The independent source for health policy research, polling, and news.

Affordable Care Act Premiums Are Falling in Many Areas of the U.S. in 2020, But Changes Vary Widely By County and Type of Plan, County-Level Analysis Shows

ACA Open Enrollment Runs Through December 15

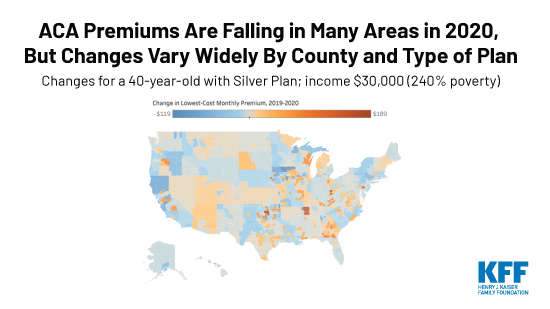

Although premiums for Affordable Care Act Marketplace benchmark silver plans are decreasing on average across the U.S. in 2020, changes vary widely by geographic location and plan type, including premium increases in a number of counties and plans, according to a new KFF analysis of county-level data.

The analysis of premium data from insurer rate filings to state regulators, state exchange websites and healthcare.gov shows how premiums are changing next year at the county level, both before and after accounting for the federal subsidies that are available to some consumers depending on their income. An interactive map illustrates changes in premiums for the lowest-cost bronze, silver and gold plans by county.

The analysis finds that unsubsidized premiums for benchmark silver plans – which are the basis for determining federal financial help – are dropping by 3.5 percent, on average, and by just under 3 percent for the lowest-cost bronze, silver and gold plans. However, whether consumers will see their premium payments rise or fall will depend on their income, preferred metal level plan and how specific plan premiums are changing at the county level.

Other key findings of the analysis, How ACA Marketplace Premiums are Changing by County in 2020, include:

- In 2020, the ACA’s premium tax credits would cover the full premium of the lowest-cost bronze marketplace plan for a 40-year-old with an annual income of $20,000 in 2,661 of the nation’s 3,142 counties, or 85 percent of counties. The figure is 1,736 counties (55%) for a 40-year-old making $25,000; 608 counties (19%) for a person the same age who makes $30,000; 287 counties (9%) for someone making $35,000; and 135 counties (4%) for a 40-year-old making $40,000.

- As in the previous two years, insurers generally loaded the cost from the termination of federal cost-sharing reduction payments entirely onto the silver tier of plans, a practice known as “silver loading”. That means subsidy-eligible enrollees will continue to receive relatively large ACA premium tax credits, although the amount may be smaller than in past years based on decreases in the underlying benchmark silver premiums.

- For subsidized enrollees, even a gold plan may be available at no cost after tax credits are applied. For instance, the tax credit for a 40-year-old with an annual income of $20,000 covers the full premium of the lowest-cost gold plan in 240 counties in the U.S. (or 8 percent of counties).

The ACA open enrollment period for the federal marketplace and most state marketplaces began Nov. 1 and ends on Dec. 15.

With KFF’s updated Health Insurance Marketplace Calculator, consumers can generate estimates of their health insurance premiums and the federal subsidies they may be eligible for when purchasing insurance on their own in the ACA marketplaces. Consumers also can search our collection of more than 300 Frequently Asked Questions about open enrollment, the health insurance marketplaces and the ACA.