FAQs: What’s the Latest on IPAB?

On November 2, 2017, the U.S. House of Representatives passed legislation (H.R. 849) to repeal the provision of the Affordable Care Act (ACA) that authorized the Independent Payment Advisory Board, or IPAB. Although IPAB was authorized under the ACA in 2010, no members have been appointed and currently the Board is not operational. These FAQs address common questions about IPAB, including how it was designed to operate and the implications of eliminating it.

What is the Independent Payment Advisory Board?

The Independent Payment Advisory Board was authorized by the ACA to help slow the growth in Medicare spending. The Board is to consist of 15 full-time independent experts to serve as members, appointed by the President and confirmed by the Senate. IPAB is directed to recommend Medicare spending reductions to Congress and the Administration if the per capita growth in Medicare spending exceeds specified target levels.

Why was IPAB authorized by the ACA?

IPAB was authorized to help constrain the growth in Medicare spending over time. The Board was conceived as an independent body of experts with authority to make Medicare savings recommendations if spending exceeded growth targets, according to a process specified in the ACA (described below). The goal was to create an evidence-based process that removes the political influence of stakeholders from Medicare payment policy decisions. Unlike the Medicare Payment Advisory Commission (MedPAC), which provides analysis and policy advice on Medicare to Congress, IPAB has statutory authority to recommend certain changes to Medicare that are required to be implemented to achieve savings (or equivalent savings proposals made by Congress).

Why is IPAB controversial?

IPAB has been a source of controversy from its beginning. Many members of Congress and other stakeholders have expressed concern about the authority granted to IPAB to make decisions about the Medicare program that are typically within the purview of Congress, such as modifications to the formulas used to establish payments for Medicare Advantage and Part D plans, provider payment rates, and prescription drugs. Some have expressed concerns about the potential for the Board to tilt the balance of power from Congress to the Executive branch with respect to Medicare policy. Another concern is the potential for IPAB’s recommendations to indirectly affect beneficiaries, despite explicit limits on IPAB’s scope of authority with respect to benefits, premiums, cost sharing, and “rationing.” In light of opposition to IPAB by many members of Congress, there have been several legislative attempts to repeal this provision of the ACA since 2010, including the latest House legislation (H.R. 849).

What would be the impact of the House-passed bill to repeal IPAB?

H.R. 849 would repeal provisions in the ACA that authorized the establishment of IPAB. According to CBO, repealing IPAB would increase spending by $17.5 billion between 2018 and 2027, because in CBO’s assessment, the Board will be required to generate Medicare savings of that amount over the 10-year period. The House legislation does not include offsets to cover the cost of repealing IPAB. Repealing IPAB could affect Part B premiums paid by beneficiaries and the financial outlook of the Medicare Hospital Insurance (Part A) trust fund.

What triggers IPAB to recommend Medicare spending reductions, and when is this expected to happen if IPAB is not repealed?

IPAB is required to propose Medicare spending reductions if the five-year average growth rate in Medicare per capita spending is projected to exceed the per capita target growth rate, based on general and medical inflation (2015-2019) or growth in the economy (2020 and beyond). The Centers for Medicare & Medicaid Services (CMS) Actuary is required to make this determination each year.

Each year since 2013, the CMS Actuary has made a determination that the Medicare per capita spending growth rate is not projected to exceed the target growth rate. In the 2017 Medicare Trustees report, the actuary projects that spending growth will exceed the target growth rate for the first time in 2021, and again in 2024, 2025, and 2026.

