Changes to “Public Charge” Inadmissibility Rule: Implications for Health and Health Coverage

|

Key Takeaways |

|

In August 2019, the Trump Administration announced a final rule that changes the public charge policies used to determine whether an individual applying for admission or adjustment of status is inadmissible to the U.S. Under longstanding policy, the federal government can deny an individual entry into the U.S. or adjustment to legal permanent resident (LPR) status (i.e., a green card) if he or she is determined likely to become a public charge.

|

Introduction

In August 2019, the Trump Administration announced a Department of Homeland Security (DHS) final rule to make changes to “public charge” policies that govern how the use of public benefits may affect individuals’ ability to enter the U.S. or adjust to legal permanent resident (LPR) status (i.e., obtain a “green card”). The final rule does not affect public charge deportability grounds, which are governed by the Department of Justice. The rule broadens the programs that the federal government will consider in public charge determinations to include previously excluded health, nutrition, and housing programs, and outlines the factors the federal government will consider in making a public charge consideration.1 The preamble to the rule indicates that its primary goal is to better ensure that individuals who apply for admission to the U.S., seek an extension of stay or change of status, or apply for adjustment of status, are self-sufficient. The preamble also identifies a range of consequences on the health and financial stability of families, as well as direct and indirect costs associated with the rule. This fact sheet provides an overview of the proposed rule and its implications for health and health coverage of immigrant families.

What Was Public Charge Policy Prior to This Rule?

Under longstanding policy, if authorities determine that an individual is “likely to become a public charge,” they may deny that person’s application for lawful permanent residence or their entry into the U.S.2 Certain immigrants, including refugees and asylees and other humanitarian immigrants, are exempt from public charge determinations under law.

Under previous policy clarified in 1999, the federal government specified that it would not consider use of Medicaid, the Children’s Health Insurance Program (CHIP), or other non-cash programs in public charge determinations. Previously, there was confusion about whether use of Medicaid, CHIP, or other non-cash programs applied in public charge determinations.3 In 1999, the Immigration and Naturalization Service (now part of the Department of Homeland Security (DHS)) issued guidance that defined a public charge as someone who has become or who is likely to become ‘‘primarily dependent on the government for subsistence, as demonstrated by either the receipt of public cash assistance for income maintenance or institutionalization for long-term care at government expense.”4 The guidance specified that the federal government would not consider use of Medicaid, CHIP, or other supportive programs in public charge determinations, with the exception of use of Medicaid for long-term institutional care.5 The guidance noted that this clarification was needed because confusion about policies “deterred eligible aliens and their families, including U.S. citizen children, from seeking important health and nutrition benefits that they are legally entitled to receive. This reluctance to access benefits has an adverse impact not just on the potential recipients, but on public health and the general welfare.”6

What are the Key Changes in the Rule?

The rule broadens the programs that the federal government will consider in public charge determinations to include previously excluded health, nutrition, and housing programs. The rule redefines a public charge as an “alien who receives one or more public benefits for more than 12 months in the aggregate within any 36-month period (such that, for instance, receipt of two benefits in one month counts as two months),” and defines public benefits to include federal, state, or local cash benefit programs for income maintenance and certain health, nutrition, and housing programs that were previously excluded from public charge determinations, including non-emergency Medicaid for non-pregnant adults, the Supplemental Nutrition Assistance Program (SNAP), and several housing programs (see Appendix Table 1).7 The rule does not include CHIP or subsidies for Affordable Care Act Marketplace coverage as public benefits. Public charge determinations will only consider use of benefits by the individual and will not take into account benefits used by other family members, including children, of the person for whom officials are making the determination.8

DHS will find an individual “inadmissible” if officials determine that he or she is more likely than not at any time in the future to become a public charge based on the totality of the person’s circumstances. At a minimum, officials must take into account an individual’s age; health; family status; assets, resources, and financial status; and education and skills when making this determination.

The rule identifies characteristics deemed as positive factors that reduce the likelihood of an individual becoming a public charge and negative factors that increase the likelihood of becoming a public charge. In general, being younger or older than working age, having health needs, lacking private health coverage, having limited income or resources, not being employed and not being a primary caregiver, having a lower education level, having limited English proficiency, and using or previously using public benefit programs would be considered negative factors. The rule establishes a new income standard of 125% of the federal poverty level (FPL) ($26,663 for a family of three as of 2019); family income below that standard will be considered to be a negative factor.9

The rule also identifies heavily weighted negative or positive factors. One heavily weighted negative factor is having received or being approved to receive one or more public benefits for more than 12 months in the aggregate within the 36-month period prior to applying for admission or adjustment of status. Another health-related heavily weighted negative factor includes having a medical condition that is likely to require extensive treatment or institutionalization and being uninsured and lacking the financial resources to pay for the medical costs associated with the condition. Other heavily weighted negative factors include not being a full-time student or employed and having been previously found inadmissible or deportable on public charge grounds. Heavily weighted positive factors include having income above 250% of the FPL ($53,325 for a family of three in 2019) or having private health insurance that is not subsidized by Affordable Care Act tax credits.

