Explaining Health Reform: How will the Affordable Care Act affect Small Businesses and their Employees?

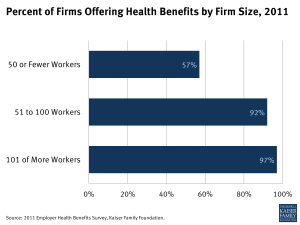

Several provisions of the Affordable Care Act (ACA) will likely have significant effects on small businesses, their employees, and families. Currently, smaller businesses are less likely to offer health insurance coverage to their employees than larger companies: 57% of small businesses with 50 or fewer workers offered health benefits to employees, compared to 92% of businesses with 51 to 100 workers, and 97% of businesses with 101 or more workers in 2011.1 This fact sheet explains the changes that are likely to take place with reform, when they go into effect, and which businesses will be affected.

Maintaining Current Coverage: “Grandfathered” Group Health Plans

The ACA permits those small businesses that wish to keep the insurance plan they currently have to do so. In 2011, approximately 72% of small businesses (with 100 or fewer workers) had at least one plan grandfathered under the ACA.2 So-called “grandfathered” group plans are subject to fewer requirements under the ACA. For example, grandfathered plans are not required to:

- cover preventive services without cost sharing;

- cover Essential Health Benefits (discussed below);

- provide for an internal and external appeals process for contesting coverage decisions; or

- allow direct access to an OB/GYN without referral

If a company’s plan is grandfathered under reform (meaning that it was in place before March 23, 2010), the plan remains grandfathered even if the company enrolls new employees in the plan. Businesses wishing to keep their grandfathered plans may even change insurance carriers and keep grandfathered status if the benefits and costs to employees stay largely the same. Grandfathered plans may keep this status so long as they do not make significant changes to coverage (such as increasing cost-sharing or cutting benefits).3

Changes to Health Insurance Purchased by Small Businesses

The ACA includes broad changes to the insurance market for plans purchased by small businesses. Note that some of these changes only apply to new (non-grandfathered) plans and others apply to all plans, regardless of grandfathered status.

Access: Beginning in 2014, all health insurance plans must guarantee the availability and renewal of coverage regardless of health status. (Note that small employers with 50 or fewer employees already have guaranteed issue in all states, but this provision of the ACA expands the guaranteed availability of insurance).4 Furthermore, young adults may remain on their parents’ plan until age 26.

Costs: As of 2014, premium rating based on health status will be prohibited for new (non-grandfathered) plans. Premiums for new plans will only be allowed to vary by age, tobacco use, policy type (individual or family), and geographic location. Health plans may reward participation in a qualified wellness program by providing up to a 30% discount on the cost of coverage, so long as reasonable alternatives or waivers are made available for employees with medical conditions that would preclude them from participating.

Coverage: New (non-grandfathered) plans will cover a set of minimum benefits (called Essential Health Benefits) beginning in 2014. Based on initial guidance issued by the federal government, each state would determine its benefit package based on a range of benchmark plans in the state.5 All plans (regardless of whether they are grandfathered) will be prohibited from imposing exclusions for pre-existing conditions (effective since 2010 for children under 19; effective in 2014 for adults).

Value: All plans (regardless of grandfathered status) will have to report the proportion of their income from premiums that are used on medical care and quality improvement. If this amount (called the Medical Loss Ratio or MLR) is less than 80%, small businesses and individuals enrolled in the plan will receive a rebate.

Comparison: New plans will be labeled as bronze, silver, gold, and platinum “tiers” demonstrating the actuarial value of the plan (the percentage of costs covered for a typical population) to facilitate comparison across plans.

Provisions of the ACA Relating Specifically to Small Businesses

The aspects of the ACA that relate most directly to small businesses are the creation of new insurance exchanges, tax credit subsidies, and penalties if some employers do not offer coverage.6

Creation of Insurance Exchanges

Small businesses will have the option to purchase insurance through a new market, called the Small Business Health Options Program (or SHOP Exchange). The exchange will be designed to offer individuals and small employers an easier way to compare and purchase plans. Employers may continue to purchase insurance through the market outside of the exchange, and the insurance reforms above will apply throughout both markets. Each state is required to create an exchange by 2014; otherwise the federal government will run one in the state. Until 2016, states will have the option to define small businesses as either 1-50 employees or 1-100 Full-Time Equivalent (FTE) employees for the purposes of exchange enrollment and the insurance market reforms described above.7 After 2016, all businesses with 100 or fewer FTE employees will be able to purchase insurance through the SHOP exchange. The non-partisan Congressional Budget Office (CBO) estimates that approximately 2.6 million small business employees will get coverage through the exchanges in their first year (2014), increasing to approximately 3.7 million employees receiving coverage through the exchanges in 2017.8

Penalties for Not Providing Affordable Coverage

Though there is no requirement that small businesses offer health insurance, some smaller businesses (with at least 50 employees) will have to pay a penalty if they do not offer affordable coverage. Enforcement of those penalties will begin in 2015, a year later than originally scheduled.