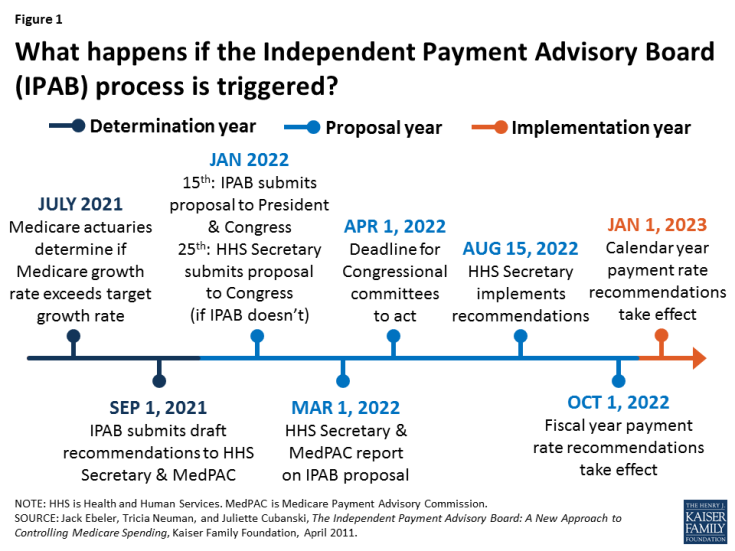

What is the timeline for action if the IPAB process is triggered?

A determination by the Chief Actuary that Medicare spending reductions are required under the IPAB process initiates a three-year cycle, which includes a determination year (2021 in this case), proposal year (2022) and implementation year (2023) (Figure 1).

In January of the proposal year, IPAB is required to submit proposed recommendations for Medicare spending reductions to the President and Congress for fast-track consideration by the Congress. If the IPAB process is triggered because spending exceeds target levels, and IPAB does not submit savings proposals to the Congress, as required, then the Secretary of the Department of Health and Human Services (HHS) is directed to make recommendations to Congress that would achieve the required savings, and for implementing them.

How much Medicare savings is IPAB required to recommend?

The ACA set target growth rates for Medicare spending. The target is not a hard cap on Medicare spending growth, but if spending exceeds these targets, IPAB is required to submit recommendations to reduce Medicare spending by a specified percentage. According to the ACA, the required savings amount is the lesser of the percentage point difference between the Medicare growth rate and the target growth rate, or the “applicable percent”, multiplied by total Medicare program spending in the proposal year.

The “applicable percent” is the limit on the amount of Medicare savings that IPAB recommendations can achieve in the implementation year, and is defined as a percent of total Medicare spending in the proposal year multiplied by an amount specified in the ACA. For implementation years beginning in 2018 and later, the applicable percent is equal to 1.5 percent of total Medicare program spending to be achieved in the implementation year. For example, if the difference between the Medicare growth rate and the target growth rate is 1 percent, the required savings would be 1 percent of total Medicare spending, rather than 1.5 percent.

What types of Medicare spending reductions can IPAB recommend, and are there limits on what IPAB can propose?

The ACA limited the scope of the Board’s authority in terms of the type of spending reductions it can recommend. IPAB cannot make recommendation that would: (1) ration health care; (2) raise revenues or increase Medicare beneficiary premiums or cost sharing; or (3) otherwise restrict benefits or modify eligibility criteria. In addition, for implementation years through 2019, IPAB cannot recommend payment reductions for providers and suppliers of services that received reductions under the ACA below the level of the automatic annual productivity adjustment called for under the law. As a result, payments for inpatient and outpatient hospital services, inpatient rehabilitation and psychiatric facilities, long-term care hospitals, and hospices are exempt from IPAB-proposed reductions in payment rates until 2020.

For implementation year 2019, IPAB would be permitted to propose spending reductions for Medicare Advantage plans, the Part D prescription drug program, skilled nursing facility, home health, dialysis, ambulance and ambulatory surgical center services, and durable medical equipment (DME).

What is the role of Congress in the IPAB process?

The ACA established special fast-track procedures and strict deadlines for Congress to consider IPAB recommendations. After the Board submits its recommendations to Congress, the appropriate committees of jurisdiction have just two and one-half months to report out a bill implementing IPAB recommendations, or an amended proposal that achieves the same amount of required savings, by April 1 of the proposal year. The Committees, and the House and Senate, are prohibited from considering any amendment that would change or repeal the Board’s recommendations unless the changes meet the same fiscal criteria under which the board operates.

What is the outlook for IPAB?

The House of Representatives voted 309-111 in favor of H.R. 849 to eliminate the Independent Payment Advisory Board. The legislation now moves to the Senate for consideration. Even if IPAB is not repealed, the IPAB process is not expected to be triggered for another four years, based on the latest projections, and it is not clear if members would be nominated or confirmed given recent history.