend eligibility for charity care to certain groups of patients. Within the broad parameters set by government regulation, hospitals establish their own charity care policies, which vary in terms of eligibility criteria, application procedures, and the levels of charity care provided. While hospitals bear the direct costs of providing charity care, support from donors and federal, state, and local governments may cover some or all of these expenses. Estimates from one recent study suggest that the value of the tax exemption alone covered about half (50%) of the cost of charity care and other community benefits provided by nonprofit hospitals from 2011 to 2018.2

The sum of charity care and bad debt is sometimes referred to as “uncompensated care”. “Bad debt” refers to instances where a hospital bills a patient but, after pursuing collection, determines that it is unlikely to collect payment. This stands in contrast to charity care, for which hospitals do not seek reimbursement. Hospitals accumulate bad debt when patients are unable or unwilling to pay for their care. Some of these patients may be eligible for charity care under the hospital’s charity care policy but do not know to apply, have difficulty doing so, have their application improperly denied, or choose not to apply.

Who is eligible for hospital charity care?

Hospitals have broad flexibility to establish their own eligibility criteria for charity care, and as a result, eligibility criteria vary across hospitals. For example, one analysis of a large sample of nonprofit hospitals that used the federal poverty level (FPL) to determine eligibility for free care in 2018 found that about one in three (32%) of the hospitals required patients to have incomes at or below 200 percent of the FPL ($50,200 for a family of four in that year) or imposed more restrictive eligibility criteria, while the remaining hospitals (68%) relied on higher income caps. For discounted care, about three-fifths (62%) of nonprofit hospitals in the study limited eligibility to patients with incomes at or below 400 percent of the FPL or used lower income levels, with the remaining nonprofit hospitals (38%) relying on higher income caps.

Hospitals may condition free or discounted care on other eligibility criteria in addition to or in lieu of income thresholds based on the FPL, such as by requiring that patients have limited assets or reside in the hospital service area or by extending eligibility to patients who are unable to afford large medical bills despite exceeding income or asset thresholds under standard eligibility pathways. For example, one analysis of charity care policies at 170 large nonprofit and government hospitals found that most policies (76%) identified a streamlined application process for some groups that are likely eligible for charity care, such as patients experiencing homelessness.

It is unclear what share of low-income patients are eligible for hospital charity care, let alone what share of eligible patients end up benefiting from these programs, or what share of their costs are covered. Eligible patients may not receive charity care because they are unaware that charity care is available, do not know that they are eligible, have difficulty completing an application, are improperly denied charity care by the hospital, or choose not to apply. Some evidence suggests that many eligible patients may not be benefiting from charity care. For example, nonprofit hospitals have estimated that, of the bad debt that they reported in 2019 (reflecting expenses in 2017 or an earlier year), about $2.7 billion came from patients who were likely eligible for charity care but did not receive it. This amount is a rough estimate, as it comes from unaudited hospital reports, is restricted to nonprofit facilities, and does not account for instances where eligible patients paid bills that would have been reduced under a given hospital’s charity care program.

How much charity care do hospitals provide?

According to the Medicaid and CHIP Payment and Access Commission (MACPAC), hospitals reported $28 billion in charity care costs in fiscal year (FY) 2019, the majority of which ($22 billion) was for uninsured individuals. Based on our analysis of hospital cost reports, charity care costs represented 1.4 percent or less of operating expenses at half of all hospitals in 2020, though the level of charity care varied substantially across facilities (Figure 1) (see Methods for details about our calculations). For example, while charity care costs represented 0.1 percent of operating expenses or less on the lower end of the spectrum (for 8% of hospitals), they represented 7.0 percent of operating expenses or more among a similar share of hospitals (9%). Charity care costs as a percent of operating expenses were 2.6% in 2020 on average, which is greater than the median given that a relatively small share of hospitals reported relatively large amounts of charity care. Variation in charity care levels across hospitals likely reflects differences in their missions and business practices; the need for charity care among patients; and federal, state, and local policies and regulations. The Medicare Payment Advisory Commission (MedPAC) has noted that the current method for calculating charity costs favors hospitals with higher markups, and it has recommended revisions that would put hospitals on more equal footing and reduce reported charity care costs on average.