The rule will become effective 60 days after it is officially published in the federal register. The rule specifies that DHS will not consider an individual’s use of the previously excluded health, nutrition, and housing programs prior to the effective date.

Who Do the Changes Affect?

The rule will affect individuals seeking to become LPRs or “green card” holders and individuals seeking to immigrate to the U.S. It also will affect certain people seeking to extend or adjust their non-immigrant status while in the U.S. Most individuals seeking to adjust to LPR status or to immigrate to the U.S. are immediate relatives of U.S. citizens or have a family-based sponsor. In 2016, 1.2 million individuals obtained LPR status, including over half a million who were already present in the U.S.10 Some immigrants, including refugees and asylees and other humanitarian immigrants, remain exempt from public charge determinations under law. Public charge policies do not apply to LPRs seeking to obtain citizenship. However, obtaining LPR status is a key step toward citizenship for immigrants seeking naturalization.

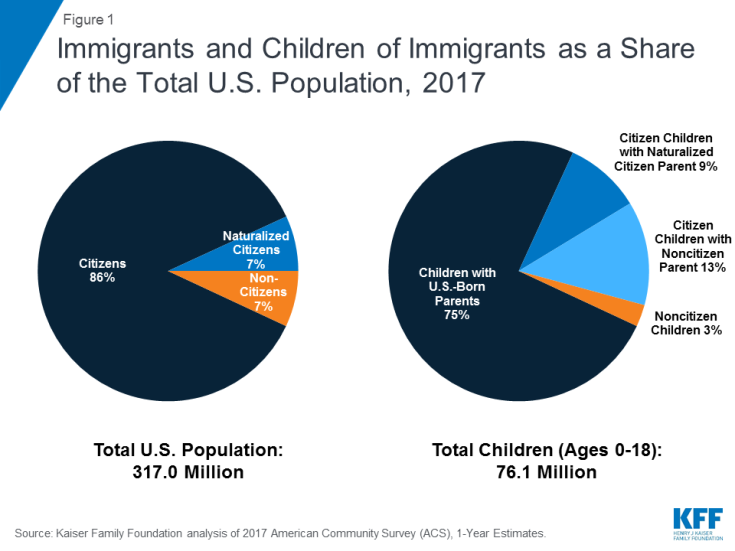

The rule will likely increase confusion and fear broadly across immigrant families about using public programs for themselves and their children, regardless of whether they are directly affected by the changes. In 2016, there were 22 million noncitizens residing in the U.S. About six in ten noncitizens were lawfully present immigrants, who include LPRs, refugees, asylees, and other individuals who are authorized to live in the U.S.11 Many individuals live in mixed immigration status families that may include lawfully present immigrants, undocumented immigrants, and/or citizens. Nearly 19 million, or 25% of children, had an immigrant parent as of 2017, and the large majority of these children were citizens. About 10 million, or 13%, were citizen children with a noncitizen parent. (Figure 1).12

What are the Implications for Health & Health Coverage?

Today, Medicaid fills gaps in private coverage for some lawfully present immigrants, providing them access to health care and financial protections that support their ability to work and care for their children. Medicaid provides families access to preventive and primary care, including prenatal care, as well as care for chronic conditions. In addition, the coverage provides families financial protection from high medical costs. By enabling families to meet their health care needs, Medicaid supports families’ ability to work and care for their children. The majority of lawfully present immigrants live in a family with at least one full-time worker (84%), a rate higher than that of citizens.13 However, lawfully present immigrants are more likely than citizens to live in low-income families and often work in jobs and industries that do not offer health coverage. Medicaid and CHIP coverage help fill this gap, but many lawfully present immigrants remain uninsured due to eligibility restrictions for immigrants that require many otherwise eligible lawfully present immigrants to wait five years after obtaining lawful status before they may enroll as well as barriers to enrollment for eligible immigrants, including fear.14

