Health-Care Deductibles Climbing Out of Reach

This was published as a Wall Street Journal Think Tank column on March 11, 2015.

Deductibles are an element of any insurance product, but as deductibles have grown in recent years, a surprising percentage of people with private insurance, and especially those with lower and moderate incomes, simply do not have the resources to pay their deductibles and will either have to put off care or incur medical debt.

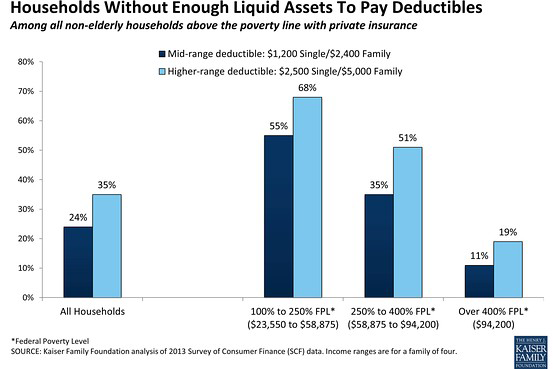

The chart above, based on a Kaiser Family Foundation study published Wednesday, shows that about a quarter of all non-elderly Americans with private insurance coverage do not have sufficient liquid assets to pay even a mid-range deductible, which at today’s rates would be $1,200 for single coverage and $2,400 for family coverage. We found that more than a third don’t have the resources to pay higher deductibles. Among low- and moderate-income households, even fewer are able to meet deductibles. It’s no wonder that collections for medical debt represent half of all bill collections. The estimates are conservative because they assume that people have all of their liquid assets available to pay their health-care bills. But most people must tap into their liquid assets to meet other obligations, such as their rent or mortgage, car repairs, or educational costs.

No doubt this growth in cost sharing has played a role in the moderation seen in the rate of increase in health spending and will continue to, as cost sharing motivates people to think twice about the health care they use. The debate is whether high deductibles are good or bad for people’s health care. A crude summary of a lot of research is that it depends. High deductibles may be okay for people who are generally healthy and have the resources to pay their cost sharing when they need to. But big deductibles can also be a real barrier to needed care for people with moderate or lower incomes who are sick.

Certain factors can help mitigate the impact of deductibles. Not everybody needs health care in a given year, or they use very little, so they don’t have to pay down their deductibles every year. About one in five workers is in a high-deductible plan that can be paired with tax-preferred savings accounts that can build up when he or she doesn’t use care. Deductibles may provide a sensible incentive for people to be prudent consumers of health care. But with so many people with private coverage lacking the funds to meet growing cost-sharing obligations, they can pose a serious financial burden and sometimes be a barrier to care for many, especially lower- and moderate-wage workers.