Over the last decade, Medicare Advantage, the private plan alternative to traditional Medicare, has taken on a more prominent role in the Medicare program. In 2022, more than 28 million Medicare beneficiaries are enrolled in a Medicare Advantage plan, nearly half of the total Medicare population. This brief provides an overview of the Medicare Advantage plans that are available for 2023 and key trends over time. ()

Plan Offerings in 2023

Number of Plans

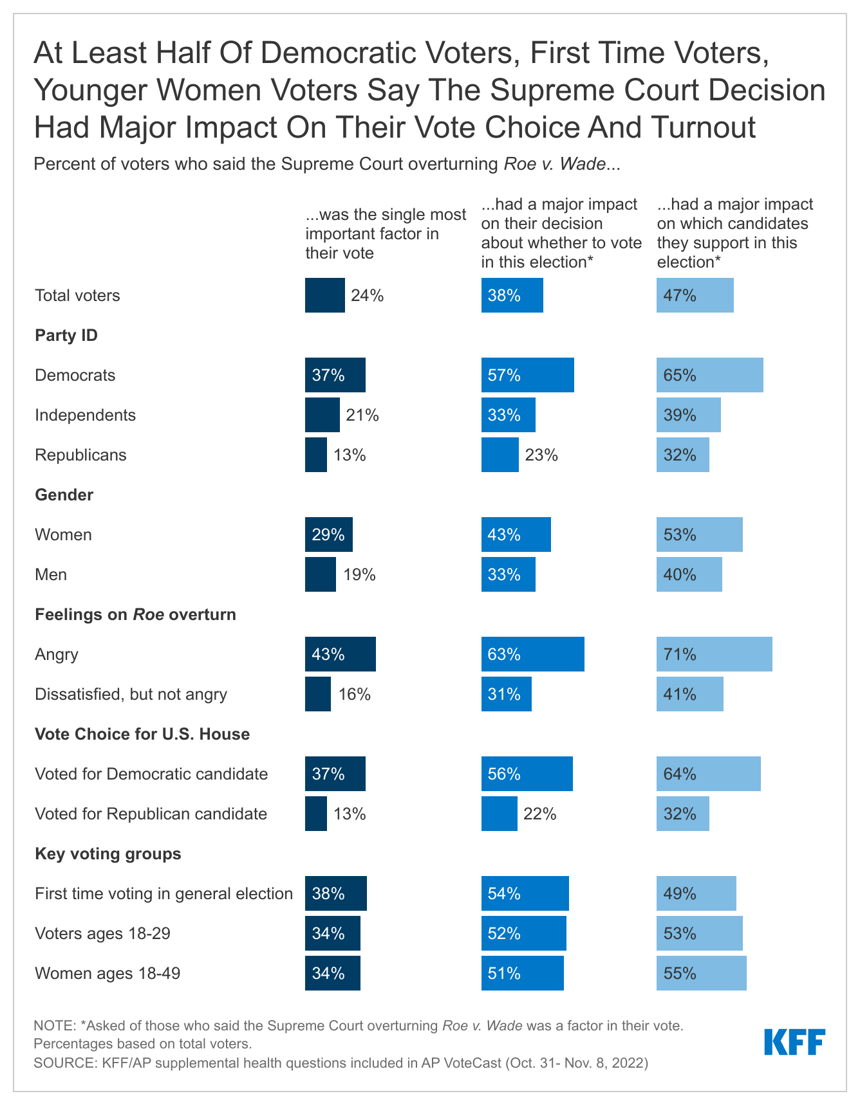

Number of Plans Available to Beneficiaries. For 2023, the average Medicare beneficiary can choose from 43 Medicare Advantage plans, more than double the average number available in 2018, and the largest number of options available over the period we examined, which goes back to 2010 (Figure 1). These numbers exclude employer or union-sponsored group plans, Special Needs Plans (SNPs), PACE plans, cost plans, and Medicare-Medicaid plans (MMPs) that are only available to select populations.

Of the 43 Medicare Advantage plans available for individual enrollment to the average Medicare beneficiary in 2023, 35 of the plans include prescription drug coverage (MA-PDs).

Total Number of Plans. In total, 3,998 Medicare Advantage plans are available nationwide for individual enrollment in 2023 – a 6 percent increase in the number of plans (228 more plans) offered in 2022 and the largest number of plans available over the period we examined, which goes back to 2010 (Figure 2; Appendix Table 1). The vast majority (89 percent) of all Medicare Advantage plans offered include prescription drug coverage in 2023.

