The independent source for health policy research, polling, and news.

News Release

The independent source for health policy research, polling, and news.

Premiums will rise substantially in 2018 Affordable Care Act marketplace plans for states using HealthCare.gov, but in many cases, people receiving premium tax credits will pay less than they did in 2017, a new Kaiser Family Foundation analysis finds.

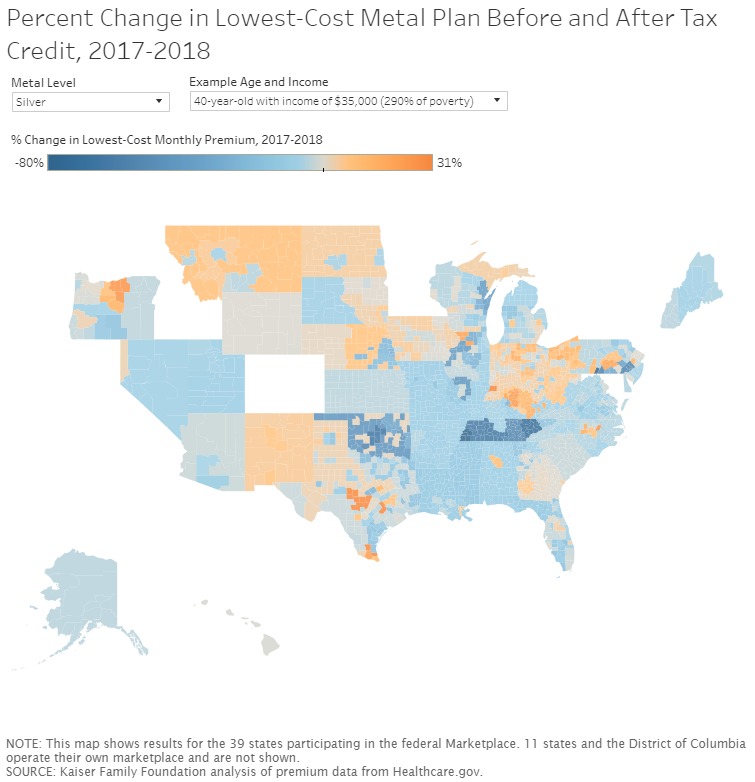

The new analysis includes county-level interactive maps charting premium changes of lowest-cost gold, silver, and bronze plans for consumers with and without premium tax credits in the 2018 HealthCare.gov marketplaces.

For people not eligible for tax credits that defray the cost of premiums, the weighted national average change for the three types of plans in HealthCare.gov marketplaces was 17 percent for lowest-cost bronze plans, 35 percent for lowest-cost silver plans, and 19 percent for lowest-cost gold plans, according to the analysis.

However, in many cases, lower-income consumers receiving premium tax credits will pay less for premiums in 2018 than in 2017, the analysis finds, because their tax credits will rise dollar-for-dollar with benchmark silver premiums. Premiums for silver plans increased much more than those for bronze or gold plans in 2018 because in many states insurers loaded the cost from the termination of the cost-sharing reduction payments entirely on the silver tier.

The change for the average premium for a 40-year-old person making up to $40,000 who is eligible for premium tax credits ranges from a 75 percent decrease to no change for the lowest-cost gold, silver, and bronze plans, the analysis finds.

The change for the average premium for a 40-year-old person making up to $40,000 who is eligible for premium tax credits ranges from a 75 percent decrease to no change for the lowest-cost gold, silver, and bronze plans, the analysis finds.

The new maps chart premium changes for a 40-year-old individual paying the full premium and for a 40-year-old individual eligible for tax credits, with an income of $25,000, $30,000, $35,000 and $40,000.

The maps show:

The analysis finds that for a 40-year-old person eligible for a tax credit, the tax credit would cover the full premium of the lowest-cost bronze plan in between 99 and 1,540 counties, depending on the person’s income.