Recent research has found that for-profit hospitals devote a similar share of their operating expenses to charity care as government hospitals on average and a larger or similar share as nonprofit hospitals. This may seem counterintuitive because, unlike for-profit hospitals, nonprofit hospitals receive large tax-breaks which are, in part, intended to subsidize the charity care that they provide. Among potential explanations for this result, for-profit hospitals may have a greater willingness to provide charity care in some scenarios because they can take a tax deduction for these expenses, and it is possible that some nonprofit hospitals may not expect significant oversight of their charity care practices from government regulators.

What role does charity care play for undocumented and lawfully present immigrants?

Hospital charity care may play an important role in protecting undocumented and lawfully present immigrants from high medical costs given that they are more likely than citizens to have low incomes and lack health insurance. In 2020, about four in ten undocumented and lawfully present nonelderly immigrants (44% and 39%, respectively) had incomes below 200 percent of the FPL compared to about a quarter (26%) of nonelderly citizens. Additionally, about four in ten (42%) nonelderly undocumented immigrants and a quarter (26%) of nonelderly lawfully present immigrants were uninsured compared to less than one in ten (8%) nonelderly citizens. This disparity reflects more limited access to private coverage and eligibility restrictions based on immigration status in health insurance programs funded with public dollars. Even though charity care programs provide financial assistance for some immigrants, overall, research suggests that immigrants use less health care, including hospital care, than U.S.-born citizens, and it remains unclear to what extent they benefit from charity care programs and how their use of these programs compares to that of citizens.

What charity care rules must nonprofit hospitals comply with in exchange for receiving federal tax-exempt status?

Federal regulations require that nonprofit hospitals provide some level of charity care and other community benefits as a condition of receiving tax-exempt status. The IRS has defined different types of community benefits, including patient benefits (such as charity care), system benefits (such as unreimbursed medical education), and community building activities (such as addressing environmental hazards). According to one study, in 2017, unreimbursed Medicaid expenses accounted for the plurality (44%) of nonprofit hospitals’ community benefit expenses, followed by charity care (17%), unreimbursed health professions education (15%), subsidized health services that are not mean-tested (10%), community health improvement services and operations (4%), unfunded research (4%), cash and in-kind contributions for community benefit (3%), unreimbursed costs for means-tested programs aside from Medicaid (2%) and building activities (e.g., related to housing) (1%). “Unreimbursed expenses” for Medicaid—the nation’s public health insurance program for people with low incomes—and other means-tested programs refers to the extent to which costs related to patients enrolled in these programs exceed corresponding revenues for hospitals. Any unreimbursed expenses from other payers are generally not counted in hospital community benefit calculations.

To retain tax-exempt status, nonprofit hospitals must:

- Establish a financial assistance policy (FAP). The FAP must describe who is eligible for charity care, the level of assistance provided, and how patients can apply. A hospital must make its FAP easily accessible to patients and ensure that the FAP is translated into the languages commonly spoken in the community served by the hospital.

- Cap charges to patients eligible for charity care based on amounts generally billed to other payers. Federal regulation defines approaches for calculating the amount generally billed based on fee-for-service Medicare rates, Medicaid rates, and/or commercial plan payment rates.

- Conduct a community health needs assessment (CHNA) every three years and adopt an implementation strategy to address those needs. The CHNA must define the community that the hospital serves and evaluate the health needs of that community, integrating input from local stakeholders. Community health needs could include, for example, lowering financial barriers to health care or improving social determinants of health.