HMOs account for about six in ten plans (58%) offered in 2023, a slight decline from 2019 and 2020 where they accounted for about two-thirds of all plans offered. The availability of local PPOs has increased rapidly over recent years. In 2023, 40% of all Medicare Advantage plans offered are local PPOs, compared to 30% in 2019. The number of regional PPOs and private fee-for-service plans (PFFS) have respectively slowly declined from around 2% of plans offered in 2019 to 1% in 2023.

The growth in number of plans varies across states and counties, with the preponderance of the growth occurring in Texas (42 more plans), Florida (26 more plans), and Pennsylvania (21 more plans) (data not shown). In contrast, Washington has 7 fewer plans available for 2023 than in 2022, while Kansas and Maine have 3 fewer plans; Montana, New Hampshire, Oregon, South Carolina, Utah, Vermont, and the District of Columbia have one fewer plan available in 2023 than in 2022. In the remaining states, the number of plans either stayed the same or the growth in plans was 13 or less.

While many employers and unions also offer Medicare Advantage plans to their retirees, no information about these 2023 plan offerings is made available by CMS to the public during the Medicare open enrollment period because these plans are not available to the general Medicare population.

Special Needs Plans (SNPs). In 2023, 1,284 SNPs will be offered nationwide, an 11 percent increase between 2022 and 2023 (Figure 3).

The rise in SNPs for people who require an institutional-level of care (I-SNPs) has been particularly notable, nearly doubling from 97 plans in 2018 to 189 plans in 2023 (an increase of 5 plans since 2022). I-SNPs may be attractive to insurers because they tend to have much lower marketing costs than other plan types since they are often the only available option for people who require an institutional level-of-care, such as those who have been in nursing homes for an extended period of time.

The majority of SNPs (61%) are plans designed for people dually eligible for Medicare and Medicaid (D-SNPs). The number of D-SNPs has increased sharply over the past five years, nearly doubling from 401 dual SNPs in 2018 to 789 dual SNPs in 2023, suggesting insurers continue to be drawn to this high-need population.

The number of SNPs offered for people with chronic conditions (C-SNPs) is also increasing in 2023 (306 plans), more than doubling from 2018 (132 plans), most of which focus on people with diabetes, heart disease, or lung conditions, as has been the case since the inception of C-SNPs. For 2023, two firms are offering C-SNPs for people with dementia (compared to three firms in 2022), two firms are offering C-SNPs for people with mental health conditions (compared to four firms in 2022), and one firm is offering a C-SNP for people with HIV/AIDS (compared to three firms in 2022).

In 2021, people with end-stage renal disease (ESRD) became eligible to enroll in Medicare Advantage plans. Prior to this change, people with ESRD were not able to enroll in most Medicare Advantage plans, subject to limited exceptions, such as C-SNPs for people with ESRD. Seven firms are offering C-SNPs for people with end-stage renal disease (up three from 2022).

Availability of Insulin Demonstration Plans. In 2023, under a provision in the Inflation Reduction Act, Part D enrollees will pay no more than $35 per month for covered insulin products in all Part D plans. This new requirement builds on the Part D Senior Savings Model established by the Center for Medicare and Medicaid Innovations (CMMI) in 2021 in which participating enhanced Part D drug plans cover insulin products at a monthly copayment of $35 in the deductible, initial coverage, and coverage gap phases of the Part D benefit. In 2023, a total of 2,881 Part D plans will participate in this model (a 33% increase over 2022), including 324 PDPs and 2,557 MA-PDs (including segmented plans). While this model will continue in 2023, beneficiaries do not need to enroll in one of the model-participating plans to benefit from the $35 monthly copay cap for covered insulin products. Under the new Inflation Reduction Act requirement, all Part D plans do not have to cover all available insulin products at the $35 monthly copayment amount, only those insulin products that are covered on a plan’s formulary.

Variation in the Number of Plans, by Geographic Area. Medicare beneficiaries living in metropolitan areas can choose from 46 Medicare Advantage plans in 2023, on average, substantially more than the average number of plans available to beneficiaries in non-metropolitan areas (29 plans).

Beneficiaries can choose from 75 or more Medicare plans in 27 counties. Similar to last year, the counties with the most plan options are predominantly in Ohio and Pennsylvania. In Ohio, for example, beneficiaries can choose from 80 or more Medicare Advantage plans in 10 counties, including Hamilton County (Cincinnati) and Cuyahoga County (Cleveland). Beneficiaries in Summit County Ohio (Akron) can choose from 87 Medicare Advantage plans – the most offerings of any county in the US. Beneficiaries living in four counties in Pennsylvania can also choose from 80 or more plans. In Texas, beneficiaries in Harris County (Houston) can choose from 77 plans and in Michigan, beneficiaries in Oakland County (Detroit) can choose from 76 plans (Figure 4).