The rule will likely lead to declines in participation in Medicaid and other programs broadly across immigrant families, including their primarily U.S.-born children. Previous experience and recent research suggest that the rule will lead individuals to forgo enrollment in or disenroll themselves and their children from public programs because they do not understand the rule’s details and fear their own or their children’s enrollment could negatively affect their or their family members’ immigration status.15 For example, prior to the final rule, there were growing anecdotal reports of individuals disenrolling or choosing not to enroll themselves or their children in Medicaid and CHIP due to growing fears and uncertainty.16 Providers also have reported increasing concerns among parents about enrolling their children in Medicaid and food assistance programs,17 and WIC agencies across a number of states have had enrollment drops that they attribute largely to fears about public charge.18 A survey conducted prior to the final rule found that one in seven adults in immigrant families reported avoiding public benefit programs for fear of risking future green card status, and more than one in five adults in low-income immigrant families reported this fear.19

Nationwide, 13.5 million Medicaid/CHIP enrollees, including 7.6 million children, live in a household with a noncitizen or are noncitizens themselves and may be at risk for decreased enrollment as a result of the rule. Decreased participation in Medicaid/CHIP would increase the uninsured rate among immigrant families, reducing their access to care and contributing to worse health outcomes. Reduced participation in nutrition and other programs would likely compound these effects. Overall, reduced participation in Medicaid and other programs would negatively affect the health and financial stability of families and the growth and healthy development of their children. As noted in the preamble to the rule, decreased participation in Medicaid and other programs would also reduce federal and state program costs; at the same time, there will be declines in federal payments to states and revenues to health care providers, pharmacies, grocery retailers, agricultural producers, and landlords as well as increased costs for individuals and organizations serving immigrant families.

Outreach and education efforts could minimize chilling effects from the rule. As noted, chilling effects on program participation will likely extend broadly beyond individuals directly affected by the rule’s changes. Outreach and education to immigrant families and communities may help reduce fears and confusion stemming from the rule to reduce this chilling effect. However, overcoming fears and uncertainty in the current environment, particularly as immigration policies continue to evolve and change, may be challenging.

| Appendix Table 1: Key Differences between Previous and New “Public Charge” Policies | ||

| Policy Based on 1999 Guidance | Unpublished Final Rule Released August 12, 2019 | |

| Definition of Public Charge | An alien who has become or who is likely to become ‘‘primarily dependent on the government for subsistence, as demonstrated by either the receipt of public cash assistance for income maintenance or institutionalization for long-term care at government expense.’’ | Public charge means an alien who receives one or more public benefits for more than 12 months in the aggregate within any 36-month period (such that, for instance, receipt of two public benefits in one month counts as two months). |

| Public Benefits that May Be Considered for Public Charge Purposes |

|

|

| Consideration of Use of Public Benefits in a Public Charge Determination |

|

|

| Heavily Weighted Negative Factors | Not Specified |

|

| Heavily Weighted Positive Factors | Not Specified |

|

Endnotes

The rule also makes changes related to use of public charge bonds.

Becoming a public charge may also be a basis for deportation in extremely limited circumstances. “Public Charge Fact Sheet,” U.S. Citizenship and Immigration Services, https://www.uscis.gov/news/fact-sheets/public-charge-fact-sheet, accessed February 12, 2018.

This confusion increased after new Medicaid and CHIP eligibility restrictions were imposed on immigrants in 1996. Those restrictions required many lawfully present immigrants to wait five years after obtaining lawful status before they could enroll in Medicaid or CHIP and made some lawfully present immigrants ineligible for coverage. However, they did not change public charge policy.

“Field Guidance on Deportability and Inadmissibility on Public Charge Grounds,” Immigration and Naturalization Service, Justice, 64 Fed. Reg. 28689-28693 (March 26, 1999), https://www.gpo.gov/fdsys/pkg/FR-1999-05-26/pdf/99-13202.pdf.

Ibid.

Ibid.

In the final rule, DHS removed the reference to long-term institutionalization within the definition of public benefit as this care would be provided through programs already included in the new public benefit definition (TANF, SSI, and Medicaid).

Public charge determinations will not consider receipt of benefits by active duty or reserve service members or their spouses or children, receipt of benefits during periods in which an individual was present in the U.S. with an immigration status that is exempt from public charge determinations, or receipt of public benefits by foreign-born children of U.S. citizen parents who will be automatically eligible to become citizens.

If an individual has income below this standard, DHS will assess whether the total value of the individual’s household assets and resources is at least five times the difference between the household’s annual income and the federal poverty guidelines for his or her household size. Income standards vary for individuals on active duty in the armed forces.

“Table 6. Persons Obtaining Lawful Permanent Resident Status by Type and Major Class of Admission: Fiscal Years 2014 to 2016,” 2016 Yearbook of Immigration Statistics, Department of Homeland Security, https://www.dhs.gov/immigration-statistics/yearbook/2016/table6, accessed February 12, 2018.

Kaiser Family Foundation analysis of the March 2017 Current Population Survey, Annual Social and Economic Supplement.