- Make reasonable efforts to determine if a patient is eligible for charity care before engaging in certain debt collection practices, including selling the patient’s debt to third parties, reporting the debt to credit agencies, and taking legal action to control a patient’s financial assets. A “reasonable effort” could entail, for example, notifying the patient of the FAP and giving them at least four months to apply following their first bill after being discharged from the hospital.

However, gaps in federal regulation and weak oversight and enforcement may allow hospitals to provide low levels of charity care in some instances. Federal regulations do not currently define or set minimum standards for hospitals to determine who is eligible for charity care or the level of assistance to be provided. A 2020 Government Accountability Office (GAO) report also raised questions about whether requirements to provide sufficient community benefits, including charity care, are being adequately enforced. According to the report, the IRS had not revoked a hospital’s nonprofit status on the basis of providing inadequate community benefits over the prior ten years.

Do states impose additional charity care requirements for hospitals?

Slightly over half of all states (26 states and DC) require all or a subset of hospitals to extend eligibility for charity care to certain groups of patients, according to a 2021 report from the National Consumer Law Center. Among those that do so, 11 states (CA, CO, CT, IL, MD, ME, NJ, NV, NY, RI, and WA) broadly extend minimum standards to for-profit, nonprofit, and government hospitals alike. The 16 remaining state laws extend to narrower groups of hospitals, including nonprofit or government hospitals (3 states: LA, OR, and TX), hospitals that receive certain types of government funding to offset the cost of care for low-income patients (9 states: GA, KS, KY, MO, NM, OH, OK, PA, and TN), and hospitals seeking approval to expand or build new health care facilities (DC and 3 states: DE, NC, and VA). These state regulations also vary in terms of eligibility criteria and the level of assistance that must be provided. For example, Nevada requires a subset of hospitals to provide free care to uninsured patients with especially low incomes (38% or 39% of the FPL in 2022 depending on household size), while Maryland requires every acute and chronic care hospital to provide free care to both insured and uninsured patients at or below 200% of the FPL and to provide discounted care to patients with higher incomes.

In addition to setting minimum standards in terms of eligibility, several states have implemented regulations intended to increase the uptake of charity care among eligible patients and to protect potentially eligible patients from certain debt collection practices. For example, one analysis found that 13 states require hospitals to screen patients for eligibility, 16 states require hospitals to notify patients prior to collecting payment and/or in every notification about collections, and 8 states regulate procedures for patients to appeal denials of charity care.

There is little information about the effectiveness of these regulations or the extent to which they are enforced. One recent example of a state enforcement activity occurred in California, where the Attorney General sent letters to hospitals alleging that they were not providing descriptions of their charity care policies to patients in the patients’ spoken languages. Another recent example occurred in Washington, where the Attorney General filed a lawsuit against 14 hospitals for violating state charity care requirements, including by sending many patients’ bills to collections when the hospitals knew the patients were eligible for charity care.

What role do Medicaid, Medicare, and other government programs play in helping hospitals afford charity care expenses?

Medicaid provides health coverage for low-income patients and subsequently plays a significant role in reducing uncompensated care, including by lowering the demand for hospital charity care. This was especially evident in 2014, when many states adopted the Medicaid expansion under the Affordable Care Act (ACA) (and when enrollment in the ACA Marketplaces also began in all states). Among hospitals in states that expanded Medicaid, total uncompensated care costs decreased from $16.7 billion in 2013 to $11.0 billion in 2014 (a 34% decrease); in contrast, uncompensated care costs decreased by a much smaller amount (from $18.1 billion in 2013 to $17.9 billion in 2014, a 1% decrease) among hospitals in states that did expand Medicaid.

Medicaid and Medicare both provide supplemental payments to hospitals that are intended, at least in part, to offset the costs of charity care and other uncompensated care:

- Medicare disproportionate share hospital (DSH) payments. Medicare provides additional payments to hospitals that care for a disproportionate share of low-income patients, which are known as “DSH hospitals”. The magnitude of Medicare DSH payments is based on hospitals’ Medicaid and Supplemental Security Income (SSI) populations and the amount of uncompensated care that they provide, among other factors. The Centers for Medicare and Medicaid Services (CMS) estimates that additional Medicare payments to DSH hospitals will total $14.0 billion in FY 2023.