In 2023, about half of all Medicare beneficiaries (53%) (in 19 percent of counties), can choose from more than 40 Medicare Advantage plans where they live (Figure 5).

This is in contrast to just 5 years ago, in 2018, when fewer than one in ten Medicare beneficiaries (7%) (in less than 1 percent of counties) could choose from more than 40 Medicare Advantage plans where they live.

In 2023, in 4 percent of counties (accounting for 1 percent of beneficiaries), beneficiaries can choose from three or fewer Medicare Advantage plans. The number of counties with no Medicare Advantage plans for 2023 is 40, a slight decrease compared to 2022 (65). Similar to 2022, two Medicare Advantage plans are being offered in 15 counties in Alaska. Additionally, no Medicare Advantage plans are available in territories other than Puerto Rico. In Puerto Rico, beneficiaries can choose from an average of 37 plans for individual enrollment and an average of 22 D-SNPs.

Access to Medicare Advantage Plans, by Plan Type. As in recent years, virtually all Medicare beneficiaries (99.7%) have access to a Medicare Advantage plan as an alternative to traditional Medicare, including almost all beneficiaries in metropolitan areas (99.99%) and the vast majority of beneficiaries in non-metropolitan areas (98.4%). In non-metropolitan counties, a smaller share of beneficiaries have access to HMOs (91% in non-metropolitan versus 99% in metropolitan counties) or local PPOs (93% in non-metropolitan versus 98% in metropolitan counties), and a slightly larger share of beneficiaries have access to regional PPOs (77% in non-metropolitan counties versus 72% in metropolitan counties).

Number of Firms

The average Medicare beneficiary is able to choose from plans offered by 9 firms in 2023, the same number as in 2022 (Figure 6). Despite most beneficiaries having access to plans operated by several different firms, enrollment is concentrated in plans operated by UnitedHealthcare and Humana, and together UnitedHealthcare and Humana account for 46 percent of MA enrollment in 2022.

Four in ten beneficiaries (40%), in 300 counties, are able to choose from plans offered by 10 or more firms or other sponsors. Sixteen firms are offering Medicare Advantage plans in Maricopa, Arizona, and 15 firms are offering Medicare Advantage plans in four counties: Pinal and Pima counties in Arizona, and Miami-Dade and Broward counties in Florida. In contrast, 3% of beneficiaries live in a county where three or fewer firms offer Medicare Advantage plans (475 counties). Further, in 85 counties, most of which are rural counties with relatively few Medicare beneficiaries (less than 1% of total), only one firm will offer Medicare Advantage plans in 2023.

Availability of Plans by Firm and County. UnitedHealthcare and Humana, the two firms with the most Medicare Advantage enrollees in 2022, have large footprints across the country, offering plans in most counties. Humana is offering plans in 89 percent of counties and UnitedHealthcare is offering plans in 84 percent of counties in 2023, roughly the same as in 2022 (Figure 7). About 9 in 10 (92%) Medicare beneficiaries have access to at least one Humana plan and 95 percent have access to at least one UnitedHealthcare plan.

Most major Medicare Advantage firms have also expanded the number of counties where they are offering plans (Figure 8).

Humana is offering plans in 2,860 counties in 2023, an increase of 123 counties from 2022, while UnitedHealthcare is offering plans in 2,709 counties in 2023, an increase of 332 from 2022. Blue Cross Blue Shield Affiliates are offering plans in 2,466 counties in 2023, an increase of 297 plans from 2022. CVS Health is offering plans in 1,978 counties, an increase of 138 counties since 2022; Centene is offering plans in 1,739 counties, an increase of 214 counties; and Cigna is offering plans in 581 counties, an increase of 104 counties. Kaiser Permanente is offering plans in 116 counties, the same as in 2022.

Multiple Plan Offerings by Firms in the Same County. Many Medicare Advantage firms are also offering more than one plan option in each county. In 1,136 counties (accounting for 50% of beneficiaries), at least one firm is offering 10 or more plans for individual enrollment. For example, in Bucks and Delaware counties in Pennsylvania, four firms are offering 10 or more plans (Humana, UnitedHealthcare, Blue Cross Blue Shield Affiliates, and CVS Health). In 137 counties, two firms are offering 10 or more plans, and in 63 counties, three firms are offering 10 or more plans.

