The independent source for health policy research, polling, and news.

Temporary Enhanced Federal Medicaid Funding Can Soften the Economic Blow of the COVID-19 Pandemic on States, but is Unlikely to Fully Offset State Revenue Declines or Forestall Budget Shortfalls

The temporary boost in federal Medicaid funding enacted as part of the Families First Coronavirus Response Act (FFCRA) will soften the economic blow of COVID-19 on states, but is unlikely to fully offset state revenue declines or forestall budget shortfalls stemming from the pandemic, finds a new KFF analysis.

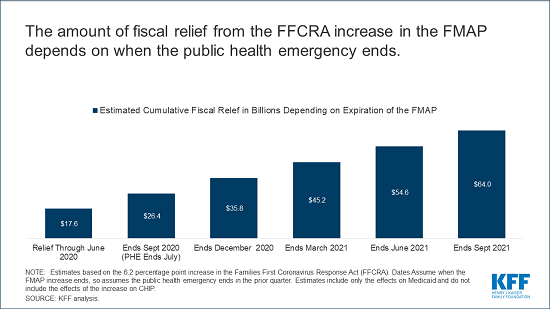

The 6.2 percentage point increase in the Medicaid FMAP — designed to provide states with broad fiscal relief, not just help with Medicaid costs — is effective from January 1 through the duration of the public health emergency period. The current emergency period is set to expire on July 24 (with the enhanced Medicaid funding ending Sept. 30), but is likely to be extended since the pandemic continues.

To be eligible for the enhanced funds, states cannot tighten Medicaid eligibility standards beyond policies in place as of January 1, must at least maintain current enrollment through the emergency period and cannot impose cost sharing for COVID-19 related testing and treatment services. The enhanced funding does not apply to the Medicaid expansion group under the Affordable Care Act.

The enhanced Medicaid funding would provide states with a total fiscal relief of $64 billion if the temporary FMAP boost were in place through September 2021, the end of the federal fiscal year, without factoring in additional changes in enrollment. (The amount would be just $26.4 billion if the emergency declaration were not renewed this month.)

An increase in the FMAP could offset or reduce state spending but is unlikely to fully offset state revenue declines and address budget shortfalls. Even if the fiscal relief is in place for all of state fiscal year 2021, early reports show that some states are projecting revenue decline of up to 20 percent for SFY. Pre-pandemic state estimates of state revenue were $944 billion for SFY2021, so federal fiscal relief available through the FFCRA accounts for roughly 4 percent of state revenues for SFY2021. This means many states still will likely need to make large cuts in many areas of their budget, including Medicaid, to meet balanced budget requirements.

For the full analysis, as well as more data and analysis about Medicaid and the pandemic, visit kff.org.