- Businesses with 49 or fewer FTE employees are exempt from these penalties.

- Businesses with 50 or more FTE employees will be fined $2,000 per employee (excluding the first 30 employees) if they do not offer coverage for employees who average 30 or more hours per week. Note that there is no penalty for part-time employees not offered coverage.

To avoid penalties, employers must offer insurance that covers at least 60% of the actuarial value of the cost of benefits. The coverage also must be affordable to employees, meaning an individual employee’s premium cannot exceed 9.5% of their household income. If the coverage offered does not meet the affordability standard, employees may receive tax credits to purchase insurance on their own through the exchange. If this is the case, small employers will either have to pay $3,000 per employee receiving the tax credit, or pay $2,000 per employee excluding the first 30 workers (whichever amount is less).

Tax Credits to Assist in the Cost of Health Insurance

Small businesses with fewer than 25 FTE employees may be eligible for tax credits to assist in the cost of health insurance.9 To qualify, such businesses must have average annual wages below $50,000 and must pay at least half of the cost of their employee’s health insurance. There are two phases to the tax credit:

- Phase 1: (2010-2013) Eligible employers receive a tax credit of up to 35% of the employer’s contribution toward insurance premiums, calculated on a sliding scale basis tied to average wages and number of employees. Small businesses with tax-exempt status meeting the requirements above may receive 25% of the employer’s contribution in the form of tax credits.

- Phase 2: (2014 and onward) Eligible employers that purchase insurance through the SHOP exchange may receive a tax credit of up to 50% of the employer’s contribution toward insurance premiums. These employers may take the tax credit for up to two years. Tax-exempt small businesses meeting the requirements above may receive 35% of their contribution in the form of tax credits. The exact amount each small business receives in tax credits will depend on the number of employees and average wages.

Grants for Wellness Programs

Small businesses (with fewer than 100 employees who work 25 or more hours per week on average) that did not have a workplace wellness program in effect at as of March 2010 are eligible for grants to start such programs.

Additional Resources for Small Employers and their Employees

- Illustrating Health Reform: How Insurance Coverage Will Work: http://healthreform.kff.org/profiles.aspx

- Employer Responsibility Under the Affordable Care Act: http://www.kff.org/infographic/employer-responsibility-under-the-affordable-care-act/

- Implementation Timeline http://healthreform.kff.org/timeline.aspx

- Resources for Individuals and Employers: http://healthreform.kff.org/resources-for-consumers-and-employers.aspx

- 2011 Employer Health Benefits Survey: http://ehbs.kff.org/pdf/2011/8225.pdf

Updated July 12, 2013

- “2011 Employer Health Benefits Survey” Kaiser Family Foundation, Sept. 2011 http://ehbs.kff.org/pdf/2011/8225.pdf ↩︎

- Ibid. ↩︎

- Changes to a plan (from the way the coverage was structured on March 23, 2010) which would cause it to relinquish grandfathered status include: increases in copayments, deductibles, or out-of-pocket limits above the rate of medical inflation, plus 15 percentage points; any increase in co-insurance rates; decreases in the amount of annual limits, or instituting a new annual limit not previously in place; a decrease in employer contributions by more than 5 percentage points; or the elimination of coverage for treating or diagnosis a specific condition. ↩︎

- “Small Group Health Insurance Market Guaranteed Issue, 2011” Kaiser Family Foundation, Jan. 2011 http://www.statehealthfacts.org/comparetable.jsp?ind=350&cat=7 ↩︎

- U.S. Department of Health and Human Services. Center for Consumer Information and Insurance Oversight (CCIIO). Essential Health Benefits Bulletin. Dec. 16 2011 http://cciio.cms.gov/resources/files/Files2/12162011/essential_health_benefits_bulletin.pdf ↩︎

- Compilation of Patient Protection and Affordable Care Act as Amended through November 1, 2010 including Patient Protection and Affordable Care Act Health-related Portions of the Health Care and Education Reconciliation Act of 2010. Washington: U.S. Government Printing Office, 2010. ↩︎

- Full-time Equivalents (FTEs) are calculated by summing the hours of full and part-time employees. For example, two half-time employees are equivalent to one full-time employee. ↩︎

- U.S. Congressional Budget Office. CBO’s March 2011 Baseline: Health Insurance Exchanges. 2011 http://www.cbo.gov/budget/factsheets/2011b/HealthInsuranceExchanges.pdf ↩︎

- For more information on small business tax credits, see http://www.irs.gov/newsroom/article/0,,id=223666,00.html ↩︎