The independent source for health policy research, polling, and news.

KFF Survey Shows Complexity, Red Tape, Denials, Confusion Rivals Affordability as a Problem for Insured Consumers, With Some Saying It Caused Them to Go Without or Delay Care

Most Consumers Across Types of Insurance Had a Problem with Their Coverage in the Past Year, Including About Three-Quarters of Those Who Used a Lot of Care or Received Mental Health Services

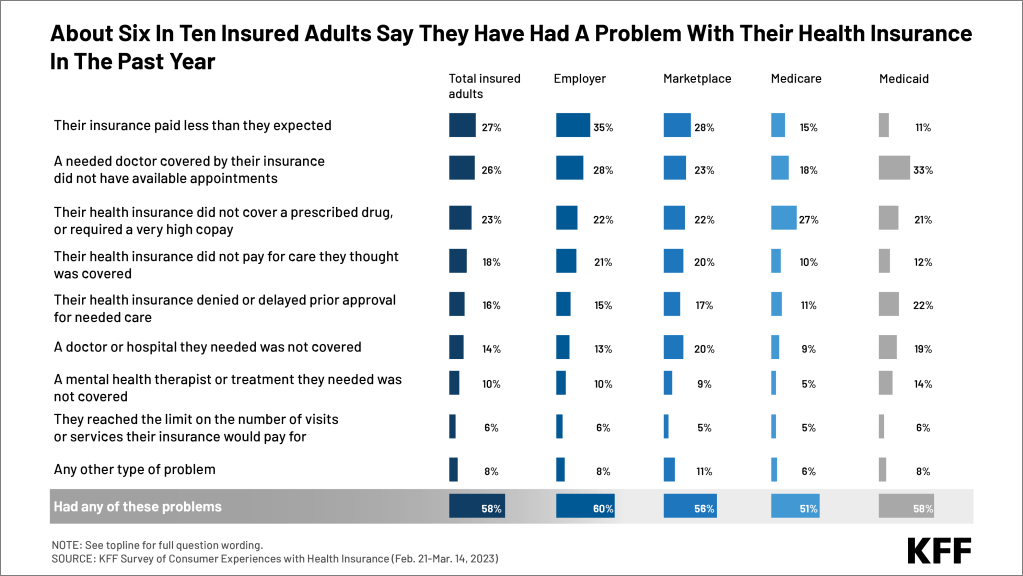

Most (58%) people with health insurance say they encountered at least one problem using their coverage in the past year, with even larger shares of people with the greatest health care needs reporting such problems, finds a new KFF survey of consumer experiences with health insurance.

Such problems vary across types of insurance but include such things as denied claims for care they thought was covered, difficulty finding an in-network doctor or other provider, and delays and denials of care that involved an insurer’s prior authorization.

At least half within each of four major types of health coverage – employer, Medicaid, the Affordable Care Act’s marketplace, and Medicare – say they had a problem using their coverage in the past year.

Such problems are more common among people with greater health care needs. For example:

- Two-thirds (67%) of consumers who rate their own health as “fair” or “poor” encountered a problem in the past year.

- About three-quarters (74%) of those who received mental health treatment in the past year reported a problem.

- More than three-quarters (78%) of those who received a lot of health care (more than 10 provider visits in the past year) reported a problem.

“The survey shows that the sheer complexity of insurance is as big a problem as affordability, particularly for those with the greatest needs,” KFF President and CEO Drew Altman said. “People report an obstacle course of claims denials, limited in-network providers, and a labyrinth of red tape, with many saying it prevented them from getting needed care.”

Today’s report captures key results from the nationally representative survey of 3,605 people with health coverage through an employer, Medicare, Medicaid or the Affordable Care Act’s marketplaces. Future reports will delve more deeply into the experiences of people with those types of coverage, as well as people with specific chronic conditions and needs across types of insurance.

The frequency that people encounter specific insurance problems varies by type of coverage. For example, people with employer and marketplace coverage report denied claims more often than people with Medicare or Medicaid, and people with Medicaid and marketplace coverage more often report problems finding in-network providers.

Insurance problems can contribute to unexpected costs, with more than a quarter (28%) of those who reported problems saying they had to pay more for their care as a result. This includes about a third of those with marketplace or employer coverage who reported problems in the past year.

Among those who reported recent insurance problems, half say they were able to resolve the issue to their satisfaction, while nearly as many say either that the issue had been resolved in a way they didn’t like (28%) or that it remained unresolved (19%). Most insured adults (60%) do not know they have appeal rights by law, and three quarters (76%) do not know what government agency to call for help dealing with their insurance.

Consumers’ insurance problems can affect their ability to get timely, needed care. Among those with recent problems, about one in six say that they were not able to get recommended care (17%), they faced a significant delay in receiving such care (17%), or their health declined (15%) as a direct result.

About half (51%) of insured adults report some difficulty understanding at least one aspect of their health insurance, such as what their insurance will cover (36%), what they will owe out-of-pocket for care (30%), or what their explanation of benefits statement means (30%). About a quarter say that they find it difficult to understand terms such as “deductible” or “copay” (25%) and to figure out which doctors, hospitals and other providers are in network (23%).

People with Mental Health Challenges Have More Problems

The report also probes the challenges facing insured people who rate their mental health as fair or poor, regardless of whether they sought or obtained mental health treatment. This includes about one in five of all people with insurance, and one in three of those with Medicaid coverage.

Substantial shares of enrollees in this group rate the availability (45%) and quality (37%) of mental health therapists and providers covered by their insurance as “fair” or “poor.”

Among those who say their own mental health is fair or poor, 43% say that there was a time in the past year when they did not get needed mental health care. Among young adults under age 30 who describe their mental health as fair or poor, more than half (55%) say they did not get needed mental health care in the past year.

People cite various reasons for not getting needed mental health care, but insurance was a factor for many. Among all insured adults who didn’t get needed mental health care, more than four in 10 (44%) say they couldn’t afford the cost, and more than a third say it was because their insurance wouldn’t cover it.

- One in six (16%) of all insured people say they have had problems paying or an inability to pay for medical bills in the past year, including similar shares of those with marketplace (19%), employer (17%), and Medicaid (16%) coverage, as well as 12 percent of people with Medicare.

- Premiums also can be an issue for consumers, particularly for those with employer and marketplace plans. About half of those with marketplace or employer coverage give their insurance plan low marks for the amount that they pay in premiums and the amount they pay out-of-pocket to see a doctor. Far fewer of those with Medicare or Medicaid rate those aspects of their coverage negatively.

- In spite of the problems people report using their insurance, a large majority (81%) give “excellent” or “good” ratings when asked to rate their insurance overall.

- Large majorities of consumers with insurance say they would support requirements on insurers that could make it easier to avoid or resolve insurance problems. These include requirements to maintain accurate and up-to-date information about who is in their network (91%) and to provide simpler, easier-to read statements explaining coverage decisions and how to appeal if you disagree (94%), all of which have been enacted by Congress though not all have been implemented.

Designed and analyzed by public opinion researchers at KFF, the KFF Survey of Consumers Experiences with Health Insurance was conducted February 21-March 14, 2023, online and by telephone among a representative sample of 3,605 adults in the U.S. with health insurance coverage, including 978 adults with employer-sponsored insurance, 815 adults with Medicaid coverage, 885 adults with Medicare, and 880 adults with marketplace insurance. Interviews were conducted in English and in Spanish. The margin of sampling error is plus or minus 2 percentage points for the full sample. For results based on subgroups, the margin of sampling error may be higher.