Blue Cross Blue Shield Affiliates are offering the most plan options in a county, with 18 different plan options in seven counties. Humana is offering the next highest number of plan choices with 16 Medicare Advantage plans available in six counties, followed by CVS, which is offering 13 plan options in nine counties. Centene is offering 12 plans options in seven counties and United Healthcare is offering 11 plan options in three counties.

New Market Entrants and Exits

In 2023, 8 firms entered the market for the first time in 2023, collectively accounting for about 6 percent of the growth in the number of plans available for general enrollment and about 5 percent of the growth in SNPs (Appendix Table 2). Five new entrants are offering HMOs available for individual enrollment. Five of the new entrants are offering SNPs; two firms are offering D-SNPs for people dually eligible for Medicare and Medicaid, two firms are offering a C-SNP for people with select chronic conditions, and one firm is offering an I-SNP.

Two of the new firm entrants are offering plans in California, and the remainder are offering plans in Arizona, Connecticut, Iowa, Idaho, Massachusetts, and Missouri.

Eight firms that previously participated in the Medicare Advantage market are not offering plans in 2023. Two of the firms had very low enrollment in 2022, while six firms had no enrollment in 2022, including one that was sanctioned in April 2021 and had to immediately suspend enrollment. Three of the eight exiting firms offered plans in California.

Premiums

The vast majority of Medicare Advantage plans for individual enrollment (89%) will include prescription drug coverage (MA-PDs), and the share of MA-PDs that charge no premium (other than the Part B premium) has increased from 59% in 2022 to 66% in 2023. In addition, 17% of Medicare Advantage plans will offer some reduction in the Part B premium in 2023. Nearly all beneficiaries (99%) have access to a MA-PD with no monthly premium in 2023, similar to 2022 (98%). However, in Alaska, beneficiaries do not have access to a zero-premium MA-PD.

In 2022, 69 percent of enrollees in MA-PD plans pay no premium other than the Medicare Part B premium of $170.10 per month. Based on enrollment in March 2022, 13% of enrollees pay at least $50 a month, including 4 percent who pay $100 or more. CMS announced that the average monthly plan premium among all Medicare Advantage enrollees in 2023, including those who pay no premium for their Medicare Advantage plan, is expected to be $18 a month.

Medicare Advantage plans may provide extra benefits that are not available in traditional Medicare, are considered “primarily health related,” and can use rebate dollars (including bonus payments) to help cover the cost of these extra benefits. Beginning in 2019, CMS expanded the definition of “primarily health related” to allow Medicare Advantage plans to offer additional supplemental benefits. Medicare Advantage plans may also restrict the availability of these extra benefits to certain subgroups of beneficiaries, such as those with diabetes or congestive heart failure, making different benefits available to different enrollees.

Availability of Extra Benefits in Plans for General Enrollment. In 2023, 97% or more individual plans offer some vision, fitness, telehealth, hearing or dental benefits. Though these benefits are widely available, the scope of coverage for these services varies. For example, a dental benefit may include cleanings and preventive care or more comprehensive coverage, and often is subject to an annual dollar cap on the amount covered by the plan. (Figure 9). Plans are not required to report data about utilization of these benefits or associated costs, so it is not clear the extent to which supplemental benefits are used by enrollees.

As of 2020, Medicare Advantage plans have been allowed to include telehealth benefits as part of the basic benefit package – beyond what was allowed under traditional Medicare prior to the COVID-19 public health emergency. These benefits are shown in the figure above, even though their costs are built into the bid, and are not covered by either rebates or supplemental premiums. Additionally, Medicare Advantage plans may offer supplemental telehealth benefits via remote access technologies and/or telemonitoring services, which can be used for those services that do not meet the requirements for coverage under traditional Medicare or the requirements for the telehealth benefits as part of the basic benefit package (such as the requirement of being covered by Medicare Part B when provided in-person). The vast majority (97%) of Medicare Advantage plans are offering telehealth in 2023.

Other extra benefits that are frequently offered for 2023 include over the counter items, such as adhesive or elastic bandages (87%), meal benefits, such as meal delivery (71%), and transportation benefits (43%). Ten percent of plans offer access to bathroom safety devices (10%), while 4 percent offer support for caregivers of enrollees or telemonitoring services (3%). This is not an exhaustive list of extra benefits that plans offer, and plans may provide other services such as home-based palliative care, therapeutic massage, and adult day health services, among others.