- Medicaid DSH payments. State Medicaid programs also provide additional payments to DSH hospitals. Federal regulations provide states with a substantial level of discretion in terms of which facilities to designate as DSH hospitals and how to distribute funding. Medicaid DSH payments totaled $19.5 billion in FY 2020.

- Medicaid uncompensated care pool payments. In FY 2020, eight state Medicaid programs paid hospitals a total of $8.2 billion to help offset the costs of uncompensated care.

Other state and federal programs may provide additional support to hospitals, which in turn can reduce the amount of charity care hospitals have to absorb. For instance, some state and local governments operate programs beyond Medicaid that provide coverage to low-income patients or that offset uncompensated care costs. As another example, the 340B Drug Pricing Program provides substantial financial support primarily to hospitals that serve a large number of low-income patients. Under this program, the federal government requires drug manufacturers to offer discounts on outpatient drugs to certain hospitals as a condition of having their drugs covered by Medicaid. Sales of 340B drugs totaled an estimated $44 billion in 2021 and DSH hospitals account for the large majority (78%) of sales. These additional revenues help facilities cover their operating expenses, including costs related to the provision of charity care.

How has the provision of charity care changed during the pandemic?

Although the COVID-19 pandemic has led to significant and ongoing disruptions in hospital operations, hospital admissions bounced back after sharp initial declines, and large amounts of government relief have helped stabilized hospital finances and charity care spending. Most prominently, the federal Provider Relief Fund (PRF) program has distributed $134 billion to hospitals and other providers as of early October 2022 to cover health care expenses or lost revenues due to the pandemic. Although the PRF program initially distributed funds on the basis of total patient revenue, which favored hospitals that received a large share of their revenues from private insurance, it later included $16 billion that was earmarked for safety-net hospitals. Among other relief programs, the government also reimbursed providers, including hospitals, for treating uninsured patients for COVID-19, with payments totaling $5.8 billion by the time the program stopped reimbursing claims in March 2022 due to lack of funding.

One study found that average hospital operating margins decreased from -1.0% in 2019 to -7.4% in 2020 when excluding COVID-19 relief funds, but that total margins—which take relief funds into account—were relatively constant over time and were 6.7% in 2020. Similarly, average charity care costs as a percent of operating expenses remained relatively constant at 2.7% in 2019 and 2.6% in 2020 based on our analysis of hospital cost reports (see Methods for details about our calculations). One analysis of 151 large nonprofit and government hospitals found that about three in ten (31%) expanded their charity care policies from 2019 to 2021, while less than one in ten (8%) moved towards more restrictive policies; the remaining hospitals made minimal, indeterminate, or no change to their charity care policies.

Some reports suggest that the financial outlook for hospitals has deteriorated in recent months, which may make it harder for hospitals to maintain current levels of charity care. Further monitoring is needed to assess the extent to which hospitals are experiencing financial stress in response to ongoing effects of the pandemic such as labor shortages, decreases in government relief, rising drug costs, and broader economic trends that have led to rising prices and investment losses.

Looking ahead

In the context of ongoing concerns about the affordability of hospital care and the growing burden of medical debt, several policy ideas have been floated at the federal and state level to strengthen hospital charity care programs. These include changes that would strengthen the requirements for nonprofit hospitals to qualify for tax-exempt status, as well as broader reforms that would apply to all hospitals. Specific proposals include creating or expanding requirements that hospitals provide charity care to patients below a specified income threshold, mandating that nonprofit hospitals provide a minimum amount of community benefits, establishing a floor-and-trade system where hospitals would be required to either provide a minimum amount of charity care or subsidize other hospitals that do so, introducing policies to increase the uptake of charity care, expanding oversight and enforcement of community benefit requirements, and restructuring the tax exemption for nonprofit hospitals to more closely tie government subsidies to the value of charity care and other community benefits provided by a given facility. A related set of proposals are intended to better align community benefits with local or regional needs and may therefore also affect the provision of charity care.

