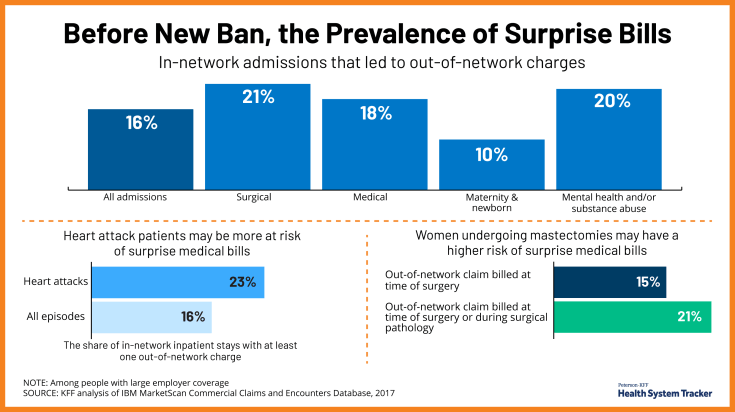

Before New Ban, the Prevalence of Surprise Bills

New federal protections that took effect Jan. 1 will bar insured patients from receiving surprise medical bills when they unexpectedly receive care from an out-of-network provider.

These bills have been a major concern for Americans for years. About 1 in 5 emergency visits and about 1 in 6 inpatient admissions at in-network facilities result in an out of network charge, putting patients at risk of a surprise bill, and the prevalence of surprise bills varies by condition, we have found.

More than any other type of hospitalizations, surgery admissions are more likely to result in an out-of-network charge (21%), followed by admissions for mental health and/or substance abuse (20%). Nearly a quarter (23%) of inpatient admissions for heart attacks resulted in an out-of-network bill, and 21% of women undergoing mastectomiess had an out-of-network charge.

Even if there’s widespread compliance with the new protections under the No Surprises Act, problems with surprise bills could still arise each year. Consumers should be aware of the new protections and know how to seek out help if they have improperly received a surprise bill.

Source