Availability of Medicare Advantage Plans with Extra Benefits. Virtually all Medicare beneficiaries live in a county where at least one Medicare Advantage plan available for general enrollment has some extra benefits not covered by traditional Medicare, with over 99% having access to at least one or more plans with dental, fitness, vision, and hearing benefits for 2023. The vast majority of beneficiaries also have access to one or more plans that offer telehealth benefits (over 99%), over the counter items (99%), a meal benefit (99%), transportation assistance (98%) but fewer have access to one or more plans that offer in-home support services (87%), bathroom safety devices (70%), or caregiver support (42%).

Availability of Extra Benefits in Special Needs Plans. SNPs are designed to serve a disproportionately high-need population, and a somewhat larger percentage of SNPs than plans for other Medicare beneficiaries provide their enrollees transportation benefits (88%) and in-home support services (34%). Similar to plans available for general enrollment, a relatively small share of SNPs offer support for caregivers (5%) or telemonitoring services (4%).

Availability of Special Supplemental Benefits for the Chronically Ill (SSBCI). Beginning in 2020, Medicare Advantage plans have also been able to offer extra benefits that are not primarily health related for chronically ill beneficiaries, known as Special Supplemental Benefits for the Chronically Ill (SSBCI). Information on the availability of SSBCI for 2023 has not yet been published by CMS, but data on enrollment in 2022 can be found here.

Discussion

More Medicare Advantage plans are being offered for 2023 than in any other year since 2010, confirming the attractiveness of this market for insurers across the country. The average Medicare beneficiary has a choice of 43 plans in 2023, offered by an average of 9 insurers, an increase in the number of plans over prior years. Medicare Advantage plans can be attractive to beneficiaries because they typically offer extra benefits, such as dental, vision and hearing, often for no additional premium, with the trade-off of more restrictive provider networks and greater use of cost management tools, such as prior authorization. The sheer number of plans presents both opportunities (to shop for better coverage) and challenges (to decipher potentially important differences across plans) although a minority of Medicare Advantage enrollees compare plans during the open enrollment period. Insurers are drawn to the Medicare Advantage market because it is profitable relative to other health insurance markets, and this comes at a cost to Medicare, in that Medicare currently pays Medicare Advantage 104% of traditional Medicare costs, on average, according to MedPAC. As the market continues to grow, and enrollment continues to climb, it will be increasingly important to assess how well Medicare Advantage is serving beneficiaires in terms of costs, quality, benefits and patient outcomes, as well as how well Medicare’s current payment methodology for Medicare Advantage is working to hold down beneficiary costs and Medicare spending.

Meredith Freed, Jeannie Fuglesten Biniek, and Tricia Neuman are with KFF.Anthony Damico is an independent consultant.

Methods

This analysis focuses on the Medicare Advantage marketplace in 2023 and trends over time. The analysis includes more than 28 million enrollees in Medicare Advantage plans in 2022.

Data on Medicare Advantage plan availability, enrollment, and premiums were collected from a set of data files released by the Centers for Medicare & Medicaid Services (CMS):

- Medicare Advantage plan landscape files, released each fall prior to the annual enrollment period

- Medicare Advantage plan and premium files, released each fall

- Medicare Advantage plan crosswalk files, released each fall

- Medicare Advantage contract/plan/state/county level enrollment files, released on a monthly basis

- Medicare Advantage plan benefit package files, released quarterly

- Medicare Enrollment Dashboard files, released on a monthly basis

In previous years, KFF had calculated the share of Medicare beneficiaries enrolled in Medicare Advantage by including Medicare beneficiaries with either Part A and/or B coverage. We have modified our approach this year to estimate the share enrolled among beneficiaries eligible for Medicare Advantage who have both Medicare Part A and Medicare B. These changes are reflected in both the 2023 data and in data displayed trending back to 2010.

Additionally, in previous years, KFF had used the term Medicare Advantage to refer to Medicare Advantage plans as well as other types of private plans, including cost plans, PACE plans, and HCPPs. However, cost plans, PACE plans, HCPPs are excluded from this analysis in addition to MMPs. These exclusions are reflected in both the 2023 data and in data displayed trending back to 2010.

KFF’s plan counts may be lower than those reported by CMS and others because KFF uses overall plan counts and not plan segments. Segments generally permit a Medicare Advantage organization to offer the “same” local plan, but may vary supplemental benefits, premium and cost sharing in different service areas (generally non-overlapping counties).