Kaiser Family Foundation analysis of the March 2017 Current Population Survey, Annual Social and Economic Supplement.

Kaiser Family Foundation analysis of the March 2017 Current Population Survey, Annual Social and Economic Supplement.

Ibid.

Findings show that recent immigration policy changes have increased fears and confusion among broad groups of immigrants beyond those directly affected by the changes. See Samantha Artiga and Petry Ubri, Living in an Immigrant Family in America: How Fear and Toxic Stress are Affecting Daily Life, Well-Being, & Health, (Washington, DC: Kaiser Family Foundation, December 2017), https://www.kff.org/disparities-policy/issue-brief/living-in-an-immigrant-family-in-america-how-fear-and-toxic-stress-are-affecting-daily-life-well-being-health/ and Samantha Artiga and Barbara Lyons, Family Consequences of Detention/Deportation: Effects on Finances, Health, and Well-Being (Washington, DC: Kaiser Family Foundation, September 2018), https://www.kff.org/disparities-policy/issue-brief/family-consequences-of-detention-deportation-effects-on-finances-health-and-well-being/. Similarly, earlier experiences show that welfare reform changes increased confusion and fear about enrolling in public benefits among immigrant families beyond those directly affected by the changes. See. Neeraj Kaushal and Robert Kaestner, “Welfare Reform and Health Insurance of Immigrants,” Health Services Research,40(3), (June 2005), https://www.ncbi.nlm.nih.gov/pmc/articles/PMC1361164/; Michael Fix and Jeffrey Passel, Trends in Noncitizens’ and Citizens’ Use of Public Benefits Following Welfare Reform 1994-97 (Washington, DC: The Urban Institute, March 1, 1999) https://www.urban.org/sites/default/files/publication/69781/408086-Trends-in-Noncitizens-and-Citizens-Use-of-Public-Benefits-Following-Welfare-Reform.pdf; Namratha R. Kandula, et. al, “The Unintended Impact of Welfare Reform on the Medicaid Enrollment of Eligible Immigrants, Health Services Research, 39(5), (October 2004), https://www.ncbi.nlm.nih.gov/pmc/articles/PMC1361081/; Rachel Benson Gold, Immigrants and Medicaid After Welfare Reform, (Washington, DC: The Guttmacher Institute, May 1, 2003), https://www.guttmacher.org/gpr/2003/05/immigrants-and-medicaid-after-welfare-reform.

Samantha Artiga and Petry Ubri, Living in an Immigrant Family in America: How Fear and Toxic Stress are Affecting Daily Life, Well-Being, & Health, (Washington, DC: Kaiser Family Foundation, December 2017), https://www.kff.org/disparities-policy/issue-brief/living-in-an-immigrant-family-in-america-how-fear-and-toxic-stress-are-affecting-daily-life-well-being-health/; Samantha Artiga and Barbara Lyons, Family Consequences of Detention/Deportation: Effects on Finances, Health, and Well-Being (Washington, DC: Kaiser Family Foundation, September 2018),https://www.kff.org/disparities-policy/issue-brief/family-consequences-of-detention-deportation-effects-on-finances-health-and-well-being/; and Hamutal Bernstein, Dulce Gonzalez, Michael Karpman, and Stephen Zuckerman, With Public Charge Rule Looming, One in Seven Adults in Immigrant Families Reported Avoiding Public Benefit Programs in 2018, (Washington, DC: Urban Institute, May 2019), https://www.urban.org/urban-wire/public-charge-rule-looming-one-seven-adults-immigrant-families-reported-avoiding-public-benefit-programs-2018

The Children’s Partnership, “California Children in Immigrant Families: The Health Provider Perspective,” 2018, https://www.childrenspartnership.org/wp-content/uploads/2018/03/Provider-Survey-Inforgraphic-.pdf .

Bottemiller Evich, H., “Immigrants, fearing Trump crackdown, drop out of nutrition programs,” Politico (Washington, DC, September 4, 2018). Accessed July 18, 2019, https://www.politico.com/story/2018/09/03/immigrants-nutrition-food-trump-crackdown-806292

Hamutal Bernstein, Dulce Gonzalez, Michael Karpman, and Stephen Zuckerman, With Public Charge Rule Looming, One in Seven Adults in Immigrant Families Reported Avoiding Public Benefit Programs in 2018, (Washington, DC: Urban Institute, May 2019), https://www.urban.org/urban-wire/public-charge-rule-looming-one-seven-adults-immigrant-families-reported-avoiding-public-benefit-programs-2018

Services or benefits funded by Medicaid but provided under the Individuals with Disabilities Education Act and school-based services or benefits provided to individuals who are at or below the oldest age eligible for secondary education as determined under state or local law are not included as a public benefit.