Recent policy changes have been concentrated at the state level. For example, since 2021, California and Washington state have expanded their charity care mandates to cover more patients through higher income eligibility thresholds. Colorado has introduced a private right of action to enforce hospital compliance with charity care requirements, and Illinois has implemented new reporting requirements for charity care programs. State and federal policymakers have also considered several other options to reduce medical debt or increase affordability more generally, such as by expanding Medicaid in states that have not already done so, reducing health care prices through direct regulation or other means, and increasing consumer protections against medical debt.

Efforts to expand hospital charity care will inevitably involve tradeoffs, including the potential cost to hospitals from protecting patients who cannot afford their hospital bills.

Methods

Our analysis of reported charity care costs as a percent of operating expenses is based on 2019-2020 RAND Hospital Data, which is a cleaned and processed version of annual cost report data submitted by hospitals to the Healthcare Cost Report Information System (HCRIS). Every Medicare-certified hospital must submit a cost report, meaning that HCRIS data encompass all US hospitals except federal hospitals and some children’s hospitals. HCRIS instructions indicate that hospitals should report amounts related to both their charity care and uninsured discounts as part of their charity care costs. The Medicare Payment Advisory Commission (MedPAC) has noted that current HCRIS calculations favor hospitals with higher markups, and it has recommended revisions that would put hospitals on more equal footing and reduce reported charity care costs on average.

Our analysis relied on a calendar year version of the RAND Hospital Data, which apportions data from different cost reports for hospitals that do not use a calendar year reporting period. We focused on short-term general hospitals in all 50 states plus DC. We recoded missing charity care costs as $0 if the hospital reported total unreimbursed and uncompensated care costs (affecting about 3% of hospitals) but left as missing otherwise. There were no other instances of $0 charity care costs in our sample. We excluded hospitals with incomplete data for the calendar year, missing or negative operating expenses or charity care costs, or outlier amounts of charity care as a percent of operating expenses (greater than or equal to 38.0%, i.e., the top 0.1% of hospitals). Our final sample for 2020 included 4,279 of the 4,546 short-term general hospitals in the 2020 RAND Hospital Data. When comparing charity care costs in 2019 and 2020, we restricted the sample to the 4,236 hospitals that were in sample in both years.

We evaluated two adjustments to our analysis and found that neither substantially affected our primary findings. First, we found that dropping all hospitals with missing charity care costs, rather than recoding a subset as $0, would result in a similar median value for charity care costs as a percent of operating expenses (1.5% versus 1.4%) and the same mean value (2.6%), with somewhat less variation across hospitals than in our analysis. For example, under this alternative approach, charity care costs would represent 0.2 percent of operating expenses or less among eleven percent of hospitals and 7.0 percent of operating costs or more among nine percent of hospitals. Second, as with our analysis comparing 2019 and 2020, when further restricting the sample to the 1,628 hospitals that used a calendar year reporting period in both years, average charity care costs as a percent of operating expenses remained relatively constant over time (at 2.3% in 2019 and 2.2% in 2020).

This work was supported in part by Arnold Ventures. KFF maintains full editorial control over all of its policy analysis, polling, and journalism activities.

- The IRS definition also indicates that charity care excludes “bad debt or uncollectible charges that the organization recorded as revenue but wrote off due to a patient’s failure to pay, or the cost of providing such care to such patients; the difference between the cost of care provided under Medicaid or other means-tested government programs or under Medicare and the revenue derived therefrom; self-pay or prompt pay discounts; or contractual adjustments with any third-party payors”. ↩︎

- We derived this estimate from the study by dividing the estimated average value of tax exemption (4.26%) by the estimated average value of community benefits (8.47%). ↩︎